PwC New Zealand | Audit

Welcome to our 2022 Audit Transparency Report

Rich Day - Transparency report final

Watch Rich Day, Audit Leader, discuss our Transparency Report and the key issues facing audit today.

Our commitment to greater transparency

Building trust and delivering sustained outcomes for our clients is central to how we operate at PwC.

Our approach to building trust is designed to meet rising expectations of transparency, accountability and stakeholder engagement. It combines expertise in audit, tax and compliance activities with a drive to expand specialist capabilities in areas such as digital transformation, Māori business, ESG, infrastructure and health outcomes. It also recognises the importance of quality – and that reporting and compliance represent just one link in a chain that includes organisational culture, executive mindset, aligned standards, certified professionals, stringent controls, tailored technologies and appropriate governance.

Our audit team sits at the heart of this approach. We understand how important the role of audit is for well‑functioning capital markets in New Zealand, particularly at a time of economic challenges and fiscal headwinds. The need for trust and confidence has never been more important. The audit profession continues to operate under significant public scrutiny and challenge.

In this context, we are delighted to share our PwC New Zealand Audit Transparency Report for 2022.

Once again we have included our Audit Quality Balanced Scorecard which provides an overview of how we are performing across a variety of key indicators including inspection results, people and culture. It helps us identify areas where we can improve and strengthen our approach. This year’s Scorecard reveals there are many areas where we are performing well such as leadership and training however there are others where we want to see further change.

As with any commitment to transparency there may be expectations that we haven’t met or insights that are challenging for us to reveal. We have a strong focus on audit quality but there is always more that can be done.

Our goal is that investors, regulators, industry bodies, and the wider market have insight into how we operate and how we are investing in continuous improvement through new systems and technology, risk processes and learning and development for our people.

Our 2022 Audit Transparency Report

This year our report includes:

- Our Audit Quality Balanced Scorecard for the year to 30 June 2022;

- The latest observations and recommendations made by the Audit Advisory Board;

- Commentary on developments in ESG and climate risk reporting;

- Insights from our team on how audit is changing and what they enjoy about the profession; and

- Information on how our firm is governed, the culture and values that guide us as well as details on the quality management system that our audit practice operates.

Karen Shires

Chief Risk & Reputation Officer

PwC New Zealand

Rich Day

Audit Leader

PwC New Zealand

Quality audits are a critical component of trusted and well‑functioning capital markets. Stakeholders need to have high levels of confidence in the transparency, objectivity and effectiveness of the audit process. We are committed to a strong culture of quality and excellence and are proud of the work our team does every day to maintain trust, quality and confidence in the capital markets and society.

What does our Audit Quality Balanced Scorecard tell us?

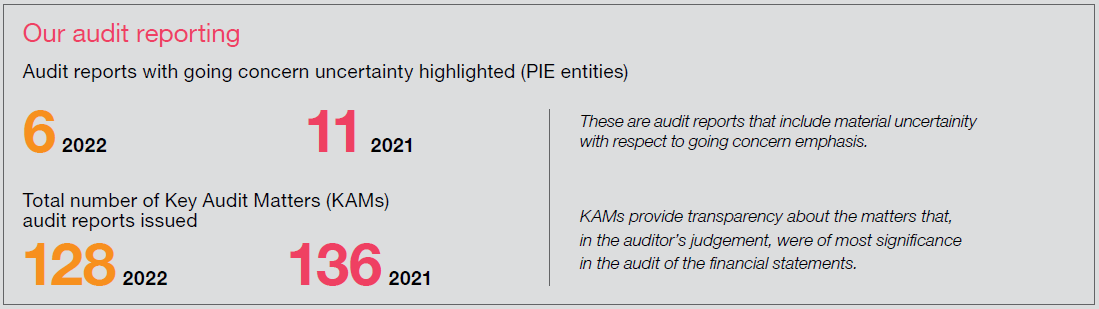

Our Audit Quality Balanced Scorecard for the year ended 30 June 2022 reveals a number of insights about audit at PwC New Zealand:

- The results of our inspections are consistent with prior years. This year we have no non-compliant and few compliant with improvements required files which is in line with our objective of having no files in these categories. Our file sample size is small with each file representing approximately 6% of the total - the results of one file inspection greatly impacts the overall percentage.

- Our strong culture of consultation has continued throughout the year. To ensure our risk and quality team are focused on the most important areas more reporting templates have been developed to aid audit teams, thereby reducing the need for formal consultations.

- The focus on quality by the leaders in our audit practice has been acknowledged by our audit teams.

