New Zealand’s 2023 Budget has been announced.

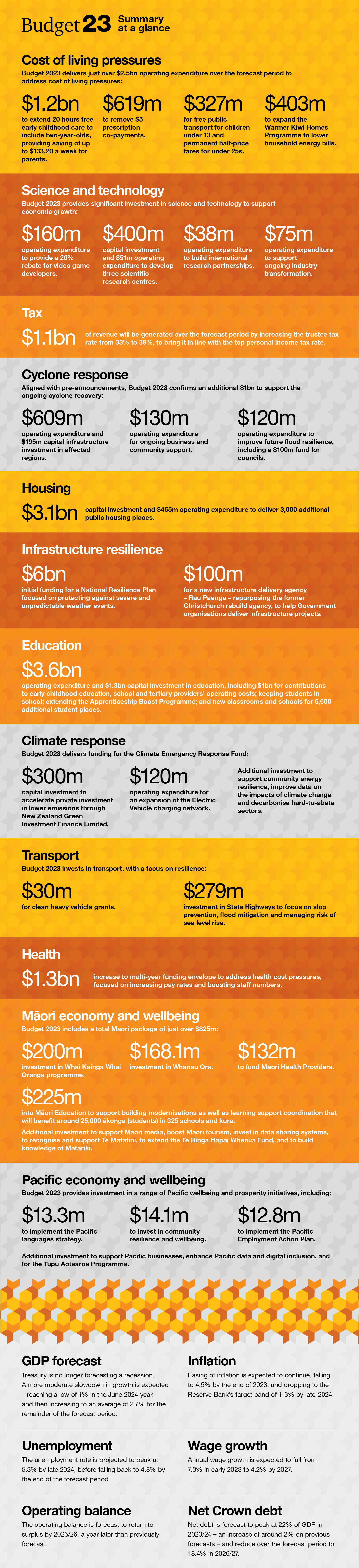

Budget 2023 delivers more significant new spending than pre-Budget messaging suggested, with an emphasis on addressing cost of living pressures, continuing to enable the cyclone response and recovery, and investing to support economic growth (with a focus on science and technology). Tax also featured, with the trustee tax rate aligned to the top personal tax rate at 39%.

This spending is taking place in an economic and fiscal environment that continues to be challenging. However the Treasury’s forecasts released today show some signs of this easing over the period. A recession is no longer forecast, with the slowdown in growth expected to reach a low of 1% in the June 2024 year. The easing of inflation is also expected to continue, dropping to within the Reserve Bank’s target band of 1-3% by late-2024.

The operating balance is forecast to return to surplus by 2025/26, a year later than previously forecast due to the spending decisions announced today. Alongside this, net debt is expected to peak at 22% of GDP in 2023/24, higher than the previously forecast peak of 19.9%.

Watch our video

© 2017 - 2025 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.