Important GST changes for NZ short stay/visitor accommodation providers

New rules from 1 April 2024

Many New Zealanders rent out a holiday home, or parts of their home, for short-stay holiday lets.

From 1 April 2024, new rules fundamentally change the GST treatment of short-stay accommodation when booked through an online platform such as a website or an app (platform) that is operated by someone else (operator). There is no change to the rules where you are selling short-stay accommodation directly e.g. through your own website. The new rules also apply to certain ride sharing / hailing, and food and beverage delivery services, but this note concentrates on short-stay accommodation providers.

Short-stay accommodation booked through an online platform will attract GST at 15%, regardless of whether or not you (the underlying supplier) are GST registered.

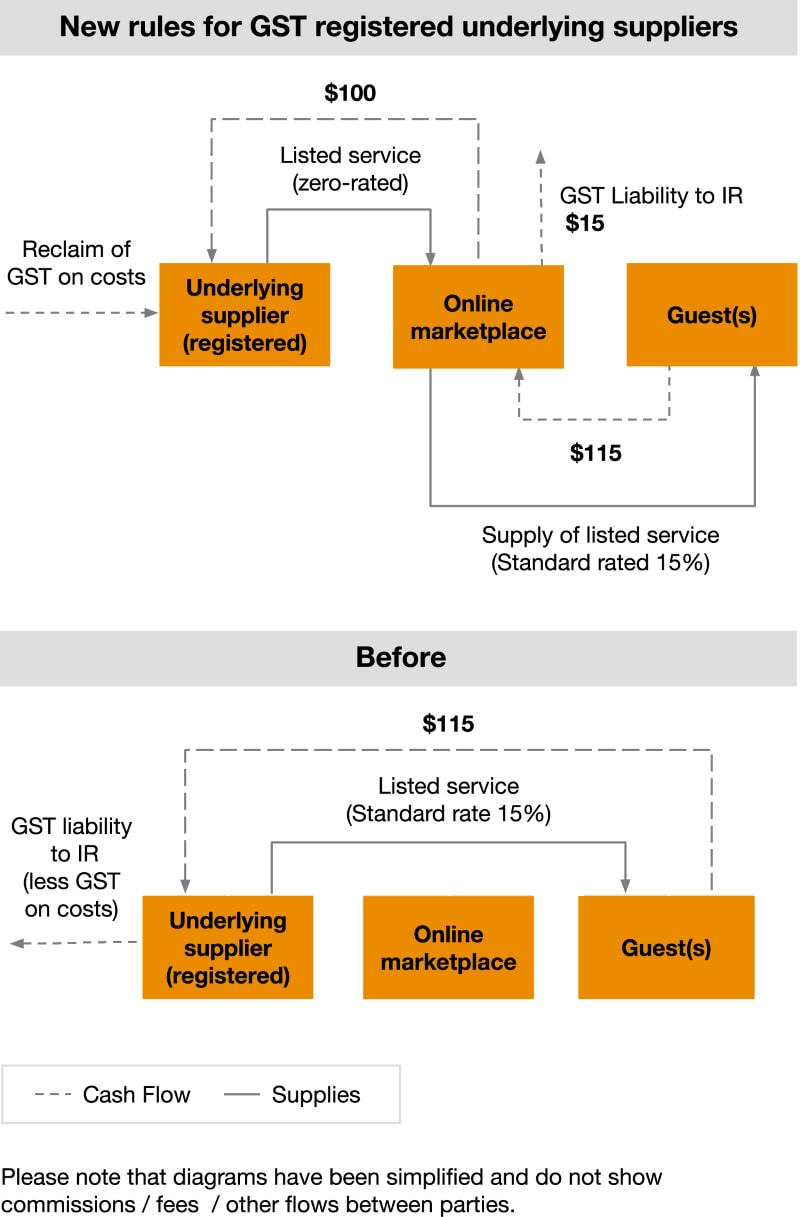

The operator of the platform will be the one who is responsible for charging the GST, paying it to Inland Revenue, and issuing taxable supply information (tax invoices) to customers.

If you are GST registered:

You must let the platforms you use know that you are GST registered.

You will no longer need to account for GST at 15% on your supplies of accommodation booked through a platform.

You must instead report these in your GST return as zero-rated supplies.

You don’t need to issue taxable supply information / tax invoices to either the customer or the platform.

You should still be entitled to claim GST on your costs in your GST return, as you have done previously. You will not receive any flat rate credit from the platform (discussed below).

If you are not GST registered:

- If you are not currently required to be registered, this change does not mean you need to register or account for GST - the platform will do this. It also does not mean that your property will come into the “GST net” and become taxable on sale.

- However, you still need to monitor whether your supplies reach the GST registration threshold. If they do, you will still need to register for GST and must notify the platform of your change in GST registration status. Then the consequences above (“If you are GST registered”) will apply.

