{{item.title}}

{{item.text}}

{{item.text}}

PwC’s Retail and Consumer Quarterly Insights provides the latest consumer behaviour news and trends in New Zealand and globally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ and other local and global sources.

It was a challenging start to the first quarter of 2023 with tough market conditions and weather related events hitting the retail and consumer sector:

After raising the official cash rate (OCR) in February to 4.75% (the highest it has been in 14 years), the Reserve Bank increased the OCR by further 50 basis points to 5.25% in early April 2023. This was above some market expectations and takes the benchmark rate to its highest level since late 2008. Retail spending is expected to slow down in the upcoming months as more households roll onto substantially higher mortgage rates.

With the wet weather over summer already impacting trading for seasonal items, Cyclone Gabrielle provided further devastation across the North Island in February and has created new challenges for the country’s economy and consumers.

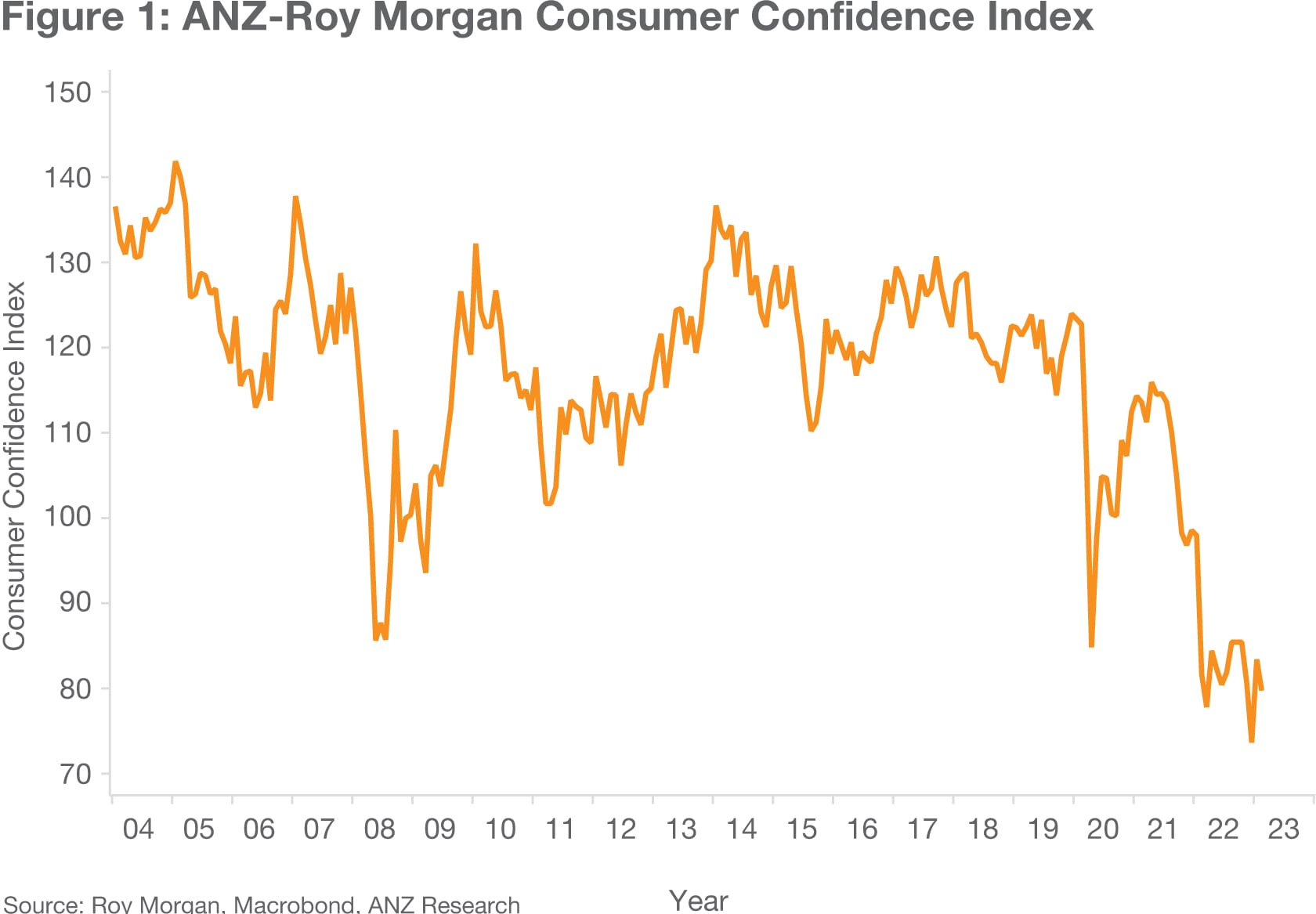

The ANZ-Roy Morgan Consumer Confidence Index has continued to decline from 83.4 in January to 77.7 in March (still above the December 2022 low of 73.8).

The portion of people who believe it is a good time to buy a major household item has fallen from -28 in January to -32 in March. This has also reached its lowest level since the 2020 lockdown in February (-35).

House price inflation expectations have increased from -0.3% in January 2023 to 0.6% in March 2023, reaching its highest level in the last six months.

Food prices were 12.1% higher in March 2023 than they were in March 2022. Fruit and vegetables prices rose 22.2% followed by grocery food prices up 13.7%.

The volume of electronic card transactions in March showed further signs of improvement. However, it remains to be seen whether this is sustainable given continued concerns over rising costs.

Year-to-date electronic spend data shows that Hospitality spending continued to bounce back as international borders reopened and travel resumed.

While sales in the Hospitality and Apparel categories exceeded pre-COVID levels, Consumable sales have effectively declined in real terms. Overall spending across all retail categories in the coming months will continue to be challenged as costs keep rising.