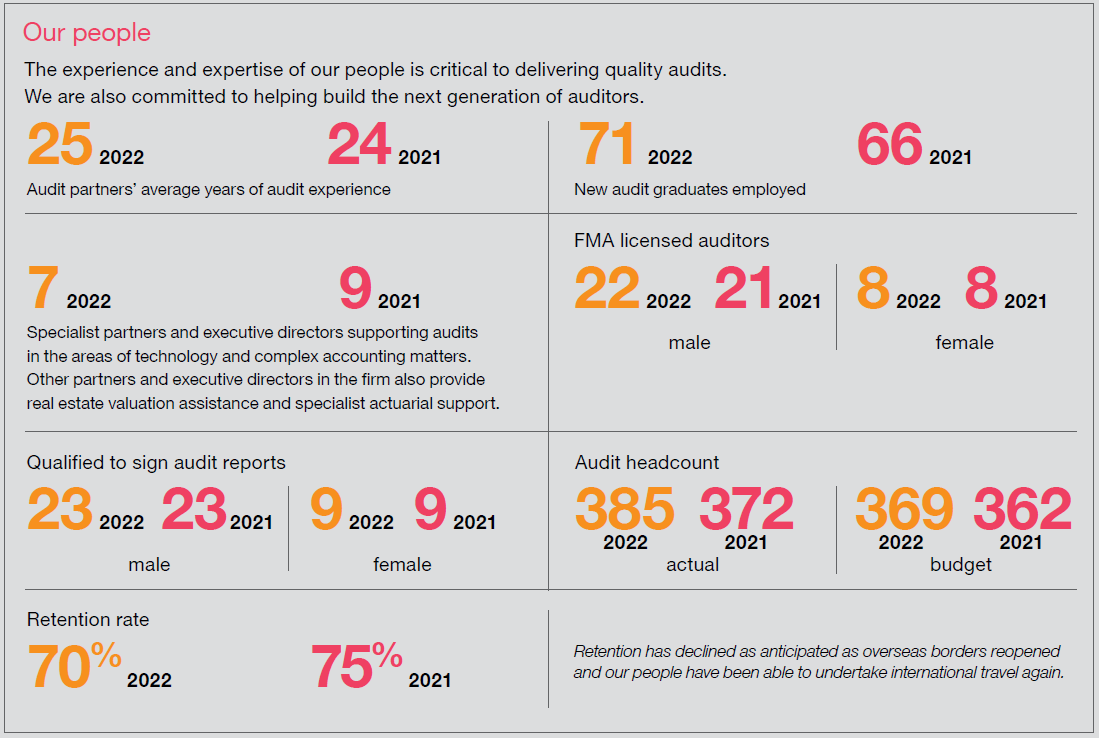

- Despite the shortage of auditors arising from border restrictions, our people have been fully supported and have recognised this with a high employee engagement score in our global people survey.

- Our work on helping our auditors understand the meaning and purpose of their work continues, but we are starting to see evidence that our people have a deeper understanding of the importance of their role.

- In line with changes to auditing standards our teams are now encouraged to seek a deeper and broader understanding of our clients' businesses. This helps provide greater insights to our clients but also makes audit work more interesting for our people.

- As COVID-19 becomes endemic, many of the complexities that have challenged auditors and accountants over the last two years have reduced. This has seen a change in the use of experts and specialists. While there has been less need for experts to assist in the consideration of an entity's going concern, we are now using digital and IT specialists more as entities move to using software as a service applications with increased digitisation and automation.

- As we anticipated, many of our people have transferred to PwC member firms offshore to take up the opportunity to learn and to work internationally. The experienced auditors special visa category introduced by the Government in December 2021 has seen us recruit over 30 experienced auditors in mid 2022. We were able to maintain our budgeted headcount despite the challenging talent environment. Auditors remain sought-after professionals and we continue to recruit experienced auditors from offshore to supplement our local teams.

- We have continued to deliver high hours of learning, both virtual and in the classroom, to all our people.

- In line with our commitment to digitally upskilling our people through The New Equation more of our people have completed our specialised virtual digital academy training. We continue to encourage more of our people to complete this programme.

- In the current year some metrics have been refined to focus on the audit practice, rather than the wider assurance practice. For these metrics the prior year comparatives have been restated for consistency.

External inspections

PwC New Zealand is subject to regular inspections by regulatory and professional bodies.

FMA regulator inspection

PwC New Zealand was not included in the 2022 inspection cycle of the Financial Markets Authority (FMA). We are reviewed bi-annually, with our next inspection due in 2023.

OAG inspections

The firm is also subject to reviews by the Office of the Auditor-General (OAG) for engagements that are completed on its behalf. During the year ended 30 June 2022 one audit partner who is an OAG Appointed Auditor was subject to review as part of an internal cold file inspection which involved the OAG reviewing specific aspects. The file was rated as compliant.

Referrals

At any time there may be matters in progress which are dealt with on a confidential basis pending resolution or further investigation. This includes the complaint made by Mr Colin Armer to the FMA in September 2019. The FMA forwarded Mr Armer’s concerns regarding Fonterra’s audits for 2015 to 2018 (inclusive) to NZICA. This specific matter continues to be investigated by NZICA.

Audit Advisory Board

Established in October 2020, the independent Audit Advisory Board advises the firm on topics including PwC’s audit quality management systems and processes, learning and development programme and how the firm is responding to structural changes in the profession.

Below we share the Board’s observations and recommendations about audit quality at PwC New Zealand and include an update on recommendations made in the prior year.

The Board is chaired by Warren Allen and includes Stephen Layburn and Alison Posa.

Audit Advisory Board observations

Based on the Board's work during this year, we have focused on two key themes:

- Sustainability (of the audit practice) and

- Transformation.

The key building blocks for our overall conclusion are:

The Audit Advisory Board concludes the enhanced approach adopted by PwC continues to support appropriate emphasis on audit quality:

- In our first year we reported significant improvement had been achieved in key metrics, including the external regulatory and peer reviews of audit assignments, that are used to report on audit quality. This pattern has been maintained in our second year and, in some areas, further improvements have been achieved;

- PwC’s quality management systems are designed to deliver quality audits – these have been subject to significant change to meet the new quality management standards. Initial external review indicates that appropriate systems and processes are in place to enhance future audit quality – and that, in a framework that calls for continuous improvement, these systems and processes are being (and will likely continue to be) subject to evolutionary improvements;

- PwC has continued its focus in this year on measuring, reporting and implementing measures that are designed to provide tangible evidence of improvement of firmwide partner personal independence. Recognising that maintenance and enhancement of personal independence is critical for the delivery of quality audits, PwC commenced, in the current period, a similar process across selected senior staff. The ongoing rollout of these measures will, in due course, instil across all resource levels greater discipline of maintaining precise records to support firm independence from its audit client base;

- PwC has developed over recent years an extensive audit quality dashboard, which is used by audit practice management and the CRRO to monitor key metrics which drive audit quality. This year has seen the maintenance and enhancement of appropriate levels of audit quality, and the dashboard being used effectively to target action where it has indicated an adverse trend; and

- The firm’s culture and drive towards audit quality was measured using upward feedback and captured, for the first time during this year, baselines which will provide excellent future benchmarks. Acceptable scores were obtained in this initial exercise.

The key challenge is aligning the audit practice’s staff and partner resources with the objective of enhancing audit quality. The Audit Advisory Board is of the opinion PwC has continued with substantial effort in this area and that effort is yielding worthwhile results:

- The audit practice has continued to build on changes that were likely accelerated by the disruptions of the COVID-19 pandemic. Further enhancements have been implemented into the audit delivery process. For example, for many aspects of the audit process, the actual location of the audit client or the personnel undertaking the audit is increasingly less of a critical factor in the completion of audit engagements. This fully supports a staff resource wishing for more flexibility around working arrangements and increased use of dedicated service centres to better deliver technology solutions to routine aspects of audits. While we observe that PwC is keeping a focus on maintaining standards within dedicated service delivery centres – we suggest the seamless integration of delivery centre staff into local audit teams will be critical to maintaining overall audit quality;

- Learning and development (L&D) processes have continued to develop with more proactive approaches being applied in order to respond to new audit/accounting standards, new technologies and industry-specific needs. This is an enhancement from earlier L&D processes that required more detailed and (largely) reactive responses to audit quality findings and issues. With this being said, PwC still uses training effectively to address audit quality risk areas;

- There has been continued evolutionary change to L&D in response to a fast-changing profession. PwC aspires for their audit professionals to be lifelong learners, who are able to find the necessary information. This has resulted in an accelerated cycle of L&D with a mix of formal and self-directed training, developmental relationships and knowledge from challenging practical experiences. Feedback indicates this process is delivering improvements in the effectiveness of the training effort and contributing to the alignment of staff resources to PwC’s audit quality objective;

- A commendable achievement, in the most difficult of circumstances, in terms of retaining a competent staff and partner resource which delivered timely results to all audit assignments. The industry faced immense challenges during this period and the initiatives put in place by PwC ensured audit quality, including timeliness of delivery, was maintained;

- A regular staff survey was launched in early 2020, to measure partner/director “leadership in quality performance” at engagement level. This current year saw high average scores being achieved;

- Upward feedback (both scores and written comments) programme introduced with commendable scores measuring director, manager and senior associate commitment to strategic priorities; and

- Partner and staff wellbeing has been a key focus and demonstrable improvements in the total workload for each team member have been achieved, together with other personnel support initiatives in a most challenging business environment.

