{{item.title}}

{{item.text}}

{{item.text}}

Early stage investment is holding up, but the sector is doing it tough.

In our last edition, which shared data from the first half of 2023, we noted that Kiwi investors were bucking international trends, as our investment levels in startups remained relatively stable compared to the same period of the previous year.

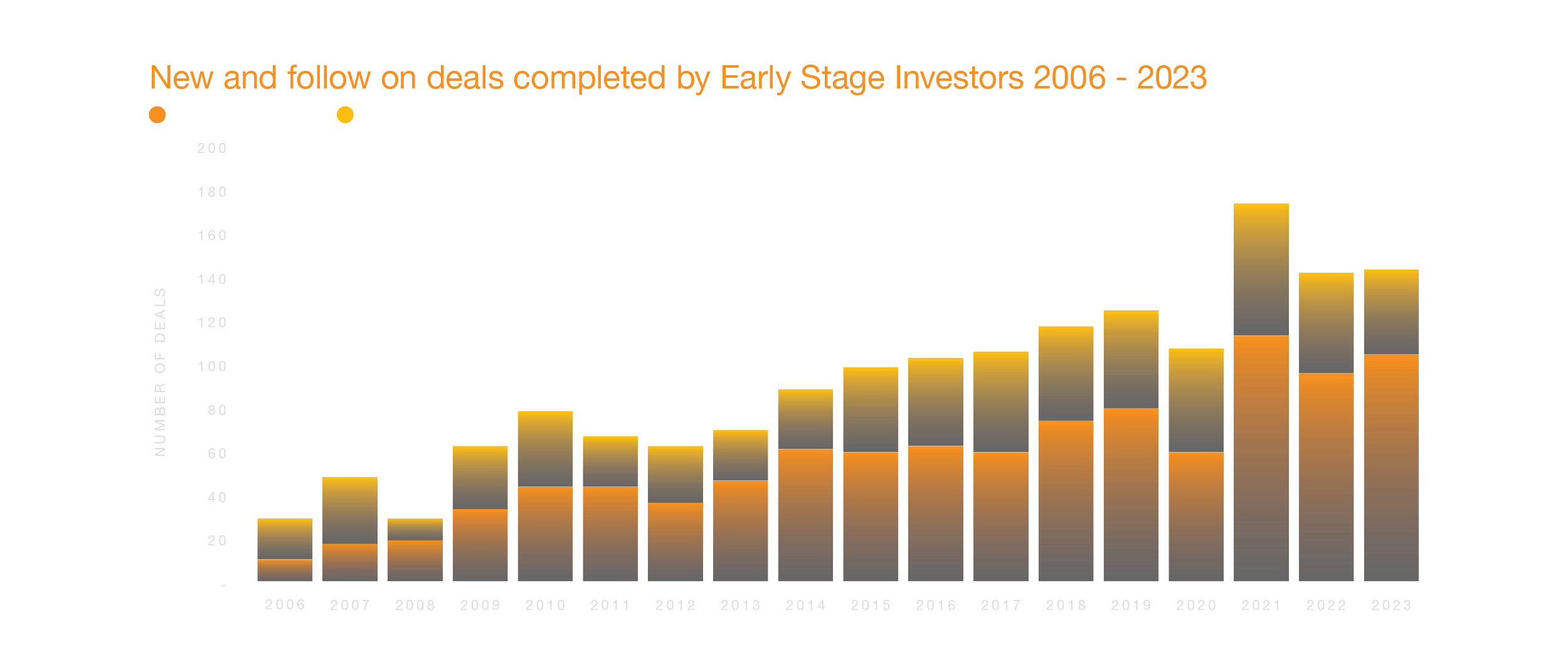

Investment activity for the remainder of 2023 did not demonstrate the same resilience, resulting in a 12% decline in funding for the full year. As a result, the total investment in 2023 amounted to $163m, compared to $186m in 2022. Despite this decline, the number of completed deals remained relatively unchanged, with 144 deals completed in 2023 compared to 142 in 2022.

