{{item.title}}

{{item.text}}

{{item.text}}

PwC’s Retail and Consumer Quarterly Insights provides the latest consumer behaviour news and trends in New Zealand and globally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ and other local and global sources.

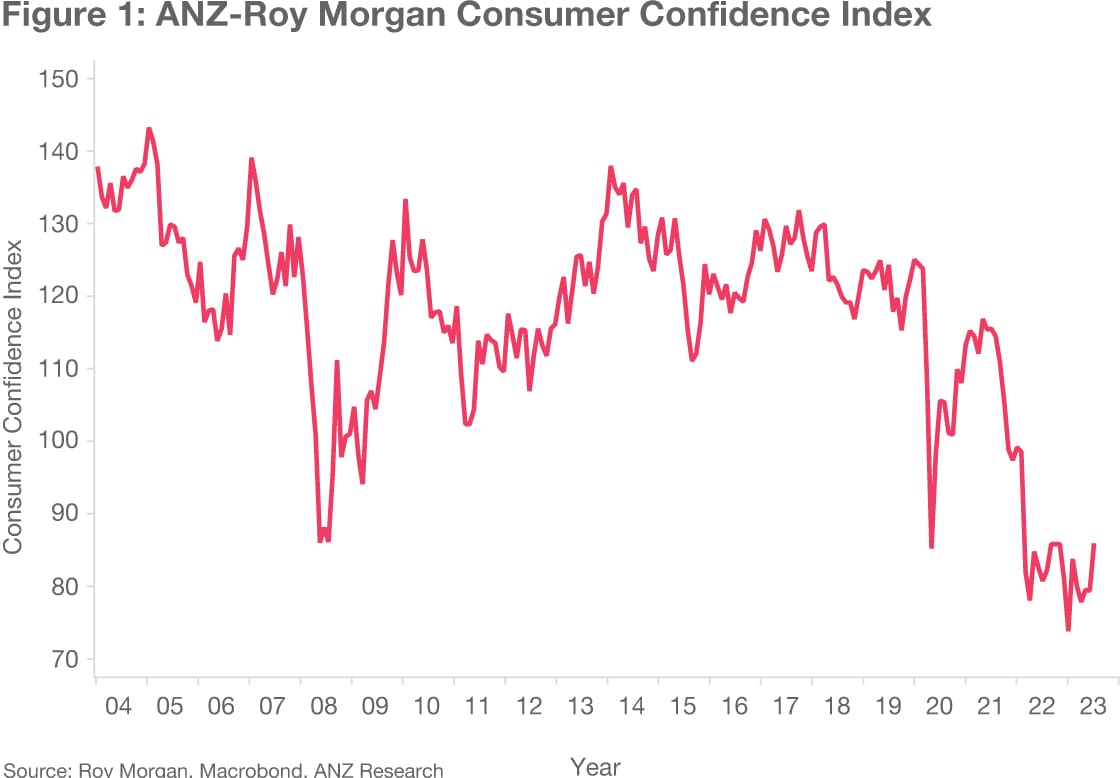

The ANZ-Roy Morgan Consumer Confidence Index increased by six points in June to 85.5, the highest recorded since January 2022.

The proportion of people who believe it is a good time to buy a major household item has increased from -32 in March to -27 in June (although still very low by historical standards).

House price inflation expectations continue to increase, from 0.4% in April to 1.6%, reaching its highest level in the last two years.

Food prices were 12.1% higher in May 2023 than they were in May 2022, causing a further drain on consumer’s pockets.

The Hospitality industry continues to grow, with monthly sales increasing from $1.09 billion in June 2022 to $1.18 billion in June 2023.

Fuel sales were down $121 million (7.2%), noting the Government’s temporary reduction in fuel excise tax finally came to an end on 30 June.

To explore further, select the buttons below.

During the second quarter of 2023, the New Zealand economy entered a technical recession after two successive negative GDP growth quarters. Economic activity is likely to decrease further as businesses and consumers continue to feel the effects of higher interest rates and inflation, although these financial pressures are now forecasted to ease from next year.

Over the last three months, ANZ-Roy Morgan Consumer Confidence Index has risen from 77.7 in March to 85.5 in June. Despite the figures over the past quarter remaining low against historical figures, the June figure is at the highest level since January 2022. Future confidence is considerably stronger than recent months, with responses to ANZ’s forward-looking questions being more positive than prior months.

