Multiple crises over the past 18 months have delivered a stark wake-up call to the world. If we’re going to prevent further pandemics, reduce the risks of climate change, build a more equitable society and still generate growth, it’s clear that we’ll have to create more sustainable economies and systems.

Businesses all over the world are adapting, moving environmental, social and governance (ESG) issues from the periphery of strategic concern to the centre. They’re acknowledging ESG as a driver of value creation and urgently developing a proactive ESG mindset. PwC’s latest Global Private Equity Responsible Investment Survey demonstrates that private equity (PE) is on this same journey and is well-placed to provide leadership, thanks to decades of experience prioritising a strategic, long-term, activist approach to value creation.

The stakes are high. Sustainable investing—a category that includes ESG investing, in which ESG considerations are an overlay to the pursuit of financial performance, and socially responsible investing (RI), in which investments are selected or disqualified based on ethical considerations—already had grown to more than US$30tn globally by 2018 and has continued to grow. Just in the US, ESG-focused assets under management grew by some US$5tn from 2018 to 2020, and the global impact investing market—a segment of the sustainable investing market that focuses on positive outcomes, regardless of returns—is now estimated to be worth about US$715bn.

PE firms putting ESG at the heart of their business strategy will be the game changers in the new sustainable economy. And just as there will be leaders, there will also be laggards. Those firms that fail to embrace ESG will risk value erosion.

Our survey shows how PE firms are best adopting sustainable investing. In particular, it explains:

- that firms are entering a new age of ESG maturity

- why ESG is becoming key to value creation

- what is driving enduring business success.

Entering the age of maturity

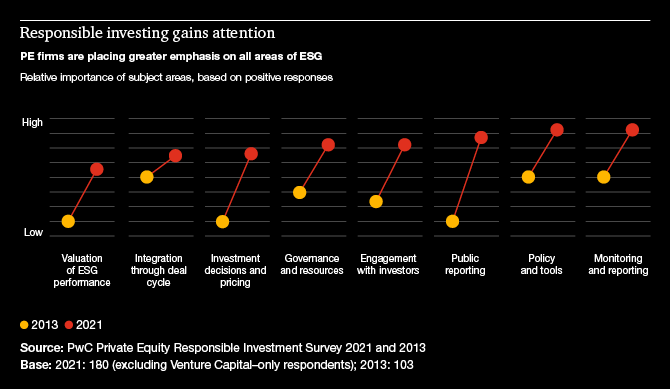

Over the past seven years, PE firms have radically reassessed the importance and value of ESG to their business. It has gone from being considered a tangential area of compliance, or a specialist product for a small minority of investors, to becoming an overarching framework that is informing the strategic thinking of the entire firm.

The attitude and approach of PE firms has matured in many important areas, including how they value ESG performance; how ESG influences investment decisions, enterprise value and/or multiple; and engagement with investors and public reporting.

This new maturity is driven by several factors. In the broader financial services sector, there has been a marked improvement in the performance of ESG-focused funds, as investors have changed their own ethical standards and become more demanding, and have also considered the financial impact of factors such as consumers’ shift to more sustainable products, potential new ESG regulations, and the reputational influence (negative or positive) of diversity and inclusion policies. One recent report by financial services firm Morningstar found that most ESG funds outperform the wider market over ten years.

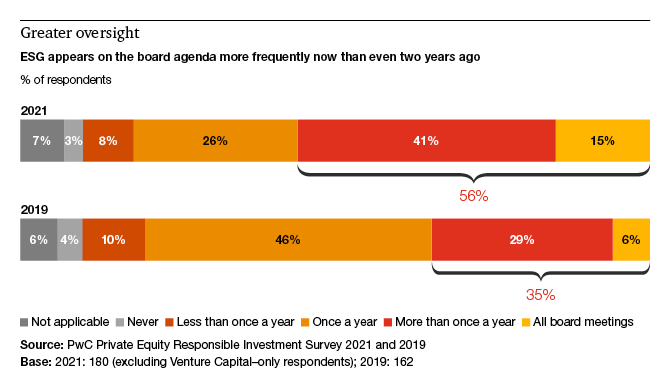

ESG is commanding more attention at the board level. In our survey, 56% of firms said ESG features in board meetings more than once a year, and 15% said it was discussed at all board meetings. That represents a substantial increase from 2019, when 35% of respondents said ESG featured in board meetings more than once a year, and only 6% said it was on the agenda at every meeting. This figure will surely continue to increase as more firms align their investment strategies to the push to decarbonise global economies, make their businesses and supply chains resilient to disruption from climate change or future pandemics, develop more inclusive workforces, and recognise that sustainability (and purpose) is important to attracting and retaining talent. The growing movement to link executive pay to ESG performance also will help focus the attention of the board.