The data for the first half of 2023 indicated a decrease in the appetite for new deals, as more deals and funding were allocated to existing investments rather than new opportunities. Historically, the distribution has remained relatively steady, with around one third of deals being new and two thirds being follow-on investments. However, in the first half of 2023, this distribution shifted to one quarter for new deals and three quarters for follow-on investments, and this trend continued throughout the year. The defensive posture of investors is understandable in the current economic conditions, but it does come at the expense of the pipeline of new companies and their ability to grow to prominence.

In 2023, the number of new deals completed decreased to 40, compared to 46 in 2022, and 61 in 2021. This indicates a narrowing pipeline of new startups at a time when we should be expanding it. Additionally, the average amount raised for new startups declined by 22%, from $1.6m in 2022 to $1.2m in 2023. Kiwi founders face global competition, along with challenges such as high inflation, skills shortages, and reduced corporate and government procurement spending. Insufficient funding hinders their ability to overcome these obstacles. It is crucial that we take action to build a robust pipeline of innovative companies that are well-equipped with resources to maximise their potential to make a significant positive impact.

We have been diligently building a startup ecosystem for fifteen years, but it will take 20 to 30 years to fully realise substantial returns, both financially and more broadly for society. It is crucial that we do not lose momentum and take our pedal off the metal. Startups play a vital role in any nation's economy, as they are the primary drivers of net job growth and the source of innovation and productivity. In Aotearoa, the technology sector already ranks as the second-largest generator of export revenue and offers high-paying employment opportunities. To bridge the productivity gap between our economy and other comparable economies, a thriving startup ecosystem is essential.

For those invested in the future of Aotearoa, keeping focused on short, medium, and long term achievements will be key. We must support and strengthen the confidence in ambitious founders and their startup teams, as well as the asset class, recognising the value they bring.

“The defensive posture of investors is understandable in the current economic conditions, but it does come at the expense of the pipeline of new companies and their ability to grow to prominence.”

“It is crucial that we take action to build a robust pipeline of innovative companies that are well-equipped with resources to maximise their potential to make a significant positive impact.”

“We have been diligently building a startup ecosystem for fifteen years, but it will take 20 to 30 years to fully realise substantial returns, both financially and more broadly for society. It is crucial that we do not lose momentum and take our pedal off the metal.”

The latest Young Company Finance deal data shows that a total of 144 deals were funded by Early Stage Investors1 in 2023, with capital funding of $163.7m. This represents a similar deal volume to 2022, but a 12% decrease in total investment. The number of new deals decreased to 40, while the number of follow-on deals increased to 104. New deals made up 31% of the total funding (down from 40% in 2022).

DeepTech2 continues to be a favourite sector for investors, accounting for 38% of total capital funding in 2023. Software was the second preferred sector, securing 30% of the total investment. Among the DeepTech sub-sectors, HealthTech attracted the lion’s share of the funding (45%), followed by CleanTech (23%).

1. Early Stage Investors refers to angel investor groups or funds, incubators, university funds and early stage venture capital funds.

2. DeepTech includes pharmaceuticals & biotechnology, AgTech, CleanTech, ClimateTech, SpaceTech and HealthTech.

When three physicists from the world-renowned Raman Laboratory research facility at Victoria University in Wellington found the spectroscopy technology available to them insufficient, they set out to solve the problem.

In doing so, the CloudSpec – revolutionary technology capable of analysing turbid (or cloudy) liquids – was developed and, in 2019, deep tech spectroscopy start-up Marama Labs was born.

“In the past, it had been very challenging to measure the chemistry of cloudy liquids – and we were encountering these challenges ourselves whilst undertaking research at the Raman Lab,” says Marama Labs CEO and co-founder, Dr Brendan Darby.

