A message from Andrew Holmes, CEO and Senior Partner

The global landscape is evolving rapidly, and New Zealand finds itself at a critical juncture, facing a series of dynamic issues that demand swift and strategic responses from businesses and also the public sector. Like many nations, we are navigating a storm of challenges and opportunities including:

- Increased living costs, fluctuating interest rates and reduced economic activity.

- Global competitiveness issues evidenced by lower rankings on international indices.

- Growing pressure on healthcare and social services given our aging population, and a smaller working-age tax base, leading to reliance on migration to sustain workforce needs and tax revenue.

- Climate change impacts with adverse weather events threatening infrastructure and agriculture.

- Changing globalisation trends, including the impact of tariffs, leading to uncertain trading conditions for our trade-reliant economy.

- Early signs that artificial intelligence (AI) has the potential to disrupt almost every type of business and change the competitive landscape.

The changing environment creates an imperative, and an opportunity, for New Zealand businesses to embrace innovation, increase competitive advantage, and focus on growth.

In this year’s survey, we find that New Zealand CEOs recognise that making the right strategic choices, and operational efficiency, are the most critical factors for ensuring the future viability of their businesses. CEOs are far more positive about the prospect of economic growth in New Zealand than they have been over the last two years.

Now is the time for business leaders to reinvent their businesses to drive growth, create and deliver value in new ways, reflecting what customers want and need, now and in the future. This moment calls for strategic decision-making to harness the opportunities. It’s the ability to innovate and respond that will determine business success in the years ahead.

The survey reveals many New Zealand businesses are already starting to reinvent and drive efficiency through the use of AI, however leaders also recognise the need to build trust in this technology through transparent communication and responsible practices.

I believe the future holds great promise for those willing to embrace change and reinvent our organisations to thrive in a rapidly evolving global landscape. While there will be challenges, there are innumerable growth opportunities. With the Government changing settings to drive growth, there are more opportunities for businesses to play their part, by embracing innovation to fuel their reinvention journey.

Finally, I would like to express my gratitude to CEOs who contributed their time and valuable insights to this year's survey. I trust that you will find this report informative and that it offers a view on how New Zealand businesses can gear up for the future.

Andrew Holmes

CEO and Senior Partner, PwC New Zealand

“I believe the future holds great promise for those willing to embrace change and reinvent our organisations to thrive in a rapidly evolving global landscape.”

Growing economic optimism

A significant majority of New Zealand CEOs are optimistic about the global economy. Notably, 69% of local business leaders believe that global economic growth will improve over the next 12 months (compared to 48% in 2024 and 13% in 2023). While this optimism is reflected across various regions (58% of global CEOs and 55% in Asia Pacific region share the positive outlook), New Zealand CEOs appear more confident than their offshore counterparts.

Closer to home, 59% of local CEOs expect the domestic economy to grow, indicating an increase in confidence compared to last year (52%).

When it comes to their own revenue growth, New Zealand business leaders are cautiously optimistic. Over the next year, 39% are “very or extremely confident” about their company’s revenue prospects. This figure rises when looking further ahead; 56% express strong confidence in revenue growth over the next three years.

In terms of workforces, 41% of New Zealand CEOs anticipate increasing their headcount in the coming year suggesting confidence in the potential for economic growth and expansion.

