Introduction

By Tom Lawson

Kia ora koutou katoa and welcome to the October 2025 edition of our Treasury Broadsheet.

We start by examining the Society for Worldwide Interbank Financial Telecommunications (SWIFT's) recent ISO 20022 migration and the rise of multi-rail payments, from regional schemes to central bank digital currencies and blockchain, highlighting what this means for New Zealand businesses.

We then cover insights from PwC’s 2025 Global Treasury Survey and the European Association of Corporate Treasurers (EACT) 2025 survey, which together show cash visibility, liquidity optimisation and forecasting at the top of the agenda. AI adoption is accelerating, but its pragmatic use across treasury functions is still developing.

We then consider why centralised liquidity and cash management is delivering such tangible benefits for those organisations with complex treasury operations, and the practical steps businesses can take to unlock them.

We also check in on the competitive domestic bank lending market: bank capacity, limited credit growth, shifting risk appetite, and how borrowers can use a disciplined financing process and robust financial modelling to help secure strong outcomes.

Finally, we unpack the terminal OCR and its implications for hedging strategies under different domestic swap curve shapes.

We hope this edition equips you with some useful ideas to strengthen liquidity, manage treasury risk with confidence, and consider technology where it adds real value. If you would like to discuss any of the articles specifically, our team’s contacts are included throughout.

Ngā mihi,

Treasury Broadsheet SWIFT and rethinking the rails of global payments

By Natasha Reddington

‘Payment rails’ refer to the infrastructure that moves money between banks, businesses, and people, both domestically and across borders. They decide how fast, affordable, and secure payments are. For customers, they shape everyday experiences, from paying overseas suppliers to receiving a payment into your bank account. From long-standing networks, like Society for Worldwide Interbank Financial Telecommunications (SWIFT), to new systems built on blockchain or central bank digital currencies (CBDCs), these rails form the backbone of modern payments today.

For decades, SWIFT has been the main rail for cross-border payments, connecting thousands of institutions and supporting trillions in daily flows. It doesn’t move money itself, but its messaging system is what makes global payments work. In 2024, SWIFT handled its highest volume of payment traffic in 15 years, a sure sign its upgrades are paying off. However, pressure is building with new regional rails and fintechs promising easier, quicker and cheaper options. In response, SWIFT is expanding its Global Payments Innovation (gpi), running pilots that link to CBDCs, and testing digital asset transfers. These efforts show SWIFT working hard to stay relevant as new rails appear around it.

Globalisation and digitisation have lifted consumer expectations for speed, transparency, and lower costs. At the same time, sanctions, shifting alliances, and geopolitics have exposed the risk of relying too heavily on a single global network, such as SWIFT. Allies are responding by building their own rails to suit local priorities. This shift is changing cross-border payments and putting SWIFT’s role as the global standard under pressure. But SWIFT is not standing still, through steady investment and innovation, it is working to hold its place in a more complex payments world that offers alternative options.

There are a number of definitions and acronyms noted to in this article. Please refer to the Global Payments and Digital Currency Terms glossary.

The global race to redefine payments

Competition is heating up. Although no challenger has replaced SWIFT, new payment providers and initiatives are gaining interest and adoption, pointing to a future where several rails operate side by side. Examples include:

- mBridge (Asia): A CBDC project led by China, Hong Kong, Thailand, and the UAE, with Saudi Arabia joining in 2024. It aims to deliver near instant cross-border transfers and reduce reliance on existing rails.

- Project Agorá (West): Project Agorá (Greek for ‘marketplace’) is an initiative backed by Bank for International Settlements (BIS), testing tokenised money and smart contracts to make global payments faster and more compliant.

- Wero (Europe): The European Payments Initiative (EPI) is creating Wero, a digital wallet for account-to-account payments, while Single Euro Payments Area (SEPA Instant) already enables euro transfers within seconds.

- BRICS Pay: BRICS Pay is being developed by the five BRICS nations of Brazil, Russia, India, China, and South Africa, to support trade in local currencies and digital assets, reducing reliance on SWIFT and the US Dollar.

- Blockchain and Stablecoins: Assets such as stablecoins USDC and USDT are already being used for B2B settlements, with blockchain rails for speed and transparency.

- Digital wallets: Digi-wallets are now being adopted by businesses as an option for international payments. Operationally, domestic bank accounts held by the fintech, are utilised for their customer which enables a quicker, traceable and lower cost consumer experience.

