Introduction

PwC’s Retail and Consumer Insights provides the latest consumer behaviour news and trends in New Zealand and internationally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Statistics NZ and other local and global sources.

Key highlights from our March 2022 edition include:

ANZ-Roy Morgan Consumer Confidence survey in February made for sobering reading with consumer confidence plunging 16 points to 81.7, the lowest level since the survey began in 2004.

The proportion of people in February who believe it is a good time to buy a major household item fell 17 points to -21,the lowest level since the start of the pandemic in March 2020.

Food prices increased 6.8% in the year ended February 2022, with fruit and vegetable prices increasing 17.0%.

Analysis of February 2022 electronic spending confirms a significant deterioration in retail expenditure with seasonally adjusted electronic spend for the core retail categories declining 8.0% (-$453m) relative to January 2022.

Comparisons with pre-COVID spending continue to highlight the impact of COVID restrictions on key categories with the Hospitality and Apparel categories 8.0% and 2.2% (respectively) below the equivalent 12 month period.

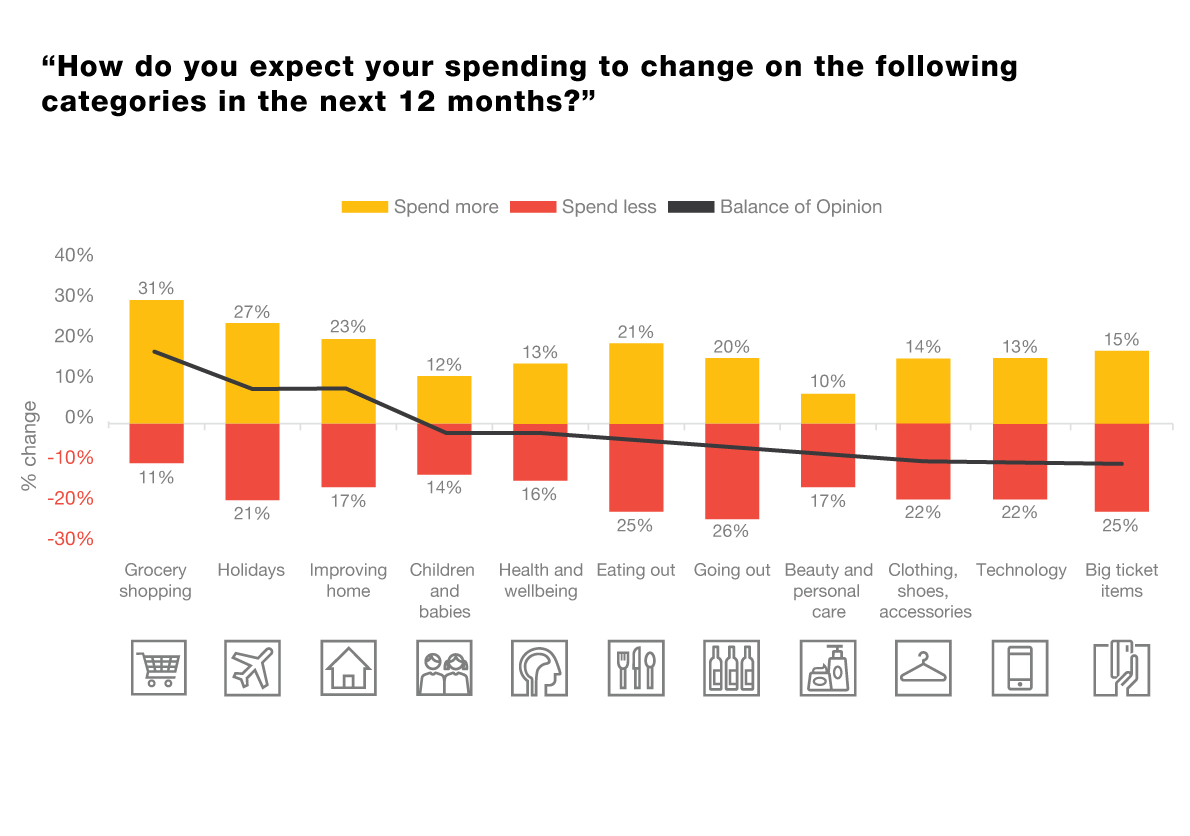

In terms of international consumer sentiment, PwC UK recently released its Retail Outlook 2022 report which confirmed that UK consumers are expecting to spend more on groceries, home improvement and social activities than in previous years.

Key initiatives to drive customer engagement include dealing with cost inflation, overcoming supply chain pressures and integrating ESG.

To explore further, select the buttons below.