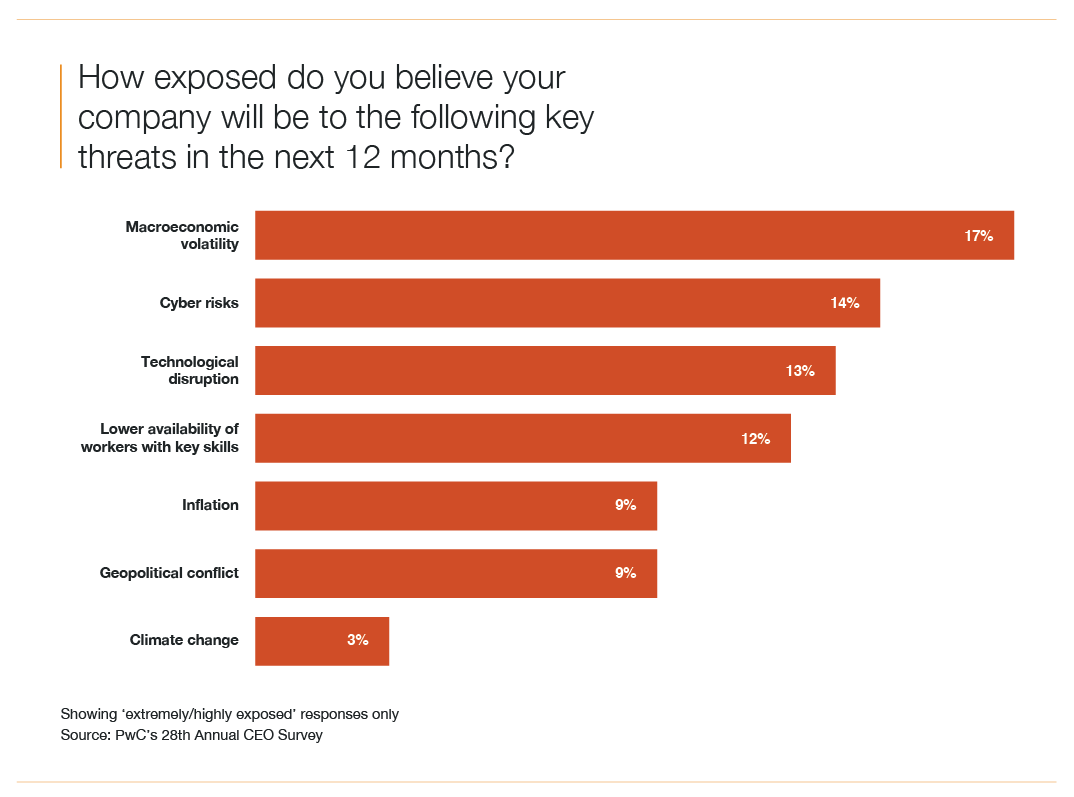

However, this optimism is tempered by potential threats. Macroeconomic volatility was identified as the greatest risk to businesses once again, followed by cyber risks and technological disruption. This view differs from global CEOs who see inflation as the second biggest threat after macroeconomic volatility.

“There's been a noticeable wave of optimism among business leaders, and rightly so. The economic landscape has improved considerably over the last year. This optimism is largely driven by a favourable shift in inflation, interest rates and the cost of capital, which have been on a downward trend.

“Will this trend continue? That is the big question and I suspect that if the survey was carried out now, rather than when it was in October/November 2024, the response might be more muted. For example, interest rates, while moving lower, may not decrease much further, and there's a possibility they could rise again in 2026.

“Given this, it’s understandable that macroeconomic volatility remains a top risk for local CEOs. While there is uncertainty locally, the global outlook is also mixed and we are exposed to many of those trends in New Zealand.

“Despite the potential challenges, the improvement in confidence about economic growth compared to last year is a positive sign. The current economic climate offers a promising landscape for growth and opportunity and CEOs are encouraged to seize those possibilities with a strategic mindset balanced by optimism and caution.”

Alex Wondergem | Partner, PwC New Zealand

“While there is uncertainty locally, the global outlook is also mixed and we are exposed to many of those trends in New Zealand.”

Alex Wondergem |Partner, PwC New ZealandEmbracing the reinvention opportunity

Almost a quarter of New Zealand CEOs (24%), believe that if their companies continue on their current trajectory, they may not remain economically viable within the next decade. This concern is even more pronounced in Asia Pacific with 45% expressing similar worries compared to 42% globally, highlighting a widespread need for transformation.