ISO 20022: a milestone for SWIFT

While new players are innovating, SWIFT is also modernising. Its biggest move is adopting ISO 20022, a new global messaging standard that replaces the old SWIFT MT format used since the 1970s.

ISO 20022 allows each payment to carry comprehensive data, making transactions easier to track, faster to process, and more reliable in meeting necessary compliance checks.

For customers, this means clearer payment information, fewer errors, and quicker investigations. Businesses using this protocol directly also get easier reconciliation and greater cashflow support. Users benefit from transparency when sending or receiving money internationally.

Progress is moving quickly:

- Deadline: By November 2025, all SWIFT payments must use ISO 20022.

- Adoption: Over half of daily SWIFT payments already use the new format.

- Benefits: Banks are reporting efficiency gains of over 40% in returns processing and up to 50% fewer false positives in AML checks.

- Support and scale: SWIFT is backing the transition with migration tools, and by 2025 ISO 20022 will cover more than 90% of high-value flows worldwide.

The good news is that New Zealand is ahead. The Exchange Settlement Account System (ESAS), the Reserve Bank’s real-time settlement system, has already adopted ISO 20022. ESAS is not a payment rail like SWIFT, but the ‘engine room’ where money is finally settled once instructions have been sent along the rails. By moving early, New Zealand is already aligned with global standards.

Access to ESAS is widening too. In March 2025, licensed non-bank deposit takers joined the system, and from September 2025, payment service providers will also be eligible. For customers, that means more competition, more choice, and likely lower costs as new players connect directly into New Zealand’s central settlement system.

|

ISO 20022 and the fintech challenge

ISO 20022 is not just an upgrade, it is SWIFT’s answer to reshape competition. Modern fintech’s can adopt the standard quickly and design services around it from the start. From faster reconciliation to AI-driven fraud detection, they are using it to win customers who are tired of slow, costly, legacy systems and processes. For banks, migration is a heavier lift, but many are aware that unless they adapt quickly, they risk losing ground to their agile fintech rivals.

Option |

Pros for users |

Challenges for users |

SWIFT (with ISO 20022 upgrade)

|

Global reach: connects 11,000+ financial institutions in 200+ countries.

Richer payment data under ISO 20022 = fewer errors, easier reconciliation.

High security and trusted by regulators. |

Can still be slower and more expensive than newer rails.

Relies on correspondent banks, which add fees.

Vulnerable to geopolitical influence and sanctions (e.g. Russia getting frozen out in 2022). |

Regional rails (i.e. SEPA Instant, EPI, mBridge)

|

Faster and often cheaper within specific regions.

Designed around local rules and priorities.

In some cases, near instant transfers.

|

Limited to regional coverage.

Not always useful for global trade.

Still evolving, not yet fully proven at any large scale.

May not always cooperate well with other systems. |

Blockchain and Stablecoins (USDC, USDT, etc.)

|

Near instant settlement across borders.

Lower transaction fees compared to banks.

Full transparency on the ledger. |

Still lightly regulated in many markets.

Price volatility for some digital assets.

Not yet widely adopted by corporates and banks. |

CBDCs (Central Bank Digital Currencies)

|

Backed by central banks = trusted value.

Potential for instant, low-cost cross border transfers.

Privacy protections being built in (i.e. RBNZ commitments). |

Still experimental.

Most won’t launch before 2030.

Global standards not finalised.

|

| Fintech platforms | Easy to use, fast payments, and often cheaper than banks.

ISO 20022 - ready from the start no legacy systems = smarter use of data.

Tailored services for SMEs and individuals. |

Not always connected directly to central rails i.e. broker.

May rely on banks in the background.

Customer trust is still progressing. |

Quick reference: global payments and digital currency terms used in this article.

In the short term, SWIFT will remain essential for high value, interbank, and sensitive transactions. But longer-term, global payments are moving toward a multi-rail future. Regional systems, CBDCs, and blockchain networks will keep growing alongside SWIFT, giving customers more choice and flexibility. Fintechs will continue to offer nimble ways to pay, often at a cheaper cost.

|

SWIFT’s challenge is not specifically survival, but rather one of adaptation. The developments made to ISO 20022, pilots in digital assets, and push for the ability to share information show it is indeed preparing for a future where no single rail dominates. The outcome is unlikely to be replacement, but coexistence, with SWIFT still central, even as the payments world becomes more diverse.