In terms of international insights and consumer sentiment, PwC’s latest Global Consumer Insights Pulse Survey highlighted that consumers are realigning their shopping habits and adopting cost-cutting behaviours as a result of growing inflation and macroeconomic pressures. PwC’s Global M&A Trends in Consumer Markets: 2023 Outlook reinforced this sentiment, as investors look to continue reviewing and refining their portfolios and businesses are set to focus on transformational deals in the year ahead.

To explore further, select the buttons below.

The first quarter of 2023 has been challenging for New Zealand businesses and consumers alike. The mood among New Zealand households has been impacted by severe weather events including the Auckland floods in January and Cyclone Gabrielle in February, a further increase in the OCR, the increasing cost of living, and alarming headlines on bank failures. While labour market data has held up reasonably well in the face of higher interest rates, the retail sector is increasingly feeling the pressure as consumers begin to rein in their spending. While still early days, the announcement by Stats NZ (on 20 April 2023) that CPI had increased by 6.7% in the 12 months to March 2023 (lower than market forecasts) suggests that consumers may indeed be pulling back on their spending.

Over the last three months, the ANZ-Roy Morgan Consumer Confidence Index has continued to decline from 83.4 in January to 77.7 in March. However, these figures are still above the December 2022 low of 73.8. The rising cost of living continues to be front of mind for consumers, particularly for those with significant mortgages. New Zealand households would likely have to spend an additional $150 per week this year to keep up with the soaring cost of living, an ASB report has suggested.

“While the recent weather events have fueled spending in parts of the retail sector, we expect the rising cost of living will continue to put pressure on consumer spending. Early indications of inflationary pressures easing overseas and the most recent CPI announcement may give New Zealand businesses some confidence for a ‘soft landing’, particularly with unemployment rates remaining low".

The portion of people who believe it is a good time to buy a major household item, still the best indicator of retail spending, fell from -28 in January to -32 in March. This has also reached its lowest level since the 2020 lockdown in February (-35). The indicator is lowest for households paying off a mortgage (about a third of households). Mortgage serviceability test rates now start at 8.5% and rise above 9.0%. Households have started to roll onto higher mortgage rates and are taking cost cutting actions on major household items. Unfortunately, the continued inflationary pressures also means people are getting less for their money.