At the same time, these challenges create opportunities for businesses. 61% of local business leaders report having taken at least one significant action to change how their company creates, delivers and captures value.

40% of leaders report that their companies have ventured into new sectors or industries where they previously had no presence. The technology sector is the most common new area, attracting 18% of these businesses, followed by engineering and construction at 13%. This move into new sectors demonstrates an effort to diversify and adapt to changing market demands.

Despite these initiatives, the pace of transformation appears modest. New Zealand CEOs report that less than 10% of their revenue currently comes from fundamentally distinct new businesses added within the last five years. This suggests that while companies are taking steps toward innovation, they may not be moving boldly enough.

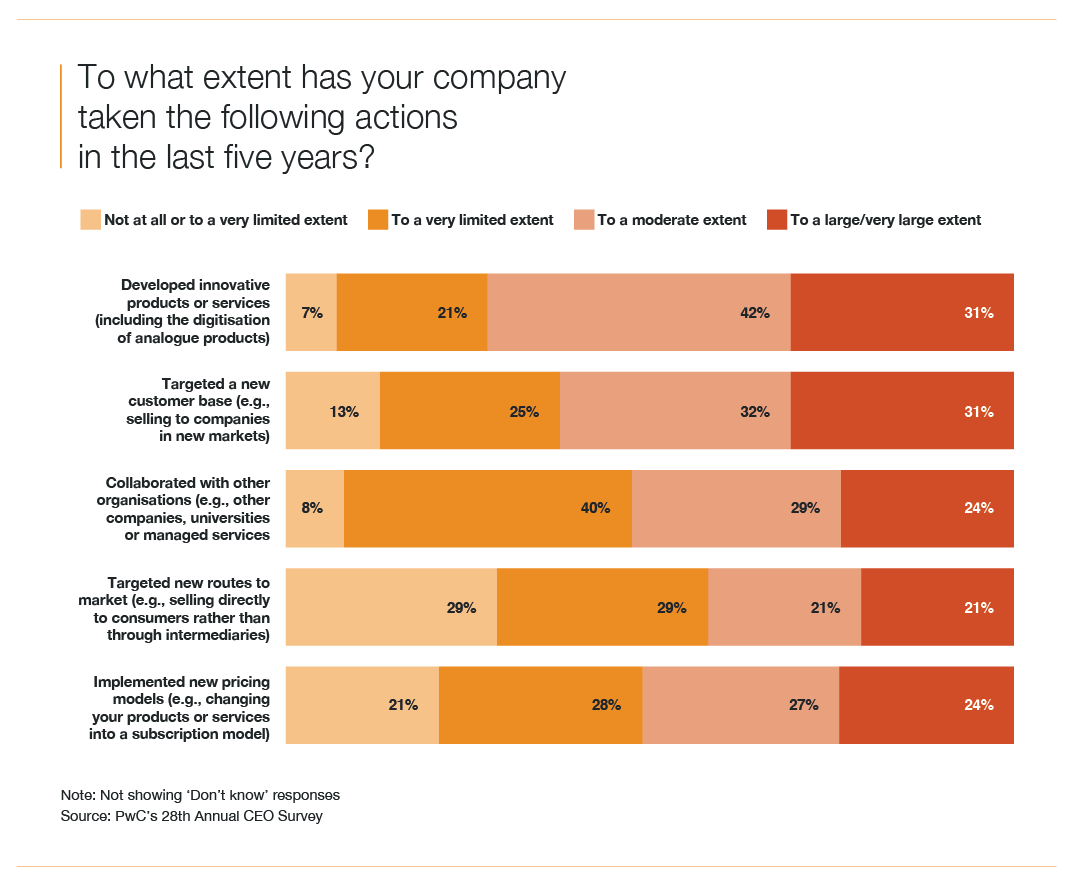

Product and service innovation remains the most common strategy for reinvention, alongside efforts to target new customer groups. However, more challenging actions, such as pioneering new routes to market, implementing innovative pricing models, or collaborating with other organisations to create new ecosystems, are less frequently pursued.

