Key findings for New Zealand from PwC’s Global Investor Survey1

Our recent report Do the financial statements of the NZX50 reflect the impact of climate change? reveals that 78% of July to December NZX50 reporters provided some level of non-financial, climate-related information either in the ‘front half’ of their annual report, or in a separate sustainability report. This falls below the 90% of June NZX50 reporters in our earlier report, but still a notable increase from 60% of NZX50 March reporters outlined in our original report.

These reports show that companies are starting to report on climate change in some way. In this latest paper, we explore the key findings of PwC’s Global Investor Survey 2022 for New Zealand and ask: are companies doing enough to satisfy the needs of stakeholders?

Based on the survey results, we seek to understand what matters to investors when it comes to sustainability topics, their thoughts on the current state of reporting, and the role of assurance in building greater trust and transparency in that reporting. We also share some practical tips for companies to consider when looking at setting their own sustainability reporting and assurance strategy.

The fact that organisations are increasingly reporting sustainability information is not surprising. Stakeholder interest in companies’ sustainability commitments, their risk, impacts and what they are doing about it is growing. With the climate-related disclosure (CRD) reporting requirements applicable this year (financial years beginning on or after 1 January 2023), and assurance mandates for greenhouse gas emissions on the horizon (financial years ending on or after 27 October 2024), there is no doubt we will see increasing pressure on all companies to report and obtain assurance on sustainability topics and key metrics. And, don’t forget, investors expect companies, and their auditors, to also consider the impact of climate change in their financial statements.

1 PwC’s Global Investor Survey 2022 (published December 2022) is an external survey collecting responses from 227 investors and analysts across 43 territories globally. Data referenced in this article is based on the responses from 40 global investors who responded that they invest in New Zealand.

The survey results reveal that protecting worker health and safety, improving data security and privacy and ensuring effective corporate governance are among the top five priorities that investors in New Zealand want companies to deliver on. The need to be innovative and maintain profitable financial performance rank higher but it is clear that sustainability issues are a priority for investors.

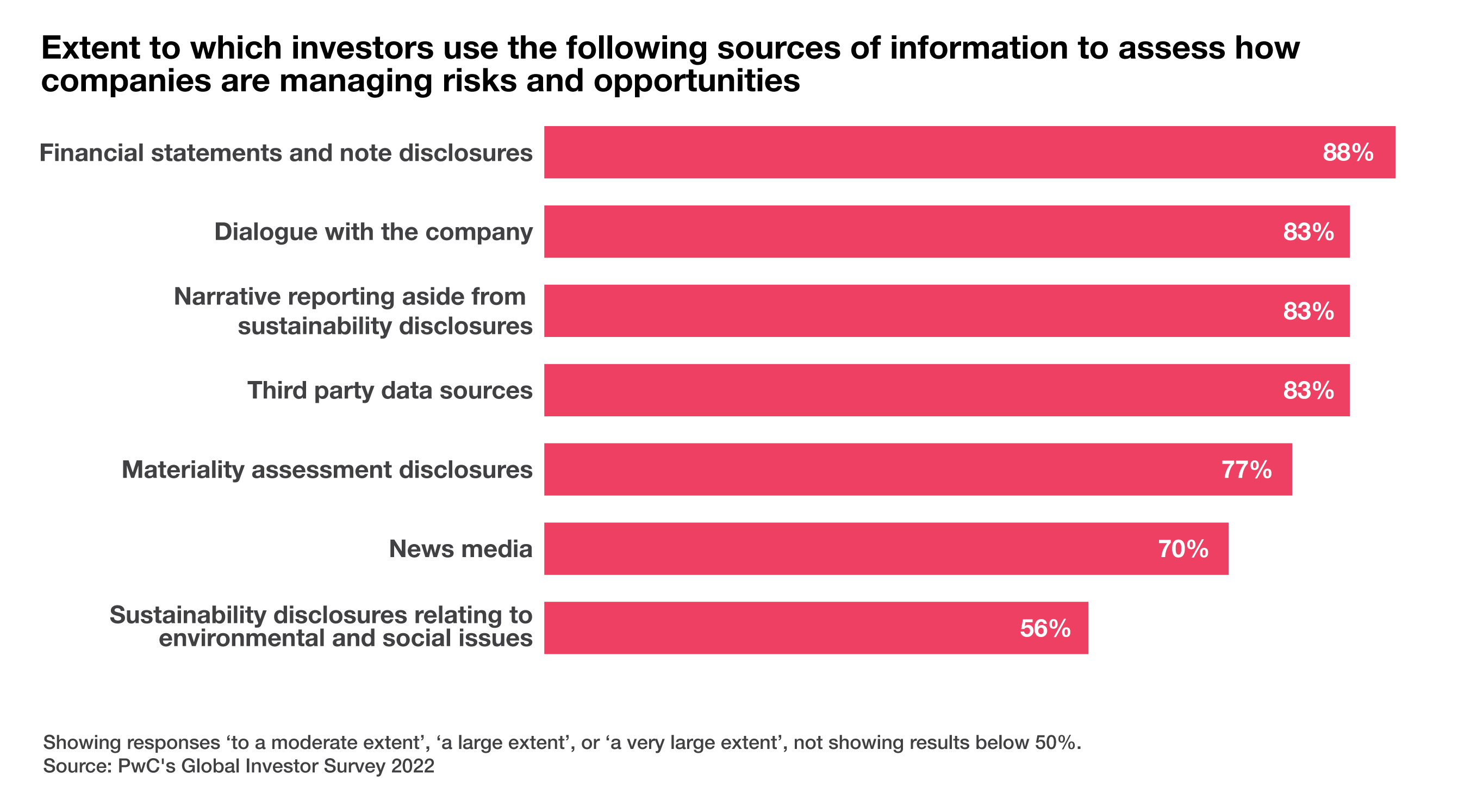

To find this information, investors are looking at financial statements, narrative reporting and engaging in dialogue with companies to assess how businesses are managing risks and opportunities. Investors currently place less importance on a company’s sustainability disclosures and in fact, more investors said they would use media and third party sources of information before sustainability reporting.

What is less clear is the reason why. Investors clearly see the importance of companies prioritising sustainability topics and in companies reporting on information related to those topics, such as the cost to meet sustainability commitments and the relevance of sustainability factors to the company’s business model. It seems unlikely that they place less reliance on sustainability reporting due to a lack of relevance.

This lack of reliance on sustainability reporting could be because it is not yet a mature means of communication for many organisations. Financial reporting is a cornerstone of corporate reporting, refined over more than a century. Therefore it may be perceived as more robust, reliable and trustworthy than sustainability reporting which is in its relative infancy. Investors may also see speaking directly with their investees as a means to request the specific information they seek. This means it is all the more important that organisations consider what really matters to shareholders as their sustainability reporting matures.

Whatever the case, the true reason may only become apparent over time. As climate standards are embedded, sustainability reporting matures, and there are continued behavioural changes towards a more sustainable future, it will be intriguing to see if reliance on sustainability reporting grows.

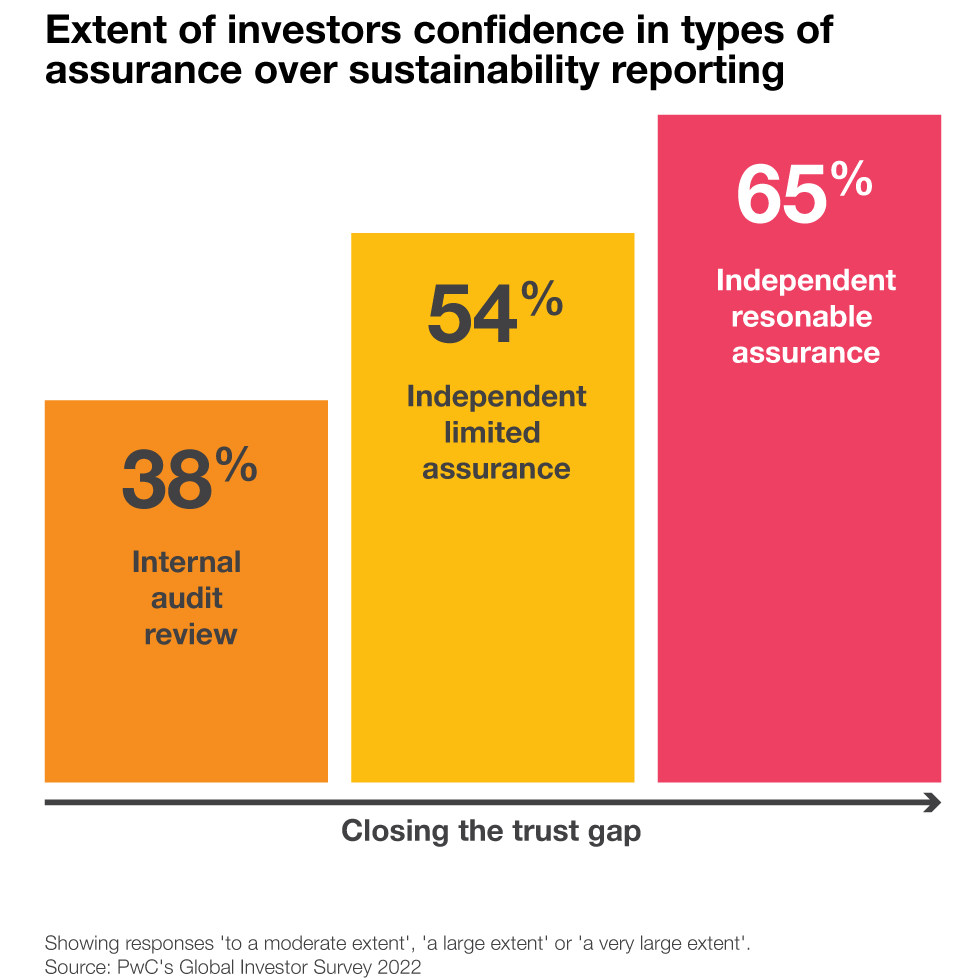

The survey set out to understand where trust and confidence in reporting was falling short, and the value that assurance brings to closing the effectiveness gap.

A significant majority of investors have concerns that the company's sustainability reporting contains at least some level of ‘greenwashing’, but many investors say assurance would give them confidence.

This shows that assurance is one way for companies to do more to meet investors expectations. A way to help close the effectiveness gap between what would give investors more confidence and what companies are currently reporting, by providing an independent view on whether management has done what they say they have done.

When asked about what types of assurance investors value, the survey showed a preference for independent reasonable assurance (assurance expressed in the form of a positive opinion, giving the same level of confidence as the auditor concludes on a company’s financial statements). This ranked higher than limited assurance (assurance expressed in the form of a negative opinion, as the auditor concludes in a review of a companies’ interim or half year financial statements). It is clear that independent assurance is more highly favoured than assurances provided by the internal audit function.

What are four ‘No Regrets’ actions companies can take to improve their reporting to meet investor needs, and build trust in what they say?

- 1. Identify what matters to stakeholders, and report it

- 2. Understand impacts of forthcoming regulation

- 3. Take efforts to increase transparency, objectivity and quality

- 4. Set an assurance strategy that brings the desired credibility to reporting

1. Identify what matters to stakeholders, and report it

To demonstrate to investors, and other stakeholders, that they are effective in managing sustainability issues and maintaining profitable financial performance, companies need to report how their sustainability-related strategic initiatives and innovations can affect the bottom line. Reporting can be used to show investors how the integration of sustainability into core business strategy and decision making will translate into future improvements in performance and prospects, creating long-term enterprise value.

A materiality assessment, stakeholder or gap analysis between your current reporting, and where you want to be against a particular reporting framework, such as CRD, is a great start. It can provide a clearer picture of whether the information shared with the market is relevant to the business, strategy and stakeholder needs and importantly, what is missing and what needs more focus.

2. Understand impacts of forthcoming regulation

Mandatory CRD reporting for a number of entities (called climate reporting entities, or ‘CRE’s) commenced on or after 1 January 2023 this year (depending on when their financial year starts). Beyond this, a current exposure draft on assurance standards will require CREs to have limited assurance over GHG emissions for periods ending, on or after, 27 October 2024, and a recent MBIE consultation has requested feedback on a proposal for assurance over the entire CRD reporting.