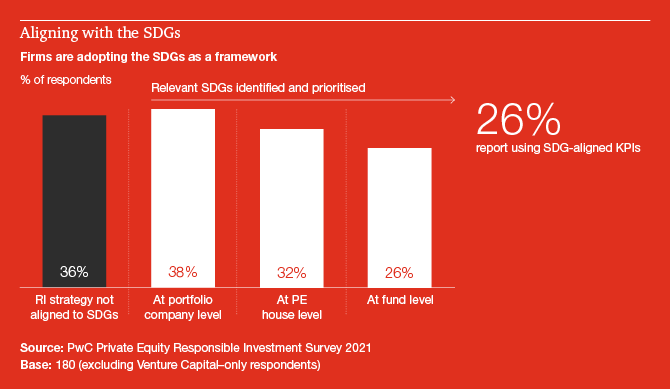

ESG is having a growing influence on business strategy throughout the transaction life cycle and across portfolios. Firms are using ESG criteria not just to assess risks and identify value creation opportunities, but also to manage their portfolio and ultimately deliver a better investment at exit. One good example is the adoption of or alignment with the SDGs as a framework. Investors and companies are finding the SDGs increasingly useful because they offer a universal approach to realising positive societal outcomes and provide a level of rigour by identifying 17 overarching goals and 169 targets. They also offer an outcomes-based framework at a time when firms and companies are trying to come to terms with many competing ESG evaluation initiatives.

65%

of survey respondents have developed a responsible investing or ESG policy and the tools to implement it.

72%

always screen target companies for ESG risks and opportunities at the pre-acquisition stage.

56%

discuss ESG as part of the executive board agenda more than once a year.

38%

have identified United Nations' Sustainable Development Goals (SDGs) that are relevant at a company portfolio level.

Creating value for investors and society

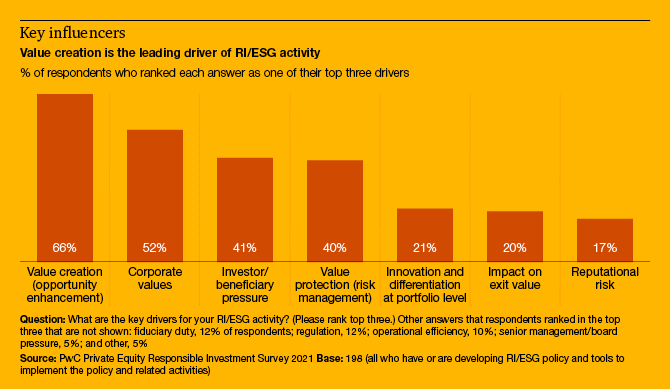

The past few years have seen a fundamental shift in focus within PE when it comes to ESG strategy and implementation. In 2019, risk management was the biggest driver of ESG activity, but this year it dropped to fourth place and respondents instead put a premium on value creation. Granted, this was the first year that value creation was among the choices given for answering this question, but the fact that respondents picked it as their top driver of ESG activity shows that PE firms are embracing a far more proactive ESG mindset. Major sustainability trends such as the circular economy, net zero, inclusive recruitment, climate technology and nature-based solutions are disrupting the status quo (and hence creating investment opportunities) throughout the business world. Consider the food, fashion and transportation sectors, where new businesses with more sustainable products are reshaping both consumer tastes and the investment and acquisition strategies of leading PE firms.

Another reason for this shift from risk mitigation to value creation could be that managing partners have come to realise that ESG offers a real business opportunity, and they don’t want their firms to miss out. There’s an increased recognition among these leaders of the value creation opportunities that arise from aligning a business with the transition to sustainability, and there’s acknowledgement that ESG is a lever for transformation, alongside other levers such as digitisation and internationalisation. Notably, more than half of all respondents (56%) have either refused to enter an agreement with a general partner or turned down a potential investment on ESG grounds. The idea that ESG is too important to be compartmentalised into a specialist department is starting to be reflected throughout business. Over half the firms surveyed say that ultimate responsibility for ESG and responsible investing rests with the firm's partners, while just 39% allocate that responsibility to a dedicated responsible investing or ESG team.

