We are pleased to release the first Treasury Broadsheet publication for 2024.

While we are only four months in, it is becoming increasingly apparent that 2024 will be a year of change. The global political landscape may be reshaped by an unprecedented 64 sovereign nations holding general elections. From an economic perspective, a likely shift in the monetary policy stance adopted by developed economy central banks will impact financial decision making in both business and government.

In this edition of the Treasury Broadsheet, we explore the evolution of interactions between business and financial intermediaries, revisit the fundamental practices that can provide structure during periods of change, and examine high-level trends in treasury management.

Specifically, we include:

- a snapshot of the treasury trends emerging across 2024

the opportunities presented by New Zealand’s open banking framework, scheduled to launch in May

accessing borrowing through non-bank lender channels

a guide to Treasury Policy fundamentals and best practices

an overview of the underlying mechanics of merchant service fee structures.

We hope you enjoy this latest edition. Please contact our team using the details below if you have any questions or would like to discuss the articles in this publication further.

Alex Wondergem

Partner

PwC New Zealand

Click on the tabs below to learn more.

A snapshot: emerging treasury trends in 2024

This year new and unique challenges are expected for Treasurers as they navigate the unpredictability of the financial markets and business cycles.

The future of treasury lies in embracing technology, data-driven decision making, and agility. In 2024, treasury professionals will navigate the evolving landscape by harnessing innovation, leveraging automation, and embracing digital transformation to unlock new opportunities and drive strategic value.

Our previous broadsheet discussed multiple treasury surveys undertaken in 2023 and outlined the top priorities for Treasurers.

Four emerging trends that reflect the priorities

- Prioritising data and analytics

- Embracing technology

- Rising geopolitical risks

- Championing ESG

Prioritising data and analytics

Data is now more accessible than ever before. To stay ahead of the curve Treasurers will need to prioritise a data-driven approach to treasury management.

A consistent theme in the 2023 treasury surveys was the importance of centralisation and automation of treasury processes, particularly in relation to cash and liquidity management. Through the use of data and analytics treasury teams will be able to create greater visibility, timeliness and accuracy in areas such as cash flow forecasting. Ultimately, aiding the centralisation of the treasury function.

Embracing technology

Taking advantage of the ever-evolving technology landscape will also be pivotal for treasury functions this year, with the potential for artificial intelligence (AI) to reshape the treasury landscape as we know it. Areas in which AI will be of most use for treasurers are the automation of existing treasury processes and cybersecurity.

API (application programming interface) will be another important digital innovation. APIs will be significant to treasurers as they aid the centralisation of the treasury function. For a more in-depth discussion of APIs please see the article on open banking also included within this broadsheet.

Rising geopolitical risks

Escalating geopolitical tensions related to trade disputes, war conflicts and other geopolitical events can disrupt supply chains, cost structures and cause volatility in financial markets.

To mitigate these uncertainties, treasury teams may look to run scenario testing, diversify supply chains and realise a contingency plan to protect business objectives.

Championing ESG

Environmental, Social and Governance (ESG) is becoming increasingly important for treasury functions to consider. Treasury teams will need to place greater emphasis on reporting ESG outcomes while also working to align their strategy with the business’ overall ESG objectives.

ESG considerations for corporate treasurers may include:

Utilisation of sustainability-linked finance e.g. green bonds.

Adoption of treasury policies which speak to sustainability measurements and reporting.

Building of new and existing relationships with both internal and external stakeholders that align with ESG priorities.

In relation to the above trends, when faced with uncertainty, corporate treasurers must learn to adapt to evolving financial market conditions and business cycles. Success will depend on their ability to utilise new technologies combined with the capability to pivot decision making to safeguard against business and financial market challenges.

Open banking: empowering consumers and driving innovation

A revolutionary way for financial data to be exchanged and accessed is coming to New Zealand this year with the introduction of open banking.

What is open banking?

Open banking is a collaborative model that decentralises financial services and enables third-party providers, like fintechs, to securely access customer banking data via APIs. The intent is to promote competition, personalised financial services, and innovation in the finance industry.