Treasury Broadsheet Treasury surveys in 2025: Key priorities for treasurers

By Zoe McCane

Treasury teams in 2025 continue to face demanding and challenging environments. Over the past five years, they have weathered a pandemic, sharp changes in interest rates, volatile consumer markets, and accelerating geopolitical tensions. While priorities will continue to flex, cash, funding, and financial risk remain at the core of PwC’s 2025 Global Treasury Survey. The bi-annual PwC survey, which shares insights from 350 treasurers worldwide, and the European Association of Corporate Treasurers (EACT) 2025 survey of ~275 respondents, each provide a lens on what and where treasurers are focusing today.

There is a ‘cash-first’ mindset emerging where treasury leaders prioritise cash visibility and liquidity

Key Treasury priorities in 2025:

Both surveys confirm a treasurer's role has become more strategic since 2019. However, what currently matters most depends where you look:

- PwC Global Treasury Survey 2025: CFOs and treasurers alike rank cash and liquidity management as well as funding / capital structure as their top two priorities, however in different top spots, respectively.

- EACT 2025: cash-flow forecasting reclaims the #1 spot, reversing the 2024 top spot when long-term funding topped the list in response to the sharp interest rate hikes and tighter credit conditions. Long-term funding now moves into the #2 position.

Liquidity: why cash forecasting still rules

Forecasting remains a key challenge. After losing the top spot between 2019 and 2023, it has once again emerged as the leading priority for EACT survey participants. PwC’s Global Treasury Survey showed both CFOs and treasurers consider effective cash and liquidity management in the top two priorities in 2025. This is covered more extensively in our related Broadsheet article, Benefits from a centralised approach to liquidity and cash management.

The PwC survey notes dissatisfaction with revenue forecasting systems. 38% of companies with greater than $10bn of revenue and 52% of those with revenues between $1-10bn still manually collect and consolidate forecasting data. AI-assisted forecasting tools continue to be implemented, being designed to improve accuracy and the timeliness of information for treasury teams.

You can’t forecast what you can’t see. Forecasting, as well as long term financing, remain top priorities in 2025.

Financial risk: managing risk in a volatile environment

Managing financial market risks remains a central focus. From the PwC survey treasurers cite foreign currency (FX) (83%), interest rates (72%), and commodities (39%) as their top exposures. Newer operational type risks are also climbing the list:

- Cyber risk is now a core treasury function concern, particularly given fragmented IT landscapes, increasing gateways to banking or fintech finance platforms and reliance on manual processes.

- Many treasury teams are partnering more closely with IT to shape cybersecurity policies and processes. Ensuring investment aligns with protection and productivity improvements.

For European treasurers in particular, disconnected systems continue to undermine forecasting accuracy and cash visibility - reinforcing the push for simpler, integrated platforms.

The fragmentation of bank providers across the EU is also a factor, which is less problematic for New Zealand with our much smaller market.

Technology: digitisation to intelligence

Technology has shifted from basic digitisation to automation and now to intelligent solutions:

- PwC 2025 survey: 74% of treasurers are expanding or actively using AI, with machine learning and predictive analytics. 65% plan to add “core enablers” such as APIs to link the ERP to the TMS and the banking platform.

- EACT 2025: European treasurers prioritise real-time reporting, while remaining cautious about using AI until current systems around the TMS structure catch-up.

Closer to home, New Zealand businesses are showing growing interest in real-time, cloud-based platforms, such as PwC’s Treasury Intelligence, to support FX risk management. This tool provides real-time visibility to a business to support foreign exchange management decisions.

A need to maintain agility and be focused on key enablers as tech moves quickly

In 2025, treasurers continue to prioritise cash, funding, and financial risk, with the PwC survey highlighting cash and liquidity management while EACT places forecasting back on top. What stands out in 2025 is the move towards integrated operating models through centralising the treasury function and the importance of connectivity. In New Zealand, as markets remain volatile and technology keeps moving, the global lesson is for treasurers to remain agile and position treasury as a tech-enabled function that not only protects treasury risks now, but also delivers meaningful strategic outcomes and value across the business in the future.

