Introduction

PwC’s Retail and Consumer Insights provides the latest consumer behaviour news and trends in New Zealand and internationally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ and other local and global sources.

Key highlights from our April 2022 edition include:

ANZ-Roy Morgan Consumer Confidence survey in March continued the recent trend, with a further fall of four points to 77.9, a new record low since the survey began in 2004.

The proportion of people in March who believe it is a good time to buy a major household item also fell a further five points to -26, the lowest level since the start of the pandemic in March 2020.

Food prices increased 7.6% in the year ended March 2022, with fruit and vegetable prices increasing 18.0%.

Stats NZ announced on 21 April that annual inflation for the March quarter was 6.9% - the highest level in 30 years (with non-tradables inflation increasing to 6.0%).

March 2022 electronic spending saw a more measured response from consumers, with seasonally adjusted electronic spend for the core retail categories declining 1.4% (-$72m) relative to February 2022.

Comparisons with pre-COVID spending continue to highlight the impact of COVID restrictions on key categories with spending in the Hospitality and Apparel categories -14.3% and -11.7%, respectively below the levels recorded in March 2021.

In terms of international insights and consumer sentiment, PwC Australia recently released a report highlighting that while the shift to online/digital shopping continues, consumers are becoming increasingly price conscious and the re-opening of our international borders may pose a threat to domestic spending.

To explore further, select the buttons below.

Consumer confidence

While all of New Zealand remained at the ‘red’ traffic light setting throughout the month of March, the Government introduced a number of changes (effective from 11:59pm on Friday 25 March 2022):

No limits on numbers attending outdoor activities, such as gatherings and events, and food and drink businesses.

A 200-person limit (increased from 100) for indoor gatherings and events.

No longer a requirement for customers to scan in, or for businesses to display a QR code poster or have mandatory record keeping.

The Government then announced that the entire country would move to the ‘orange’ traffic light setting at midnight on 13 April 2022. Unfortunately, none of this had any impact on the March edition of the ANZ-Roy Morgan Consumer Confidence Index (released on 1 April), which fell a further four points to 77.9, a new record low since the survey began in 2004. While there is no doubt that the surge of COVID cases and hospitalisations experienced in March has had an impact, rising living costs, a retreating housing market and rising interest rates have also had a direct impact on consumer confidence.

"There is clearly growing consumer wariness that can’t be solely attributed to the current Omicron outbreak. Confidence appears to have been hit hard and from all angles, including rising interest rates, cost of living pressures and a slow down in the property market."

The proportion of people in March who believe it is a good time to buy a major household item also fell a further five points to -26, still the lowest level since the start of the pandemic in March 2020. While COVID has increased the volatility in retail sales data, ANZ’s most recent survey unfortunately suggests that the foreseeable future will remain challenging for the sector - with survey results significantly below those experienced following the global financial crisis induced recession in 2008/2009. From an age demographic perspective, there is now broad agreement that now is not the time to be spending on major household items.

House price inflation expectations fell 2.0% to 2.7% (the lowest since July 2020), while consumer price index (CPI) expectations increased 0.4% to 6.0% (only the second time since 2004 that it has breached the 6.0% level). The challenging consumer outlook is also reflected in the proportion of respondents who expect to be better or worse off in 12 months' time. This indicator has fallen a further 7.0% points, with a net 9.0% of respondents now expecting to be worse off in 12 months' time. This is a record low that can’t be attributed to Omicron alone, as households face a ‘perfect storm’, including cost of living inflation, rising interest rates, a cooling housing market and ongoing geopolitical uncertainty in Eastern Europe (contributing to oil/fuel pump price volatility).