PwC is well aware of the need to transform the audit practice to respond to the ever-increasing changes it is facing. The Audit Advisory Board observes that a number of key initiatives have been progressed or planned in this year by the audit practice:

- Developing expertise to respond to the fast-approaching market need for assurance on climate-related information;

- Real progress in the response to understanding and meeting the assurance requirements of iwi-based businesses. This need will increase in the future as a result of a number of developments including the XRB Board, as the New Zealand accounting standard-setter, overseeing the development of a Te Ao Māori framework for ESG reporting;

- Several initiatives introduced during this period examining how PwC can keep the audit profession attractive for talented staff – detailed logging of experiences of individuals, with this being shared, so others can see the opportunities available;

- Continued response to the need to meet its commitments to diversity and inclusion, including those of the client base (including the different cultural requirements of many large and developing business entities – such as iwi businesses and public good entities that have Pasifika and other communities as their focus) and the rapidly-changing shape of the professional workforce – as the audit profession, in keeping with other professions, seeks to become a mirror on society;

- Substantial and continued investment in new technologies that will enhance the quality of audits. We were particularly impressed with a New Zealand initiative to identify a group of young staff, referred to as “Digital Accelerators”, who have been given support and time to be innovative, together with the challenge of finding new and effective technology solutions to various audit processes; and

- Responding to increasing and changing demands from the regulatory community, ensuring all public interest entities audited by PwC continue to meet the public interest need for quality audits. This is also carried through to all other audits.

Audit Advisory Board recommendations and PwC’s response

The Audit Advisory Board, based on its work during 2022, wishes to make three recommendations for consideration by PwC. These recommendations are in the form of supportive actions that the Audit Advisory Board sees as being needed in addition to activities already underway within the audit practice. It is our opinion that these actions are necessary to ensure PwC continues to have a sustainable audit practice capable of delivering quality audits in the future which is responsive to multiple stakeholders’ needs.

Recommendation 1

We acknowledge all the work/planning that has been initiated in terms of responding to climate-related reporting requirements, particularly those affecting around 200 New Zealand “climate reporting entities” which will soon be mandated to comply. It seems highly likely that others outside this catchment, for whom such reporting is required, will choose to follow. The Audit Advisory Board is of the view this work needs to be hastened. We consider once the New Zealand market adopts climate reporting in 2023, the demand for appropriate assurance will develop simultaneously. Even though the standards may initially not require assurance, the New Zealand market has previously demonstrated a strong desire to have such new disclosures assured at the earliest possible opportunity, to assist governance bodies to discharge their responsibilities. In our view, the current work needs to be progressed at pace to ensure PwC are, in an audit-quality sense, ready to meet market expectations. New Zealand-based resources are likely to be key here, perhaps with less reliance on international network resources, who will also face their own rapid market demand. One part of such a proactive approach may be seeking to understand the need to work with external parties on aspects of this new assurance process.

PwC New Zealand's response

We will forecast anticipated demand for assurance and associated services and ensure we have an appropriate resourcing, upskilling, recruitment and quality management plan in place to meet the expected need.

We will identify and engage with appropriate internal and external experts to ensure we have appropriate support from relevant climate experts.

Responsibility: Jonathan Skilton (PwC New Zealand Sustainability Reporting and Assurance Leader)

Date: 30 June 2023

Recommendation 2

PwC should consider an exercise reviewing and determining what the future of the audit profession may be. We have seen strong signals during the current review period that possible significant changes may develop in the near term relating to firm structures, scope of the audit assignment (including internal controls, going concern, and fraud considerations) and ever-demanding standard and regulatory responses.

The Audit Advisory Board supports an initiative for a small group; – “The Future of Audit” – to examine these possible changes and the impact they would have on the New Zealand audit practice (including resourcing) and its ability to continue to deliver quality client services.

Also, the Audit Advisory Board encourages consideration, possibly for a practical joint approach with the Australian firm.

PwC New Zealand's response

We will form a group to consider “The Future of Audit” consistent with the Audit Advisory Board’s recommendation. In doing so, we will engage with our counterparts at PwC Australia and consider any developments in Australia that may be relevant to our New Zealand business. We will also consider where there are opportunities to work more closely together in the future as we respond to changes across the profession.