Dynamic resource reallocation is critical for effective reinvention. With over half of CEOs reporting the reallocation of 10% or less of their financial and human resources annually, there are still significant opportunities for more aggressive and strategic action.

“In today's rapidly changing landscape, it's crucial for businesses to adapt to thrive. The stability of previous years will not be our future reality, as the concurrent impact of significant long-term trends, with volatile short-term conditions and challenges, push us towards new economic norms.

"Leaders have the opportunity right now to maximise the outcomes in their organisations by focusing on what they can influence, bringing innovation to the way they engage with their customers, and by doing so, best set themselves up to adapt to those factors that are beyond our control. While transformation and efficiency remain important, successful organisations will be those that have reinvented themselves to be better at what they do for their customers.

"The opportunity for New Zealand is immense, both at the organisational level and when we think at an industry level. We have substantial competitive advantages that can remain at the heart of our success if we use them effectively to build products or services for our customers, change the way we engage with the globe, and invest to further bolster those strengths.

"Our channels to market are broadening, and the ability of technology to allow a more intimate relationship with our end users continues to improve. Organisations have the opportunity to change their distribution models, pricing structures, and in some cases they will even redefine who their customer is. Leaders that analyse the link between organisational capabilities and offers, with the needs of their most valuable customer groups, will find that their businesses thrive in the future in ways that have not been possible before.

“Strategic change starts with a deep understanding of your environment and capabilities today, to allow focus on what is needed for tomorrow. To mitigate concerns about change as something radical, rather than focusing on enhancing core differentiating capabilities for future success, it is crucial to thoroughly understand your environment and its potential future. Reinvention doesn't always require looking far afield; sometimes, the solutions are right on your doorstep.

“A mindset of proactive change and reinvention, rather than crisis management, will support firms to succeed with greater purpose. I’d love to see a survey next year where 20% (or more) of company revenues come from fundamentally new businesses. That would really drive economic growth in New Zealand.”

Phil Wheeler | Partner, PwC New Zealand

“We see an opportunity for significant revenue growth through reinvention of New Zealand businesses, in turn driving economic growth."

Phil Wheeler |Partner, PwC New ZealandHarnessing the potential of AI

New Zealand CEOs are largely positive about the potential benefits of AI - over half (55%) report that it is increasing efficiency in their own work time. While initial predictions in 2024 were slightly higher, with 64% of CEOs anticipating increased efficiencies, the current data still points to an upward trend.

Local CEOs, in particular, are witnessing remarkable productivity improvements among their employees. A sizable 70% report that AI is enhancing their employees' work efficiency - a slight increase from the impact CEOs thought it would have in 2023 (68%). This effect is significantly higher in New Zealand compared to business leaders in Australia (42%), Asia Pacific (58%) and globally (56%).

While the impact of AI on profitability has not entirely met initial expectations, the outlook remains promising - 47% of New Zealand CEOs believe that AI will boost their company's profitability over the next 12 months. Interestingly, only 13% of New Zealand CEOs consider AI to be “extremely important" for their long-term business success, suggesting a cautious approach towards its integration.