“In true Founder-Problem Fit style, we solved the problem for ourselves by developing optical sensors and a method that can simultaneously measure and analyse absorption, extinction, and scattering spectra of both clear and turbid liquids,” says Brendan.

“In doing so, we quickly realised we had a viable product and started to identify potential markets where this technology could be both extremely useful and easily commercialised – from fermenting beverages and the wine industry through to pharmaceuticals, life-sciences, and water testing.

For its founders, the science behind CloudSpec was the easy part.

“Our three Marama Labs founders are all physicists – we’d all worked together on the research, and we had the scientific side well covered – so for us, the first challenge was going from a lab to a commercial scale product that’s valuable to end users,” admits Brendan.

“A lot of work now is in really understanding who those end users are, and then translating science into a product that is user friendly and providing value.”

Recognising that raising capital is key to continued growth, Brendan is the first to admit that deep tech requires a certain type of investor – one that understands scientific hardware can be hard, and that some of the more traditional metrics like Annual Recurring Revenue (ARR) or Cost of Acquisition are not necessarily relevant in the early days, where technical derisking is more important.

Then, in 2017, WNT Ventures came into the picture – a venture capital firm that openly admits it is ‘deeply invested in deep tech’.

Founded in 2014, WNT Ventures is “New Zealand’s longest-running incubator” says Managing Partner, Maria Jose (MJ) Alvarez. The most established early-stage deep tech fund manager in New Zealand, it’s also the only venture capital firm to be reappointed to the Callaghan Technology Incubation Programme.

“At WNT Ventures, we see about three hundred opportunities per year, so it’s our job to see themes and trends before they are a thing,” says MJ.

“We invest in breakthrough technology, and in teams with high IP and high levels of conviction – and Marama Labs ticked all of those boxes.”

Brendan is quick to acknowledge the huge value experienced investors can bring to the table.

“In the deep tech space, it can be a long path to success. You’re working with fundamentally new IP and you’re often figuring out the science and the business model at the same time.

“Getting that investor and founder alignment right in the early days is crucial, as is having those conversations at the Board level that really understand the nature of the business. A great investor has seen many things in their career and can just jump in and give you solid advice on a particular scenario.”

“We’ve had both Mark Bregman from Quidnet Ventures and MJ on our board, although MJ stepped down late last year to focus her efforts on earlier stage companies in the portfolio. We consistently caught up with them in their capacity as investor directors, and they’ve both been hugely helpful to bounce ideas off and to share problems we might be going through,” says Brendan.

“The number of times I’ve been stuck on a problem as a founder and I’ve talked to Mark or MJ and they’ve just been able to see it from a different angle – it’s never about telling us what to do, it’s just about unlocking the problem and challenging us to look at things in a different way.”

For MJ, the role as an investor is clear.

“Founders know best when it comes to the tech, but often it’s the first time creating a company so our job is to have the team that has that lived experience and can bring that to the table.

“Our job is to bring the balance between focus and looking at new opportunities. We always need to be looking one step forward and looking to help take that startup from where it is to where it needs to be.”

MJ is well-aware of the challenges associated with the current economic climate, and the impact it can have on founders and investors alike.

“If we look back to 2020 and 2021, the money was just overflowing and, as a result, lots of things were funded which probably wouldn’t happen now.

“The reality is, some investors need to know when to pull the plug and over the last year or so, the economy has forced people to make those decisions which is good for rebalancing,” says MJ.

“At the end of the day, it’s not just about raising capital, it’s about building a great company – and if you’re doing that well, investors will be looking for you, they’ll find you and they’ll get you the funding you need.”

With “a product already in the market, core tech already patented, and revenue being generated”, Marama Labs’ plans for the next six to twelve months include both growing existing markets and moving into new ones, says Brendan.

“Not only is a key focus of ours to grow in the wine market, but we also have plans to use the funding we secured last year to launch our first product iteration into the life-sciences market in late 2024.

