The PwC Global Risk Survey highlighted two important findings for New Zealand businesses to explore. Firstly, it revealed that New Zealand boards tend to be more conservative in their approach to risk appetite compared to their global counterparts. Our data indicates that only 8% of New Zealand boards were identified as eager for risk, whereas the global average was 15%.

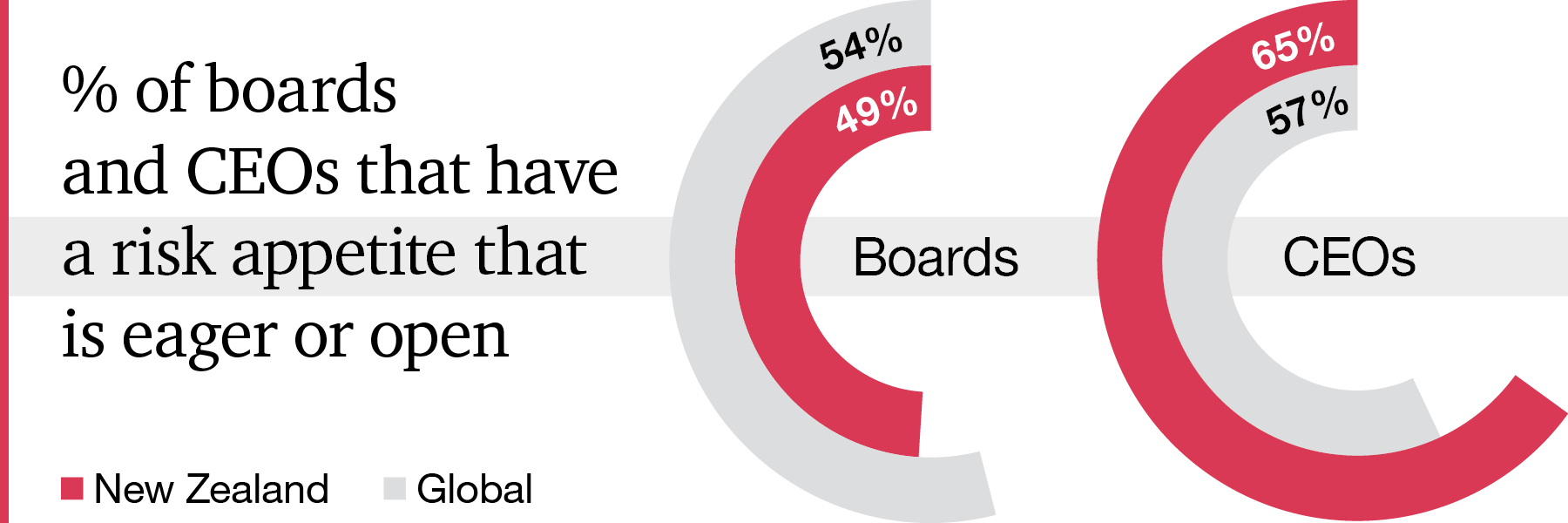

Secondly, the survey showed that there is a significant gap between the risk appetite of New Zealand boards and CEOs. While globally, the risk appetite was broadly aligned, with 54% of boards and 57% of CEOs eager or open to risk, in New Zealand the gap was much wider, with 49% of boards and 65% of CEOs expressing eagerness or openness to risk.

The disparity could be attributed to how effectively the practice of risk management - and especially the concept of risk appetite and its implementation through different levels of an organisation - has been adopted as a powerful tool for decision-making. We take a look at why there could be a misalignment between perceived and genuine inclination toward risk, and discuss why it is crucial for businesses to adopt risk management disciplines as core leadership and management capabilities.

Risk management practices that help managers oversee risk, and lean into opportunities

One reason for the lack of well-defined risk appetite in New Zealand organisations is an inconsistency in the maturity of risk management practices more generally. Risk management is often seen as a process that runs on the side, a tick box for board reporting, rather than a fundamental enabler of strategy execution to enhance value and keep the organisation safe. Risk management should focus on quality conversations that balance risk and reward, ensure clarity about the potential impact and probability of risks, and enable timely course correction.

