Key findings for New Zealand from PwC’s Global Investor Survey 20231

Sustainability reporting and assurance requirements are ramping up in Aotearoa New Zealand - and so are investors' expectations.

Using results from PwC’s Global Investor Survey2, we explore how investors who invest in Aotearoa New Zealand are looking to sustainability reporting, and assurance, to understand how companies are managing their organisation and creating value.

1 PwC’s Global Investor Survey 2023 (published November 2023) is an external survey collecting responses from 345 investors and analysts across 30 territories globally. Data referenced in this article is based on the responses from 36 global investors who responded that they invest in New Zealand.

2 Both 2023 results and 2022 results where comparable date is available.

Investors' concerns are shifting

Dealing with inflation and macroeconomic volatility is important, but has become business as usual for companies, and therefore investors see less exposure than last year. The survey shows investors’ concerns redirected to other threats, with some of the largest increases seen in environmental and social matters (climate change, health risks, and social inequality). This is not surprising with many New Zealand companies impacted by the significant adverse weather events this past year. Economic, health and welfare pressures continue to dampen outlook and increase costs for business. Investors see ongoing risk for companies as the consequences prove to be tangible - and impact the bottom line.

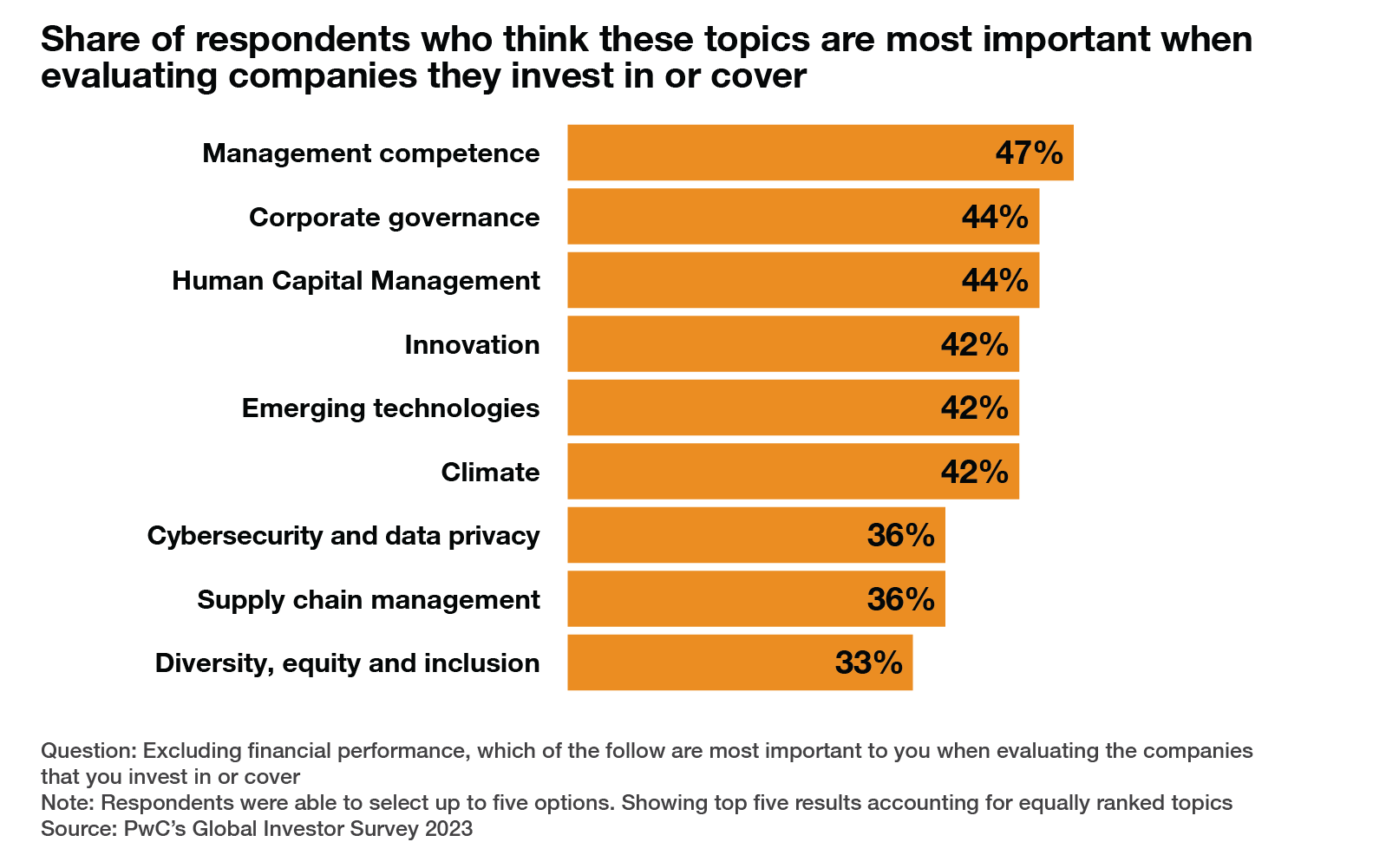

To make informed evaluations about companies, core business capabilities are the most important topics investors want transparency on. Competency of management and corporate governance lead the list of priorities.