Household spending will also be influenced by the labour market developments. We have seen job security for most remain strong. However, RBNZ said employment was beyond the maximum sustainable level supporting its surprising 50bps OCR increase in March. Certain sectors (i.e. hospitality, retail) are struggling to cope with a rise in the minimum wage, coming on top of escalating costs and rising inflation.

ANZ’s “misery index” is a measure of economic distress felt by everyday people, due to the risk of (or actual) joblessness combined with an increasing cost of living. The misery index is calculated by adding the seasonally adjusted unemployment rate to the inflation rate. This broadly matches the evolution of consumer confidence. The mix will evolve as the year goes on, but the sum is likely to remain below par for some time.

House price inflation expectations have increased from -0.3% in January 2023 to 0.6% in March 2023, reaching its highest level in the last six months. They are now strongest in Auckland (while only 1.1%, it does appear to mark a trough) and weakest in Wellington (-0.5%). House prices remain in an orderly decline, with houses also taking longer to sell.

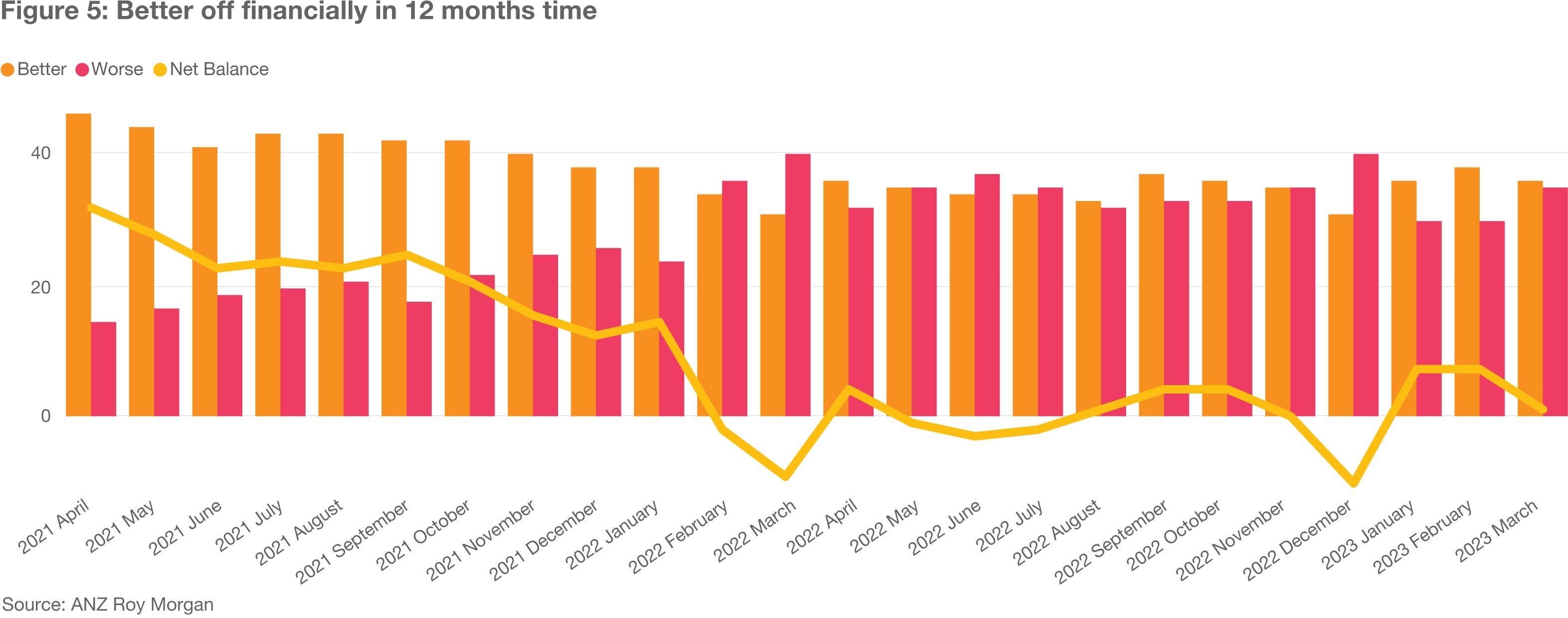

Another contributor to the decline in consumer confidence in March was perceptions about personal finances over the next year. A net 1.0% of consumers expect to be “better off” this time next year, down 6 points from February. This included 35.0% (down 2 points) who say they will be ‘better off’ financially this time next year compared to just over a third, 34.0% (up 5 points), who say they will be ‘worse off’.

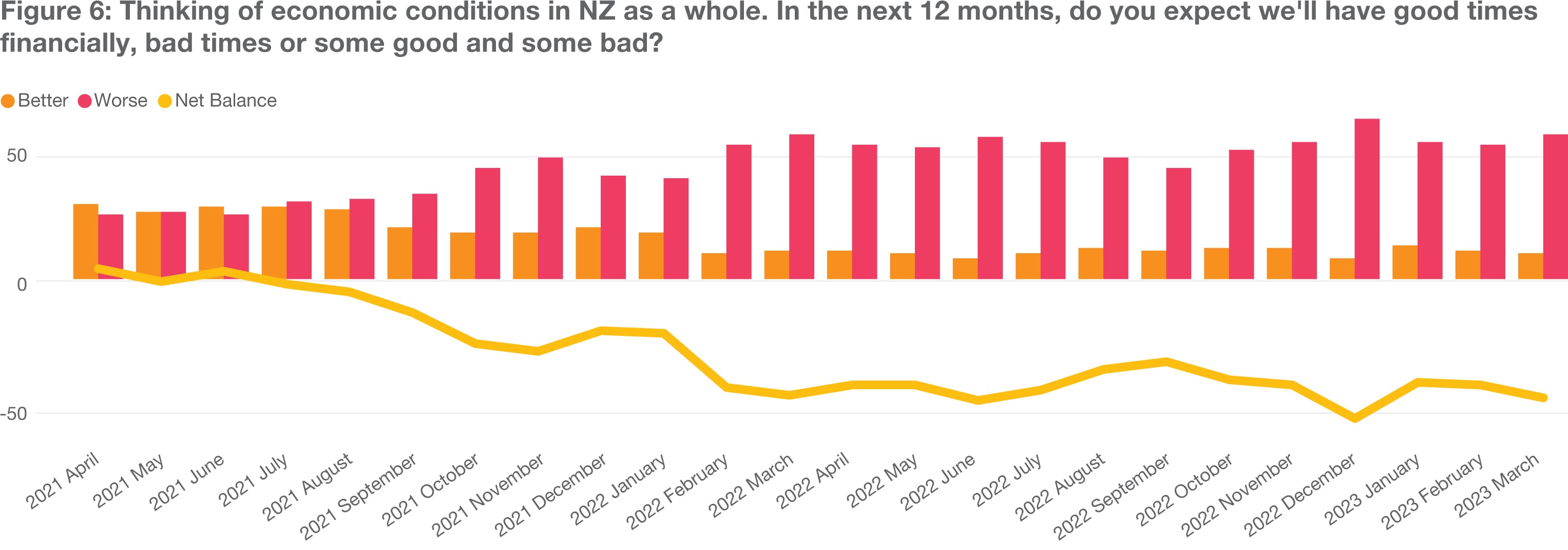

Reflecting the global financial markets transition into a less stable period, net perceptions regarding the economic outlook in 12 months’ time fell to -46.0% with only 10.0% of respondents saying there will be “good times” economically in New Zealand over the next 12 months.

