{{item.title}}

{{item.text}}

{{item.text}}

We have pulled the results together into five separate summaries covering the key takeaways from the latest data. In this first summary, we look at the main survey findings and share the top level insights.

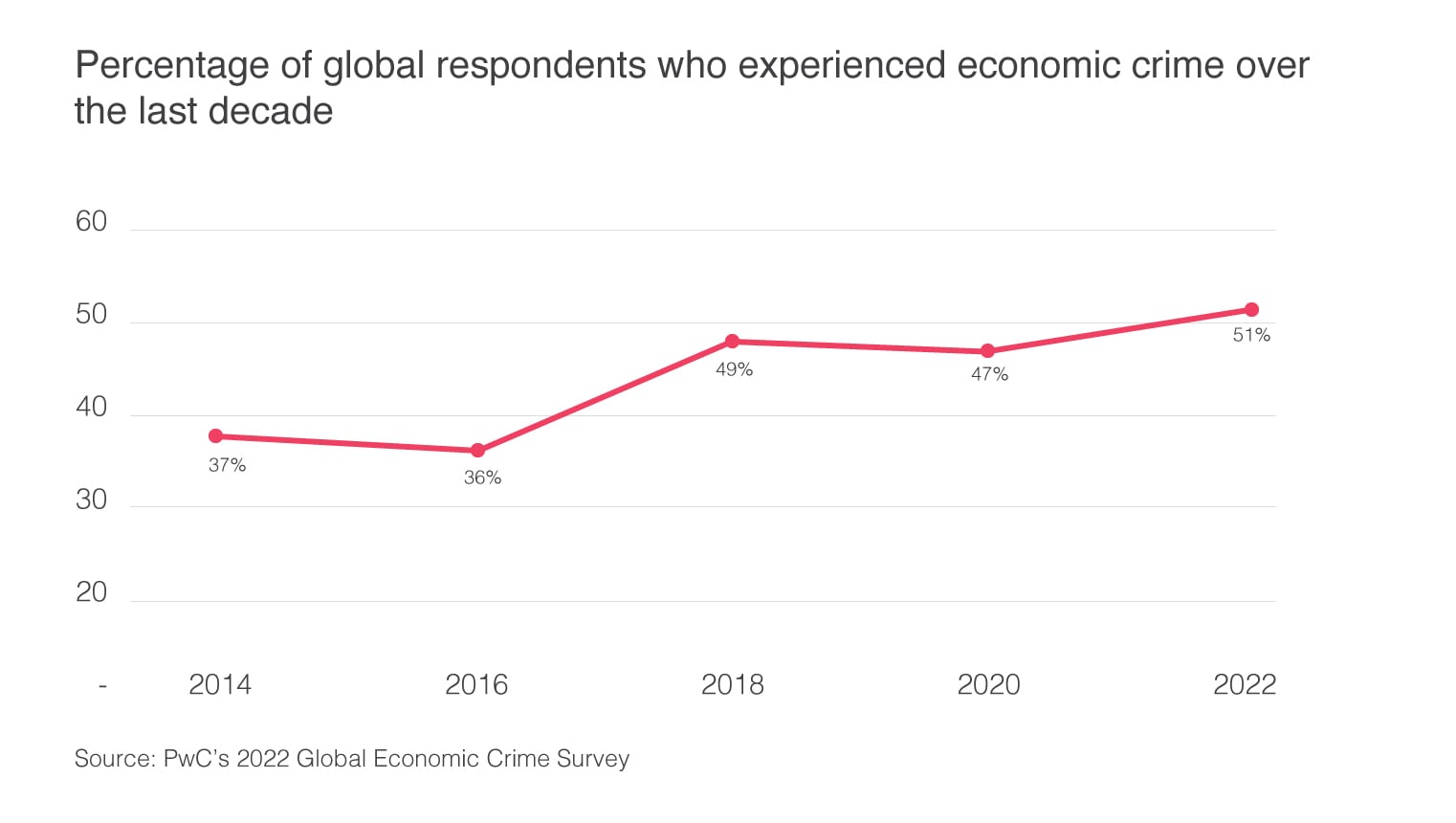

Globally, 51% of businesses have experienced economic crime in the past 24 months. It’s the first time that GECS results have shown over half of the respondents having some experience of economic crime. This trend is consistent with what we are seeing in New Zealand.