Responsibility: Rich Day (PwC New Zealand Audit Leader)

Date: 30 June 2023

Recommendation 3

The landscape in tertiary education has been significantly impacted by the COVID-19 pandemic. Over the past two years lectures, tutorials and examinations have predominantly been conducted online. Amongst other things, this deprives students of valuable opportunities to learn appropriate interpersonal skills necessary for an audit professional. The audit practice is heavily reliant on staff resources with strong interpersonal skills to properly interface with clients. PwC’s future L&D programme will be required to have more emphasis on the “non-technical” skills required of a PwC auditor of the future. Perhaps one of the outputs from “The Future of Audit” initiative promoted in Recommendation 2 could be a template of skills required for the future PwC auditor. This could then be effectively linked to both the firm’s recruitment and its L&D processes.

PwC New Zealand's response

We agree with the recommendation to ensure appropriate focus on non-technical skills that will be essential to the auditor of the future.

We have modified the learning curriculum to place an emphasis on soft skills while also ensuring the required technical elements are delivered. Where possible, a return to the classroom learning environment has been included in order to ensure more effective emphasis is placed on these skills.

We have developed the Audit Career Pathway for auditors to appreciate the need to develop not only technically, but personally and professionally in a broader context as they progress.

A core pillar of the current curriculum is on the skills needed for success as an auditor in the future.

As suggested by the Audit Advisory Board we will incorporate any learnings from Recommendation 2 into this curriculum. These essential skills will also be built into talent acquisition, team goal-setting and promotion assessment processes.

Responsibility: Nathan Wylie (PwC New Zealand L&D Leader)

Date: 30 June 2023

2021 Recommendations and progress to date

The Audit Advisory Board, based on its work during 2021, made three recommendations for consideration by PwC and one recommendation for which PwC could be a supportive stakeholder. The recommendations focused on:

- Developing a plan to address audit staffing challenges. This included working with the professional body to procure special visas, moving to a national resourcing model and hiring international staff among other initiatives.

- Status update: The firm successfully navigated resourcing needs over the past year. Completed.

- Evolving partner/staff structure, recruitment and training and client relationship processes to better reflect the diversity of the audit client base.

- Status update: The firm has implemented initiatives to increase ethnic representation such as expanding its intern programme to develop a wider diversity of talent. This initiative is on-going.

- Considering how PwC can help contribute to ensuring the sustainability of the audit profession. This means engaging and retaining the next generation by articulating the attractiveness of a PwC career as an audit professional.

- Status update: The firm has evolved the audit team structure through technology and tools and commenced planning for a “mixed-resource” model for climate-related and broader ESG reporting. This initiative is on-going.

- Progressing an approach to reconsider the regulatory process in New Zealand particularly as it relates to disciplinary action.

- Status update: Solid progress has been made with the formation of a ‘Sustaining the Audit Profession’ working group involving other firms and stakeholders to focus on a variety of issues facing the audit profession. This initiative is on-going.

Audit Advisory Board recommendations and PwC’s response

The Audit Advisory Board, based on its work during 2022, wishes to make three recommendations for consideration by PwC. These recommendations are in the form of supportive actions that the Audit Advisory Board sees as being needed in addition to activities already underway within the audit practice. It is our opinion that these actions are necessary to ensure PwC continues to have a sustainable audit practice capable of delivering quality audits in the future which is responsive to multiple stakeholders’ needs.

Recommendation 1

We acknowledge all the work/planning that has been initiated in terms of responding to climate-related reporting requirements, particularly those affecting around 200 New Zealand “climate reporting entities” which will soon be mandated to comply. It seems highly likely that others outside this catchment, for whom such reporting is required, will choose to follow. The Audit Advisory Board is of the view this work needs to be hastened. We consider once the New Zealand market adopts climate reporting in 2023, the demand for appropriate assurance will develop simultaneously. Even though the standards may initially not require assurance, the New Zealand market has previously demonstrated a strong desire to have such new disclosures assured at the earliest possible opportunity, to assist governance bodies to discharge their responsibilities. In our view, the current work needs to be progressed at pace to ensure PwC are, in an audit-quality sense, ready to meet market expectations. New Zealand-based resources are likely to be key here, perhaps with less reliance on international network resources, who will also face their own rapid market demand. One part of such a proactive approach may be seeking to understand the need to work with external parties on aspects of this new assurance process.

PwC New Zealand’s response

We will forecast anticipated demand for assurance and associated services and ensure we have an appropriate resourcing, upskilling, recruitment and quality management plan in place to meet the expected need.

We will identify and engage with appropriate internal and external experts to ensure we have appropriate support from relevant climate experts.

Responsibility: Jonathan Skilton (PwC New Zealand Sustainability Reporting and Assurance Leader)

Date: 30 June 2023

Recommendation 2

PwC should consider an exercise reviewing and determining what the future of the audit profession may be. We have seen strong signals during the current review period that possible significant changes may develop in the near term relating to firm structures, scope of the audit assignment (including internal controls, going concern, and fraud considerations) and ever-demanding standard and regulatory responses.

