{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

PwC’s Retail and Consumer Quarterly Insights provides the latest consumer behaviour trends in New Zealand and globally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with sharp insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ, combined with other local and global sources.

The ANZ-Roy Morgan Consumer Confidence Index increased from 85.5 in June to 86.4 in September. This is the highest level recorded since January 2022, despite confidence levels still being at a historical low.

With the cost of living crisis continuing to prevail, Stats NZ announced they will release monthly price change data for alcoholic beverages, tobacco, petrol and diesel, international airfares and accommodation, in addition to the current reporting on food and rental prices. Stats NZ’s monthly updates will now cover around 44% of New Zealand’s household spending monthly.

There is increased market commentary around house prices rising across the country. The ANZ September consumer confidence survey showed that consumers are anticipating a yearly increase in house prices of 3.2% for the next two years. ANZ economists expect the median house price nationwide to reach $812k at Christmas, from $780k in September (+4.1%).

When comparing the seasonally adjusted value of retail electronic card transactions from June to September, there was a small increase in spending in the retail industries by 0.2% (including fuel and vehicle spending) and core retail industries by 0.6% (including spending in relation to consumables, durables, hospitality and apparel).

The four major banks have bumped up home loan rates which means rising interest rates will continue to put a squeeze on New Zealand households when a significant portion of homeowners have already been rolling onto higher rates from earlier in the year.

The Hospitality industry continues to grow as a result of increased travel and higher operational costs that have been passed on to consumers and the market.

The food price index is still having a considerable impact on households with grocery food prices up 10.7% in the year to September 2023. Restaurant meals and ready-to-eat food was also up 8.6% (Stats NZ).

It will be interesting to see the trend in spending as we enter the golden quarter of the holiday season. Is Santa going to come around? Or will there be fewer presents under the tree?

To explore further, select the buttons below.

During the third quarter of 2023, New Zealanders have continued to adjust to a high interest rate environment and the cost of living crisis. Retailers are bearing the brunt of the impact, with retail spending continuing to fall. Excluding the COVID-19 lockdown period, consumer spending has reached a four year low. The OCR has been held at 5.50% since May, with expectations that it will remain at this elevated level for some time. There is still a possibility that the RBNZ may look to enact further monetary policy tightening in an attempt to control inflation, currently at 5.6%, although this has begun slowly trending downwards.

In quarter three, the ANZ-Roy Morgan Consumer Confidence Index increased slightly from 85.5 in June to 86.4 in September. This is the highest recorded since January 2022, despite confidence levels still being at a historical low. As the Consumer Price Index (CPI) has begun trending downward, the market's expectations of future inflation levels, as proxied by two-year ahead CPI inflation expectations, sit at 4.20% which is the lowest reading since March 2021 (prior to inflation quickly accelerating).

"Whilst consumer confidence is slowly trending upwards, tough times appear to be continuing for both consumers and retailers. Costs are continuing to rise and consumer spending looks to be slowing down as a result. Retailers will be hoping the sales activity around Black Friday, Cyber Monday, and the Christmas period, will reflect the usual peak in retail spending, and not be significantly impacted by the high interest rate environment and rising costs of living."