The upward trend in economic crime may reflect changing business operating environments over the last two years, due to factors such as COVID-19 and the increased use of technology and remote working.

Although COVID-19 is the easy answer for what’s driving this change, we should also consider other areas such as environmental and geopolitical instability, supply chain issues and an ever changing global economy.

What can your business do?

With the upward trend in economic crime comes added responsibility. Factors to consider are:

If you aren’t meeting minimum expectation levels, you may not be aware of all fraudulent activity that is impacting your organisation.

What goes up, may not necessarily come down

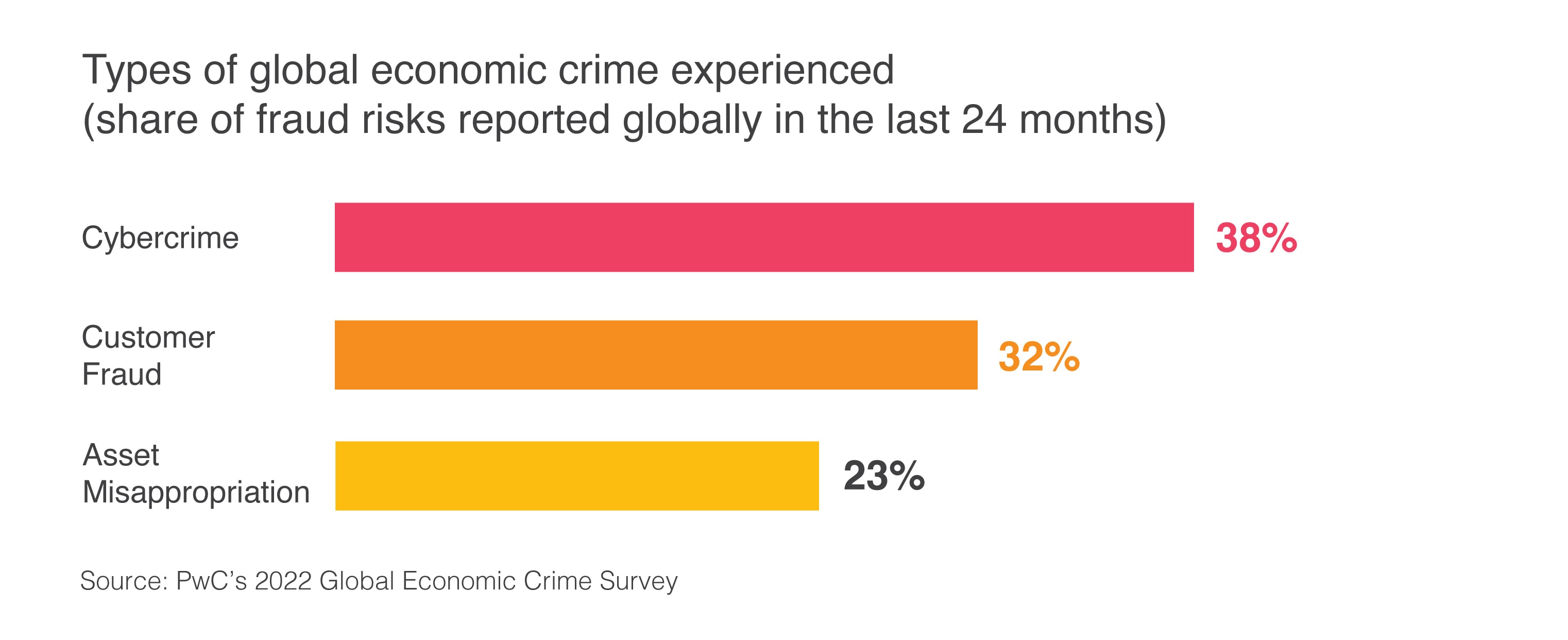

Since the last survey, cybercrime, customer fraud1 and asset misappropriation remain the top three most prevalent types of economic crime globally.

In New Zealand businesses we are seeing cybercrime continuing to be a common threat, especially given the ability to attack from outside an organisation.

When the last Global Economic Crime Survey was conducted in 2020, respondents’ anticipated future cyber attacks. They also believed it to be the most disruptive type of fraud - which appears to have become true.

Globally, 38% of businesses experienced cybercrime in the past 24 months. Interestingly, these results are consistent with our conversations with local businesses, although these businesses also reported fraud in the procurement space.