“Despite the current market challenges, we’ve got a very active programme of product development and we’re showing good interest in our new market in particular. We’re excited to be launching into the life-sciences market, and we’re hoping to raise further capital off the back of that launch, too.”

Dr Brendan Darby

CEO and co-founder,

Marama Labs

Maria Jose (MJ) Alvarez

Managing Partner,

WNT Ventures

In only a few years, ag-tech startup Hectre has taken the relatively traditional orchard industry and turned it on its head, significantly reducing produce waste and ensuring more fresh produce reaches consumers’ tables in the process.

Founded in 2016, Hectre combines both orchard management and post-harvest fruit quality solutions that use data and AI to change the game for the global produce industry.

Whilst the technology is disruptive by nature, it’s also practical and easy-to-use by design – which growers love.

“Fresh produce as a whole is a trillion-dollar industry, and us taking part in that is where the opportunity is,” says Hectre chief executive and co-founder, Matty Blomfield.

“By giving growers digitisation and traceability tools, we are impacting the supply chain globally and giving value back to the growers.”

It was Hectre’s high-quality technology, coupled with their “confidence, growth and vision” that caught the attention of deep-tech investor Nuance Connected Capital, who led the late 2023 round of funding which secured NZ$5m of investment.

“We were quite excited by Hectre and its Spectre solution, which uses computer vision AI to deliver accurate, early fruit sizing, colour and grading data to growers,” says Nuance General Partner, Mitali Purohit.

“The technology is disruptive for the industry but easy for growers and packhouses to use. It’s a modern-day solution that Hectre’s customers love – they love that it’s so simple to use, seeing gains in productivity and they love dealing with the Hectre team.

“We also admired Hectre’s ambitious targets, particularly in what is a relatively archaic industry, and wanted to support their big hairy audacious goal by making that journey a whole lot easier for them.”

While the company is “growing faster than ever now” it hasn’t always been plain sailing when it comes to securing investment, admits Matty.

“Before we raised capital, we would land a new deal and use that to fuel the company for the next couple of months. We were barely making ends meet."

That all changed in 2017, when Richard Coon and Angel Investors Marlborough (AIM) stepped into the picture as one of the first investors into Hectre.

“We met Matty back in 2017, the same year we started Angel Investors Marlborough (AIM), and between us ended up investing around NZ$2m,” says Richard.

“We have always invested quite heavily in agritech, and the decision to invest in Hectre was two-fold.

“Firstly, we love the space they’re in. The world needs 70% more food by 2050 and yet, when you look at the whole industry, from the growers producing food to the supermarkets selling it, it’s just incredibly decentralised and inefficient. There are huge levels of wastage between the grower on the land and the customer in the supermarket, and here was Hectre, setting out to address the whole supply chain.

“Secondly, the orchard industry was one that generally had very little investment in technology, and we could see there was just this huge opportunity and a logical way to approach the market,” adds Richard.

Matty acknowledges the company “wouldn’t be where it is today” without Richard.

“That first round of capital puts you on a path. We’ve had to work hard, and it hasn’t always been simple or straightforward or easy, but I’m a firm believer that external capital can fuel exciting new things that can add value in the world that would ordinarily take a much longer time. I really believe in this model.”

Matty is also quick to acknowledge the value Nuance has brought to the table, with Mitali coming on board as an Investor Board Observer last year.

“Nuance are pretty special in themselves. When we went into their office in Takapuna and pitched to them, something resonated between us – something on a real, human level.

“Mitali has been so willing to help where and when we need it. She has put in the effort time and time again. She has been relentless and reliable – and supportive. That’s one of the things I value the most.”

Getting the fit right is equally important for Nuance, given its strong commitment to purpose-driven investments – investments that “improve the way we live, or the planet” says Mitali.

“When it came to Hectre, we saw an investment fit as well as a people fit. Culturally we were quite aligned, and the type of customers they serve and the type of fund raising they want to do in the future, we just felt we could really add value.