Despite the recent OCR rise, consumer inflation expectations have increased again, edging up from 5.3% in January 2023 to 5.4% in March. That’s the highest level since June 2022. Food prices were 12.1% higher in March 2023 than they were in March 2022, according to recent figures released by Stats NZ.

Fruit and vegetables prices rose 22.2%

Meat, poultry, and fish prices rose 7.8%

Grocery food prices rose 13.7%

Non-alcoholic beverage prices rose 8.2%

Restaurant meals and ready-to-eat food prices rose 8.7%

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions series data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we are able to compare YTD retail-related electronic spend data by sector with the comparable periods in 2020, 2021 and 2022.

Inflation continues to have a significant influence on the value of card transactions. As a result, we now also consider the volume of card transactions in order to filter out this additional “noise” from the underlying data. The chart below presents monthly growth in the volume of annualised (LTM) electronic card transactions for the Core Retail and Retail Industries categories1.

The chart provides some interesting insights for retailers in relation to underlying consumer activity:

Since the onset of COVID, card volume growth has fluctuated over the last two years compared to the pre-COVID period (up to February 2020) where the monthly growth in annualised card volumes consistently averaged ~6.0%.

Due to the nationwide lockdown in August 2021, the LTM Core Retail volume growth declined to -10.5% in July 2022 (compared to 10.7% growth in July 2021 the previous year).

The volume of electronic card transactions has significantly improved, with March 2023 overall growth of 8.3% surpassing the pre-COVID average.

Going forward, it will be interesting to note if year on year growth in annualised transaction volumes now stabilises at (or above) the ~6% average achieved prior to COVID.

With the widely reported consumer headwinds, we could see discretionary spending squeezed over the next 12 months in areas such as dining and going out, clothing and hospitality, as consumers cut back on spending. This is also starting to show in the online spend trends in the past year. The 2022 annual eCommerce review by NZ Post reported that there was always going to be some correction to the hyper-growth of online spend following the end of COVID restrictions. However, what wasn’t expected was the ‘inflation pandemic’ that also followed. 2022 online retail spending was up 62.0% on 2019 but declined 4.0% on 2021. Boxing Day and overall December 2022 online spending in particular were 27.0% and 23.0% down compared to 2021.

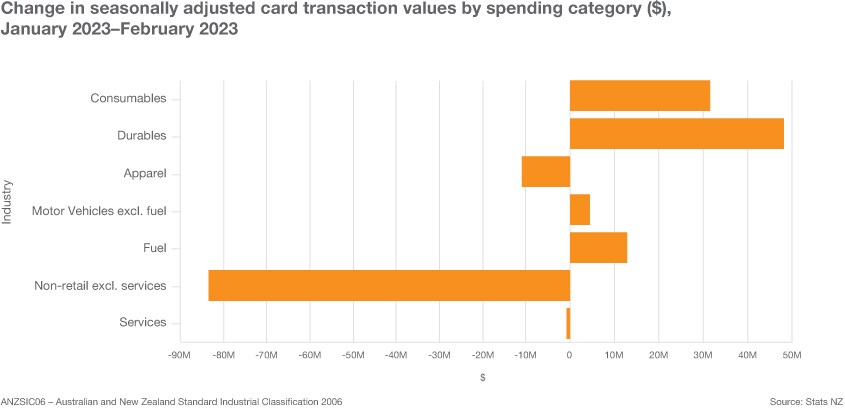

The March 2023 electronic spend data (released by Stats NZ on 12 April 2023) showed that seasonally adjusted spending in the Core Retail and Retail Industries slightly increased by 0.5% and 0.7%, respectively compared to February 2023.