The Audit Advisory Board supports an initiative for a small group; – “The Future of Audit” – to examine these possible changes and the impact they would have on the New Zealand audit practice (including resourcing) and its ability to continue to deliver quality client services.

Also, the Audit Advisory Board encourages consideration, possibly for a practical joint approach with the Australian firm.

PwC New Zealand’s response

We will form a group to consider “The Future of Audit” consistent with the Audit Advisory Board’s recommendation. In doing so, we will engage with our counterparts at PwC Australia and consider any developments in Australia that may be relevant to our New Zealand business. We will also consider where there are opportunities to work more closely together in the future as we respond to changes across the profession.

Responsibility: Rich Day (PwC New Zealand Audit Leader)

Date: 30 June 2023

Recommendation 3

The landscape in tertiary education has been significantly impacted by the COVID-19 pandemic. Over the past two years lectures, tutorials and examinations have predominantly been conducted online. Amongst other things, this deprives students of valuable opportunities to learn appropriate interpersonal skills necessary for an audit professional. The audit practice is heavily reliant on staff resources with strong interpersonal skills to properly interface with clients. PwC’s future L&D programme will be required to have more emphasis on the “non-technical” skills required of a PwC auditor of the future. Perhaps one of the outputs from “The Future of Audit” initiative promoted in Recommendation 2 could be a template of skills required for the future PwC auditor. This could then be effectively linked to both the firm’s recruitment and its L&D processes.

PwC New Zealand’s response

We agree with the recommendation to ensure appropriate focus on non-technical skills that will be essential to the auditor of the future.

We have modified the learning curriculum to place an emphasis on soft skills while also ensuring the required technical elements are delivered. Where possible, a return to the classroom learning environment has been included in order to ensure more effective emphasis is placed on these skills.

We have developed the Audit Career Pathway for auditors to appreciate the need to develop not only technically, but personally and professionally in a broader context as they progress.

A core pillar of the current curriculum is on the skills needed for success as an auditor in the future.

As suggested by the Audit Advisory Board we will incorporate any learnings from Recommendation 2 into this curriculum. These essential skills will also be built into talent acquisition, team goal-setting and promotion assessment processes.

Responsibility: Nathan Wylie (PwC New Zealand L&D Leader)

Date: 30 June 2023

2021 Recommendations and progress to date

The Audit Advisory Board, based on its work during 2021, made three recommendations for consideration by PwC and one recommendation for which PwC could be a supportive stakeholder. The recommendations focused on:

- Developing a plan to address audit staffing challenges. This included working with the professional body to procure special visas, moving to a national resourcing model and hiring international staff among other initiatives.

- Status update: The firm successfully navigated resourcing needs over the past year. Completed.

- Evolving partner/staff structure, recruitment and training and client relationship processes to better reflect the diversity of the audit client base.

- Status update: The firm has implemented initiatives to increase ethnic representation such as expanding its intern programme to develop a wider diversity of talent. This initiative is on-going.

- Considering how PwC can help contribute to ensuring the sustainability of the audit profession. This means engaging and retaining the next generation by articulating the attractiveness of a PwC career as an audit professional.

- Status update: The firm has evolved the audit team structure through technology and tools and commenced planning for a “mixed-resource” model for climate-related and broader ESG reporting. This initiative is on-going.

- Progressing an approach to reconsider the regulatory process in New Zealand particularly as it relates to disciplinary action.

- Status update: Solid progress has been made with the formation of a ‘Sustaining the Audit Profession’ working group involving other firms and stakeholders to focus on a variety of issues facing the audit profession. This initiative is on-going.

What is audit quality?

At PwC, ‘audit quality’ means that we consistently:

Comply with auditing standards

Use our experience and expertise to identify and resolve issues in a timely manner

Exercise professional scepticism

Apply a deep and broad understanding of our clients’ businesses and the financial environment in which they operate

Recognising our role in the capital markets and building trust in society, this means that we:

- ask tough questions

- apply an objective and sceptical mindset

- embrace the supervision and review process as a way to continuously improve

- stay current on professional standards

- have timely, meaningful exchanges with audit committees and management including identifying where an entity needs to improve financial reporting processes, resourcing and the quality of supporting workpapers

- plan our work and resolve issues in a timely and thorough fashion

- remain alert for issues that need deeper analysis

- act with professionalism

- provide reliable and informative audit reports.

There may be times where the results we publish do not meet our high expectations or those of the community. Our ultimate goal is that investors, regulators, industry bodies, and the wider market have insight into how we operate and the steps we are taking to improve audit quality.

How could rising interest rates and inflation impact financial reporting?