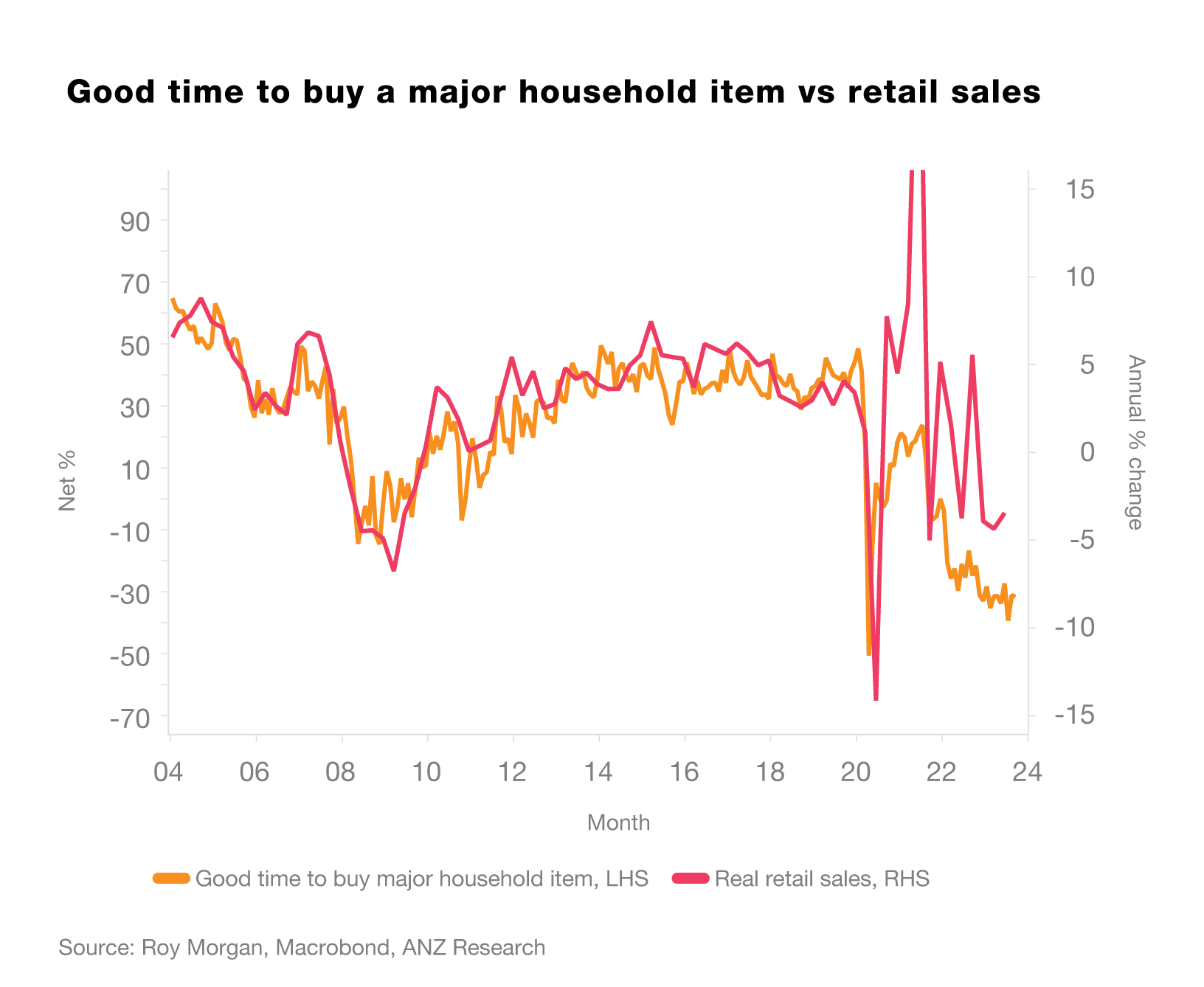

The portion of people who believe it is a good time to buy a major household item, still considered the best indicator of retail spending was -32 in September. This is up from an annual low of -39 in July but still a lot lower than most retailers would want to be seeing. With rising interest rates and consumers rolling off low fixed mortgages, an overwhelming majority believe it is a bad time to buy a major household item. Tough times for retailers are expected to continue.

With the cost of living crisis continuing to prevail, Stats NZ have announced they will now release monthly price change data for alcoholic beverages, tobacco, petrol and diesel, international airfares and accommodation. Currently they only release food and rent price data monthly. By including these new categories in its monthly updates, Stats NZ will cover around 44% of New Zealand’s household spending monthly. The RBNZ have signalled this increase in the frequency of data will enable them to have stronger insight into inflation going forward. The food price index is still having a considerable impact on households with grocery food prices up 10.7% in the year to September 2023. Restaurant meals and ready-to-eat food was also up 8.6% (Stats NZ).

There is increased market commentary around house prices rising across the country and the consumer confidence survey shows a 3.2% house price inflation expectation. This is in stark contrast to survey results from February 2023 which showed no house price inflation expectation. ANZ economists expect the median house price nationwide may reach $812k at Christmas from $780k in September. The potential for house price increases may be influencing more optimistic responses from those with mortgages in the consumer confidence survey question regarding “Better off than last year” (despite increasing interest rates).

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we have compared YTD retail-related electronic spend data by sector with the comparable periods from 2020 to 2022.

On 13 October 2023, Stats NZ released the September 2023 electronic spend data which showed that seasonally adjusted spending in the Retail Industries and Core Retail Industries decreased by 0.8% and 0.2% compared to August 2023, respectively.

Motor vehicles (excluding fuel), down $2.3 million (-1.1%)

Apparel, down $9.7 million (-2.8%)

Consumables, down $4.5 million (-0.2%)

Durables, down $20.0 million (-1.2%)

Fuel, down $6.1 million (-1.0%)

The most significant decrease when comparing the August and September retail electronic spending was within the Apparel category which decreased by 2.8% from the previous month. This drop in spend against August, as well as in the other Retail Industries categories, shows a consistent trend of households tightening their belts as the pressures of higher cost of living continue to be felt.

retail industries, up 0.2% (this includes fuel and vehicle spending)

core retail industries, up 0.6% (this includes spending in relation to consumables, durables, hospitality and apparel).

Fuel, up $143 million (+8.9%)

Durables, up $3.6 million (+0.1%)

Consumables, up $58 million (+0.7%)

Motor vehicles (excluding fuel), down $4.0 million (0.6%)

Apparel, up $50 million (+5.0%)

The 8.9% increase in the Fuel category versus the previous quarter was mainly driven by higher prices paid at the pump due to increased global oil prices and the end of the 25c fuel Excise Duty tax cut and diesel road user charge discount.

