Overview

The insurance industry has undergone a transformation. Insurers came through the challenges presented by COVID-19 remarkably well. The industry met its escalating obligations to policyholders, dealt with unprecedented interruptions to its business, went above and beyond for its customers, and proved its own relevance in a time of extreme crisis.

Now is the time to assess where the industry is heading and what long-term changes are needed to address the macroeconomic fallout from COVID-19; environmental, social and governance (ESG) issues; and workforce-related challenges. Some market players are rethinking their long-term strategies as the notions of trust and societal purpose are playing a greater role in the industry than ever before.

It is against this backdrop, and as a follow-up to our Future of Insurance 2020 report, that we developed our views on insurance in 2025 and beyond. Our findings highlight five trends that will influence the industry and five imperatives insurers need to consider as they rethink their strategies.

It is an exhilarating and challenging time for an industry that is traditionally risk-averse and slow to change. Now, insurers must harness the momentum they’ve gained to reassess the future and reimagine their place in the world.

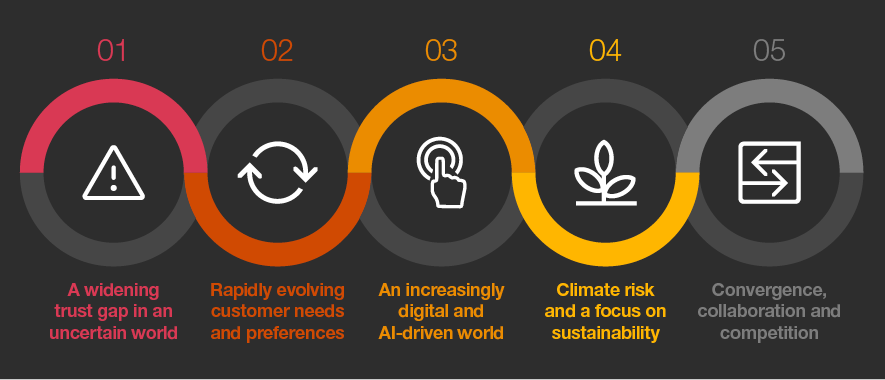

Five trends affecting the future of insurance

An ambitious agenda must necessarily start with a thorough understanding of the forces that will likely shape insurers’ growth trajectory—over the next five years and beyond.

Adaptive ways to reimagine your business

We have identified five interconnected and mutually reinforcing strategic imperatives for all insurers to consider as they embark on their next phase of growth.

- Go on the offensive with digital

- Embrace customer-centric ecosystems

- Embed ESG in your organisation’s core

- Win the race for talent

- Put a premium on execution

Go on the offensive with digital

Engage in digital ecosystems.

Build unique customer intelligence.

Build products and services to meet the demands of a digital world.

Disrupt your distribution.

Re-engineer the value chain as a set of digital services.

Adopt a digital mindset.

Embrace customer-centric ecosystems

Reimagine customer value.

Pick your spot and align capabilities.

Build a network of trusted partners.

Design for digital collaboration.

Align the operating model for multi-nodal value creation.

Embed ESG in your organisation’s core

Elevate the understanding of ESG in your organisation.

Make social responsibility a core ethos of your purpose.

Embed ESG in business strategy.

Make ESG actions and results transparent.

Win the race for talent

Redefine the future of work.

Harness the power of culture.

Upskill your workforce for the new world.

Take advantage of the gig economy.

Rewrite your human resources playbook.

Put a premium on execution

Build an outcome-oriented organisation.

Build a strong change-management capability.

Establish a transformation management organisation.

Adopt an agile delivery model.

As expectations evolve and the industry transforms, insurers will need to choose their own path as they contribute to a bold new vision for the industry. Regardless of the path they choose, insurers that anchor their strategy around their social purpose, transform their business model to meet emerging customer needs, and develop an agile, tech-powered organisation will create distinct competitive advantages.

With a spotlight on purpose, trust and transformation, the evolution of the industry in the coming years will be significant for all the players in the insurance ecosystem.

Contact us