Treasury Broadsheet Benefits from a centralised approach to liquidity and cash management

By Brett Johanson

As discussed previously in the Treasury surveys in 2025: key priorities for treasurers article, the challenge remains for CFOs and treasurers in the visibility and management of liquidity and cash. The themes have been covered in previous Treasury Broadsheet articles which have discussed cashflow efficiency, the importance of centralisation and automation of treasury processes. These themes have also been at the forefront of recent client engagements.

The challenge remains; how can cash be used most effectively across the group or organisation structure so cash is not trapped but is optimised and managed efficiently. Group cash needs to be in the right place at the right time. This is a fundamental objective and at the core of the corporate treasury function.

Challenges we observe around the grouping or pooling of cash usually relate to matters such as ownership, having adequate capturing and reporting systems / processes, and access to timely and accurate rolling cashflow operating and capital expenditure forecasts.

Cashflow forecasting is key and it continues to be a work-in-progress when using technology and digital innovation to enhance the accuracy and timeliness of forecasts.

A formal policy statement or intra-group lending and borrowing arrangement may be adopted to provide the necessary transparency around the ownership challenge of cash. These example questions help in structuring the arrangement:

- What is the nature and purpose of the depositing and borrowing activity?

- Is it for working capital, core borrowing or treasury investment purposes?

- Is the cash used for group purposes and/or an entity's expenditure only,

- How is interest charged, accrued and paid?

There are various tools that corporate treasurers can employ to support the centralisation of group cash. Transactional banking features and functionality needs to be understood. Assuming a group has just one transactional bank, features such as visibility of account balances, end-of-day cash balance sweeping and interest rate offset mechanisms can assist.

The design and use of these features can be specific to an organisation, but often rely on a base level of functionality from your banking partner. In designing these features for your organisation, matters such as; how and where within the group are creditors payments made (e.g. at a centralised internal unit and/or entity level), what working capital responsibilities are decentralised and therefore residual cash credit balances and/or overdraft limit structures are important.

There are resounding benefits that accrue from an effective centralised liquidity and cash management function. Organisations have captured efficiencies around administration management, reduced duplication of tasks, enabled more efficient counterparty exposure management, improved strategic working capital and treasury investment management decision making. Ultimately, this also reduces use of overdraft and borrowing facilities and better captures treasury investment returns through the maturity profiling of bank term deposits.

Although the challenges remain, the benefits are undeniably positive for an organisation seeking to streamline and centralise its liquidity, cash and working capital management. Often the hardest part of commencing such a project is accessing the appropriate expertise and committing the necessary resources.

Treasury Broadsheet Unlocking value in a competitive lending market

By Ben Bridgman

Over the past two years, New Zealand’s economy has faced a prolonged period of flat or negative GDP growth. This slow growth has been set against the backdrop of an Official Cash Rate (OCR) sitting at decade-high levels, elevating the cost of borrowing and further reducing borrowing appetite. These conditions have created a challenging lending environment, making the current slowdown in credit growth unsurprising. Over this time credit expansion has fallen to levels not seen since the economic disruptions of the Covid-19 pandemic and the 2008 Global Financial Crisis.

Do New Zealand banks have capacity to lend more?

A key measure in New Zealand’s banking system is the Core Funding Ratio (CFR). This reflects a bank’s liquidity position and the proportion of a bank’s loans funded by stable and/or longer-term sources, such as retail deposits, longer-term sources such as retail deposits and long-term wholesale funding. Under banking regulations, the Reserve Bank requires banks registered in New Zealand to maintain a minimum CFR of 75% to ensure that the deposit-takers retain resilience against future funding shocks. Commercial banks maintain CFR above this to ensure that they have a buffer over the regulated requirements however the trend over the last two years shows that this ratio has been elevated above historical levels. Over the past two years, deposit growth has tracked at a pace broadly in line with historical norms, but with lending growth slowing sharply, CFRs have naturally risen. This dynamic leaves banks with surplus liquidity, increasing their lending capacity.

But do New Zealand banks want to start lending more?

Historically, credit growth in New Zealand has closely tracked the performance of the broader economy, with periods of strong GDP growth typically accompanied by an expansion in lending.

