Introduction

PwC’s Retail and Consumer Insights provides the latest consumer behaviour news and trends in New Zealand and internationally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ and other local and global sources.

Key highlights from our Quarter 3 2022 edition include:

- The ANZ-Roy Morgan Consumer Confidence Index continues to trade in a relatively narrow band between 81.9 in July 2022 and 85.4 in September (still below the levels seen at the time of the GFC).

The proportion of people who believe it is a good time to buy a major household item has also tracked sideways over the last three months (-25) and remains a concern for all retailers.

House price inflation expectations have fallen throughout the year from 4.8% p.a. in January 2022 to 0.5% p.a. in September 2022, with expectations highest in Auckland (2.0% p.a.) and weakest in Wellington (-0.7% p.a.).

In July Stats NZ announced that annual inflation for the June quarter was 7.3%, with food prices up 6.5%, including ready-to-eat food (+6.4%) and milk, cheese, and eggs (+10%).

While the volume of electronic card transactions in September showed further signs of improvement, the key question is whether this recovery will be sustained and card transaction volumes are able to revert to their long-term, pre-COVID growth rates of ~6%.

Year-to-date electronic spend data confirms that while sales in both the Apparel and Durables categories have managed to keep pace with inflation, Consumable sales have effectively declined in real terms.

While Durables and Motor Vehicles have performed well year-on-year, the outlook for both these categories would appear to be finely balanced as improvements in the international supply chain are likely to be offset by further increases in the OCR and mortgage rates.

- In terms of international insights and consumer sentiment, the PwC June 2022 Global Consumer Insights Pulse Survey reinforced recent trends, including sustained growth in online shopping, the adoption of a hybrid WFH model and the importance of ESG considerations in consumers’ purchasing behaviour and decision-making.

To explore further, select the buttons below.

Consumer confidence

With the COVID Protection Framework (traffic lights) ending at midnight on 12 September 2022 and the last Government vaccine mandates (for health and disability workers) ending on 26 September 2022, New Zealand finally feels as though it has turned a corner in the fight against the global pandemic. What is less clear though is the financial, economic and social impact this battle has had on New Zealand. From an economic perspective, consumers continue to feel the cost.

Over the last three months the ANZ-Roy Morgan Consumer Confidence Index has traded in a relatively narrow band between 81.9 recorded in July 2022 to 85.4 in September (released on 30 September 2022). With COVID cases and hospitalisations continuing to fall (case numbers are now only released by the Ministry of Health on a weekly basis), the attention of consumers is now firmly on the cost of living, ongoing inflationary pressures, the outlook for the property market and the potential for further mortgage rate rises.

“While consumer confidence continues to explore depths not even seen at the time of the GFC, retail spend has remained relatively buoyant as a strong labour market provides confidence despite ongoing increases in the cost of living, OCR and mortgage rates”.

The proportion of people who believe it is a good time to buy a major household item, still the best indicator of retail spending, has also tracked sideways in the last three months, recording -25 in September 2022. This indicator of retail spending remains at extremely low levels (lowest level of -30 was recorded in May 2022) and must remain a concern for all retailers. In relation to whether or not it is a good time to buy a major household item, a gap has emerged between survey respondents that have a mortgage and those that don’t. This makes sense as, for most households, their mortgage payments have already increased, and if they haven’t yet, they probably will soon.

Fortunately for households (and retailers), the labour market remains tight, enhancing employee job security and contributing to ongoing wage cost inflation. However, persistent wage growth (fueling domestic inflation) may force the Reserve Bank to drive the OCR higher (and for longer) than current market expectations.

In order to curb inflation, the Reserve Bank needs to control demand and consumption. The unexpectedly large fall in retail sales in Q2 (figure 3) suggests that this is starting to happen, although the data remains volatile due to COVID distortions. In terms of inflation, consumer expectations appear stuck at around 5% p.a. - while still too high, this is at least off the peak of 6.0% recorded in March 2022.

House price inflation expectations have fallen throughout the year from 4.8% p.a. in January 2022 to 0.5% p.a. in September 2022. Expectations are highest in Auckland (2.0% p.a.) and weakest in Wellington (-0.7% p.a.). The challenging consumer outlook is also reflected in the proportion of respondents who expect to be better or worse off in 12 months' time. This indicator has been in negative territory for the majority of this year and only turned positive in August 2022 (a net +1 of respondents believing that they would be better off financially in 12 months’ time).

The relentless pressure on households was confirmed on 18 July 2022, with Stats NZ reporting annual inflation for the June quarter of 7.3%. The most significant contributor to the annual increase in the CPI was housing and household utilities, which increased 9.1%. Transport was the second most significant contributor to the annual increase, up 14%, including a 32% increase in petrol. The cost of food also contributed to the annual movement, with food prices up 6.5%, including ready-to-eat food (+6.4%) and milk, cheese, and eggs (+10%).