“We have enjoyed supporting Matty and the team as partners in their own company. They have welcomed our input, they’ve responded to every introduction we’ve made, and they’ve just been so open and willing to take on board our advice and ideas.”

When it comes to the current economic climate and its challenges, Mitali is unequivocal in her view that “startups just need time” and continuing to invest is critical.

“During these economic cycles, if we continue to invest – and if we invest in the foundations of technology and team – then when we all come out the other side we’ll be in stronger and more sustainable positions. If we don’t invest now, these startups will just disappear.

“It’s slightly clichéd, but diamonds are made under pressure, and we need to keep supporting founders who think they can do it, so they can continue working away through these more challenging times.”

The current climate leaves no room to get it wrong, adds Matty.

“One of the problems with the current capital environment is that there are simply no chances to make mistakes. You need to ensure you’ve got that blade super sharp.”

With more than 80% of its revenue coming from international markets, it’s clear that Hectre has already carved a niche in the global produce industry with its comprehensive approach.

“Hectre has 140 customers in 11 countries, and its biggest market is the United States, followed by South America and Europe. The company has about 40 staff and is growing very fast, with its Annual Recurring Revenue (ARR) growing over 100 per cent per annum, which is really exciting,” says Richard.

Looking ahead to the next 6-12 months, the focus will be on securing enterprise level customers and getting to breakeven point, says Mitali.

“It’s all about focus – focusing on sales, focusing on getting the team together and being really productive, focusing on securing interim capital to get to sustainability, with a Series A round on the horizon.”

For Matty, there are “a couple of really important milestones to hit”, including “unlocking packers as a channel to reach thousands of growers – and we've already proved it on a small scale.

“At the end of the day, our solutions are about giving value back to the grower.

“In many cases, producers aren’t making ends meet. The reality is we need what our growers produce, they need to be paid more, and so much produce is still lost in the supply chain. We can help change that.”

Matty Blomfield

Chief Executive and Co-founder,

Hectre

Mitali Purohit

General Partner,

Nuance Connected Capital

Richard Coon

Angel Investors Marlborough

In an era defined by urgent calls to address the global climate crisis, sustainability remains a hot topic for businesses and consumers alike.

Having seen firsthand the amount of plastic waste generated by the eCommerce industry and believing there must be a more sustainable way to package orders, Rebecca Percasky and Kate Bezar tackled the packaging industry head-on.

The result? Better Packaging Co. – a carbon-neutral certified BCorp focussed on producing packaging that delivers a whole lot of good.

Founded in 2018, the duo started with their now infamous ‘Real Dirt Bag’ compostable courier satchels before expanding to include garment bags, labels, pallet wrap and more.

The business grew rapidly, says Rebecca.

“We were bootstrapping for the first two years. The business grew quickly, and as a product-based business we were always chasing our tail. We were working with a four-month manufacturing cycle, and we needed alternative ways of funding to allow for that combination of rapid growth and purchasing pattern.

Enter Even Capital: the brain-child of New Zealand entrepreneur and investor duo Anna Stuck and Sarah Park, and a firm whose whole reason for being is to even the playing field for female -founded and female-led businesses.

“For us, it’s about backing women to lead and succeed,” says Sarah.

“We’d been observing Better Packaging in the market place for a number of years – before we’d started Even Capital – and when we met with Rebecca and Kate in early 2022, we were blown away by what they’d achieved.”

At the time, Better Packaging Co. was sitting on a new, world-first product range they had developed; POLLAST!C – a packaging solution made from recycled Ocean Bound Plastic (OBP), rescued from the environment in Southeast Asia.

Kate explains, “POLLAST!C deserved to be launched and commercialised properly to capitalise on our first-mover advantage and desire to ‘own’ the market.

“Investment needs to be for the right reasons, and that’s when Even Capital came on board, leading a round in late 2022.”

The round raised approximately $5 million – an “impressive achievement given the timing and the beginning of the market downturn,” says Sarah.