The past two years of flat or negative GDP growth have therefore naturally coincided with subdued lending activity. Presently our observations are that banks are becoming increasingly active in the market, positioning themselves to expand their loan books and capture opportunities as economic momentum builds. The lending momentum that developed during the period of improving business and consumer confidence in late 2024 and early 2025 has largely persisted, even in the face of the downside surprise in Q2 2025 GDP reading and renewed weakness in confidence. Despite these setbacks, lenders remain focused on capturing growth opportunities in the market.

A review of recent statements from New Zealand’s major banks reinforces this trend, with CEOs emphasising their commitment to the commercial space. Westpac has highlighted a “real focus to support small and medium businesses,” while ASB has reaffirmed its intention to “back businesses to compete, scale and drive growth.”

How can New Zealand banks lend more?

As the New Zealand banks are motivated to grow the size of their lending books, pricing competition has started to heat up. Net interest margins (NIMs) published by the RBNZ track the average cost of debt in New Zealand and show that margins are currently elevated above the ten-year average at 2.32%.

In practice, competition for quality borrowers is intensifying, with lenders increasingly prepared to price aggressively to secure new lending business and as a result we would expect to see NIM trend lower over the coming 12 months. This is consistent with what we have observed in the market recently with elevated interest from banks looking to start growing their lending books again. This increased demand has led to increased pricing competition with falling NIMs as banks seek to remain competitive. For borrowers, this environment presents an opportune time to reassess funding strategies, as competitive pricing and flexible structures become more readily available.

Benefiting from this environment

In today’s competitive lending landscape, first impressions matter. Borrowers who approach banks with a clear and compelling funding narrative are more likely to capture attention and secure more favourable terms. A well-run RFP process not only introduces competitive tension between lenders but also provides a platform to demonstrate financial strength and credibility. Central to this is a robust model for future performance as banks look for resilient cash flows, realistic growth plans and sustainable debt servicing capacity. By combining a strong forward-looking financial model with a well-structured RFP, borrowers can unlock enhanced value.

PwC’s debt advisory team can support borrowers in shaping this process and developing the financial models that enhance lender confidence, helping businesses secure the right capital on the best possible terms.

Treasury Broadsheet Terminal OCR: why the ‘destination’ rate matters for interest rate risk management

By William Trapeznik

Interest rates are never static. They move in response to economic conditions, monetary policy, global markets and geopolitical events. For managers of financial market risk, and in particular interest rate risk management, the concept of the terminal Official Cash Rate (OCR) is important.

Terminal OCR expectations flow directly into the short-end of the swap curve (0–3 years), but their influence on the curve diminishes over the longer term. Therefore, when considering strategic and tactical hedging decisions, an understanding of the current monetary policy settings, financial market expectations for the terminal OCR rate, the shape of the swap curve, and an expectation of a fair long-term neutral OCR rate, should all feed into effective interest rate hedging decisions. This is increasingly relevant at present as financial markets price in a terminal OCR rate while the RBNZ approaches the bottom of the current monetary policy easing cycle.

What is a terminal OCR?

The terminal rate is most closely linked to how the US Federal Reserve articulates its view on the “long-run" level of interest rates at the end of the current interest rate cycle (i.e. where will rates end). A key related concept is the “neutral” OCR, which is more commonly covered in New Zealand. This is the RBNZ’s estimate of the OCR that is neither expansionary nor contractionary. Neutral is shaped by factors such as investing and borrowing demand, productivity, demographics, fiscal policy and importantly inflation and growth expectations. Global interest rate trends may also play a role. These factors will have different influences from time to time.

The neutral rate evolves gradually and provides a base against which the terminal rate can be understood:

- When significant upward inflationary pressures are present, the OCR may need to be set above neutral (contractionary monetary policy), and the peak of that cycle becomes the projected terminal OCR.

- When significant disinflationary pressures are present, the OCR may need to be set below neutral (expansionary monetary policy), with the projected trough of that cycle becoming terminal.

The terminal OCR is cyclical and time specific. It is the level at which the RBNZ is expected to conclude hiking or cutting rates in the current monetary policy cycle. It reflects near-term conditions such as inflation pressures, the output gap, labour market dynamics, and global financial settings.