Within the Retail Industries category, movements in spending on a seasonally adjusted basis between February and March 2023 were:

Motor vehicles (excluding fuel), up $11 million (+5.5%)

Durables, up $3.4 million (+0.2%)

Fuel, up $7.3 million (+1.3%)

Consumables, down $32 million (-1.2%)

Apparel, up $5.1 million (+1.5%)

Using the PwC Retail and Consumer Dashboard we also analysed year-to-date electronic spend and year-on-year growth by retail category. The Hospitality industry continues to bounce back as international borders reopened, travel resumed and international visitors gave a boost to the tourism industry, with monthly sales increasing from $891 million in March 2022 to $1.3 billion in March 2023. Sales growth in Apparel has managed to keep pace with inflation, while Consumable spending has effectively declined in real terms. The month-on-month increase in Apparel and Durables from February 2023 is not unexpected. This is likely a result of spending in relation to the February weather events as repair work starts and damaged goods are being replaced.

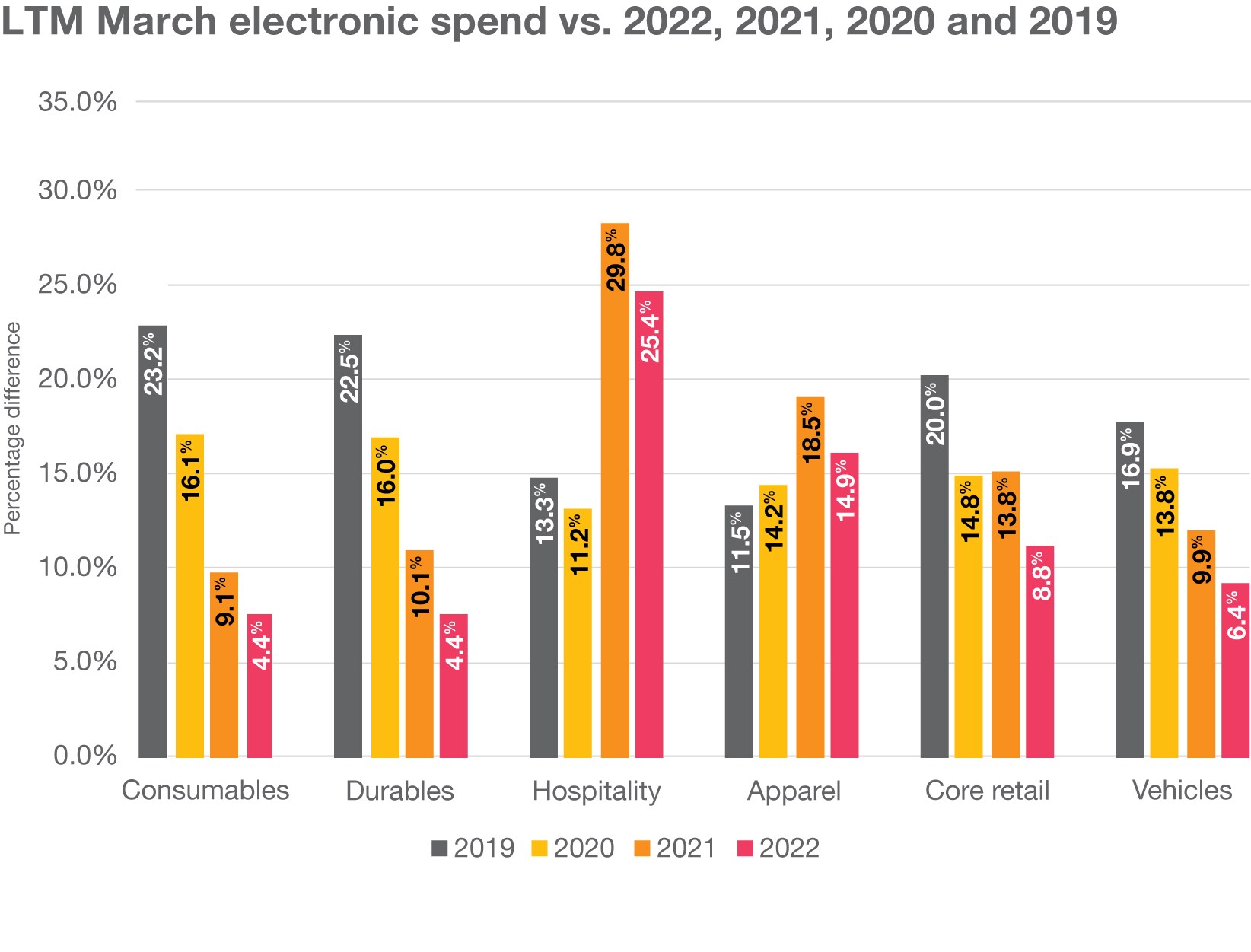

Due to COVID related disruptions, it is still useful to consider recent spending patterns in a wider, longer-term perspective. The chart below compares spending in the last 12 months (LTM) to March 2023 with spending in the equivalent 12 month periods in 2022, 2021, 2020 and 2019.

A similar analysis based on the monthly progression of LTM electronic spend by category showed that Hospitality and Apparel have outperformed results against the equivalent period in 2019. It is also worth noting the decline in Consumables and Durables spending is partly due to less stockpiling of basics and necessities post COVID, but is also likely due to rising costs and consumers bracing for a recessionary period.

1 “Core Retail” comprises the Consumables, Durables, Hospitality and Apparel categories, while the “Retail Industries” category also includes Fuel and Vehicles.

Based on PwC’s recently published Global M&A Trends in Consumer Markets: 2023 Outlook, we can expect a more stable outlook for dealmaking compared to 2022, as investors continue to review and refine their portfolios and businesses focus on transformational deals to accelerate the delivery of their strategic objectives and shareholder value.

Consumer goods: Large fast-moving consumer goods (FMCG) operators will continue to reshape their portfolios, and this will likely pave the way for acquisitions and disposals.

Pet care and pet food: This reflects growing levels of pet ownership globally, a trend that has accelerated during COVID.