This requires executive level leadership, a deep understanding of the business, its strategy, and the sector it operates in, and a voice at the table to advise and challenge during important discussions.

Organisations should invest in developing strong risk management frameworks and practices, and in risk management leadership. This includes a continuous improvement mindset, to regularly assess current practices and find areas for improvement. Training and education programs can be implemented to enhance risk management capabilities, and clear processes and guidelines should be established, along with a culture of risk awareness and accountability.

Well defined and embedded risk appetite statements, and the fallacy of "no appetite"

Many New Zealand organisations struggle with identifying and defining risk appetite statements, and reaching a collective agreement on them. The default position becomes a “no” or “low” appetite, with little in the way of supporting definition, which hampers the establishment of a clear risk appetite and the subsequent alignment of decision-making processes. A "no appetite" position provides a false sense of security, and is often misleading because every organisation inherently has some level of tolerance for risk. Failing to acknowledge this can lead to a lack of clarity on what the most important risks are, and undermine effective risk management.

Organisations can address this by shifting their mindset to recognise that risk appetite exists on a spectrum. By developing a risk appetite statement that reflects the organisation's strategic objectives and tolerance levels, and clearly acknowledges that risk is inherent in operations, organisations can make informed decisions and allocate resources accordingly. It is important to then communicate the risk appetite statement to all stakeholders, ensure a shared understanding, and regularly review and update it based on changing circumstances and business needs.

Creating a positive risk culture

In New Zealand organisations, it is uncommon to see the deliberate implementation of risk appetite alongside strong change management practices. Instead, the understanding of risk appetite is shaped by culture and perception based on lived experiences. The way management and boards respond to bad news is crucial in shaping this understanding across the organisation. When the response to bad news acknowledges the risk appetite, is constructive, and prioritises learning and improvement by asking probing questions that challenge assumptions and foster critical thinking, it reinforces the desire for appropriate risk taking. On the other hand, if the management team and boards respond negatively and provide messaging that does not align with the risk appetite, they can unintentionally create a risk-averse culture and excessive risk buffers throughout the organisation.

Organisations should seek to foster a culture that encourages calculated risk-taking in line with the set appetite. This includes providing training and support to understand and take informed risks, and communicating the learning opportunities that come from failures. By creating a culture of psychological safety, where individuals feel comfortable taking risks and learning from unsuccessful attempts, organisations can recognise and reward innovative thinking and encourage open and transparent communication to help overcome risk aversion.

Unlocking innovation potential

Well-defined and embedded risk management practices have the power to greatly enhance an organisation's potential for innovation. Boards play a vital role in creating the right environment by establishing the framework and risk appetite for innovation initiatives. By clarifying the distinction between acceptable risk levels for innovation and those for day-to-day operations, ambiguity that can hinder progress is eliminated. For instance, the level of financial loss an organisation is willing to bear during innovation, viewing it as a valuable learning opportunity, will likely be much higher than the tolerance for financial loss during regular business activities.

Organisational risk appetite statements should be clear on the appetite for innovation, versus regular operations, recognising that different categories of risks may be more acceptable in innovation than others. By providing this context for risk appetite, boards can effectively support management teams to adopt an innovation mindset when appropriate, creating opportunities for the organisation.

Bridging the gap

New Zealand organisations need to define their risk appetite, and then align behind it, to drive innovation, make informed decisions, and achieve their strategic objectives. By working collaboratively, boards and management can build confidence and bridge the gap in risk perception. This can be achieved by investing in robust risk management frameworks, including risk appetite statements that acknowledge that risk appetite exists on a spectrum. Such frameworks will help to cultivate a culture that encourages calculated risk-taking and learning from failures. Through open communication, scenario analysis, and continuous testing of appetite settings, organisations can reach a collective agreement on risk appetite and its nuances, enabling growth and confidence that potential risks are in focus.

Author: Lara Hillier

Are you a Risk Pioneer? Take our real-time benchmarking survey.

This ten-minute survey will compare your responses with our global study data to help you explore your approach to risk and reveal your risk archetype.

Contact us

If you’d like to learn more about the survey, or talk about any of the topics covered, please reach out to one of our team or click here.