For managers of interest rate risk, the market’s pricing of the projected terminal OCR has a direct bearing on short-term swap rates, given market-implied OCR expectations are one of the primary fundamental drivers of this segment of the curve. However, effective hedging decisions require consideration beyond the terminal OCR alone. Consideration also needs to be given to movements in the belly (3–7 years) and long-end (7–10 years) of the swap curve, with the latter typically influenced by global factors such as US 10-year Treasury bond yields. The interaction of these domestic and global forces shapes the overall curve, and it is this dynamic that ultimately highlights where the most economically valuable hedging opportunities may lie.

Curve shape dynamics

The short and long ends of the swap curve do not always move together. Curve shape has direct implications for hedging because it determines where economically valuable rates may be available, which in turn can influence the hedging strategy within Treasury Policy requirements. Different recognised curve shapes include:

- Normal curve: Short-end rates are lower than the long-end rates. Reflects greater uncertainty about the future path of rates and the presence of a positive term premium.

- Inverted curve: Short-end rates are higher than long-end rates. Often reflects increasing contractionary near-term monetary policy with markets expecting monetary policy easing in the future.

- Flat curve: Maturities priced at similar levels. Neither clearly upward sloping nor downward sloping.

The difference between the 2-year and 10-year swap rates (the 2s10s spread) is a widely used indicator of the swap curve’s shape and steepness. Historically, this spread has averaged around 60 basis points. Spreads above this level typically indicate a steeper curve, while narrower spreads point to a flatter curve.