As well as being the most common type of fraud, organisations also considered that cybercrime (23%) and customer fraud (12%) incidents were the most disruptive in terms of impact on an organisation (monetary or otherwise)

1 Fraud against a company through illegitimate use of, or deceptive practices associated with, its products or services by customers or others (e.g. mortgage fraud, credit card fraud)

New channels for detecting and reporting misconduct have emerged. In the majority of instances, corporate controls such as primarily suspicious activity monitoring, fraud risk management2 and corporate security (both IT and physical security), are still the main avenue for detection.

We have seen over the last few years that organisations have focused on ‘survival’, rather than ensuring that systems and controls are up to date and reflect the growing number of ways that fraud can occur.

2 General controls used to prevent fraud, such as internal training and phishing email exercises

An important aspect of good corporate culture in New Zealand is whistleblowing and providing clear and safe avenues for people to report any concerns. It is worth considering how the pandemic and the shift to remote workplaces has changed the traditional ways of uncovering internal fraud. Are whistleblowing routes still accessible in the same way? Are lines of communication open and available to everyone in the organisation?

There is an increased focus and use of these services. This is timely given the upcoming update of the Protected Disclosures Act 2000, with The Protected Disclosures (Protection of Whistleblowers) Act 2022. With this new Act, there will be an extension of grounds under which protected disclosures can be made and protections for disclosers. Please see our recent publication on “Updates to the Protected Disclosures Regime” for more information.

11% of global respondents detected economic crime via a whistleblowing hotline and/or tip off.

Through whistleblower services that PwC New Zealand provides to our clients, an individual raised concerns relating to a contractor that had submitted inflated invoices to obtain reimbursement for the cost of corporate events attended by organisation management.

The complainant wished to stay anonymous. The contents of the disclosure were provided to the organisation, without any details of the complainant.

PwC was engaged to investigate the facts and circumstances of these concerns to work out their veracity. As part of our investigation, we collected and reviewed electronic data, conducted fieldwork to obtain receipts and invoices from relevant establishments and lastly interviewed relevant employees of the organisation to obtain any responses.

The review of this information indicated that certain individuals knowingly approved these contractor invoices that had falsely recorded costs under additional time worked.

Whistleblowing services enable transparency, accountability and an avenue to raise an issue, but have the discloser’s identity protected. Commonly, employees that are close to the wrongdoing can offer a unique vantage point.

Whistleblower services empower employees to advance change and create an organisation that rejects serious wrong-doing. With an increasing number of organisations in New Zealand activating whistleblower services, they are creating and enhancing a culture of integrity that demonstrates zero tolerance for serious misconduct and wrongdoing.

The results of the survey show that fraud and economic crime remain a key concern for businesses both here in New Zealand and globally. Below we outline some scenarios to watch out for and some of the questions to ask to assist your organisation in reducing your vulnerability:

With some third parties struggling to operate in the current environment, new ones are contracted on short notice and without appropriate due diligence. This can cause organisations to work with inappropriate, unsuitable and/or unprofessional parties that can be a reputational risk.

New processes or procedures are implemented without appropriate testing or rigour, and can lead to control gaps that can be exploited by staff.

New and/or different bank accounts are used for payments due to changes in a supplier’s banking arrangements, and can lead to the opportunity for staff to manipulate bank account information.

Shifts in resources often cause moves for employees to operational roles, leaving gaps in important areas such as fraud detection and prevention.

Increased security risks from remote working:

- Many businesses may relax information security processes and protocols in order to expedite the set up involved with employees working from home.

- The adoption of new technology systems to enable remote working is often not as highly scrutinised as systems that are established within a corporate office environment. This leaves businesses in a compromising position, open and vulnerable to the threat of cyber fraud.

- There can be a breakdown of relationships and reduction of immediate supervision which comes from remote working which might increase the risk of fraud.

- There can be a breakdown of relationships and reduction of immediate supervision which comes from remote working which might increase the risk of fraud.

We protect your business value and reputation, and closely manage the risks associated with fraud, financial crimes, regulatory challenges and other unplanned events through our industry experience and forensic technology. Our Forensics Services team can provide the following services:

Forensic Investigations

Digital Forensics & Incident Response (DFIR)

eDiscovery

Anti-Money Laundering, Countering Financing of Terrorism, and Sanctions compliance

Forensic Accounting

Fraud Prevention, including maturity and risk assessments

Protected Disclosure and Whistleblower Services.

{{item.text}}

{{item.text}}