Consumer confidence

With all of Aotearoa entering the red traffic light on 23 January 2022, the February edition of the ANZ-Roy Morgan Consumer Confidence Index (released on 4 March) is the first month of the survey where most New Zealanders have faced a real risk of contracting COVID. Against that backdrop, the results of the February survey made for sobering reading with consumer confidence plunging 16 points to 81.7, the lowest level since the survey began in 2004. Unfortunately, the outlook for the March survey may be no better as daily COVID cases increased from 197 on 1 February to 14,633 on 28 February and COVID hospitalisations had increased to 344 by this date.

“Omicron has heaped further pressure on households that are already dealing with heightened inflation concerns, rising interest rates, supply chain disruption and a cooling housing market. While these aren’t new, Omicron might be the final straw for some retailers and consumers."

The proportion of people in February who believe it is a good time to buy a major household item fell 17 points to -21,the lowest level since the start of the pandemic in March 2020. From a regional perspective, households’ response as to whether it was a good time to buy a major household item varied significantly, with the South Island remaining relatively stable while sentiment towards major expenditure plunged in the North Island. By age, older demographics held up better while the 25-34 age group plummeted.

Interestingly, the Omicron impact on consumer confidence has been far more pronounced in New Zealand than in Australia. This may be due to the fact that the Delta outbreak was far more significant in Australia, while Omicron is the first widespread community outbreak in New Zealand.

House price inflation expectations eased 0.5% points to 4.8% (unchanged in Auckland, but lower elsewhere), while consumer price index (CPI) expectations also eased 0.2% to 5.6%. The subdued consumer outlook is also reflected in the proportion of respondents who expect to be better or worse off in 21 months time, with this indicator falling 16 points to -2. This is the first time in this series that has been in negative territory.

In terms of inflation data, Statistics NZ released its February 2022 food price index on 11 March 2022.

Spend trends

Changes in consumer spending habits can be seen in the Statistics NZ electronic card transactions series data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we are able to compare YTD retail-related electronic spend data by sector with the comparable periods in 2019, 2020 and 2021.

February 2022 electronic spending (released by Statistics NZ on 10 March 2022) saw a significant deterioration in consumer confidence and retail expenditure with seasonally adjusted electronic spend for the core retail categories declining 8.0% (-$453m) relative to January 2022. As mentioned, this decline in sentiment coincided with all of Aotearoa entering the red traffic light on 23 January 2022 and the first time where most New Zealanders faced a real risk of contracting COVID.

Within the core retail category, all movements were negative on a seasonally adjusted basis between January and February 2022:

Consumables, down $141m (-5.7%)

Fuel, down $35m (-5.9%)

Durables, down $51m (-3.0%)

Motor vehicles (excluding fuel),

down $9m (-4.3%)

Apparel, down $50m (-14.4%)

In terms of the actual February figures (compared to February 2021), total core retail spend was up 0.3%, with the most significant movements recorded in Fuel (excluding vehicles) (+7.7%), Consumables (+3.9%), and Durables (+3.6%) categories. February 2022 was a tough time for not only the hospitality sector (-10.0%), but also the Apparel sector (-7.6%). The ongoing impact of COVID on the hospitality sector is readily apparent from the monthly changes in electronic spend, including the ~$600m (-47.6%) slump in August 2021 and a further ~$250m (-21.9%) decline in spending in February 2022.

Feb 2022 electronic spend by sector

Hospitality electronic spend - last 12 months

Given the ongoing disruption caused by COVID, including all of New Zealand moving to the ‘red’ traffic light setting on 23 January 2022, it is perhaps more useful to consider recent spending patterns in a wider, longer term perspective, including pre-COVID. The chart below compares spending in the last 12 months (LTM) to February 2022 with spending in the equivalent 12 month periods in 2021, 2020 and 2019.

Consumables, over the last 12 months to February 2022 is up +17.7%, compared to the equivalent period in 2019.

Apparel over the last 12 months to February 2022 is down -2.2%, compared to the equivalent period in 2019.

Durables over the last 12 months to February 2022 is up +17.3%, compared to the equivalent period in 2019.

Fuel (excluding Motor Vehicles) over the last 12 months to February 2022 is down -16.2%, compared to the equivalent period in 2019 - despite the recent surge in oil prices.

Hospitality over the last 12 months to February 2022 is down -8.0%, compared to the equivalent period in 2019.

A similar analysis based on the monthly progression of electronic spend by category versus the equivalent period in 2018/2019 provides similar results. However, it is interesting to note that while Fuel (excluding Motor Vehicles) has improved in recent months, as a result of underlying commodity price increases, notwithstanding the reduction in traffic volumes, recent performance in both the Hospitality and Apparel sectors has deteriorated. No doubt these categories and the broader retail and consumer sector will be looking forward to the reopening of our international travel borders, with fully vaccinated Australians expected to return to New Zealand from 12 April without quarantine restrictions (1 May 2022 for all other visa waiver countries), as well as a timeframe or framework in relation to when the country might move beyond the current red traffic light setting.