The Reserve Bank continues to increase the OCR, with a further 50 basis points increase announced on 5 October (taking the current OCR to 3.5%). The ANZ expects a further 50 basis point increase at the last remaining Reserve Bank meeting this year, followed by a further three more 25 basis point hikes in the first half of next year (reaching 4.75% by May 2023).

Spend trends

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions series data that includes all debit, credit and charge card transactions with New Zealand-based merchants. Using our Retail and Consumer Dashboard, we are able to compare YTD retail-related electronic spend data by sector with the comparable periods in 2019, 2020 and 2021.

Unfortunately, throughout 2022, inflation has become a more significant influence on the value of card transactions. As a result, we now also consider the volume of card transactions in order to filter out this additional “noise” from the underlying data. The chart below presents monthly growth in the volume of annualised (LTM) electronic card transactions for the Core Retail and Retail Industries categories1.

The chart provides some interesting insights for retailers in relation to underlying consumer activity:

Over the pre-COVID period (up to February 2020), the monthly growth in annualised card volumes consistently averaged ~6%.

With the onset of COVID, card volume growth declined throughout 2020 as a result of lockdowns and various COVID-related restrictions on travel and social gatherings.

The recovery in volume growth from February 2021 reflects the easing in restrictions compared to the previous year.

The nation-wide lockdown in August 2021 hit the country hard with LTM Core Retail volume growth declining from 10.7% in July 2021 to -10.5% in July 2022 (the last month to include August 2021 data).

The figures are now recovering as the impact of the nationwide lockdown (from 17 August to 7 September 2021) drops out of the data, with September 2022 Core Retail and Retail Industries volume growth of 42.1% and 40.2%, respectively.

While the volume of electronic card transactions in September showed further signs of improving, the key question going forward is whether or not this recovery will be sustained and card transaction volumes are able to revert to their long-term, pre-COVID growth rates of ~6%.

September electronic spend data (released by Stats NZ on 11 October 2022) confirmed that seasonally adjusted spending in the Core Retail and Retail Industries grew by 2.2% and 1.4%, respectively compared to August 2022.