“While off a low base, consumer confidence has reached new highs in comparison to the last 12 months. However, challenges remain due to persistently high inflation and mortgage interest rates. Consumers continue to be impacted by interest rates and high living costs, which may stifle retail and consumer spending in the coming months”.

The portion of people who believe it is a good time to buy a major household item, still considered the best indicator of retail spending, rose to -27 in June from -32 in March. Consumers with a mortgage have considerably stronger negative views on this metric and negative sentiment towards their own financial situations compared to a year ago, in contrast to those without a mortgage. Consumers who have a mortgage rolling off low fixed mortgage rates over the next few months are having their living costs jump by thousands of dollars due to high interest rates. This is likely to have a considerable impact on household spending over the next year with a greater portion of household incomes going towards repayments (especially those with large debt balances).

The OCR increased by 25 bps in May to 5.5% (a 14 year high), with the RBNZ then leaving the rate on hold on 12 July 2023. Persistent rate rises since October 2021 have slowed consumer spending and contributed to sustained house price deflation since their peak in December 2021.

The cost of living crisis is still on a number of consumers' minds, with Stats NZ announcing yet another rise in food prices. Food prices rose 12.1% in the year to May 2023, causing a further drain on household income. Fruit and vegetables were the largest contributor to the increase up 18.4%, with the impact of Cyclone Gabrielle continuing to be felt by the primary sector. Other notable increases were meat, poultry and fish increasing by 11.7% and non-alcoholic beverages increasing by 11.6%. However, on a monthly basis the increase in food prices was the lowest recorded since April 2022, suggesting that the peak of food price inflation may have been reached. The most recent ANZ Consumer Survey also confirmed that CPI expectations have fallen to 4.3%, from 5.4% in March 2023.

Consumer expectations in relation to house price inflation have also increased from 0.4% to 1.6%. Significantly, expectations are now positive in all regions across the country. House price inflation expectations are now the highest they have been in the last two years, with some market commentators suggesting that house prices have now plateaued (since their peak in December 2021).