- You should receive extra money from the online marketplace, calculated at 8.5% of the GST exclusive price of your accommodation booking (see the flat rate credit scheme section below).

If you operate a platform, and haven’t yet had advice on the rules, we recommend seeking urgent advice regarding the impact of these rules on your business. This is also the case if you are a booking agent for property owners or act as an intermediary between owners and platforms that interact with guests - the rules are complex and you should seek advice urgently.

For further information on these rules, please refer to Inland Revenue guidance and Inland Revenue’s special report.

- Information you must give the platform

- Opt-out rules for large operators

- Flat rate credit scheme

- Impact for income tax

Information you must give the platform

You (the underlying supplier) must provide the platform with your name, IRD number, GST registration status, and notify of any changes to these details. Additional details may also be required if the online marketplace is resident in New Zealand under the new reporting rules for platform operators (see Inland Revenue guidance).

Opt-out rules for large operators

If you are a large operator of short stay accommodation, you may be able (or the platform may ask you) to opt out of platform rules and therefore, continue to be responsible for collecting and remitting GST, and issuing taxable supply information (i.e. no change to the current rules). This applies, broadly, if you either:

(1) make more than NZ$500,000 in taxable supplies in a 12-month period; or

(2) have more than 2,000 nights of accommodation listed on 1 electronic marketplace in a 12-month period).

Flat rate credit scheme

If you are not registered for GST, the platform should pass you an amount equal to 8.5% of the GST exclusive price of your supply to the guest. This is a proxy for the GST that you would get back from Inland Revenue on your costs, if you were registered for GST. See the diagram above. The platform should also provide a statement of flat-rate credit passed on, at least monthly.

If you are GST registered and accidentally receive the flat rate credit, you are required to pay this back to Inland Revenue in your GST return for the period in which your receive it. If not, you may be subject to interest and penalties on the amount received.

Underlying suppliers who are not required to register (supplies under $60k per annum), could alternatively register for GST voluntarily, as they can under current law. This would mean you can claim GST on costs, instead of receiving the flat rate credit. In this case, it is important to also consider the consequences of GST registration on the property i.e. it may become subject to GST on sale or if you change it back to private use. We recommend seeking advice.

Impact for income tax

If you are GST-registered, you account for income and expenses on a GST-exclusive basis.

If you are not GST-registered, you may have to undertake some complicated calculations in your income tax return. For income, account for income on a GST exclusive basis. The flat-rate credit is excluded income for income tax purposes. If you have:

Expenses for bookings through a platform, deduct expenses on a GST exclusive basis. This is because the flat-rate credits you receive from the marketplace recognises the GST on the costs you incur when making this income.

Expenses for bookings outside of a platform, deduct expenses on a GST inclusive basis.

Expenses relating partly to bookings through a platform and partly from non-platform bookings, an apportionment may be required. See page 27 to 30 of the special report published by Inland Revenue for more details on the income tax calculations required.

Other recent GST changes that may impact accommodation providers

Mixed use assets - GST treatment on disposal

Under current rules, if your property is used partly for taxable purposes and partly for non-taxable purposes (e.g. private use), GST generally applies to the sale or disposal of the property, even if it’s a minority percentage of taxable use.

However, recent changes allow GST-registered persons to elect to treat certain assets that have mainly private or exempt use, such as dwellings, as not subject to GST on disposal. The goods cannot have been acquired or used for the principal purpose of making taxable supplies and the person cannot have claimed GST deductions for the cost or capital improvements to the goods (or purchased them zero-rated).

If you have a minority taxable use and have claimed GST or purchased zero-rated, you may be able to repay the GST and elect to treat the asset as not subject to GST on disposal (subject to certain conditions). This is only available until 1 April 2025. We recommend reaching out if you would like to discuss this further.

Repeal of apportionment rule for holiday homes

The special GST apportionment rule for “mixed use asset” holiday homes (which are used both privately and for taxable use, with at least 62 days vacant use per year) will be repealed from 1 April 2024. The general GST apportionment and adjustment rules will apply instead. Reach out if you would like some advice.

Next steps for underlying suppliers of short stay accommodation:

Check the position with the platforms that you book through.

Where you collect the payment from guests directly, you may need to make a payment to the platform to cover their GST liability.

If you are not GST-registered:

Make sure the online marketplace holds the correct information (and your GST registration status is correct) so that you receive the flat rate credit.

Review your pricing arrangements and consider the impact of this additional GST cost.

Ensure you are making income tax adjustments as necessary.

If already GST registered:

Notify the platforms of your GST registration status (if you do not, and you receive the flat rate credit when you shouldn’t, you may be subject to interest and penalties if you don’t pay it back to Inland Revenue).

Consider what processes will need to change (e.g. ensuring you disclose zero-rated supplies for bookings through platforms).

If you are a large operator, consider whether you can/want to opt out and what agreements are required with the platforms.

If you have any questions or would like to discuss the impact of these changes, contact us: