The New Zealand energy transition is gathering pace, with the Government recently committing to its Emissions Reduction Plan and a range of support to accelerate the transition to a low carbon economy. Energy companies are also more actively pursuing sustainability strategies and investments to support decarbonisation and the transformation of the energy system.

Shareholders and communities' growing awareness of reaching net-zero is also putting the electricity sector under increasing pressure to show how it can both achieve decarbonisation and meet the growth goals needed to support wider electrification. In addition, recent supply challenges have made energy security and affordability increasingly important.

The recent announcements and future investment into meeting the Emissions Reduction Plan will certainly help accelerate New Zealand’s transition to a low carbon economy. However, significant effort is needed to understand the challenges that a change to a truly low carbon energy system will bring for energy companies, government, businesses and communities more broadly. Below, we have provided a perspective on these, and as New Zealand charts its own path through the energy transition, how they can be addressed to ensure success. These have been contrasted with international areas of focus for the energy sector, discussed in a recent PwC Strategy& report, The road to responsible growth - How the energy industry can accelerate recovery and growth through purpose. The aim of all these being to enable responsible growth while meeting the needs of shareholders and broader society.

The energy transition in New Zealand - Key imperatives

We see three key imperatives for the energy system to balance; decarbonisation, resilient supply and affordability.

- 1. Decarbonisation

- 2. Resilient supply

- 3. Affordability

1. Decarbonisation

Use of energy contributes about 69% of New Zealand’s net domestic carbon footprint (Source: Climate Change Commission 2021). Electrification of our energy systems, energy efficiency initiatives and adoption of green fuels will therefore be the primary path to decarbonise our economy.

One primary source of decarbonisation for New Zealand is the expected electrification of carbon emitting components of the energy system, eg transport and process heat, and increasing the proportion of renewable electricity generation. In New Zealand, local and international interest in renewable electricity generation projects to help fuel this transition increased significantly in the past few years. Overseas investors especially are seeing value in New Zealand wind and solar, while domestic energy companies are also cementing their plans. Around 400 MW of renewable generation is currently being developed, with at least a further 1 GW of solar and 2 GW of wind under investigation.

Despite the recent work, significant investment is still needed to achieve our climate commitments. Transpower projects up to 8 GW of new generation is needed by 2050 to meet demand growth (source: Transpower NZGP1 projections December 2021). The construction cost of these generation projects could be as high as $15 billion (real 2021 dollars), excluding costs associated with grid connections and network capacity.