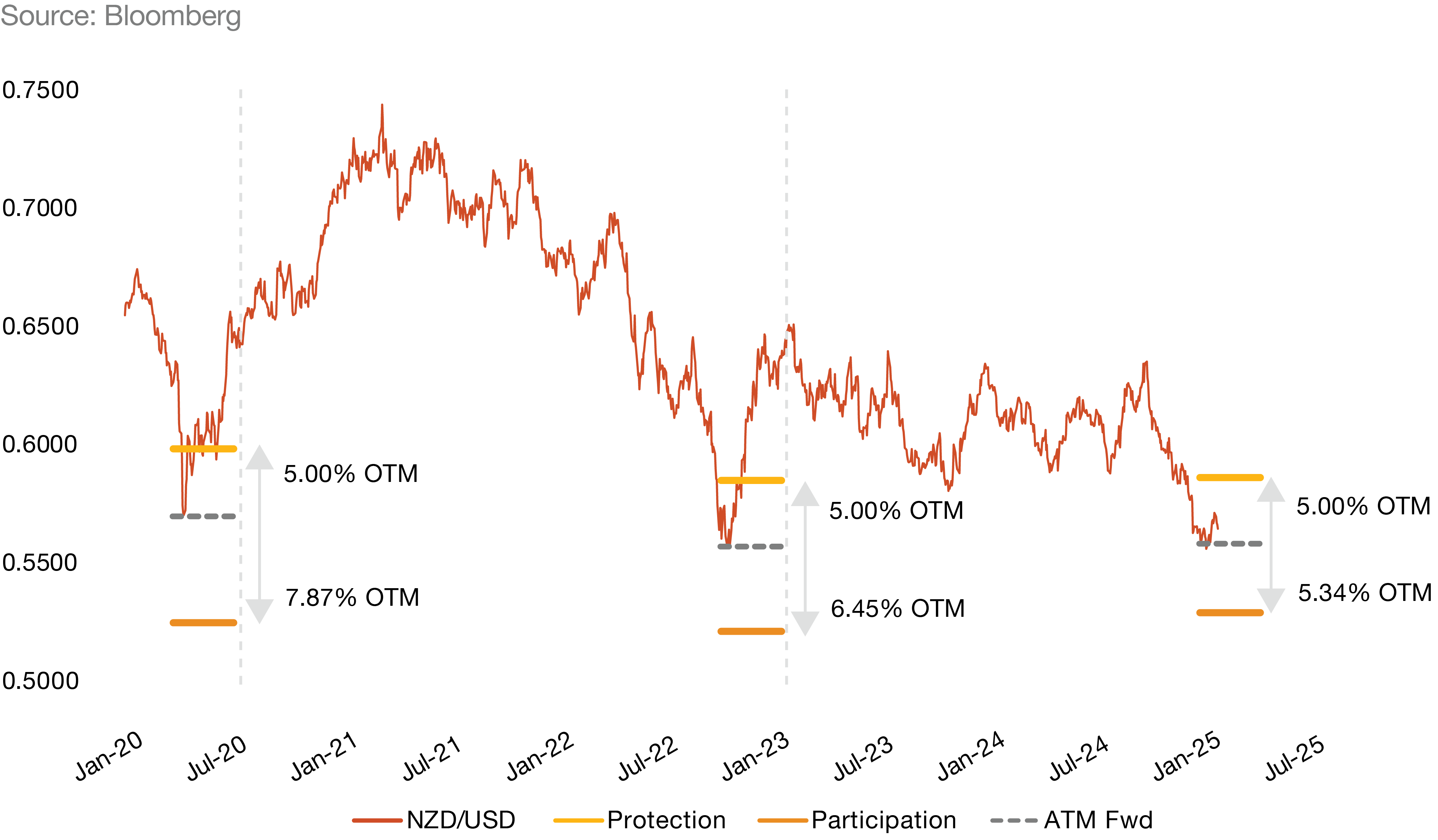

Terminal OCR expectations and hedging considerations

Similar to what we are seeing in the current interest rate environment, when the economy moves into the later stages of the monetary policy cycle, terminal OCR expectations become increasingly important for hedging decisions. Considered alongside long-term pricing, these expectations form a critical basis for developing interest rate hedging strategies that remain aligned with Treasury Policy parameters and approved risk tolerance levels. Different swap curve shapes in turn present distinct considerations for hedging approaches:

Yield curve shape |

Swaps rates |

Hedging considerations |

Market conditions |

| Inverted curve (short high, long low) | Short-dated swaps are expensive, long-dated swaps appear economically valuable relative to history. | Entities may prefer to keep near-term fixing closer to the lower end of policy limits to avoid locking in elevated short rates, while selectively using long-dated capacity to secure value further out. Forward start swap strategies are attractive in this type of swap curve environment. Swap shortening strategies are sometimes used to build up more protection against higher short-term rates. Use of interest rate option products. | Post aggressive hiking cycle where markets expect OCR cuts in the near term. |

| Elevated flat curve (short and long high) | Swap rates are expensive relative to long term average OCR and BKBM rates across the curve. | Positioning is often kept toward the lower end of allowable Treasury Policy limit ranges. Typically, only entities with a strong preference for budget certainty may still execute fixing under these conditions. Interest rate options may be preferred to transacting swaps. | Mid-hiking cycle with inflation concerns. |

| Steep curve (short low, long high) | Short-dated swaps are relatively attractive, long-dated swaps are expensive. | Treasurers may choose to increase fixing in near-term buckets, making use of lower short-end rates, while staying at minimums in long-dated cover until offshore-driven long-end levels ease (flattening the curve). | Early recovery phase, central banks easing policy but markets demanding term premium.

Similar to the current domestic swap curve. |

| Low/flat curve (cheap across maturities) | Swap rates are cheap across maturities.

|

Where Treasury Policy allows, fixed cover may be lifted more broadly, moving toward the upper end of policy ranges. Treasurers often spread execution across short, medium, and long maturities to capture value. Build up longer term interest rate protection. Provides flexibility for shortening the swap hedge portfolio under an inverted curve. | Periods of low inflation and growth expectations, accommodative monetary policy |