As part of our regular programme of thought leadership, we released a paper examining the key considerations related to rising interest rates and inflation to help companies navigate the changing financial landscape. Rising interest rates and inflation: what impact on financial reporting do companies need to prepare for? focused on the financial reporting considerations for FY22 including hedging strategies and declining investment and asset values.

Karen Shires

Chief Risk & Reputation Officer, PwC New Zealand

ESG and climate risk reporting − where are we now?

ESG (environmental (climate risk), social and governance) reporting has continued to evolve and what was once a small portion in an annual report, if included at all, it has become front and centre as a major driver for investment decisions and stakeholder engagement.

Globally, efforts are being made by standard setters, regulators and governing bodies to develop the right standards, regulation and competencies for this type of reporting.

In our 2021 Transparency Report, we noted the introduction of legislation (the Financial Sector (Climate-related Disclosures and Other Matters) Amendment Bill) that was likely to be approved by Parliament. Since then, this Bill has been approved and the standards that will support it have been drafted by the External Reporting Board (XRB).

The consultation process for these new standards concluded in September 2022 and the final standards are due out in December 2022. The entities that are required to report, called Climate Reporting Entities (CREs), will need to put significant time and resources into ensuring that they are meeting the requirements of the new standards.

Alongside the introduction of the new standards, the Bill introduced a requirement for assurance on greenhouse gas emissions for CREs for accounting periods that end on or after 27 October 2024.

From our research to date, we know that the CREs have a long way to go to meet the upcoming mandatory reporting requirements. Our best advice is for CREs to ensure they are putting adequate time and resources into developing their climate-related disclosures.

The development of a roadmap for how they will meet the mandatory climate-related reporting requirements, as well as how they will align it with their financial reporting and obtain the associated assurance on financial reporting and greenhouse gas emissions, is a sound starting point.

Key challenges we are seeing include:

- integrating climate risk into business strategy and enterprise risk management;

- defining the reporting boundaries for greenhouse gas emissions and implementing appropriate processes, and;

- controls to reliably gather the requisite data to be able to meaningfully report and to do so consistently in subsequent periods.

At PwC New Zealand, we are working with our clients to assist them in effectively telling their ESG story, including climate risks and impacts. It is important that this is done in a way that provides value to stakeholders, is both transparent and authentic and meets any relevant compliance frameworks and regulatory requirements. We understand that these non-financial disclosures drive significant decisions by key stakeholders and it is important that these disclosures are accurate, objective, comparable and ultimately auditable to the same level as financial disclosures.

Climate risk considerations and how they impact financial statements have increasingly become a significant focus from regulators and other stakeholders. International Financial Reporting Standards (IFRS) require disclosure of significant judgements and critical estimates. Climate risk and its material financial reporting impacts should be considered, accounted for and appropriately disclosed in order to comply with IFRS. These considerations and disclosures are challenging to determine and bring a more forward looking and long-term approach to the financial statements than has likely ever been done before.

How is PwC preparing our people for climate-related disclosures?

To ensure our people are equipped with the appropriate knowledge and skills, we continue to invest through providing ongoing professional development and in-depth training in this area. We currently have three members of our team on secondment to our PwC Global Reporting platform helping lead PwC's Network response to sustainability reporting and assurance. Further, two of PwC's Asia Pacific Centre of Excellence team are based in New Zealand, including our Asia Pacific ESG Upskilling Lead. These roles give us a line of sight into global and regional developments that we use to inform our local upskilling strategy.

PwC has developed and is developing sustainability and ESG-related training that is being rolled out globally. In New Zealand, we are focused on equipping our people with the appropriate methodologies, processes and technical knowledge by developing New Zealand specific training and utilising the global resources available.

Jonathan Skilton

Partner, PwC New Zealand

How are NZX50 companies reflecting climate change in their financial statements?

As part of our regular programme of thought leadership, this year we have analysed how climate change is reflected in the financial statements of NZX50 companies. We have produced two reports so far – one examining March reporters and another focusing on June reporters. Both reports reveal similar findings including:

- Currently, information on how climate change impacts financial statements is rare.

- Similarly, climate change is not often mentioned in KAMs.

- However, we're increasingly seeing the inclusion of Climate-related information in the 'front-half' of annual reports.

Karen Shires

Chief Risk & Reputation Officer, PwC New Zealand

Tiniya du Plesis

Partner, PwC New Zealand

Mariann Trieber

Executive Director, PwC New Zealand

Our community of solvers

Davin Franks video

Davin Franks, Digital Accelerator

“As a digital accelerator, I look at how we can utilise technology to improve our ways of working. We do this in a variety of areas including improving processes that have previously been quite manual or developing new solutions for how we present and analyse data.