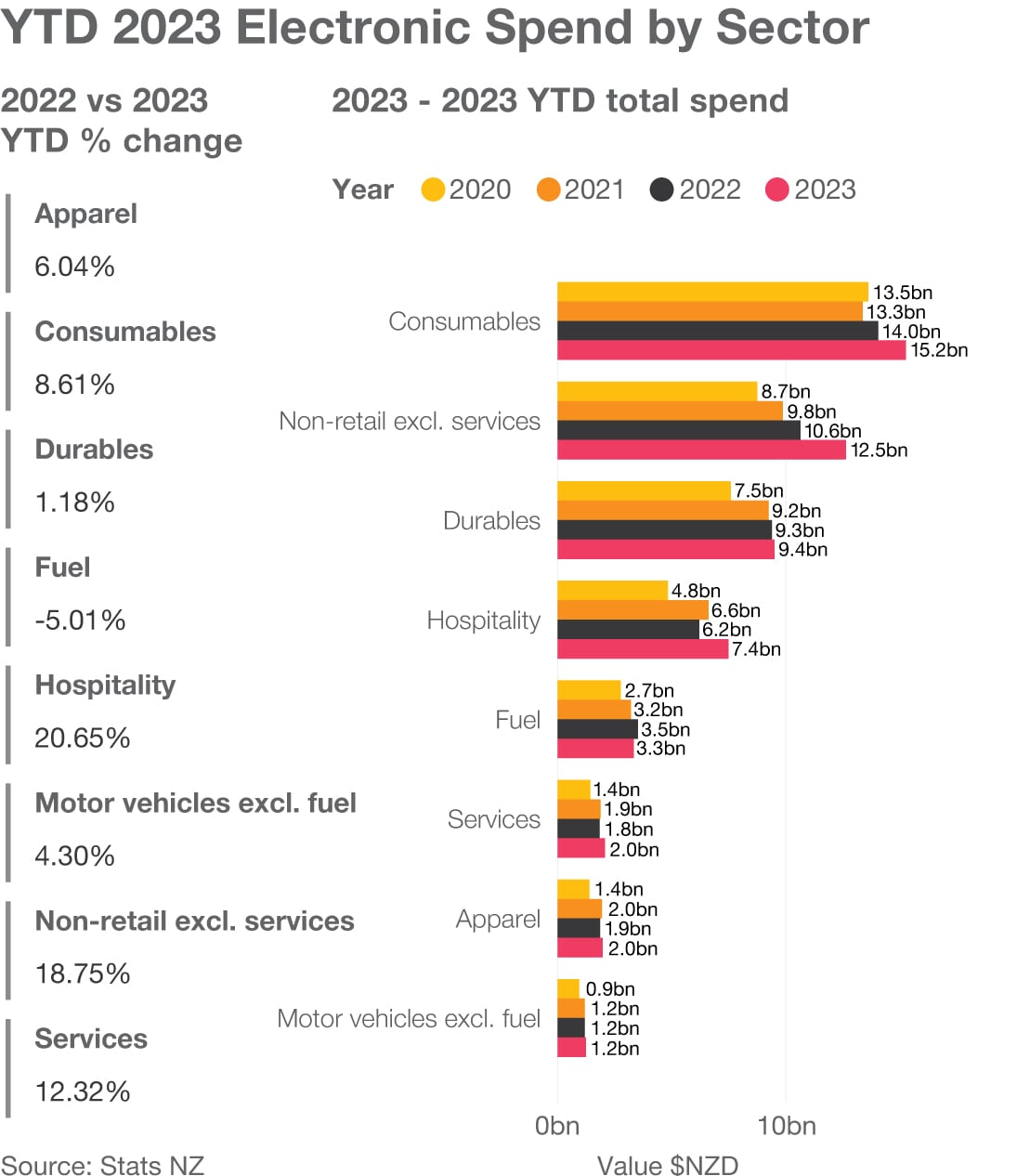

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions series data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we are able to compare YTD retail-related electronic spend data by sector with the comparable periods in 2020, 2021 and 2022.

