{{item.title}}

{{item.text}}

{{item.text}}

The Aotearoa New Zealand climate standards, issued by the External Reporting Board (XRB), came into effect on January 1, 2023. These standards mandate around 200 organisations to disclose detailed information about the present and future effects of climate change on their operations. As we reach the midpoint of the initial reporting period, the first climate-related disclosures, or ‘Climate Statements’ are being published.

A reminder of what the Standards aim to achieve

The Standards aim to support the allocation of capital towards activities that align with a transition to a low-emissions, climate-resilient future. They help investors to gain a better understanding of the full financial implications of climate change on organisations, which will in turn be expected to influence where capital flows.

They also encourage mandated organisations (and their directors) to assess, understand and disclose material climate risks, as they have historically done for other categories of risk material to their organisation.

All disclosures must meet the Standard’s requirements. Similar to financial reporting standards, the outputs of the climate-related disclosures (CRD) standard will attract review and scrutiny from stakeholders, investors, and the New Zealand regulator, the Financial Markets Authority.

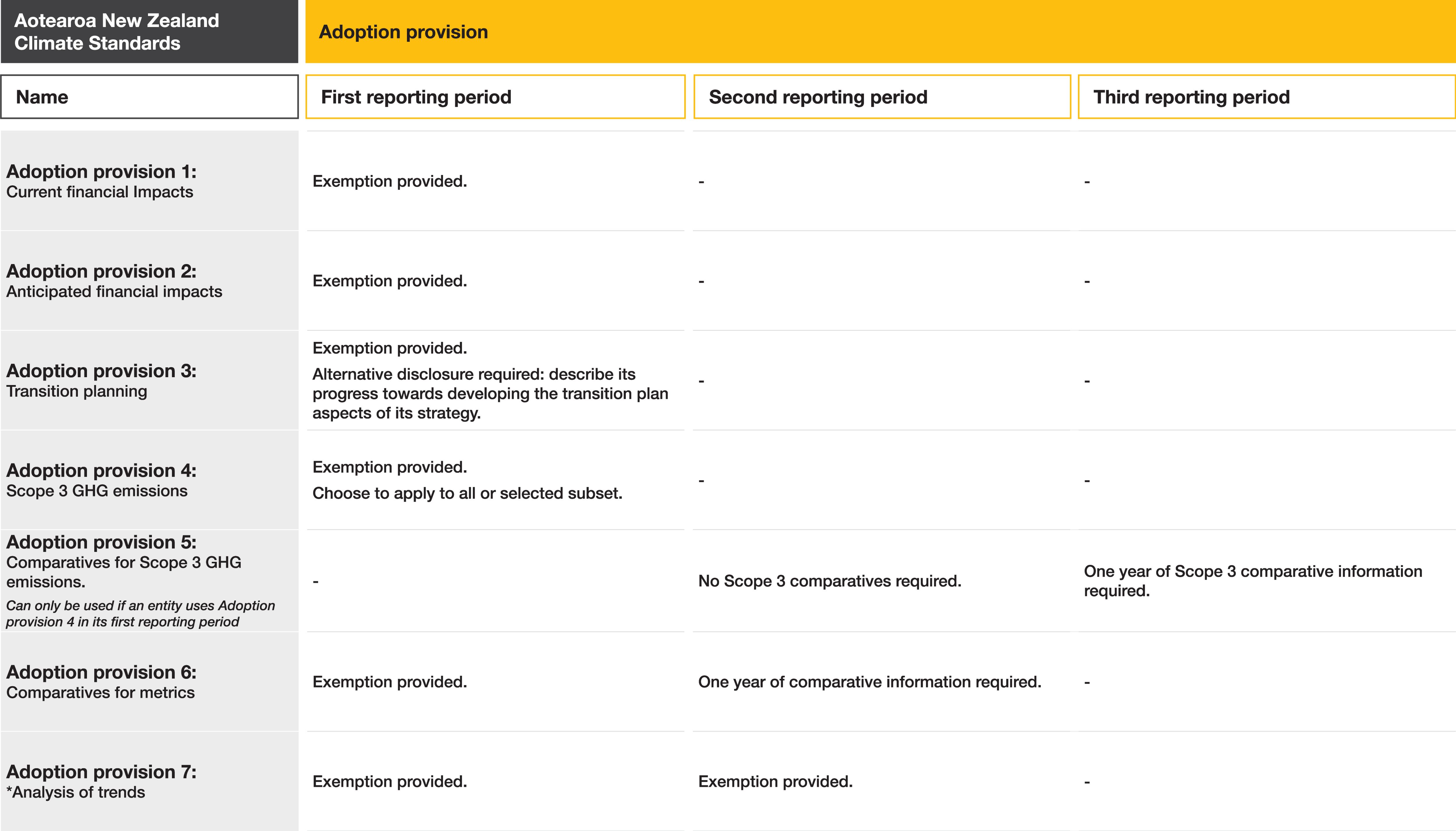

The XRB recognises that it may take time to develop the capability to produce high-quality climate-related disclosures. It has therefore taken a phased approach to the implementation of the standard, providing an exemption to some of the disclosure requirements in the initial reporting periods.