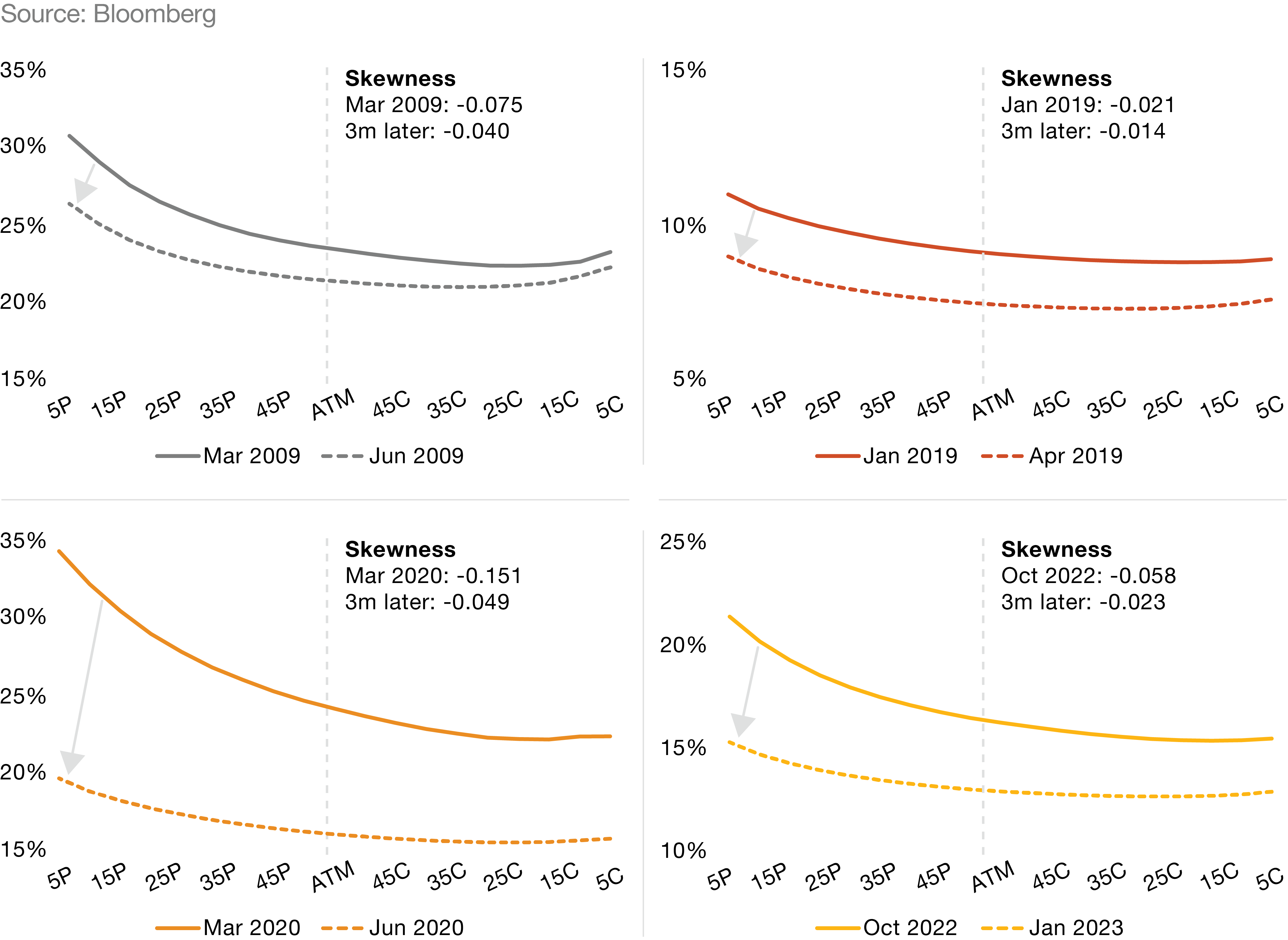

Lessons from past cycles

History shows that markets have frequently misjudged terminal OCR expectations. During the 2021 to 2023 tightening cycle, market pricing consistently underestimated how high the OCR would need to rise as inflation pressures proved more persistent. The OCR ultimately reached 5.50% in May 2023, notably above what markets had priced in through much of 2022. In earlier easing cycles, such as during the Global Financial Crisis, market pricing for OCR troughs went too deep relative to where the RBNZ ultimately cut.

Because the terminal OCR rate is a moving target, a staggered execution strategy can be an effective way to manage uncertainty while seeking risk management protection and value. This involves executing hedges in tranches:

- One tranche is placed at current market levels to secure base protection.

- Additional tranches are set as call orders at progressively more advantageous levels, so that if market pricing moves lower than is currently embedded in the curve, those orders are triggered. It is important to note that no hedge exists unless the strategy is executed, so these tactics need to be balanced against the organisation’s risk management objectives.

This approach allows participation if rates fall while ensuring a base level of protection. Combining tranches with diversification across maturities and bank counterparties, balanced with continuous monitoring of curve shape, can improve hedging and risk management effectiveness compared to one-off more concentrated hedging.

PwC’s corporate treasury team has extensive experience in managing and navigating interest rate market movements, and can support you in executing optimal, policy-aligned interest rate hedging decisions that achieve your financial and treasury objectives.

Weekly market wrap ups

See the latest news in local and global economic and market developments from the past week.

Market Intelligence

Get a quick summary on vital market developments within New Zealand and around the world, along with what you need to look out for in the weeks ahead.

Contact us