“M&A teams need to consider how inflation impacts deal value, and ensure the purchase price components of their deals protect against inflation-driven value transfers.”

Inflation affects deal values and while it is widely considered to have peaked, rates are expected to remain high. They are estimated to continue at 4% - 5% over the next few years (which may be prolonged by the impact of Cyclone Gabrielle), compared to the nominal 2% markets had learnt to expect in the period leading up to 2022. It must now be considered as a specific value consideration.

In this article we discuss the tools buyers and sellers have available to them to mitigate the risks that higher inflation has introduced into M&A transactions. We also examine some factors to consider when drafting the SPA to avoid unintended value transfers between buyer and seller.

This article follows on from our earlier piece, How to optimise value by getting Sale and Purchase Agreement terms right.

Parties must understand how inflation has been factored into the valuation model from which the enterprise value is derived. This is a critical first step before considering how to approach purchase price protection mechanisms in the SPA. For example:

Have the right inflation rates been used? (e.g. cross-check various sources, match rates to the company’s industry and the right (short/long-term) time horizon, differentiated between major revenue and cost categories)

Has the appropriate discount rate been applied for cash-flows and determining the terminal value?

Have specific business-related factors been taken into account? (e.g. contractual indexation clauses with customers, suppliers and employees, price elasticity, market size and market share, other market forces, inventory valuation, foreign exchange exposure)

Assuming inflation was properly modelled into enterprise value, parties must then understand the residual exposure for vendor and purchaser in the other elements of the enterprise-to-equity value bridge, or purchase price mechanism. Depending on which purchase price mechanism is chosen, there are two main tools to mitigate this residual risk:

target working capital (applicable to the majority of transactions, whether completion accounts or locked box)

cash profits (locked box only).

The next question is how inflation may impact target working capital. For example, will working capital at completion be higher due to inflation, and therefore drive an unintended benefit to the vendor if the target working capital is not appropriately adjusted?

Businesses' net working capital (NWC) levels will be impacted in different ways by inflation. For a business with positive NWC, inflation will put pressure on cash requirements because more cash will be tied up in working capital. For example, FMCG businesses with significant inventory balances or relatively high receivables and prepayments compared to trade payables. From an M&A perspective, a buyer will want to factor this into the purchase price, increasing target working capital to reflect the higher cash requirement.

Note that in SaaS businesses where revenues are typically subscription-based (or other businesses that work with advance payments such as travel agencies or hotels), higher inflation may drive more negative working capital as increased subscription prices will increase deferred income (a liability) coupled with higher employee and supplier costs.

Inflationary impacts may result in value erosion unless the target is able to fully pass through increases in the price of its inputs (raw materials, utilities, labour etc) to its customers. Most likely, however, a target will only be able to partially pass through price rises, or there may be a lag until they are able to do so, and therefore the NWC target may need to be adjusted to reflect this, if it has not been factored into the EV or a historical period is used to set the NWC target.

Indexation is one protection mechanism which may be employed. However, applying one inflation rate to the NWC balance might be overly simplistic, as each component of working capital may not be impacted to the same extent by inflation (e.g if contractual terms with suppliers already include inflationary adjustments to pricing, further adjusting accounts payable for inflation may be unnecessary).

A more appropriate approach is to analyse the expected impact of inflation on each working capital component, to arrive at a target NWC which reflects the impact of inflation on the business. This can be dealt with as part of the NWC analysis undertaken during financial due diligence and should address matters such as:

What room is there for inflation-indexing or other price increases in customer agreements? What is the company’s ability to increase customer prices and what is the timing of this?

What is the company’s purchasing power from its key suppliers?

How is inventory being valued and how often is it revalued?

Is the company contractually obliged or under market pressure to increase salaries in line with or even more than inflation?

What initiatives have been implemented to manage working capital? (e.g. advantageous purchasing before price increases or deposits paid to secure lower prices; increased focus on debtor collection)

An example of how the impact of inflation could lead to an incorrect NWC target if not adjusted for is shown below, for simplicity we have only demonstrated the impact of inflation on the target level of inventory.

Working capital - inflationary impacts

Rising costs of goods and services, coupled with price rises passed on to consumers, may materially impact the net working capital adjustment within the completion mechanism. The below graph looks at the impact on inventory. However, inflation is likely to impact all components of working capital and should be considered individually. To the extent that prices have increased significantly, an adjustment may be factored to apply constant prices to target NWC, consistent with the position as at the locked box date or estimated completion date.