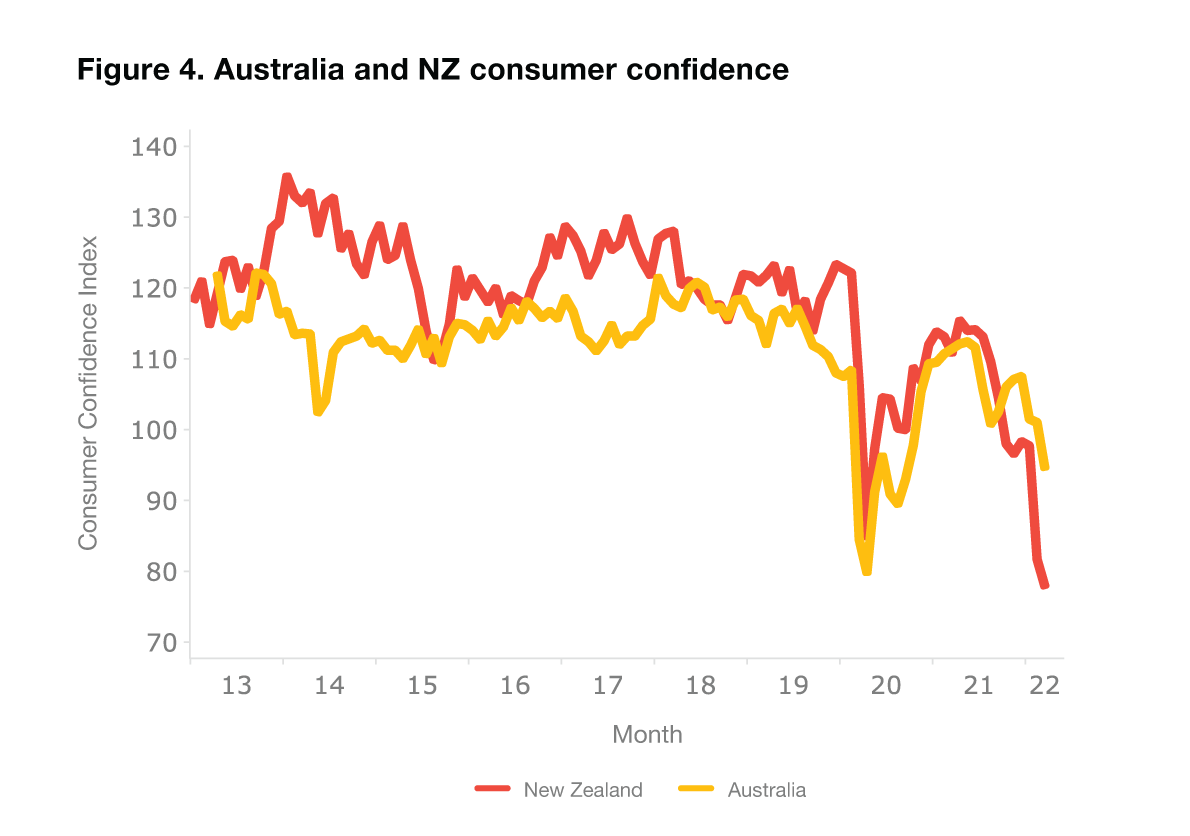

Consumer confidence is also significantly lower in New Zealand than in Australia, where both inflation and interest rates are lower, and Omicron less recent.

Stats NZ announced on 13 April that annual food price inflation had reached 7.6% in the 12-month period ending 31 March 2022. Key movements by category included:

In response, the Reserve Bank also announced on 13 April an increase in the official cash rate by 50 basis points to 1.5%.

Following these announcements, Stats NZ announced on 21 April that inflation for the March quarter (compared with the December 2021 quarter) was 1.8% and that annual inflation (March 2022 quarter compared with the March 2021) was 6.9% - the highest level in 30 years. While the government has focused on various international influences contributing to inflation (e.g. COVID related global supply chain disruption, the Russian invasion of Ukraine) it is important to note that domestic inflation pressures had continued to intensify with non-tradables inflation increasing to 6.0%.

Spend trends

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions series data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we are able to compare YTD retail-related electronic spend data by sector with the comparable periods in 2019, 2020 and 2021.

March 2022 electronic spending (released by Stats NZ on 11 April 2022) highlighted a more measured response from consumers (compared to the significant decline reported for February. Seasonally adjusted electronic spend for the core retail categories declined 1.4% (-$72m) relative to February 2022. New Zealand remained in the ‘red’ traffic light throughout the month of March.