New Zealand is one of a number of territories mandating the assurance of sustainability reporting. Regulations have been adopted in the EU and the US also has propositions being considered. Closer to home, late last year, Australia drafted legislation empowering their standards setting board to make auditing and assurance standards for sustainability purposes, alongside sustainability reporting standards.

There is also a need to anticipate the wider implications and indirect impacts of the changing regulatory landscape. Other stakeholders such as banks and insurers, are increasingly interested in an organisation’s sustainability commitments; as well as how, and whether, they are achieving these. Customers and suppliers may require upstream and downstream value chain information to comply with their reporting requirements, for example to report on scope 3 Greenhouse Gas emissions.

Early understanding of the scope and timing of current or proposed sustainability reporting and assurance regulations is important for companies. This starts with New Zealand’s climate related disclosures but includes considering cross-border impacts of certain regulations e.g. European and US regulation, or impacts on traditional organisational boundaries through a need for upstream and downstream value chain information, such as scope 3 GHG emissions.

3. Take efforts to increase transparency, objectivity and quality

The risk of greenwashing can be reduced by reporting robust and reliable information that can be assured. Tracking and reporting sustainability performance with the same precision and data quality as financial performance can help companies towards this goal. Like with financial reporting, designing and implementing reporting solutions with appropriate governance and target operating models is crucial to enable processes, controls and systems to be put in place for investor-grade reporting that is ready for independent assurance.

4. Set an assurance strategy that brings the desired credibility to reporting

Exploring the purpose and needs for assurance can help determine the scope of information subject to assurance and to what level it is limited or reasonable. Consider:

Regulatory requirements.

Needs of lenders or stakeholders in the value chain.

The level of trust desired for decision making.

Expectations of the industry and market (what are peers doing?).

Addressing reputational risk and wider stakeholders’ concerns about greenwashing.

To satisfy all considerations, an independent assurance opinion over more than the regulatory minimum i.e. voluntary assurance, may be preferred. Companies might also consider whether the assurance report should be made publicly available, or just for the attention of those charged with governance.

As part of a study on the state of play in sustainability reporting and assurance, it was identified that in 2021 68% of the largest global companies obtained some level of publicly available assurance over sustainability reporting; an increase from 58% in 2020.2 With very few countries presently requiring assurance by regulation, this demonstrates an increasing appetite for voluntary assurance, perhaps to be ready for upcoming regulation, to gain competitive advantage, or simply to keep pace with peers.

There is lots to consider before reporting can meet the pre-conditions for assurance; developing reporting criteria, obtaining confidence in data quality and ensuring processes and controls are designed, implemented and operating effectively. Plenty of time is needed. Engaging an assurance provider early can limit late surprises.

And when it does come to choosing an assurance provider, investors expect a broad suite of capabilities. Expertise in applying professional scepticism and assessing management estimates and assumptions is what they value the most, but independence and ethics, ability to assess forward looking information, and subject matter expertise rank nearly as high.

Top ranked qualities giving investors confidence in assurance providers:

76%

experts in applying professional scepticism and ability to assess the reasonableness of management's estimates and judgements

70%

ability to assess forward-looking information, incuding scenario analysis

70%

subject to regulation that requires independence and ethical standards

70%

access to experts with the necessary subject matter expertise

Other qualities that give confidence in assurance providers:

68%

comprehensive view of the business across all types of corporate reporting

68%

experience in performing audits of complex organisations

63%

trained in using audit methodologies

2 The State of Play: Sustainability Disclosure & Assurance 2019-2021 Trends & Analysis, published by IFAC, and AICPA & CIMA is a study on the largest companies by market capitalisation across 21 jurisdictions over their sustainability reporting.

How we can help

Our PwC Sustainability Reporting and Assurance team can help you understand what the reporting and assurance requirements are and how to best approach them based on your current progress.

Partner, Sustainability Reporting & Assurance Leader, Auckland, PwC New Zealand

+64 21 355 879