While these provisions provide some relief for those organisations who are new to considerations of climate risk and opportunity, two areas that entities will need to pay particular attention to in the next reporting period are:

Disclosure requirements 15 & 16 of NZ CS 1 require entities to disclose what climate change impacts will or could occur:

Current impacts: These are the effects that the organisation has already experienced during the current reporting period. It refers to things that were previously seen as risks or opportunities but have now actually happened, creating issues or incidents.

Anticipated impacts: These are climate-related risks and opportunities that could affect the organisation's future financial performance, financial position, and cash flows. It includes a description of the timeframes within which these impacts could reasonably be expected to occur. Entities are required to describe the impact in words and provide specific numbers (quantification) if possible.

Disclosure requirement 11(e) of NZ CS 1 requires an entity to describe how it will position itself towards a low-emissions, climate-resilient future state. In other words what an entity's transition plan might look like.

A transition plan is an aspect of an entity’s overall strategy that describes an entity’s targets, including any interim targets, and actions for its transition to a low-emission, climate-resilient future

The process of transition planning doesn’t mean that an organisation needs to develop a bespoke ‘transition plan’. However it does need to demonstrate how it has introduced climate change considerations into existing strategy and plans. Entities should acknowledge the challenges that climate change brings and set out a case for how they will be overcome. Doing this well will give primary users of this information (investors) confidence that their investments are climate resilient.

To be successful in transition planning an organisation should:

Explore a range of options to pivot or adapt its organisational strategy.

Map out a future path that is informed by consideration of climate change risks and opportunities. The ability to be agile with this will enhance an organisation’s transition plan.

Be clear on, and take tangible actions that support climate change resilience.

From our experience supporting organisations in preparing their first Climate Statement, we have identified several challenging areas:

Evaluating your business’ current climate change activities (if any) and identifying where to build maturity consistent with the requirements of the CRD regime.

Many organisations lack a robust understanding of their climate change risks and opportunities, as well as their potential impact on the organisation. These are crucial inputs into the disclosure and for the ongoing management of overall risk.

By developing a shared view of the most material climate change risks and opportunities, you can develop strategies for mitigating and managing these risks, and to identify where further analysis is required.

Climate change scenarios are plausible descriptions of the future based on a set of assumptions about key driving forces and relationships, encompassing both physical and transition risks in an integrated manner. Due to its novel and complex nature, scenario analysis is a particularly challenging area for many organisations to tackle.

Developing robust climate change scenarios involves engaging stakeholders, employing creative thinking, utilising physical climate change data sets, and understanding the relationships and interdependencies between these inputs across a range of plausible futures.

The Standards require entities to set out climate-related metrics and targets. Through sharing this information, readers of Climate Statements can see how a company measures and manages its climate-related risks and opportunities. It also helps compare companies in the same sectors or industries. Figuring out the right metrics and targets can be tough. It's important to think them through carefully as they'll be the basis for future reporting and tracking progress over time.

To accurately quantify climate-related impacts, it is important to understand how risks or opportunities translate into to financial impacts on an organisations cash flow, financial position and performance. As we approach the second year reporting requirements, entities should consider how to quantify risks and opportunities in a meaningful way that meets the standard’s requirements.

Determining the strategies and actions to address the impacts of climate change involves identifying and implementing measures to reduce greenhouse gas emissions, increase energy efficiency, promote renewable energy sources, and enhance resilience to climate-related risks.

In New Zealand and across our PwC global network, we are hearing that pressure to understand and disclose climate-related risks is mounting from investors and banks. We have seen plans or policies around climate change risk become a condition for services such as refinancing.

Around the globe, sustainability and climate change has grown to be one of the biggest drivers of transformation and a consideration for organisations across all sectors at the executive and board level. In New Zealand, robust and credible analysis of climate change impacts continues its rapid development from a ‘nice-to-have’ to a ‘need-to-have’. The most effective time to take action to address the issues and opportunities it represents is now.

Developing a Climate Statement is a complex undertaking for any organisation. Preparation of compliant disclosures requires significant time, expertise and engagement across the business.

We understand that organisations are under pressure to get this done in time for upcoming disclosure deadlines. Our PwC team has extensive capability, experience and understanding of the Climate Standards. We combine climate risk assessment, scenario analysis design, GHG emission measurement and management, risk management and governance expertise, to help organisations confidently prepare for a climate-related disclosure.

Find out more about our Sustainability, Climate and Nature services here.

James Ayling

Hunter Douglas

Climate Scientist & Manager, Sustainability, Climate & Nature, Wellington, PwC New Zealand

+64 27 336 2557