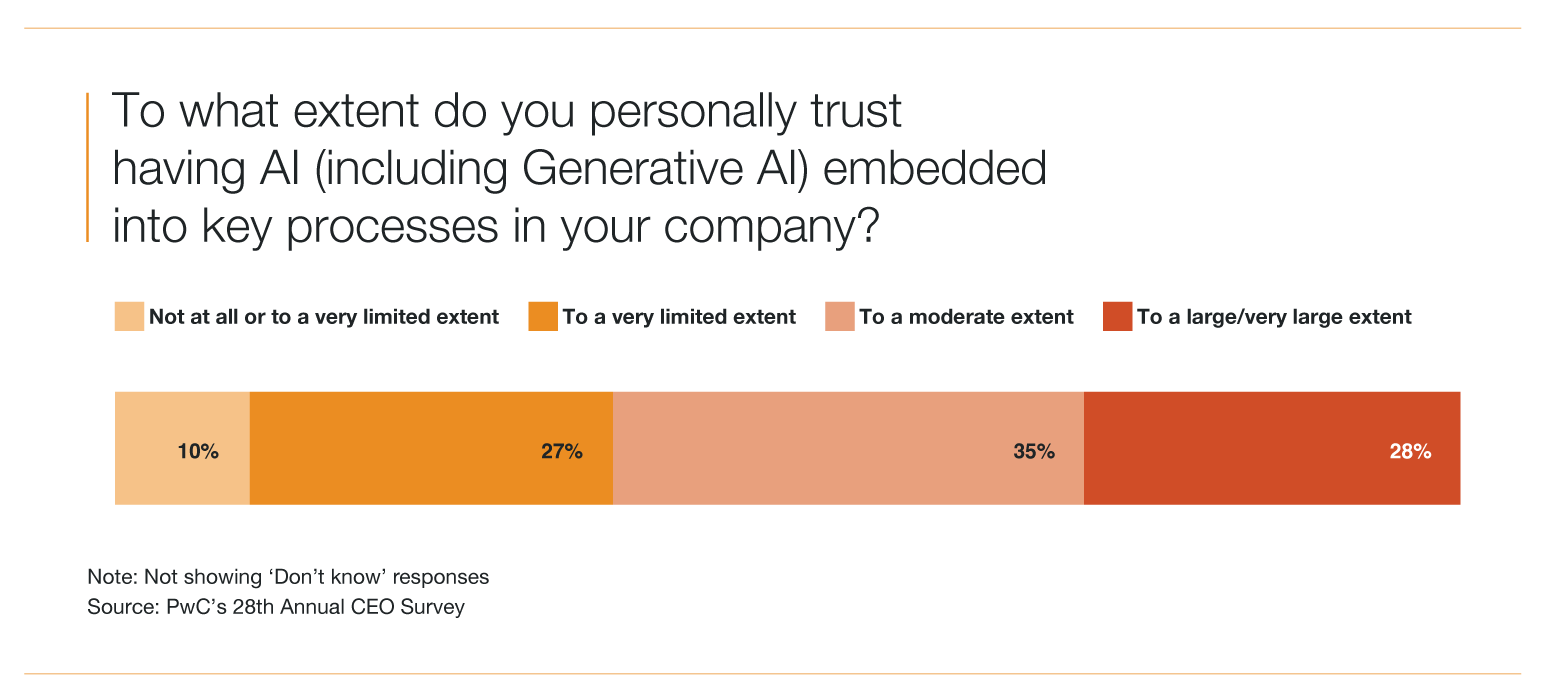

Despite the optimism, trust in AI remains a potential barrier to wider adoption. Less than a third of local CEOs (28%) express a high degree of trust in integrating AI into their business practices. This hesitancy highlights the need for robust frameworks and education to build confidence in the technology’s capabilities and how best to integrate it within business.

Looking ahead, CEOs are prioritising the integration of AI into technology platforms, business processes, and workflows over the next three years. Surprisingly, fewer than a third of CEOs are planning to incorporate AI into their workforce and skills strategies, indicating a potential area for development as businesses seek to maximise the benefits of AI.

“AI is no longer a future potential - it’s a productivity driver today. Like many new technologies, initial hype has often exceeded the practical implementation, but the broader story now is absolutely one of meaningful progress. GenAI is starting to make its mark for organisations that are embracing this technology.

“Our local CEOs are ahead of their global counterparts, including those in Australia, when it comes to seeing an increase in employee efficiencies. The challenge now is scaling this impact sustainably and responsibly across every layer of the business. Leaders should be thinking about how they can embed the technology further into business processes and workflows to unlock deeper value.