Within the core retail category, movements in spending by category on a seasonally adjusted basis between February and March 2022 were:

Motor vehicles (excluding fuel),

up $5m (+2.7%)

Consumables, down $78m (-3.3%)

Durables, unchanged (0.0%)

Apparel, down $20m (-6.9%)

Fuel, down $4m (-0.1%)

It is interesting to note that compared with February 2022, the non-retail (excluding services) category increased by $223m (14.5%). This category includes medical and other healthcare, travel and tourism, postal and courier delivery, and other non-retail industries. In contrast, spending in the hospitality industry fell by $149m (14.3%) between March 2021 and March 2022.

In terms of the actual March figures (compared to March 2021), total core retail spend fell by 1.2%, with the most significant movements recorded in the Hospitality (-14.3%) and Apparel (-11.7%) categories. For the first quarter of 2022, we can see a build-up of factors, including cost of living inflation, rising interest rates and the ongoing impact of COVID restrictions all having a negative impact on retail spending. The categories most adversely affected include Hospitality, Apparel and Services, which declined in the first quarter of 2022, by -8.8%, -5.7% and -2.2%, respectively.

March 2022 electronic spend by sector

Hospitality electronic spend - last 12 months

Despite the recently announced Government decision to move to the ‘orange’ traffic light on 13 April 2022, it is still useful to consider recent spending patterns in a wider, longer term perspective, including pre-COVID. The chart below compares spending in the last 12 months (LTM) to March 2022 with spending in the equivalent 12 month periods in 2021, 2020 and 2019.

Consumables are up 17.9%

Durables are up 17.4%

Hospitality is down 9.6%

Apparel is down 2.9%

Fuel (excluding Motor Vehicles) is down 15.1% - despite the recent surge in oil prices.

A similar analysis based on the monthly progression of electronic spend by category versus the equivalent period in 2018/2019 provides similar results. However, it is interesting to note that while Fuel (excluding Motor Vehicles) has improved in recent months, despite the reduction in traffic volumes, performance in both the Hospitality and Apparel sectors continues to deteriorate. While these categories and the broader retail and consumer sector will be pleased to see the recent reopening of our international travel borders to fully vaccinated Australians, the continuation of mask wearing requirements will be disappointing for many retailers.

International insights

In terms of international insights and consumer sentiment, PwC Australia recently launched a new video series Consumer Market Bites, which in its first edition explored consumer trends and the economic outlook for the retail and consumer sector.

Key takeaways from this interactive session which appear equally relevant to the sector in New Zealand include:

Continued shift to digital and online

One in four Australians stated in the PwC survey that they purchase a product on a daily basis through a digital channel. With consumer behaviour being habitual, we would expect consumers to continue buying online, which has implications for how we think about the inter-relationship between physical stores and retailer’s online proposition.

Price focused

51% of Australians said that they would be more price oriented in 2022, while 57% said that they would look to increase their savings. With higher interest rates and mortgage payments up, it is likely that consumers will put more money into the repayment of their mortgages, rather than spending on products and experiences.

Sustainability

44% of Australian respondents said that they will shop more eco-friendly, while 38% said that they're looking at improving their health or being more health conscious. The survey also suggested quite a strong correlation between consumers that focus on sustainability and higher income levels.

Shop local

44% of Australian respondents stated that they were more likely to shop at retailers that are local to them - both in the physical world, but also online. Younger generations, e.g. gen X and gen Z, especially appear to focus on supporting independent, local businesses.

Spending shift from goods towards certain services

During the COVID lockdowns what we saw was a spending switch towards particularly household oriented goods. People bought more sofas, computers, televisions and furniture. We've all bought those now, so what we are going to see is that spending switch, as people re-engage with the services (and hospitality) sector.

Reopening of borders

When we closed our international borders, we didn't have international tourists, people holidayed domestically, and we saw spending shift at some level to the regions. That is now going to shift back again. Australia expects to lose about AUS$20bn in terms of net spending as the borders open up and Australians go overseas. That represents a loss of retail expenditure, with spending shifting towards airlines and travel agents.