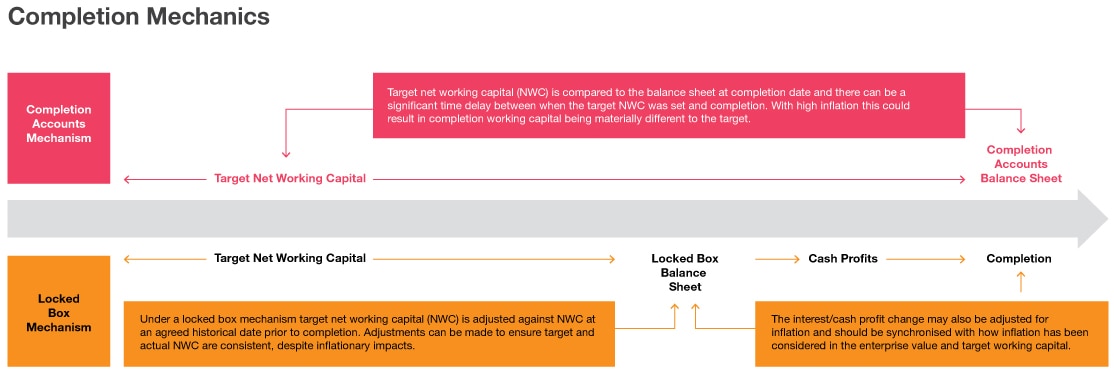

The choice of purchase price adjustment mechanism (whether locked box or completion statement) and the likely time lag between signing and completion may have a significant impact in a high inflation environment. While completion statement mechanisms have typically been favoured in times of greater uncertainty, locked box mechanisms have the advantage of ‘locking in’ value for both vendors and purchasers, allowing price certainty. This is particularly relevant in a high-inflation environment where there are concerns as to whether inflation can be accurately reflected in enterprise value and target NWC.

Parties must then ensure that appropriate protections are incorporated into the SPA to prevent value erosion at completion.

Locked box: Cash, debt and working capital are valued at a date in the past. If inflation was correctly captured in the enterprise value, the purchaser will be protected against inflationary value erosion in the business. Working capital and target working capital should be synchronised from an inflationary perspective, assuming a nominal LTM average per locked box date was used as target level.

Inflation appears to work to the purchaser’s advantage, unless corrected through the two remaining ‘moving parts’ in the purchase price: cash profits and leakage. One protection mechanism is indexation of cash profits, but care is needed to prevent double-counting with any nominal amounts included in the cash profit calculation itself (e.g. where actual cash profits are applied rather than an equity ticker or forecast profits).

Completion accounts: The benefit of this mechanism is that cash, debt and NWC are valued as at completion date. This main risk here is that actual working capital and target working capital might be out of sync, if inflation was not (properly) factored into the target calculation (e.g. a vendor benefitting from a higher working capital value at the completion date due to inflation).

If the period between signing and completion is expected to exceed six months, parties might consider moving away from a ‘fixed nominal amount’ in the SPA to a ‘base amount’, in which the key components are identified and retrospective inflation rates relevant for each component are applied to arrive at a more realistic target level at completion date. Given the additional complexity this adds to agree upon and apply a mechanism for adjustment, we suggest this is only used in situations where inflation is likely to create material value swings.

The choice of mechanism and time difference to completion may have a significant impact in a high inflation environment, the diagram compares these impacts in a completion account and locked box mechanism.

Deferred consideration, such as an earn-out, may be another option for parties to manage value uncertainty in an inflationary environment (e.g. where buyers are wary of the target’s ability to pass price increases onto customers).

It’s important to remember that earn outs can be complex in theory and in practical execution, and clear drafting in the SPA is essential to achieve the intended outcome.

How PwC can help

Our dedicated Sale and Purchase Agreement (SPA) team provides expert support at all stages of a transaction from pre-deal work through to post-completion support. Pre-deal, the team assists in the identification and articulation of value issues related to pricing and deal completion mechanics, to assist clients in their SPA negotiations; Post-deal the team assists clients in protecting or generating value through the execution of the SPA completion mechanism. Every business is different and every deal is different: we tailor our work to address your key concerns and commercial objectives. Our SPA review offering helps clients to maximise opportunities and minimise risks associated with pricing and completion mechanisms. We bridge the gap between your legal and financial advisers, the due diligence findings and the tax structuring.

Related content

Contact us

Partner, Sale and Purchase Agreement (SPA) Advisory, Auckland, PwC New Zealand

+64 21 087 52614