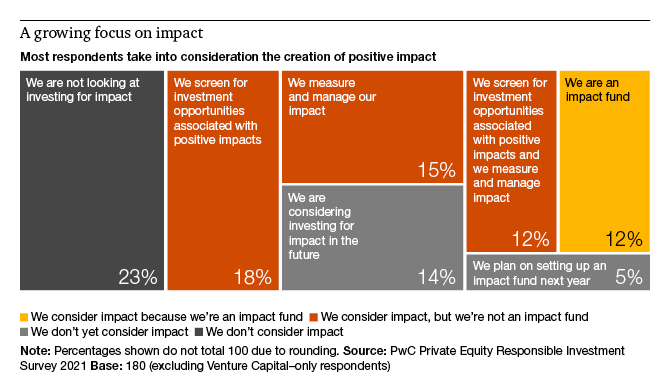

The growing interest in impact investing and the emergence of mainstream impact investing strategies is a key point to be noted. This change, no doubt, has come about because firms are starting to understand that investors value funds that offer positive environmental and social impacts given the now obvious fragility of our natural world and the fabric of our global society. The PE business and ownership model is well-placed to better engage with investments and drive change. Additionally, according to the Global Impact Investing Network, PE is the most common asset class in the impact investing industry, and a clear majority of PE-focused investors (86%) reported performing in line with or exceeding their financial performance expectations.

Seventeen percent of our respondents note that they either already have dedicated impact funds or are planning on setting up an impact fund in the next year, and an additional 14% say they are considering investing for impact in the future. Of our respondents, 45% note that although they don’t have an impact fund, they’re either already measuring and managing for impact, or are using a screening framework to seek out investment opportunities associated with positive impacts, or both.

Overall, the idea of investing for impact is becoming a mainstream strategy within PE, and this being the case, PE appears to be getting ‘impact ready’ and trying to prove to investors that they can invest for impact without sacrificing returns.

66%

of survey respondents rank value creation as one of their top three drivers of responsible investing or ESG activity.

40%

rank value protection as one of their top three drivers of responsible investing or ESG activity.

49%

say they integrate highly material ESG issues into commercial due diligence when making investment decisions, albeit on an ad hoc basis.

>7 in 10

say they integrate ESG risks and opportunities into their transformation or value creation plan.

17%

have a dedicated impact fund or say they plan to launch one in the next year.

45%

do not have an impact fund but consider the impact of their investments.

Easy as ESG: The drivers of sustainable success

Employing a comprehensive ESG strategy requires firms to consider a wide range of specific, but often interconnected factors that could negatively or positively affect portfolios and the overall success of the business.

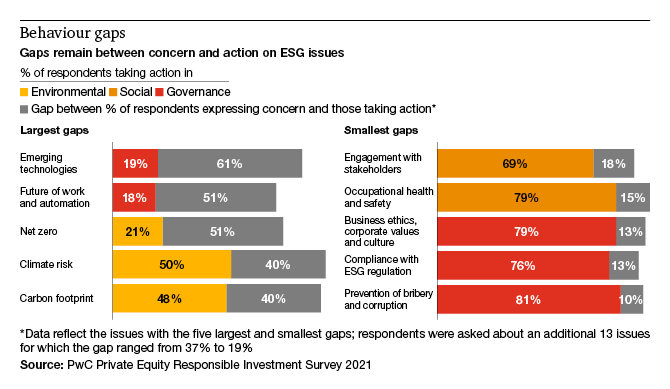

Significant gaps remain between concerns about individual ESG issues and the actions being taken to address them. In cases where ESG issues have long been a governance concern or are mandated by regulation—such as occupational health and safety, or preventing bribery and corruption—the gap is small. However, on issues that are fast becoming business-defining in the post-pandemic global economy, such as net zero, climate risk, biodiversity and emerging technologies, the gap between concern and action should be a topic of discussion.

The UN’s Principles for Responsible Investing (PRI) 2021–24 Strategy also makes it clear that topics including climate and human rights will become ever more important for investors, especially in the context of the post-pandemic recovery.