While investors place a lot of value on a company that can be trusted to get the basics right, the broad range of topics selected shows they continue to consider wider aspects of a company’s performance when assessing their investments.

ESG topics are also prevalent, with human capital management and climate both featuring on the list. The need for companies to embrace innovation and emerging technologies also rank highly in investors’ priorities.

The trust gap

Investors remain extremely cautious about the reliability of information sources. When asked, 100% of investors believe that corporate reporting contains at least some unsupported claims about a company’s sustainability performance (e.g. greenwashing). This is even higher than last year’s result of 95%.

This suggests that companies have some way to go to address the gap between what investors expect and and the current state of reporting.

So how can companies make their sustainability reporting more useful and address the gap between investor needs and expectations? And how can they do this effectively and efficiently, while also adding value for their organisation? Below we suggest some key considerations for companies when addressing these questions.

Key considerations for sustainability reporting:

Click on the tabs below to learn more

Investors want companies to accelerate the use of emerging technologies, such as AI, alongside their sustainability strategy.

The two are not mutually exclusive and approaching investment in AI and other emerging technologies, with sustainability in mind, is an opportunity.

Investors do have concerns with new technology (security, privacy, misinformation and bias). Companies need to show they have the appropriate governance processes and controls in place to manage associated risk. Take time to explore solutions - the right technology can address risk as well as improve holistic data management, reporting, and decision making capability across the business. Benefits include:

helping organise multiple data sets

offering analysis and insight with efficiency and accuracy

steering and operating the business by regularly reporting key performance indicators that keep people and business accountable to the sustainability strategy.

More than ever, investors want companies to disclose their impact on society and the environment, now and in the future. A majority of the 89% of investors who believed this was important also wanted companies to disclose the monetary value of those impacts. They believe this will help companies better understand the trade-offs between environmental and societal issues.

There is no doubt that the reporting impact, and determining the value of that impact, is a challenge but companies should not shy away from investing time and effort here - there is an upside for those who embrace it.

78% of investors agreed, to some extent, that companies should invest to address ESG issues relevant to their business even if it reduces short term profitability. The majority are also willing to increase investment in companies that do so - whether it is addressing sustainability issues relevant to its business' performance and future prospects, or changing its conduct to have a beneficial impact on society or the environment.

As well as meeting investors expectations, being able to report this information will allow for better integration of sustainability factors into internal decision making. The data can be used to enable more holistic consideration of actions and investments, creating value beyond short term financial outcomes, with a focus on longer term sustainable business.

Investors are increasingly relying on a company’s materiality assessment for investment decision-making. The survey reveals 61% use the company’s materiality assessment when assessing how they manage risks and opportunities (up from 35% in the prior year).

A materiality assessment is a critical step in the journey of effective sustainability reporting and companies should not underestimate the value of time and effort spent here. A robust materiality assessment can be used for:

Focused decision-making - addressing risks and opportunities that matter most to the business and its investors.

Efficient data gathering - prioritising key metrics that you need to operate the business and for investor reporting.

Deeper insights and diverse perspectives from a range of stakeholders engaged in the assessment process.

All investors that we surveyed believe if companies meet relevant reporting regulations and standards, it would help their decision making. Globally, territories are using reporting regulation to help close the information gap for investors.

In New Zealand, the regulation for company reporting is focused on how companies are addressing climate-related risks and opportunities. This year will see companies publishing their first mandatory reporting of climate related disclosures for climate reporting entities under the Aotearoa New Zealand Climate Standards (‘NZ CS’).

From late 2024, we will see mandatory assurance over the GHG emissions disclosed in these reports3. Assurance is a means to increase investors’ confidence in reporting - and they want more!

94% [2022: 71%] of investors would have confidence in the accuracy of non-financial reporting if an assurance practitioner were able to assure that a company’s management has done what they’ve reported they’ve done.

And, across all types of assurance we surveyed, be it limited or reasonable assurance, external certification or verification, this has continued to grow. The most significant increase is where companies obtain reasonable assurance. This saw the largest increase to 92%, from 65% last year.

Company’s should pay close attention to competitors and regulators, at home and overseas, to be ahead of the curve when it comes to investors' expectations of sustainability reporting.

3 Assurance over GHG emissions is mandatory for climate reporting for accounting periods ending on or after 27 October 2024

How we can help

Our PwC Sustainability Reporting and Assurance team is ready to talk to you about your reporting and assurance requirements. For more information about the work we do and services we provide click here.

Partner, Sustainability Reporting & Assurance Leader, Auckland, PwC New Zealand

+64 21 355 879