"There is little doubt that AI will change every layer of business in the coming decade, so getting started is key to remaining competitive and being fit for the future.

“However, it’s clear that trust issues remain. In my view, building this trust will be critical to unlocking AI's full potential for long-term business success. Success comes down to those that approach AI as a strategic enabler rather than just a tool.

"The potential of AI is immense and likely beyond what most of us can even envision. We are entering a period where human intelligence will likely be exceeded by advanced AI, but its impact for businesses will largely depend on how we act now.

"CEOs are prioritising integration over invention, which is a smart move in the short term. Long-term success will require addressing trust barriers and more deeply embedding AI across workforce and business strategies to transform.”

Scott McLiver | Chief AI Officer, Partner, PwC New Zealand

“Leaders should be thinking about how they can embed the technology further into business processes and workflows to unlock deeper value.”

Scott McLiver |Chief AI Officer, Partner, PwC New ZealandBalancing the costs and benefits of climate action

Local CEOs are committed to climate-related investment. A substantial majority (77%), say they have initiated these investments in the past five years, although at lower levels than their Australian, global and Asia Pacific counterparts (81%, 85% and 87% respectively).

Cost is a common challenge businesses face when implementing sustainable practices, although this is not universal - fewer than half of local business leaders (42%) report facing additional expense. However, New Zealand CEOs report increased costs related to climate investments more frequently than their counterparts in Australia (28%), globally (36%), or in Asia Pacific (34%).

While cost is a concern, the potential for increased revenue through climate investments is a prospect for many businesses. Globally, 33% of CEOs report that these investments have led to increased revenue from product or service sales, with those in Asia Pacific reporting an even higher impact at 39%. In contrast, only 21% of CEOs in New Zealand and 17% in Australia have observed similar revenue gains.

Overall, the survey reveals that cost increases from climate-friendly investments have generally been higher than revenue gains.

The data also highlights the varying degrees of financial impact that sustainability initiatives are having, suggesting that while some regions experience significant revenue growth, others are still in the early stages of unlocking the potential.

“The survey results are interesting. However, to interpret them fully we’d need to understand what the climate-friendly investments and related costs are. In my view, what we’re seeing is that local companies are largely aligning with global trends, but there are unique challenges for our market. Market size, lack of government financial incentives and geographic isolation mean that these investments don't always yield the same revenue gains as seen in larger markets.

“This should not deter us. While the path may be challenging, climate initiatives are essential for future-proofing businesses. The commitment to sustainability is not just a trend; it's a necessary evolution in how we conduct business, ensuring resilience and competitiveness in a changing global market.

“Globally, consumer expectations of sustainable, climate-positive business practices continue to mature, and have become a standard part of doing business. Consumers now take product certifications for granted for example, and companies must comply with international standards, regardless of local legislation. This shift is not just about compliance; it's about integrating sustainability into the strategic core of businesses.

“At the same time, consumers are increasing in awareness of the impacts of climate change, de-globalisation can be seen with changing government priorities around the world in respect to international climate agreements.

“The awareness of climate change risks has increased over the past few years, but we do see that as the recency of climate-related weather events ebbs, leaders are becoming less focused on these risks. It is important we are aware that our reliance on natural assets is both a strength and a vulnerability, underscoring the importance of sustainable practices to protect these resources.”

Annabell Chartres | Sustainability, Climate and Nature Leader, Partner, PwC New Zealand

“While the path may be challenging, climate initiatives are essential for future-proofing businesses.”

Annabell Chartres |Sustainability, Climate and Nature Leader, Partner, PwC New ZealandExplore our Survey Methodology

PwC’s 28th Annual Global CEO Survey: Reinvention on the edge of tomorrow

CEOs report early productivity gains from Generative AI and rising payoffs from investments in sustainability. The challenge is to increase scope and speed.

28th Annual Global CEO Survey - Asia Pacific: Reinvention in motion.

Asia Pacific CEOs go into 2025 with both optimism and caution.