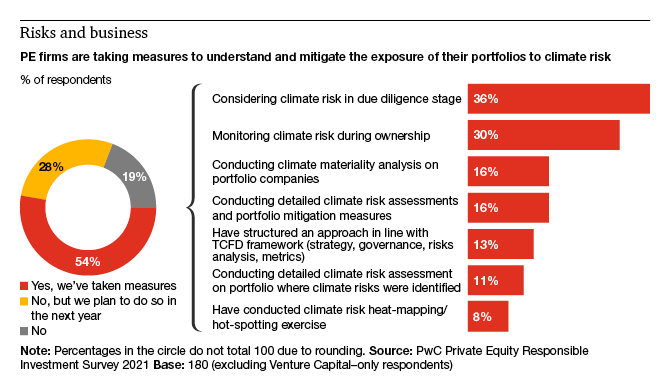

Climate risk

Over the past 18 months, the business world and most global governments came alive to the existential risks posed by climate change. Increasingly, the financial services sector is taking action, and that is reflected in PE firms’ concerns about climate risk.

In 2019, the vast majority of PE firms said they were concerned about climate risks in their portfolio. But most appeared to be slow off the mark in addressing the issue. This year, more than half of the firms in the survey are already taking action, and 36% say they consider climate risk when making investment decisions.

The reality, however, is that evaluating the climate risk of a portfolio is complicated. The UN PRI’s guidance, published last year, aims to address some of the challenges in the implementation of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), in particular the challenges around the knowledge, data, constrained resources and scale of addressing climate risk for whole portfolios. In addition, PE firms have to evaluate a variety of available third-party tools and methodologies. As governments around the world start to take more aggressive action on climate change, and as institutional investors and other limited partners increasingly factor climate risk into their own investment decisions, PE will need a greater level of knowledge and sophistication to chart the right course.

36%

of survey respondents consider climate risk at the due diligence stage to understand and/or mitigate the exposure of portfolios.

47%

have not undertaken any work in understanding the climate risk exposure of portfolios, but more than half of those respondents say they intend to in the next year.

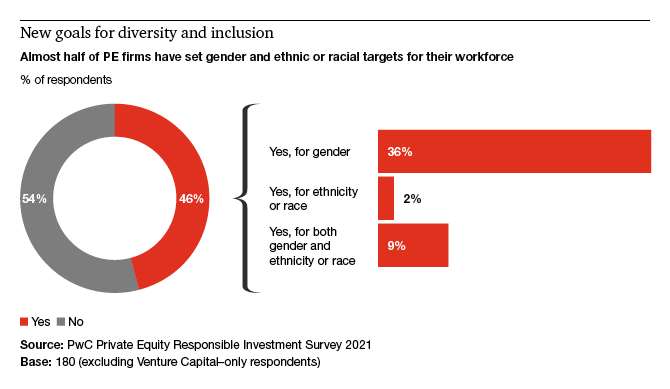

Diversity and inclusion

The past five years have seen a new resolve on the part of business to improve diversity and inclusion within the workplace, particularly in terms of gender equality. Indeed, 77% of survey respondents say diversity is a core value and integral to their culture. A majority already believe that diverse teams generate business benefits—notably in the field of innovation. Improving diversity and inclusion throughout the sector is becoming a higher priority in a globalised workforce where firms compete for a new generation of talent that views diversity as the norm, not the exception, and where more diverse teams and boards can deliver greater success. In the UK, for example, more than 80 firms have supported the Level 20 nonprofit initiative to improve diversity and inclusion across PE; Level 20 chapters are also being established throughout the Continent; and almost all PE firms with a French presence have signed on to France Invest’s diversity charter promoting gender equality. However, in some countries, collecting and disclosing data on diversity and race might present legal challenges.

46%

of survey respondents have set some form of gender and ethnic or racial diversity targets.

77%

of those that set diversity and inclusion targets see diversity as a core value for the organisation.

> 90%

are concerned about diversity and inclusion.

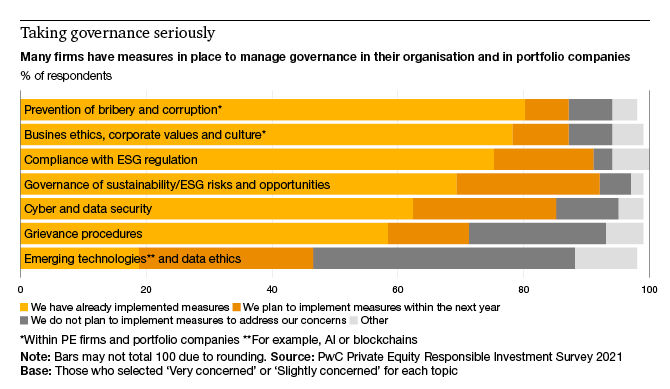

Governance

Prevention of bribery and corruption has long been a top governance concern for business. Interestingly, the next three issues of concern that are being addressed by PE all relate to the future of sustainable business. The connection to compliance with ESG regulation and governance of ESG risks and opportunities is obvious. However, as PE firms address business ethics, corporate values and culture, they will increasingly do so through the lens of responsible investing or ESG strategies. Their outlook and approach will also be shaped by the diversity and innovative talent of their workforce. Ultimately, the governance of both firms and portfolio companies will determine whether the value creation strategies that are being shaped to meet the challenges of our changing world will be sustainable.