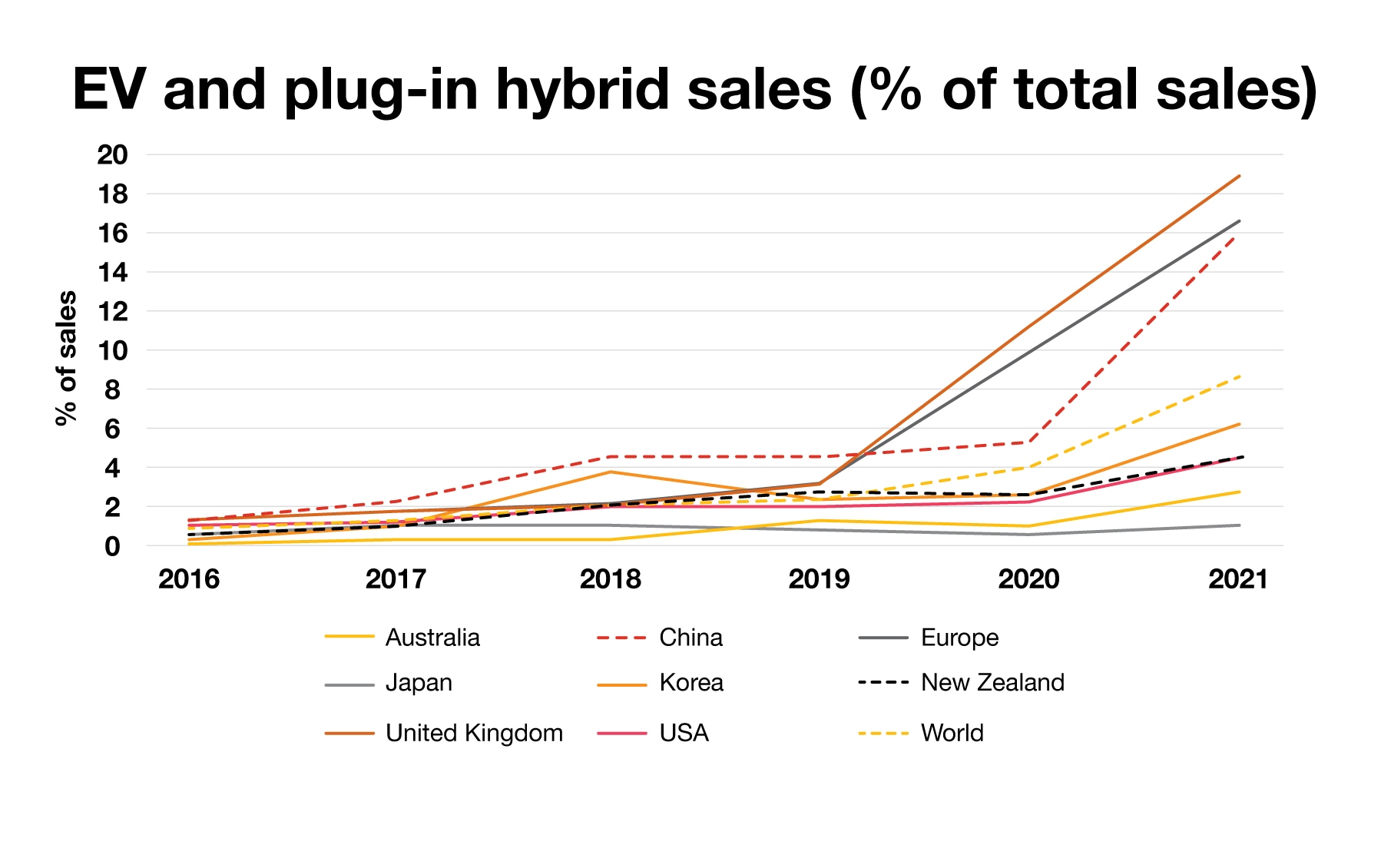

While this activity is starting to support the electricity supply side, the demand side has yet to respond at the same pace. Subsidies to drive Electric Vehicle (EV) uptake through Road User Charge (RUC) exemptions, the Clean Car Rebate and the scrap and replacement scheme will hopefully improve uptake over the coming years. However, New Zealand is still far behind the rest of the world. EVs and plug-in hybrids made up only 5.7% of new vehicle registrations since the introduction of the clean car rebate in July 2021 (Source: NZTA). Globally, EV and Plug-in Hybrid cars represented 8.6% of sales in 2021, but in China, Europe, and UK sales exceeded 15%.

Source: IEA, 2022 Global EV outlook

Outside of electricity New Zealand also needs to consider the role of green gasses and fuels in the future energy system. Not all carbon intensive energy uses will make economic sense to transition to electricity, having both a green electricity and molecule based system will be key to our low carbon energy future.

2. Resilient supply

Maintaining security and supply will be crucial for New Zealand’s renewable transition. With electricity at the heart of the transition, developing a secure and resilient electricity system will be critical alongside maintaining diverse energy supply options, including green fuels and means of energy storage.

As New Zealand transitions to higher levels of renewable generation we will increasingly rely on hydro, wind and solar generation to decarbonise our economy. However, these sources can be intermittent or subject to weather patterns. Over 5,000 GWh of firm electricity generation is required to get us through winter in dry years, this is currently met through coal and gas-fired generation.

To create a resilient supply in a highly renewable system, there are two options being considered:

Overbuild renewables - The Electricity Authority’s Market Development Advisory Group (MDAG) research indicates that between 400 to 500 MW of new renewable generation and demand response is required each year to 2050 to underpin an overbuild strategy.

Build large renewable energy storage capacity - The Government’s NZ Battery project is investigating renewable generation storage technologies. This includes pumped hydro schemes like the Lake Onslow project, green storage fuels such as hydrogen and biofuels, compressed air, flexible geothermal generation, and flow batteries. These are relatively untested solutions and may take some time to develop. For example, Onslow would not be expected to be operational until 2037 (Source: Infrastructure Commission).

As we transition to a high renewable based electricity system it will also be important to ensure we have security of supply for transitional fuels such as natural gas, and in future green fuels such hydrogen or biofuels. New Zealand will need to consider how we maintain supply of these fuels so we don't risk the lights going out, but also balance how we incentivise the transition away from fossil fuels over time.