International insights

In terms of international consumer sentiment, PwC UK recently released its Retail Outlook 2022 report. While released prior to the Russian government's invasion of Ukraine, the report confirms that the UK economy is expected to return to growth in 2022, despite challenges around the cost of living, labour shortages and supply chains.

“Generally, retail in the UK held up well in 2021, and Christmas results were broadly positive. That gives cause for optimism into 2022, even with challenges around inflation, interest rate and tax rises, because many opportunities remain: resilient consumer sentiment, employment and wage growth, combined with lockdown savings and pent-up demand.”

Inflation, alongside pent-up demand, is also responsible for the intention behind spending priorities in the UK over the next 12 months. Consumers are expecting to spend more on groceries, improving home, eating out and going out relative to previous years. A similar trend might be expected to emerge in New Zealand as the impact of Omicron begins to fade. To win the battle for share of wallet in a low growth environment, the PwC team in the UK identified five key initiatives: |

Recent news

Statistics NZ confirmed that economic activity rose 3.0% in the December 2021 quarter as measured by gross domestic product, following a fall of 3.6% in the COVID affected September 2021 quarter.

The Government has reduced costs on consumers at the pump with a 25 cents-a-litre excise tax cut, leading to savings of between $11 to $17 a tank.

The war in Ukraine is causing commodity prices to rise further pushing ANZ’s inflation forecasts to 7.4%.

Fonterra has reported that its first-half profit (from August 2021 to January 2022) fell 7.0% to $364m, down from the previous year’s first-half profit of $391m. A significant increase in the price of milk is good news for dairy farmers, however, it has been detrimental for the profitability of processing companies like Fonterra, who are struggling to pass the higher costs onto the price of the dairy products it manufactures.

With new COVID outbreaks in China, there are fears that its ‘zero-COVID’ policy could push the country into another lockdown and put additional stress on global supply chains. Additionally, the value of the Russian rouble has depreciated so severely due to economic sanctions that Russia may default on its sovereign debt.

The Commerce Commission’s report into the supermarket sector has found that competition in the market is “not working well” for consumers and that Kiwis are facing higher prices than they would under a more competitive system. Other than recommending a mandatory code of conduct, the report did not propose any significant structural changes.

Briscoe’s Group has reported a net profit of $87.9m for the year ended 30 January 2022, up from the previous year’s net profit of $73.2m. Sales were also up by ~6% at $744.4m.

- The New Zealand Government is opening its borders to vaccinated Australian tourists from 11:59pm on 12 April 2022 and visa-waiver countries from 11:59pm on 1 May 2022. Those who hold visas will be able to travel to New Zealand without isolation from 1 May. This is expected to revive New Zealand’s tourism, hospitality and retail sectors as international visitors finally return.

Recent deals

- The Government has confirmed the merger of RNZ and TVNZ, creating a single non-profit public media entity. Expected to be operational by 1 July 2023, the merger is intended to encourage digital innovation as well as add new capability and services.

The Commerce Commission has approved the merger between 2degrees and Orcon Group, a $1.7bn dollar deal which will see the creation of a stronger third player in New Zealand’s telecommunications industry. Operating under the 2degrees brand, the enlarged company will be owned by Australian fund managers Macquarie Asset Management and Aware Super.

Australian private equity firm Allegro has acquired Gull New Zealand for $572m, subject to approval from the Overseas Investment Office and the Commerce Commission. The sale is a result of a divestiture undertaking given by Ampol due to the proposed acquisition of Z Energy.

- Kinetic, an Australian bus operator, has signed a contract to acquire NZ Bus Ltd. The deal will see Kinetic become the largest operator of electric buses in Australasia and one of the largest globally.

PwC Retail and Consumer Dashboard

The PwC Retail and Consumer Dashboard is updated monthly, to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of the COVID lockdowns. If you are interested in online access to our dashboard to help inform your decision making, please contact: Matt Gunn

How we can help:

PwC has advised many of New Zealand’s largest listed and privately owned retailers across a wide variety of projects and roles, including assurance, tax, capital solutions, transactions services, M&A, restructuring, real estate, supply chain and digital consulting services.

We have a comprehensive understanding of the rapidly evolving retail environment (offline and online) and are uniquely placed to combine strategy with technical, industry and execution expertise. We pride ourselves on a focused partnership approach to our work in the sector, based on principles of trust, independence and challenging insight, using specialist teams tailored to specific client needs.