Almost 95%

of survey respondents are most concerned about business ethics, corporate values and culture, prevention of bribery and corruption, and cyber and data security.

89%

are concerned about compliance with ESG regulation.

68%

are currently a signatory of the UN PRI.

56%

say that more than half their investment team has received some formal ESG training.

Next steps

- Set a strategy, both as a company and as an investor

- Set a clear road map and targets for sustainable value creation

- Build a team equipped to face the challenge

Set a strategy, both as a company and as an investor

ESG issues will reshape the global economy in the coming years and affect the investment success of PE and the entire financial services sector. Furthermore, these issues are interconnected. So it’s crucial for PE firms to incorporate responsible investing and ESG into their general business strategy and no longer consider it as a side issue or specialist offering. Some ESG issues—such as climate risk, net zero, diversity and emerging technologies—will have an overarching influence on firms and their investment portfolios. Other issues might be more specific to individual companies, sectors or geographic locations. Understanding both the big picture and specific portfolio ESG risks and opportunities will help shape a strategy that will deliver sustainable value creation.

Set a clear road map and targets for sustainable value creation

PE firms should approach responsible investing and ESG the same way they would other strategic issues with direct impact on their investment returns. At the portfolio level, PE firms should engage with their portfolio companies’ management teams to truly integrate ESG into their transformation and value creation plans.

When assessing new investment opportunities, PE firms should not look at the ESG risks only during diligence, but should start thinking about the value creation opportunities early on and bake those into the value creation plan. They should consider how ESG might be treated in the commercial, finance and tax due diligence. Fundamentally, leaders should ascertain whether there’s an opportunity to align the business with the sustainable transition that could form part of the investment thesis and truly unlock potential sustainable value creation. If ignored, sustainability issues can erode value, hinder growth and block access to finance. Conversely, if addressed properly, they can drive value creation across the spectrum.

Build a team equipped to face the challenge

Paradigm shifts require a rethink of accepted ways of doing things, to ensure resilience. An understanding of ESG issues will be a fundamental necessity for successful private equity investors. Operational training is essential for investment teams if they are to prepare quickly and truly comprehend the topic.

Firms will also need to recruit the right talent to deliver sustainable value creation. That will involve hiring people with sustainable business expertise and, in general, hiring more diverse teams in terms of gender, ethnicity and age, as well as socioeconomic background and training. The good news is that the firms that demonstrate a commitment to ESG will likely be best placed to attract and retain that talent.

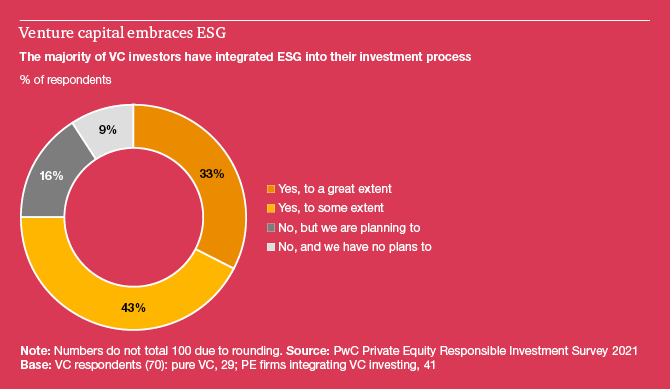

Spotlight on venture capital

For the first time since we started these surveys, we included a short module directed at venture capital (VC) in response to the momentum we have been seeing in the market. This module was completed by 70 respondents (29 of which were pure VC firms and 41 of which were larger PE houses integrating a VC investment activity). We asked VC respondents four ESG questions, and, interestingly, there were no major discrepancies in the way in which these two groups of VC investors responded to the questions. This could suggest that there’s no significant delta between the practices in place at pure-play VC firms and the practices of VC investment teams operating as part of a larger, diversified PE house. This could, in turn, be a reflection of the significant growth in VC commitment to the ESG agenda and broader transition to sustainability.

76%

of survey respondents in the VC module currently consider ESG in their investment process.

37%

have refused an investment because of ESG concerns.