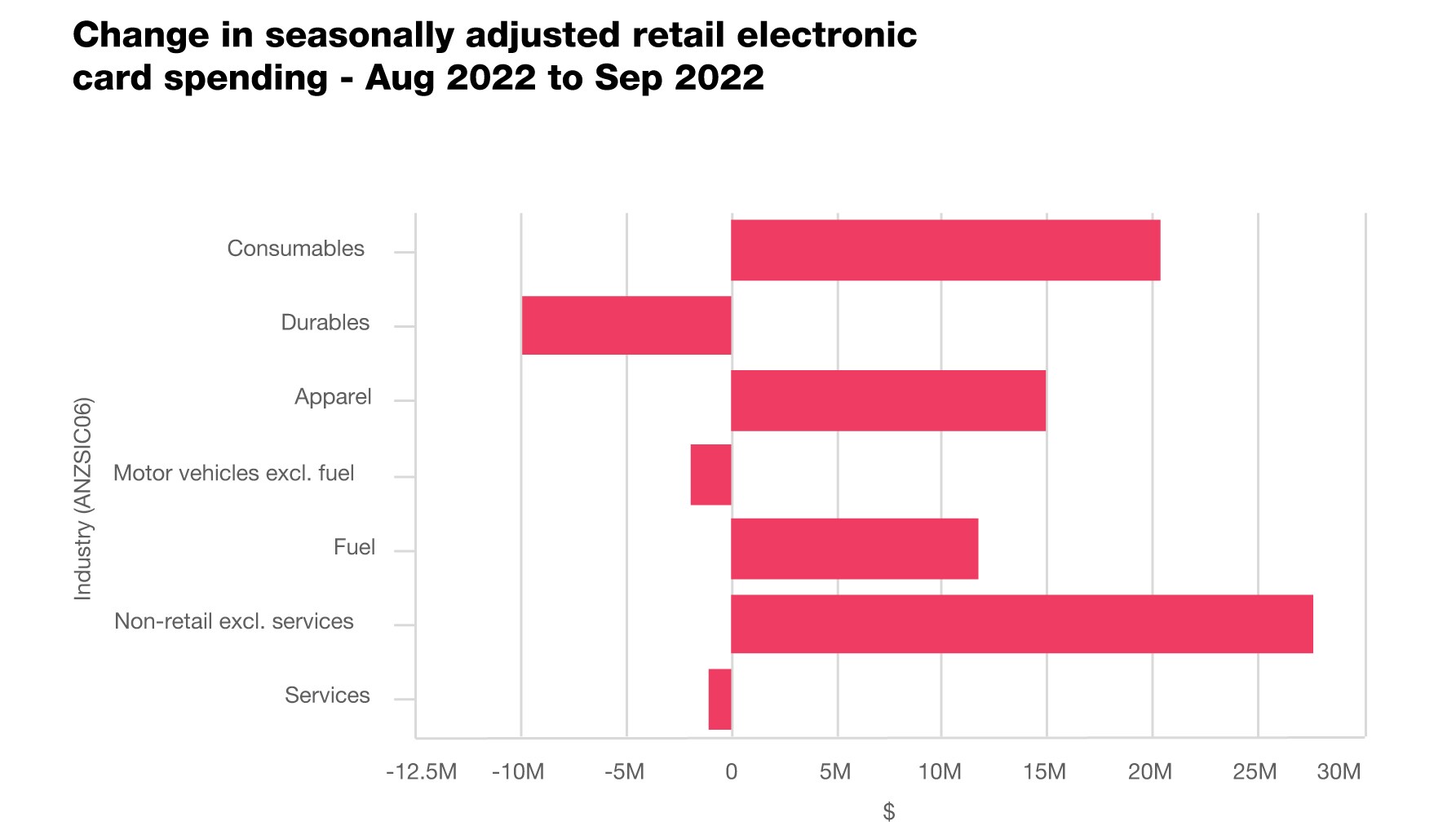

Within the Retail Industries category, movements in spending on a seasonally adjusted basis between August and September 2022 were:

Consumables, up $20 million (+0.8%)

Motor vehicles (excluding fuel), down $2 million (-0.9%)

Apparel, up $15 million (+4.3%)

Durables, down $10 million (-0.6%)

Fuel, up $12 million (+2.0%)

Using the PwC Retail and Consumer Dashboard we are also able to analyse year-to-date electronic spend and year-on-year growth by retail category. While the growth in fuel sales (+14.9% year-on-year) is largely attributable to international commodity price volatility, it is interesting to note that sales growth in both the Apparel and Durables categories has managed to keep pace with inflation, while Consumable sales have effectively declined in real terms. When we examine the data on a month-on-month basis, the recovery in the Hospitality sector is most pronounced, as international borders reopen, with monthly sales increasing from $569 million in September 2021 to $1.2 billion in September 2022 (+110%).

Despite the COVID Protection Framework (traffic lights) ending at midnight on 12 September 2022, it is still useful to consider recent spending patterns in a wider, longer-term perspective, including pre-COVID. The chart below compares spending in the last 12 months (LTM) to September 2022 with spending in the equivalent 12 month periods in 2021, 2020 and 2019.

A similar analysis based on the monthly progression of LTM electronic spend by category versus the equivalent period in 2019 provides similar results. This analysis confirms that performance in the Consumables category has continued to moderate (perhaps as result of less stockpiling of basics / necessities and more takeaways / dining out as COVID-related restrictions have continued to ease).

In addition to Hospitality, year-on-year out-performance has also been achieved in the Durables and Motor Vehicles categories. That said, the outlook for both these categories would appear to be finely balanced as improvements in the international supply chain are likely to be offset by further increases in the OCR and mortgage rates (let’s hope job security remains high).

1 “Core Retail” comprises the Consumables, Durables, Hospitality and Apparel categories, while the “Retail Industries” category also includes Fuel and Vehicles.

International insights

PwC’s June 2022 Global Consumer Insights Pulse Survey (Consumers respond to waves of disruption) highlighted that while consumers may have shown patience during the early days of the pandemic, as companies simplified supply chains, streamlined their product lines and cut customer service, this patience seems to be wearing thin. In the latest global consumer survey, PwC found indications of discontent for shoppers both in-store and online:

Other key themes emerging from this latest survey include:

The rise and rise of digital / online shopping

Globally more than 60% of respondents report that they increased their online shopping during the pandemic. Approximately 50% of respondents say they will increase their online shopping further over the next six months, while a further 39% expect to continue at current levels.

WFH is here to stay

While consumers are somewhat less likely to work from home than they were in PwC’s December 2021 survey, over 40% still work in a hybrid manner, with one in ten permanently working from home.

Supply chains remain a problem

Many consumers have direct experience of the ongoing supply chain issues. According to the survey, two of the most frequently experienced issues experienced when shopping in-store are longer queues and the unavailability of product. When shopping online, more than 40% of consumers report longer delivery times than expected and products being out of stock.

Preference for local and domestic

In times of crises, including geopolitical conflict and concerns in relation to climate change, many consumers are looking to shop local and support domestic producers. Six in ten respondents indicated that they wanted to support their local economy, while 42% believe local and domestic goods are higher quality.