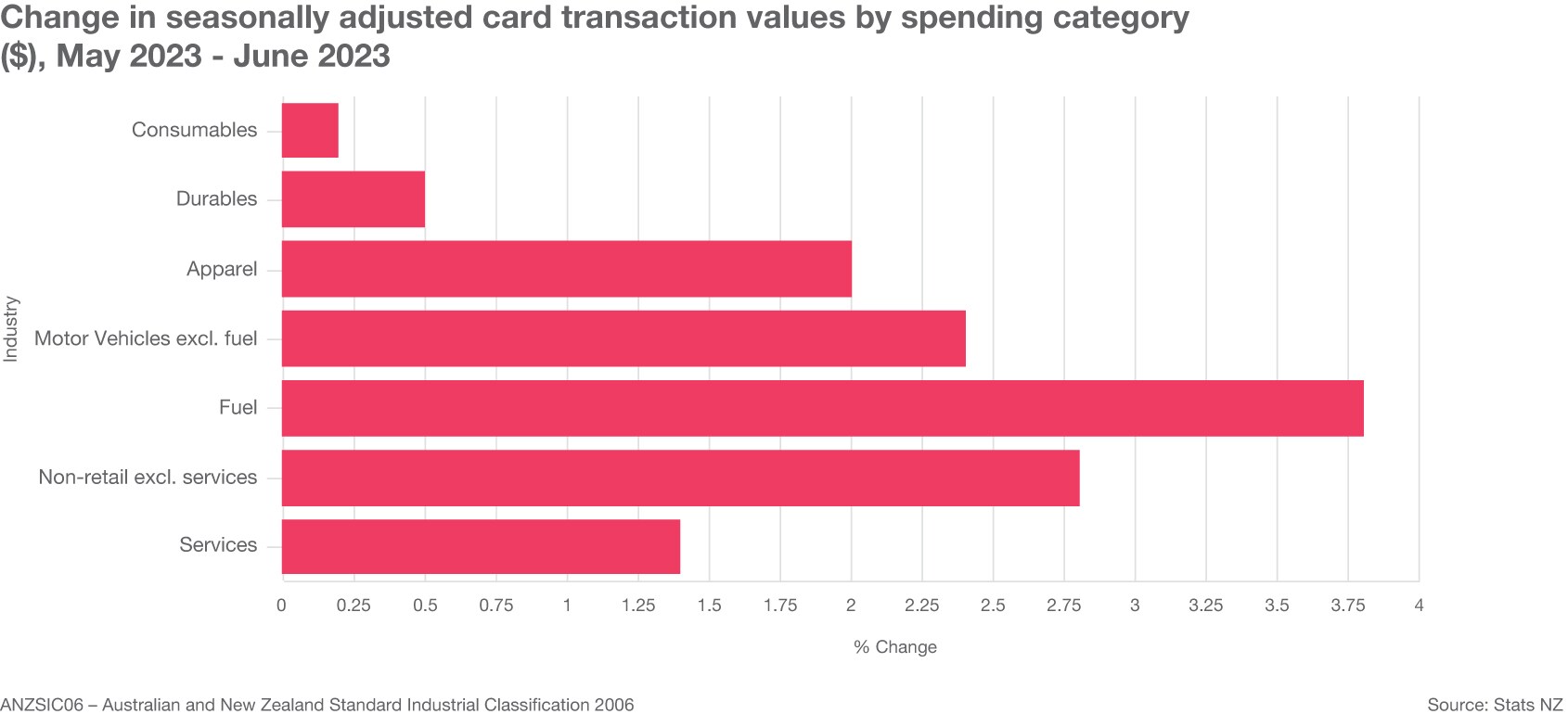

The June 2023 electronic spend data (released by Stats NZ on 13 July 2023) showed that seasonally adjusted spending in the Retail Industries increased by 1% compared to May 2023. However, seasonally adjusted spending in the Core Retail Industries remained unchanged.

Fuel, up $20 million (+3.8%)

Motor vehicles (excluding fuel), up $5.1 million (+2.4%)

Durables, up $8.2 million (+0%)

Consumables, up $5.0 million (+0.2%).

Apparel, up $6.6 million (+2.0%)

An increase in spending in the retail industries by 0.7% (this includes fuel and vehicle spending)

An increase in spending in the core retail industries by 0.8% (this includes spending in relation to consumables, durables, hospitality and apparel).

Consumables, up $152 million (2.0%)

Apparel, down $35 million (3.4%)

Durables, up $58 million (1.1%)

Fuel, down $121 million (7.2%)

Motor vehicles (excluding fuel), up $5.1 million (0.8%)

It is interesting to note the uncharacteristic movement in June quarter related to fuel. With the short-term adjustment in fuel tax coming to an end, it seems to have given the June fuel spending a last minute boost, despite the overall decrease in fuel spending over the quarter.

The effect of inflationary pressures on spending, such as consumables, was clearly reflected in the recent edition of the Kiwibank household spending tracker. The report identified that the “growth in dollars spent at grocery stores continues to outpace the growth in the volume of transactions made”. This means that while the size of the transaction (i.e. the amount of consumables) may not increase by much, the cost of that transaction is much greater than it used to be. This is supported by the latest data on the Consumer Price Index for the June 2023 quarter which saw an increase of 2.7% in grocery food prices.

Using the PwC Retail and Consumer Dashboard we also analysed year-to-date electronic spend and year-on-year growth by retail category. The Hospitality industry continues to grow as international borders reopened, travel resumed and international visitors gave a boost to the tourism industry, with monthly sales increasing from $1.09 billion in June 2022 to $1.18 billion in June 2023. While this is an increase in growth, the rate of growth has declined drastically, from 50.6% in 2022 to 8% in 2023. This is likely to be a result of increased prices of raw materials, staffing and other operational costs that hospitality providers have faced, and consequently, have been forced to pass on to consumers and the market.

1 “Core Retail” comprises the Consumables, Durables, Hospitality and Apparel categories, while the “Retail Industries” category also includes Fuel and Vehicles.

PwC’s recently published Global M&A trends in Consumer Markets: 2023 Mid-Year Update has shown M&A activity in consumer markets reached its lowest level since pre-COVID. The continued economic uncertainty has directly affected consumer spending and this will likely lift only gradually during 2023.

However, it is expected that restructuring activity across consumer markets, particularly in retail and some parts of the leisure sector, will increase with a growing number of companies facing liquidity or refinancing. This also increases the potential for (pre-) distressed M&A, with opportunistic, cash-rich corporates and private equity funds expected to be the most likely buyers.

Our report also highlights the ever increasing desire to innovate and leverage technology to get more out of existing consumer spend, and to convert or find new customers. We believe this is partly due to the pressure for businesses to transform through transactions and accelerate the delivery of their strategic agendas.

Looking ahead to the second half of 2023, the retail sector remains challenging with M&A activity more likely to occur in the more resilient subsectors, such as consumer health and wellness (including clinics offering health and beauty services), beauty, pet retail and pet services, or in specific situations which are driven by refinancing or the need to transform.