Consumer health: Driven by a combination of positive long-term growth trends, such as an ageing population, greater consumer focus on health, challenges to public health funding, and increased digitalisation.

Refining of business portfolios: Investors will continue to focus on refining their portfolios — in particular those in consumer health and direct-to-consumer — to adapt to consumer trends that have accelerated during COVID. Crisis resilience and adaptation to new ways of working and living will drive deal activity.

Lowering risks via smaller deals and structured deals: With macroeconomic conditions still uncertain, consumer sentiment is expected to remain subdued and large deal financing difficult / more expensive.

Opportunistic dealmaking: A rise in opportunistic M&A is anticipated, led by corporates or private equity investors with significant dry powder to deploy. Highly leveraged corporates are expected to actively pursue divesting non-core assets across their portfolios as a means of strengthening their balance sheets, which will create opportunities for opportunistic buyers as these assets come to market.

43% of consumers surveyed chose shopping in-store as their preferred channel. More tellingly, consumers who said they intend to spend more time in-store signalled that they expect more inclusion of technology, including in-store entertainment, immersive digital experiences, such as donning a virtual reality headset to try out new products, and being able to book appointments with a sales adviser or personal shopper.

Many consumers have direct experience of the ongoing supply chain issues. According to the survey, rising prices are having the greatest impact on their in-store shopping experiences (68%), followed by products being out of stock (42%) and the hassle of standing in longer queues (39%).

The survey finds that various components of the metaverse are already available and being explored by consumers. 26% of customers surveyed said they have participated in metaverse-related activities in the last six months for entertainment, virtual experiences or purchasing products.

This has become a source of friction for consumers and they’re acting on their concerns. Half of respondents surveyed said they don’t share any more personal data than necessary (49%), and 32% opt out of receiving emails, texts and other communications.

Hallenstein Glasson warned early winter trading may be “challenging” with cost of living and inflationary pressures. Sales for the first eight weeks of the winter season were up 13.9%, but Chief Executive Stuart Duncan believes that the company will see significant challenges throughout the rest of the season due to the current economic environment in New Zealand and around the world.