Expectations of sustainability

ESG factors continue to affect consumer shopping behaviours, with millennials and Generation Z significantly more likely to consider them in trust, advocacy and purchase decisions. Around half of all respondents indicated that ESG factors often or always affect their trust in a company or brand or the likelihood that they will recommend it to others.

Recent news

On 13 September 2022, the Government ended most of the remaining COVID restrictions including mask wearing and entry test requirements. Masks are no longer required to be worn by customers and staff in retail stores and supermarkets. Household contacts of positive COVID cases no longer have to isolate, reducing the pressure created by staffing shortages that much of the retail sector has experienced over the last two and a half years.

Costco, a large American multinational supermarket chain, opened its first store in New Zealand in September. The West Auckland megastore introduces a number of American household brands to the New Zealand market. The Australian managing director of Costco has indicated that further stores in Christchurch, Wellington and Hamilton may be opened if the store is a success.

Hallenstein Glasson reported on 30 September a 23.2% decrease in net profits for the year ended August, with profits declining from $33.3m to $25.6m, largely due to pandemic struggles. New Zealand sales were down 13.0%, while sales in Australia increased by 17.4%. Full-year online sales were up 16.1% compared to last year, making up 27.9% of total group sales.

The Warehouse group announced on 28 September that profits had declined by 18.3% for the financial year ending 31 July. The group reported that net profit decreased from $109.3m last financial year to $89.3m. Despite store closures due to COVID, the group had its second largest revenue result. This follows a record $3.41b annual revenue in FY21 and $3.29b in FY22.

Briscoe Group reported on 14 September a small decline in first-half profits. First half net profit decreased by nearly 3.9% to $45.6m while total sales increased by 2.7% to $368.0m. The ongoing impact of COVID, along with other economic factors, has disrupted supply chains and continues to impact the group.

Small scale suppliers will be allowed to jointly negotiate with the two key supermarket operators in New Zealand. Government is allowing collective bargaining between small scale food suppliers and New Zealand’s two key operators, Foodstuffs and Woolworths, to increase competition in the supermarket sector.

Retail NZ has criticised the Fair Pay Agreements Bill currently with the Education and Workforce select committee. Retail NZ CEO, Greg Harford, has said if the legislation is passed into law, it will be “administratively burdensome, add to the cost of living crisis and ultimately lead to fewer and less flexible employment opportunities for New Zealanders”. This follows independent research commissioned by Retail NZ earlier this year that found just 29% of respondents thought it was a good idea.

Retail giant Harvey Norman, and credit provider Latitude, are being sued by the Australian Securities and Investments Commission (ASIC) for allegedly misleading consumers on interest-free finance deals.

Kmart is planning to open four more stores in New Zealand within the next year. Kmart Australia and New Zealand CEO John Gualtieri confirmed an expansion plan for four new stores and the opening of its own North Island distribution centre.

Tupperware has announced the closure of its business in New Zealand after 49 years. UOL, the sole importer of Tupperware in New Zealand, announced the shutdown of operations in New Zealand, due to a drop in sales and tupperware parties as a result of COVID.

Fonterra Co-operative Group Limited has decided to maintain full ownership of its Australian business after completing a strategic review.

Recent deals

Nestlé Health Science has agreed to acquire The Better Health Company (TBHC), the parent company of GO Healthy and Egmont, from CDH Investments and TBHC founding shareholders. Under the transaction, Nestlé Health Science will acquire The Better Health Company in its entirety. This includes the GO Healthy brand, New Zealand’s leading supplement brand; New Zealand Health Manufacturing, an Auckland-based manufacturing facility for vitamins minerals and supplements; and the Manuka honey brand Egmont.

Vodafone NZ is rebranding to One New Zealand from early 2023. Following its 2019 sale to NZX-listed investor Infratil and Canada-based private equity giant Brookfield Asset Management, this is a further move to separate from the telco’s former global parent.

- The planned merger of RNZ and TVNZ faced criticism from the heads of New Zealand's six biggest media organisations during submissions to a Parliamentary Select Committee. The new entity, known as Aotearoa New Zealand Public Media or ANZPM, will receive a significant share of the NZ On Air funding that used to be contestable.

PwC Retail and Consumer Dashboard

The PwC Retail and Consumer Dashboard is updated monthly to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of COVID. If you are interested in online access to our dashboard to help inform your decision making, please contact: Beini Guo

How we can help:

PwC has advised many of New Zealand’s largest listed and privately owned retailers across a wide variety of projects and roles, including assurance, tax, capital solutions, transactions services, M&A, restructuring, real estate, supply chain and digital consulting services.

We have a comprehensive understanding of the rapidly evolving retail environment (offline and online) and are uniquely placed to combine strategy with technical, industry and execution expertise. We pride ourselves on a focused partnership approach to our work in the sector, based on principles of trust, independence and challenging insight, using specialist teams tailored to specific client needs.