Open banking revolutionises the conventional banking model by enforcing standardised data formats and secure communication protocols, with the aim to encourage a fairer and more competitive financial services landscape in New Zealand.

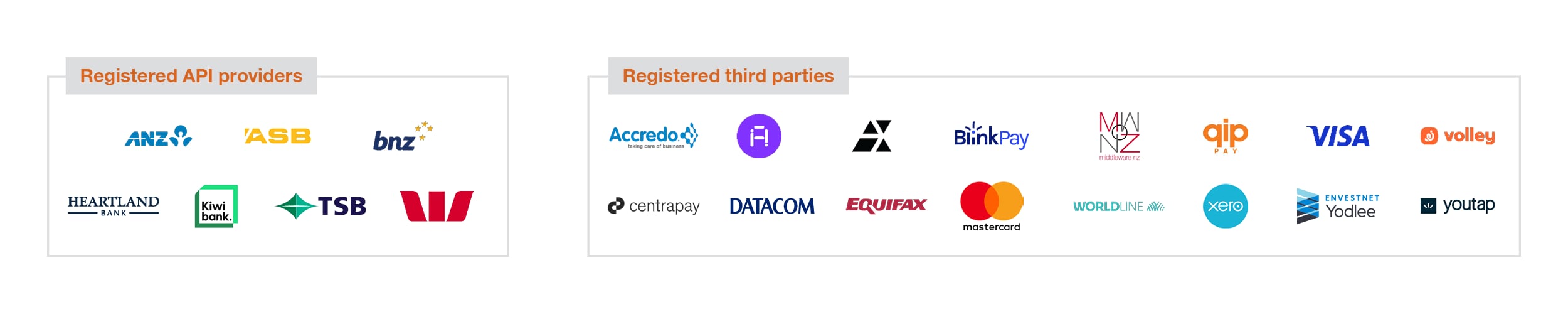

From May 2024, four of the banks - ANZ, ASB, BNZ, and Westpac - must have the ability to allow customers to easily access or switch financial services providers through the open banking model. Kiwibank is to be included in the plan from May 2026. This will have a significant impact on the vast majority of consumer bank accounts across Aotearoa. There are currently 16 third party vendors including Visa, Mastercard and Xero set to use customer bank data through the API pipeline, opening up their services to bank customers.

The rise of fintechs:

Nipping at the heels of the conventional banking system, the fintech industry is experiencing rapid growth on a global scale with digital banking and financial services transforming the financial landscape. These tech players are offering apps and services that can be cost effective and efficient, with development teams nimble enough to keep in step with higher customer demand and expectations. Traditionally, financial data has been centralised within banks and institutions, being difficult and cumbersome to extract. This is all about to change with open banking.

What is an API? API is the acronym for ‘Application Programming Interface’. An API is a collection of guidelines or protocols that enable software applications to interact with each other in order to share data, features, and functionality in a secure environment.

Click on the tabs below for more information on opening banking.

APIs - Banks and financial institutions create open banking APIs that facilitate the sharing of data with registered third-party (fintech) providers. This allows for secure communication and data exchange between the bank's database and these third-party apps.

Customers consent and sharing - To put the customers in control, account holders can instruct their bank to share specific financial data with third-parties. These providers will then be able to access specific transactional information to assist to provide the customer personalised services in a secure environment.

Security - Banks and financial institutions have strong security measures in place to safeguard the confidentiality of customer data.

- Regulations and Open Banking Standards -

- Payments NZ serves as a governing body for the New Zealand payments system and has been tasked by the industry to set up the API Centre which will connect banks with registered third parties.

- To support Open Banking in Aotearoa, in 2021 the New Zealand government of the day agreed to establish a Consumer Data Right (CDR). A CDR empowers consumers to securely share their data with trusted third parties, providing personal control over to whom and what information is shared. The proposed legislation was released in draft form. The current government has recently announced its intention to proceed with this CDR legislation.

Open banking offers choice and personalisation, speed in payments and reconciliations, collaboration, convenience which in turn makes it cost effective. It provides access to a wider range of financial services and products that were previously harder for a consumer to access.

The open banking model places the customers' needs first, empowering them with the ability to select and manage who has access to their financial data in order to receive targeted solutions.