By doing this we can become more efficient, improve quality and add extra value for our clients. For example in the funds and asset management space, we receive a large amount of investment confirmations which include a lot of information. Previously, someone had manually taken the information from the confirmations and reconciled this to the fund records through various formulas in excel. This was a time consuming process and allowed for human error. To streamline the process and enhance quality, we built an Alteryx workflow which automated it. The workflow reduced the time this reconciliation process took significantly; immediately identifying any issues and allowing the team to focus on other, more complex parts of the audit.”

Rusila Waqasobasoba video

Rusila Waqasobasoba, Graduate

“I wasn’t sure what to expect from a career in audit but it’s different to what I thought it would be. I really enjoy being able to build strong relationships with our clients and get to know their businesses. I like that we work with our clients to help them make their processes more efficient and effective. As auditors, we aim to obtain as much necessary information as we can to complete the audit in a timely manner but also ensure that it is a smooth process with our clients along the way.

In terms of PwC, I like working with our different team members. I feel like we all bring something unique to the table and come up with fresh perspectives. There’s a lot of support here from both my peers and more senior people as well as coaching and mentoring opportunities.”

Savindri de Silvia video

Savindri de Silva, International Transfer

“It’s been six months since I joined PwC New Zealand as an international transferee after spending four and a half years with PwC Sri Lanka. In Sri Lanka I have worked in audit as well as in transaction services. As an Audit Senior Associate in New Zealand, I’ve been able to bring those experiences together in my role.

Since I was small I have wanted to visit New Zealand and when I saw the Auckland office advertised as an opportunity for international transfers; I decided to apply. It was a big move for me and took a lot of courage. Everyone has been so welcoming and I’m really enjoying it over here.

I enjoy being part of a big team – there’s never a dull moment. We work hard but also get the opportunity to come together as a family whether that’s to celebrate birthdays or for social events.”

Troy Adrian

Troy Adrian Gonzales, Offshore Acceleration Centre

“I am the supervisor/team leader for PwC New Zealand's remote audit team members. Our remote team members are an integrated part of the audit teams they work with and enjoy the close coaching and support they are given by the team on the ground in New Zealand. Locally we work to identify any issues or challenges there might be in delivering audits and help to resolve them in a timely way.

I enjoy collaborating with my team members and also the engagement teams in New Zealand – we’re able to build great rapport which contributes to the overall success of our work.”

Danielle Kennedy video

Danielle Kennedy, Sustainability Reporting and Assurance

“I’m part of the Sustainability Reporting and Assurance team working with clients on their reporting and assurance over their sustainability and climate-related reporting. When our clients focus their attention and obtain assurance on this type of reporting, they give their investors and stakeholders comfort that this information is accurate and audited at the same level as their financial information.

This type of reporting is becoming front and centre as a major driver for investment decisions and stakeholder engagement. It is essential that it is valuable, authentic and transparent. As assurance providers, we assist our clients in ensuring that the disclosures they report are truthful and aligned across their financial and non-financial reporting.

Our team has worked with a range of clients who are at different stages in their sustainability and climate-related reporting journey. For clients who are new to this type of reporting, we help them get started and ensure they have transparent, value-add information that tells their story and aligns to their overall business strategy. For clients who are further progressed, we help them ensure their stakeholders can trust their reporting by getting them ready and providing assurance on their sustainability and climate-related reporting.

Most importantly, here in New Zealand, we are helping the mandatory climate reporting entities prepare for the upcoming climate standard being issued later on this year. This will require assurance on greenhouse gas emissions. Ensuring the climate-related disclosures meet global and local expectations and ensuring the greenhouse gas emissions are assurance ready is a large piece of work for us and our clients.

For me, this is my dream job. Helping clients to authentically tell their story and the good things they do to help our people, planet and their profit makes each day fulfilling. I’m excited to get the day started and work with our clients everyday. I feel like I am serving a greater purpose and I’m excited to see our clients grow in this reporting space.”

Will Smith

Will Smith, Learning Leader

“There's such an incredible pace of change in the business world, driven by things like advancements in technology, accounting and auditing standard changes and integration of climate and sustainability considerations into the core of organisations. Our teams look to us as Learning & Development professionals to deliver the training they need to develop them into well rounded professionals who are able to meet our clients' needs with confidence and clarity

I like the impact we can have on people through learning and development. We get to be across basically every topic that the practice needs to know. The best part is using our creativity to bring difficult concepts to life and make them fun. I love having the autonomy to create content that our people will enjoy while still absorbing the knowledge they need to deliver high quality audits – that is the sweet spot.”

PwC is #Auditor Proud

#AuditorProud day, September 29, is a global celebration of the pivotal role auditors play in maintaining trust and confidence in the capital markets. This year some members of the PwC team shared what makes them proud to be an auditor.

Find out more