The consumer sector remains attractive from an M&A perspective, with dealmaking activity driven by portfolio reviews and strategic deals. We anticipate M&A activity will pick up in the food ingredients and agri-business subsectors, and we have also noted a growing interest in consumer services (such as lawn care, home cleaning, grocery and food delivery), with investors attracted to the recurring nature of the revenues and the digital base for the provision of services.

Overall, M&A activity in the hospitality and leisure sector during the first half of the year has been dominated by the sports subsector. Business travel has almost returned to the levels seen in 2019, and deal activity in the travel subsector has picked up as a result.

After experiencing record M&A activity levels between 2021 and mid-2022, in a sector that benefited from pandemic-fuelled demand and profits boosted by the ensuing supply chain disruptions, deals activity within the transportation and logistics sector has since abated and remains below both pandemic and pre-pandemic levels in the first half of 2023.

PwC’s Global Consumer Insights Pulse Survey has reinforced the importance of empowering consumers by providing them with the necessary tools, information, technology and support for their decision-making. Results from the survey highlight the benefit of removing frictions before the purchase experience and how by doing so businesses can get closer to their customers, fostering both paid and earned loyalty.

Consumers are using diverse ways to research products prior to making a purchase decision, with 31% of respondents typically researching items/products they intend to buy through social media. There is also an increasing willingness to engage with AI during the shopping experience, with 44% of consumers indicating they would be interested in using chatbots to search for product information before they make purchase decisions.

The survey highlights a trend towards consumers favouring buying directly from brands with a majority of consumers (63%) indicating they purchased products directly from a brand’s website, while an additional 29% indicated they are considering the direct-to-consumer (D2C) option. Maintaining sophisticated e-commerce channels and optimising digital marketing will enable increased control over the customer experience, access to valuable customer data and insights, and improved profit margins and revenue opportunities.

Half of those surveyed indicated they intend to boost their online spending over the next six months, however, 50% of respondents also expect to continue shopping in physical stores. This reinforces the advent of the “phygital” consumer described in the February survey, where consumers are saying that they want the physical shopping experience to be enhanced, facilitated or mediated by digital technologies.

From 1 July 2023 New Zealand banned the manufacture, sale or distribution of single-use plastic produce bags, plates, bowls and cutlery. New Zealand is considered to be the first country in the world to implement this ban, which is expected to eliminate 150 million plastic bags each year and is part of a longer term goal of reducing carbon emissions.

A recent Retail Radar report from Retail NZ reports that 36% of retailers don’t expect to survive the next 12 months, with 59% indicating that they didn’t meet sales targets over the quarter, up 15% on the previous quarter.

Global food delivery service company, DoorDash, has officially launched in Auckland, more than a year after it first launched in New Zealand. With over 1,300 eateries already signed up, and 3,000 people registered to deliver, DoorDash hopes to add much needed competition to the market and allow eateries to reach more customers.

On 12 July, RBNZ confirmed that it will be holding the OCR at 5.5% and warned it will need to remain restrictive for the foreseeable future. ASB Chief Economist Nick Tuffley said in a statement that “We don’t expect OCR cuts until May next year, give or take”.

Consumers NZ's sentiment tracker's latest report sheds light on a recent surge in concern among shoppers regarding the effects of climate change, specifically among individuals aged 50 and above. The report highlights around 85% of people have either intensified or sustained their endeavours to shop sustainably.

Pernod Ricard, a global liquor company, has acquired a 14.2% equity stake in AF Drinks, an Auckland based non-alcoholic drink company. The transaction will allow AF Drinks to leverage Pernod Ricard’s global networks to launch in the US and Britain markets.

On 9 May, weight loss company Jenny Craig was placed into administration following its US arm filing for bankruptcy. Administrators were unable to find a buyer for the physical stores operated by the Australian and New Zealand business. Jenny Craig's online business has been acquired by health technology company, Eucalyptus.

New Zealand children’s shoe brand, Bobux, has been acquired by Australia's largest privately owned footwear company, Munro Footwear Group. The acquisition comes just four weeks after Bobux went into receivership citing overspend on an IT upgrade and COVID related supply chain issues.

Synlait Milk Limited has announced its intention to divest the Dairyworks and Talbot Forest Cheese businesses.

The PwC Retail and Consumer Dashboard is updated monthly to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of COVID. If you are interested in online access to our dashboard to help inform your decision making, please contact: Beini Guo

{{item.text}}

{{item.text}}