Despite the challenging economic conditions, Sarah reiterates the importance of continuing to invest in startups.

“Economic cycles come and go, but innovation doesn’t stop. In fact, innovation can happen during more challenging times. Often, when there is less capital, when there are fewer consumers – businesses are forced to become smarter and more efficient.”

Better Packaging Co. has spent the last 18 months getting the business to break even, “so that when we raise again, it’s for growth and innovation” says Rebecca.

“We looked at every part of the business to identify the levers and we pulled them all! We focused on using tech to scale and automate, and working out how we do more with the same resources to enable profitable scaling.”

“We also just wanted to know for certain that we had a fundamentally good business model that was able to make consistent, healthy margins,” says Kate.

“We’re in a comfortable place now, which is really important in this environment because you never know what’s going to happen.”

Both parties highlight the importance of alignment and getting the balance right when it comes to investment and what it can enable for startups.

“For a values driven business like ours, investors have to be aligned,” says Kate.

“It’s vital that you get on, and respect who is sitting around the investment table. Done well, investment is a partnership which means you’re going to work alongside each other for a long time. We've been incredibly fortunate with our investors and see them as an extension of the team – we get to leverage their expertise and resources as required,” says Rebecca.

“We quickly realised our expertise was in sustainable packaging, not raising money. It was a steep learning curve. We had to learn a whole new language – terms we had never heard of. In hindsight, we would have benefitted from external support and expertise,” admits Rebecca.

“Our advice would be to think about the effort involved in raising, and to outsource where possible; it's worth getting experts to help. It’s exhausting and all-consuming, but it’s great to be in the position we’re in now.”

“Entrepreneurs are often a jack of all trades, but investment has been really beneficial and has enabled us to bring people onto our team who really know their stuff,” says Kate.

Like any partnership, it’s important to be honest where there is room for improvement, says Sarah.

“It has been so rewarding sitting alongside Rebecca and Kate – helping them to really delve down into the financial model of the business, helping them to navigate some of their challenges and just mentoring them on general business skills and providing that support when times are tough.”

“We’ve worked really well together, and the ship has started to get some wind behind its sails. Now is the perfect time for the appointment of a new director – someone who has the right skills to support Better Packaging Co. as it moves into this next phase – and we’re excited to see what this incredible duo can do next.”

Rebecca Percasky and Kate Bezar

Co-founders,

Better Packaging Co.

Sarah Park

Co-founder & Managing General Partner,

Even Capital

Last year the demand from investors for ‘growth at all costs’ was replaced with the requirement for ‘operational efficiencies’. Now we are seeing a merger of these two trends, with expectations for companies to prove that they can show growth and a clear path to profitability, while maintaining cost efficiencies.

Looking ahead, we expect investor caution to remain, however there is optimism surrounding New Zealand start-ups and the global issues they are addressing. In addition to this, with 56 applications to date, and over $500m of funds nominated for investment, we expect the Active Investor Plus program to be an exciting source of capital as these investors allocate funds to approved companies and domestic VC funds. The potential economic benefit to New Zealand and our start-up economy is immense. This, combined with the insights from NZTE’s global team, put the Investment team at NZTE in a position to continue to help start-ups refine their value proposition for their target markets, clarify their capital strategy, and connect them with prospective investors both domestically and from around the world.

Annabelle Glazewski

Ringatohu Haumi - Pākihi

Investment Director - Companies

NZTE

PwC is dedicated to helping startups with great ideas make their way in the world. We provide support through tailored financial reporting, tax advisory and compliance, legal advice and support, structuring, strategic advisory services as well as networking opportunities. We collaborate with others in the local ecosystem including NZTE, AANZ, NZGCP, KiwiNet, and other New Zealand VC funds. Alongside publishing Startup Investment NZ, we are sponsors of KiwiNet Awards and the NZ Hi-Tech Awards.

{{item.text}}

{{item.text}}