On 5 April, the Reserve Bank of New Zealand increased the OCR by another 50 basis points to 5.25%, the highest it has been since 2008. This has resulted in significant backlash from many around the country, with some expecting recession and claiming this to be ‘a dangerous policy’ when considering the softer approaches of other central banks.

Dairy company Synlait Milk has reported a large reduction in first half profits due to lower sales, technical issues and higher costs. For the six months ended January 2023, net profit fell from $27.9m to $4.8m, and revenue from $790.6m to $769.8m compared to the previous year.

The Warehouse Group, New Zealand's largest retailer, has seen its profit more than halve during the six months ending 29 January. Net profit fell from $44.4m to $17.4m off the back of falling margins and a slow down in trading across the business when compared to the six months ending the 29 January 2022. The business saw a contrasted financial performance between its first and second quarters. Its performance started off strong, but faded as economic conditions tightened, costs increased, and restructuring costs were incurred.

Outdoor retailer KMD Brands reported record first half sales and rising profits amid rebounding tourism. KMD Brands, the owner of Kathmandu, Oboz, and Rip Curl brands, saw profits and revenue rise from a loss of $5.5m to $14m and $407.3m to $547.9m, respectively compared to the same period ended January 2022.

The latest Consumer Pulse report from Canstar NZ shows that two-thirds of people are cutting back on spending to meet mortgage payments. Of the 66% of mortgage holders pulling back on spending, just under half were reducing their spending on non-essential expenditure such as entertainment and clothes. However, 21% of those reducing their spending were doing so on essentials such as groceries, electricity and phone usage.

The private equity owner of Trade Me Group is considering its exit options, including a trade sale or a dual-listing on the ASX and NZX, reported the New Zealand Herald on 30 March. The preferred option was a partial listing, given the large size of the business, and a listing would likely happen in 2024. Apax has not officially had advisers appointed.

Blackmores acquisition may be under consideration by Suntory. Asahi, a rival of Suntory, has also believed to have taken a look at Blackmores, while a handful of private equity players are also thought to have shown interest.

BWX, an Australia-based beauty and skincare business, is believed to be in talks with special situations private equity investors Allegro Funds and Tanarra Restructuring Partners. Talks with Allegro were ongoing as of 30 March, but the exact deal structure has not yet been settled. Allegro is likely looking to buy BWX's debt to gain control of the company through a possible debt-for-equity swap and the situation remains fluid as BWX's management is looking to refinance its debt, control inventory, and sell non-core brands. The company entered voluntary administration in the first week of April.

Kraft Heinz is believed to have suspended the sale process for its Australia and New Zealand business due to severe flooding in New Zealand. The sale process for the AUD 1bn Australia and New Zealand operations had been quietly progressing over the last few weeks, and KKR is considered the most likely buyer for the assets, while Pacific Equity Partners has also taken a look.

Joylab and Kāpura have merged to form one of the largest hospitality groups in New Zealand. The deal saw Heineken subsidiary DB Breweries acquire the remaining minority shareholding in Auckland-based hospitality service network, Joylab, and all of the shares in Wellington-based Kāpura.

Independent brokerage ICIB has merged with AUB Group’s broking unit BrokerWeb Risk Services (BWRS) to become New Zealand’s fifth largest insurance broker. The business is known as ICIB BROKERWEB Insurance and Risk Advisory.

The proposed merger between TVNZ and RNZ has been scrapped by the Government. Prime Minister Chris Hipkins announced that the TVNZ-RNZ merger “will stop entirely” in a post cabinet press conference on 8 February. Instead RNZ and NZ On Air will receive a funding boost to strengthen its public media role.

The PwC Retail and Consumer Dashboard is updated monthly to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of COVID. If you are interested in online access to our dashboard to help inform your decision making, please contact: Beini Guo

{{item.text}}

{{item.text}}