3. Affordability

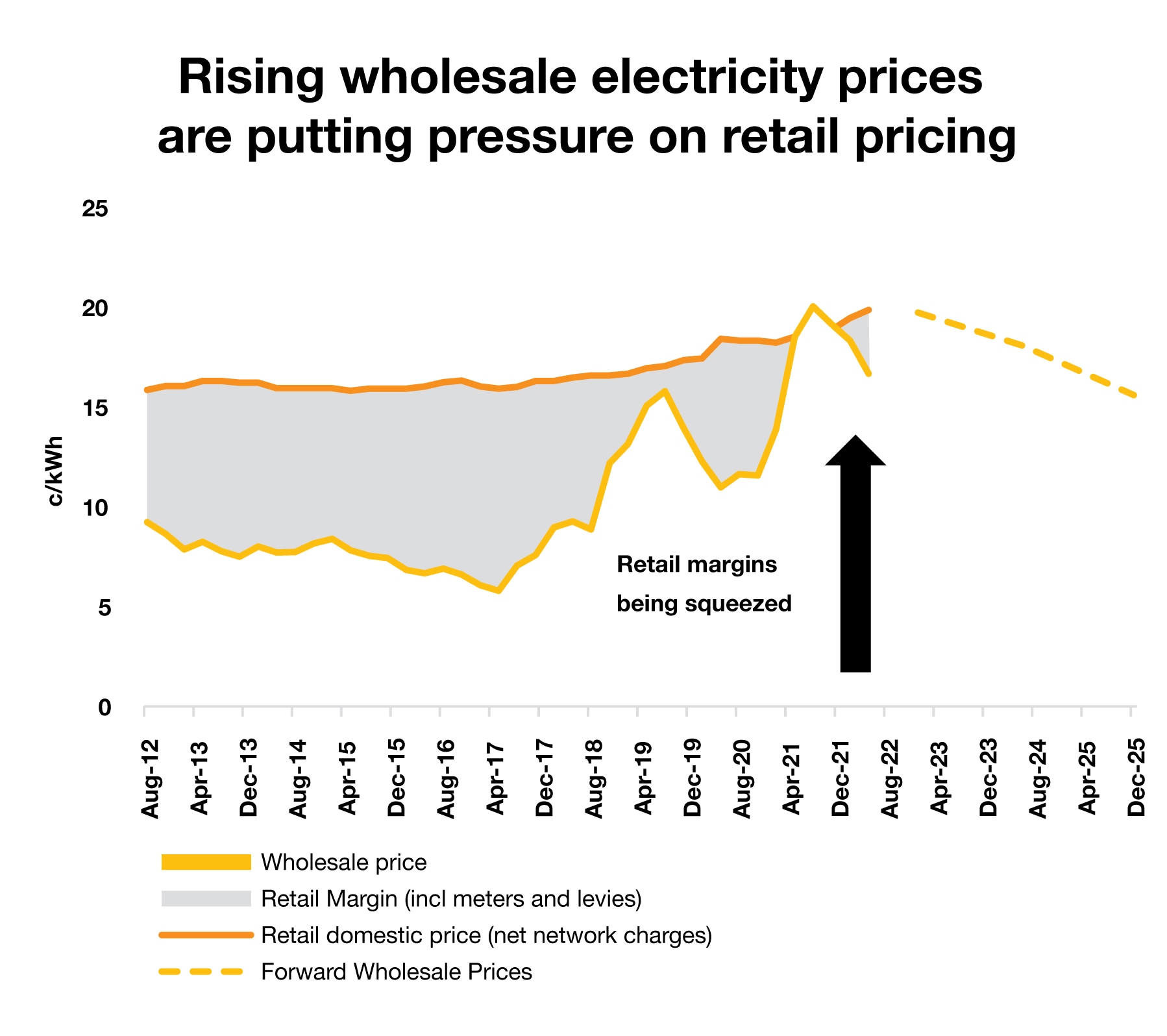

Increasing demand as well as gas and generation supply constraints are causing historically high wholesale electricity and gas prices. We are starting to see this flow through to consumer prices as retail margins are squeezed.

While this is expected to continue for the next couple of years, longer-term, the issues of affordability still loom. The cost of building a secure renewable energy system is high, and getting the proper levels of investment without overbuilding must be managed carefully. For example, the Lake Onslow pumped hydro scheme is expected to cost in excess of $4bn to construct, but it is uncertain how often it will be called on or how costs will be recovered.

Much of this infrastructure needs to be built now, ahead of demand growth. Under current regulatory and market structures, costs will fall more heavily on today’s consumers as these are spread across fewer units of demand, further impacting affordability. As part of designing our future energy system we will need to consider how we provide the right signals or incentives to build early, but also how costs will be spread between generations.

What to do next

Creating New Zealand’s future low carbon economy will require both significant investment and change to meet our future goals. For government and energy companies there are also some key items that will need to be on the to-do list to enable an effective response to these future challenges and growth for the economy with this change:

Having secure, affordable energy is important to all of us and while the energy transition is gathering pace, New Zealand still requires significant thought and investment to meet our 2050 climate goals. Energy companies who think, behave and act with agility will be best placed to succeed. We believe the above three areas will be key for energy companies and government in tackling the challenges to balance decarbonisation, security of supply and affordability in New Zealand’s energy transition.

About us

PwC is the world's leading advisor to the energy industry, working with every segment of the business – from upstream to midstream to downstream to provide business solutions tailored to meet your needs.

Our skills, experience and teams of industry specialists in New Zealand advise businesses of all shapes and sizes throughout Auckland, Waikato, Hawkes Bay, Taranaki, Wellington, Canterbury and Otago. Small, large, local, global, old, new – we've seen what it takes to make a business successful.

Being part of the PwC global network allows us to pull on the experienced industry leaders across New Zealand and throughout the world, giving you the best industry advice and insights into the oil and gas industry.

Contact us

Partner, Deals - Corporate Finance & Infrastructure, PwC New Zealand

Tel: +64 21 242 6075