Within the third quarter, the four major banks have increased home loan rates which means rising interest rates will continue to put a squeeze on New Zealand households, when a significant portion of homeowners have already been rolling onto higher rates from earlier in the year. The Consumer Price Index for the third quarter showed that inflation slightly cooled at an annual rate of 5.6%. Prices are still increasing albeit at a lower rate than the previous quarters. It will be interesting to see the trend in spending as we enter the golden quarter of the holiday season. Is Santa going to come around? Or will there be fewer presents under the tree?

Using the PwC Retail and Consumer Dashboard we have analysed year-to-date electronic spend and year-on-year growth by Retail category. The Hospitality industry continues to grow as a result of increased travel and higher operational costs that have been passed on to consumers and the market.

1 “Core Retail” comprises the Consumables, Durables, Hospitality and Apparel categories, while the “Retail Industries” category also includes Fuel and Vehicles.

Reboot retail cost management: 5 questions to ask

Retail executives feel less confident on their prospects for growth in 2023, considering the daunting challenges they are facing: inflation and the risk of an increasing decline in consumer spending. Adding further pressure are heightened consumer expectations, from a greater desire for a seamless omnichannel experience to ultra-personalised offers and timely, convenient delivery — all of which require additional investments.

Meanwhile, wages are on the increase and a talent shortage looms large. Retailers have also seen input costs rise while having little recourse other than to pass those costs onto their mercurial, price-sensitive customers.

How should leaders respond to this squeeze? What cost management strategies does the moment need? The answers to these five questions can guide your company toward a more sustainable approach to cost management:

Which business outcomes are most important for your company?

How can you simplify operations to deliver those outcomes?

Where does digitisation offer the highest return?

How can you best align with service providers?

How can you develop a more sustainable approach to cost management?

A balancing act: Promoting considered consumption to deliver responsible growth

Today’s consumer is increasingly discerning in what, how and when they buy. The growing trend of conscious consumerism is no longer in its infancy.

Expectations are changing, and there’s a growing demand for quality over quantity, durability over disposability. Added to that is concern over personal finances, where inflation remains the critical factor affecting people’s spending power, even with consumer confidence gradually returning. For many brands, this has created a conflict: how do they support this new consumer behaviour while maintaining long-term growth when, for so long, they have focused on encouraging increased consumption?

The solution lies in a complete change in how an organisation thinks and operates. It must go further than grounding sustainability in its offerings and do more than focusing on what consumers are looking for right now. Only by positively changing around your consumer can you better understand their wants, needs and states, and deliver differentiated experiences that balance mindful consumption and responsible growth. Something which might present a clear paradox.

A report released by Retail NZ this quarter has estimated that retail crime in New Zealand is costing the economy over $2.5bn per annum. Of this approximately $1.3bn is lost due to shoplifting, burglary and internal crime such as fraud and employee theft.

Consumer NZ has accused both of New Zealand’s major supermarket chains, Woolworths and Foodstuffs of breaching the Fair Trade Act. The complaint was lodged to the Commerce Commision citing instances of both groups providing false or misleading information to consumers in the promotion and sale of goods and services. This included charging consumers a different price than was advertised, having more expensive promotional prices than the original price, and misleading multi-buys.

The price of eggs has left many New Zealanders scrambling, increasing almost 60% in the year to September. The initial price increases were caused by a ban on battery and caged hens. The supply is increasing but the price of eggs continues to rise.

In the October Monetary Policy Review the Reserve Bank held the OCR at the current rate of 5.50%. Within the statement they signalled that rates will remain at these elevated levels until inflation is under control, messaging the potential for another 25 basis point hike (ANZ/RBNZ).

Cardrona Distillery Limited, a Wānaka producer of premium spirits, has been acquired by International Beverage, the international arm of Thai Beverage (ThaiBev). Cardrona Distillery includes the award-winning labels of Cardrona single malt whisky, The Reid Vodka, The Source Gin and Rose Rabbit liqueurs. The acquisition includes the distillery, cellar door and visitor centre near Wānaka.

Two New Zealand cookie producers have combined after Cookie Time Limited acquired Mrs Higgins Limited. Mrs Higgins was previously owned by Rangatira investments. The acquisition includes Mrs Higgins Auckland based state of the art factory.

EBOS group limited has acquired Superior Pet Food Co, a manufacturer and supplier of dog rolls in New Zealand which first began production in the 1970’s.

New Zealand beauty product distributor, CS&Co has announced its sale to Swiss based DKSH Consumer Goods. CS&Co distributes over 50 domestic and international brands.

The PwC Retail and Consumer Dashboard is updated monthly to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time. If you are interested in online access to our dashboard to help inform your decision making, please contact Beini Guo.

PwC has a comprehensive understanding of the rapidly evolving retail and consumer environment (offline and online) and are uniquely placed to combine strategy with technical, industry and execution expertise. We pride ourselves on a focused partnership approach to our work in the retail and consumer sector, based on principles of trust, independence and challenging insight, using specialist teams tailored to specific client needs.

PwC has advised many of New Zealand’s largest listed and privately owned retailers and consumer products businesses across a wide variety of projects and roles, including Assurance,Tax, Capital Solutions, Transactions Services, M&A, Restructuring, Real Estate, Supply Chain and Digital Consulting Services.