Recent news

The Government has announced that from 1 April to 30 June 2022, they will provide funding to local governments to implement half price public transport. The three-month initiative, which is expected to cost the central government between $25m to $40m, is expected to give New Zealanders more money to deal with rising living costs.

The Reserve Bank has raised the OCR by 0.5 points to 1.5% in a bid to combat rising inflation. This OCR rise will increase costs for mortgage holders, with savers expected to benefit from increasing term-deposit interest rates. ANZ Chief Economist Sharon Zollner thinks it’s likely that the OCR will be raised again in May, when the Reserve Bank issues its next monetary policy statement.

Domestic supply lines are suffering further delays with ongoing delays for ships at the country’s ports due to COVID related worker shortages. As of December 2021, about 15% of shipping capacity was lost due to port delays. Global shipping integrity (an indicator of whether ships arrive at ports on time and has been constant at ~90% over the past decades) is currently at 30% to 40%.

Hallenstein Glasson has reported a 40% decrease in first half profits from $19.8m to $11.9m, citing COVID lockdowns on both sides of the Tasman leading to the loss of 5,432 trading days as shops were forced to close temporarily. Compared to Australia, New Zealand lockdowns had a more severe effect for Glassons as sales fell 13.6% to $53.4m in New Zealand, but rose 5% to $72m in Australia.

The Warehouse Group has indicated that it is interested in joining the New Zealand grocery sector to compete with Woolworths and Foodstuffs. The company has recently launched Market Kitchen, an own brand range which sells pantry staple items and currently provides ~300 essential and grocery items. Chief Executive Kick Grayston says it will be introducing a wider range of new products in the coming months. The Warehouse Group recently reported a 4.3% decrease in first half net profit of $50.4m from $55m as well as a 8.2% decrease in revenue.

As of 11:59pm on 13 April 2022 all of New Zealand moved to the “orange” setting of the Government’s COVID-19 response framework. As communicated by the Government, this indicates that New Zealand has passed the current peak in cases and hospitalisations. While there is still frustration regarding mask wearing requirements, the change in setting is likely to have a positive impact on the retail sector as the country moves back towards some form of pre-pandemic normality.

Retail sector business confidence remains depressed due to the ongoing Omicron outbreak and record inflation. The latest business survey conducted by the Institute of Economic Research (NZIER) showed that 94% of respondents faced increased costs that were unanimously expected to continue into the next quarter. Furthermore, businesses found that finding workers was the biggest constraint, with 70% of respondents struggling to find skilled staff.

Recent deals

Online financial services company Heathland Group is expanding into Australia with the acquisition of StockCo Holdings 2, a rural finance company. The ~NZ$170m transaction will be funded in the short term through new debt facilities and is expected to contribute ~A$10-12m to Heartland’s annual net profit.

Waste Management NZ has been acquired for $1.9bn by Australian investment fund Igneo Infrastructure Partners. Waste Management NZ is New Zealand’s largest waste company, with five landfills, 29 transfer stations, 900 rubbish trucks and 1,200 employees. The deal is subject to the approval of the Overseas Investment Office but is expected to complete by the end of 2022.

- Air New Zealand has announced a $1.2bn rights issue with 2.3bn shares expected to be issued at a price of $0.53 per share. The decision to raise capital is directly attributable to the impact of COVID with revenues severely impacted while fixed costs remain high.

PwC Retail and Consumer Dashboard

The PwC Retail and Consumer Dashboard is updated monthly, to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of the COVID lockdowns. If you are interested in online access to our dashboard to help inform your decision making, please contact: Matt Gunn

How we can help:

PwC has advised many of New Zealand’s largest listed and privately owned retailers across a wide variety of projects and roles, including assurance, tax, capital solutions, transactions services, M&A, restructuring, real estate, supply chain and digital consulting services.

We have a comprehensive understanding of the rapidly evolving retail environment (offline and online) and are uniquely placed to combine strategy with technical, industry and execution expertise. We pride ourselves on a focused partnership approach to our work in the sector, based on principles of trust, independence and challenging insight, using specialist teams tailored to specific client needs.