64%

say their limited partners have expectations regarding ESG risk management, and 57% believe they’re able to align with those expectations.

Key challenges for VC

We asked survey respondents from venture capital an open-ended question: “What are the biggest challenges regarding ESG risk management that you face as a VC investor?” The following are snippets of answers:

- Lack of dedicated resources in early-stage companies we invest in.

- Lack of data and resources [at the fund level].

- The challenge is to be reasonable in our expectation regarding our portfolio.

- [Low] level of influence and high growth/dynamic nature of successful startups’ organisation and processes.

- Lack of uniformity in standards, reporting and scoring.

- The ability to identify the risks and align a mitigation approach in small/startup companies where the frameworks are still not clear/adequate.

- Scaling this process and maintaining high-quality data as we and our companies grow.

- We are investing in mission-driven companies with which we are fully aligned on intentionality. As most investees tend to be small, they don’t have much ESG framework in place. We don’t see this as a risk but more as an opportunity to support them [in] their journey to become a more sustainable company.

The relevance of ESG to VC

VC cannot simply replicate PE’s approach to integrating ESG due to the size, scale, level of influence, resource constraints and inherent disruptive nature of startups. One of the challenges the VC market is facing is the lack of an ESG framework suitable for VC and an agreed-upon set of relevant and adapted ESG measurements/KPIs. There is value in integrating ESG for both the VC fund manager and the underlying portfolio, and the encouraging results of this survey perhaps show that a level of ESG maturity among our VC respondents and an understanding of the value of ESG already exist, despite the unique challenges and lack of established frameworks.

Because capital raising in the venture space remains competitive, a well-articulated approach to ESG could be beneficial, especially in the current climate, in which we are seeing an increase in expectations from investors and limited partners when it comes to VC ESG integration. At a portfolio company level, ESG performance could increase the prospects for follow-on funding rounds or achieving value at exit, whether by trade sale, PE acquisition, other buyout or initial public offering.

The nature of innovative, disruptive tech and business models, core to many VC-backed businesses, means they are sometimes playing in an unregulated space. With the inevitability of new regulation designed to control the risks and impacts associated with these types of innovations, there is a real benefit to getting ESG right in preparation for future regulatory changes.

Furthermore, reputation is critical, and without it, it’s impossible to scale and attract investors. We are seeing a shift in consumer expectations, on both the individual and corporate level (e.g., procurement departments increasingly considering the greenhouse gas emissions of their suppliers and how those contribute to their net zero targets). Actions emphasising purpose and sustainability also can attract and retain key talent, which is especially important for firms when they consider the competition for resources with larger, more established companies.

ESG, impact and value creation for VC

Purpose, or the definition of a core value proposition, is particularly vital to the startup business model. When thinking about the sustainability of startups, we are indeed seeing VCs questioning how a company’s goods and services can create value for society—for example, by supporting the SDGs. There seems to be an emerging trend among the VC ecosystem towards using sustainability, both ESG and impact, as a mechanism to further qualify deal flows and back companies that will truly contribute to making our world better, through disruptions and innovative technologies.

In addition, the integration of ESG throughout the rest of the business model—in such fundamental areas as governance, ethics, key activities, business relations and human resources—is key to both managing risks and protecting value, as well as identifying opportunities and value creation drivers. VC funds typically take on a minority share in companies, but there is still an opportunity for VCs to engage companies on ESG topics and set them up for long-term sustainable growth by helping them integrate ESG in their formative years. This way, ESG performance is embedded into the company’s culture and operating principles as the business scales.

VC has the opportunity to leapfrog the journey that most PE firms have taken from basic compliance and a risk-based approach towards one focused more on sustainable value creation. Perhaps we are already witnessing this, with the recent launch of several new large VC funds (and corporate VCs) focused on climate tech.

Methodology

The Global Private Equity Responsible Investment Survey explores the views of general partners and limited partners in responsible investment among global private equity firms. This year, 209 firms from 35 countries or territories responded (compared with 162 in 2019). Of these, 198 respondents were general partners and 41 were limited partners (compared with 145 and 38, respectively, in 2019). Some respondents were both general and limited partners. The vast majority (81%) came from Europe. We believe this might be because European firms have spent the past few years adapting their strategies and investment activities to EU regulations that require robust ESG disclosure across the breadth of the financial services landscape. This level of adoption and adaptation is reflected in the survey findings.

Contact us

Partner, Sustainability, Climate & Nature Leader, PwC New Zealand

Tel: +64 21 799 927