There are specific uses that are emerging from early adopters globally. Here in New Zealand these may evolve as our open banking regulatory framework and adoption progresses.

Examples of different uses include:

- Account consolidation: Open banking allows consumers to consolidate their bank accounts from different providers into a single platform or app. This provides one view of their finances, making it easier to manage and track money.

- Payment initiation: Payments can be initiated directly from bank accounts without the need for traditional payment methods. This streamlines the payment process and provides secure and convenient payment options.

- Personalised financial products and services: With open banking, third parties can access consumer financial data with their consent. This allows for the development of personalised financial products and services, such as tailored loan offers, investment advice, or insurance recommendations based on a user's financial profile and information. Targeted services can be useful to a consumer who wants to view products and services specifically suitable to their personal circumstances. Consumers' financial data can be used to offer solutions to all sorts of financial needs.

- Enhanced fraud detection and prevention: Open banking can assist to improve fraud detection and prevention by enabling the sharing of financial data between providers. This will allow improved analysis of transactions and patterns, assisting to identify and prevent fraud.

- Streamlined loan applications: Open banking will simplify the loan application process by allowing lenders to access a user's financial data directly from their bank accounts. This eliminates the need for manual systems and processes which will provide lenders with real-time and accurate information to better assess creditworthiness.

- Cash and liquidity management: Insights from the 2023 PwC Global Treasury Survey, discussed in our previous Treasury Broadsheet article, outline that cash and liquidity management was stressed as the number one priority for modern treasurers, with digital enablement highlighted as an important technological innovation moving forward. Open banking is one innovation that opens the door to a new way of addressing cash and liquidity management, in addition to other financial challenges.

While open banking offers numerous opportunities and benefits, there are a number of considerations. These include security and privacy concerns. As it involves the sharing of financial data with third parties, concerns have been raised about data breaches, and unauthorised access. There is also an increased vulnerability to fraud, with more parties involved in the accessing and processing of customer data. This could lead to an increased risk of fraud and scams.

Once the model has launched, open banking in New Zealand will be relatively new, with consumers not necessarily aware of the benefits and how to benefit from them. This could lead to a slow uptake and hinder the full potential.

There is also an aspect of complexity and technical challenges in implementation, as the open banking framework requires significant technological infrastructure and integration. Smaller banks and fintech startups may face challenges in competing with larger, more established banks and institutions, potentially leading to an uneven playing field and quelling competition.

Open banking began to gain traction in the early 2010’s, and since, global uptake has been mixed. While some countries have embraced an open banking model, others are still in the early stages.

The European Union (EU) introduced the Revised Payment Services Directive (PSD2) in 2015, which laid the foundation for open banking in Europe. In the UK, the open banking model was launched in 2016 with a generally positive reception. The UK has seen a significant increase in the number of fintech and other third party financial services providers but there are ongoing efforts to encourage consumer adoption.

In other countries, such as the US, the uptake of open banking has been relatively slow. While there is growing interest it has been limited with no regulatory framework (such as the PSD2 in Europe) and driven by individual agreements between financial institutions and third-party providers. Recently however, there have been developments, with the The Consumer Financial Protection Bureau (CFPB) in the US proposing rules to encourage the sharing of financial data.

In Australia, open banking has been well received, with significant progress made in recent years. Customer Data Right (CDR) has been introduced, which includes open banking in its initial phase. The Australian Government has been proactive in driving open banking awareness and adoption to both consumers and the financial services industry.

Open banking has the potential to make significant and positive changes to the financial industry both in New Zealand and globally.

The extent New Zealand adopts and accepts open banking is still unknown, and undoubtedly, there will be considerations to navigate. However, the model opens the door to a new way for consumers to experience financial services, providing individuals with better choice, new tools, and improved access to unlock a wide range of tailored financial products and services. From May 2024, the future of banking in Aotearoa is open, to collaboration, innovation, and empowering consumers with greater control and choice over their financial outcomes.

Authored by Natasha Reddington with Duncan Roff

The rise of non-bank lenders

The start of 2024 has seen its share of volatility in the financial markets as we face another year of uncertainty. Inflation is remaining stubbornly high and correspondingly interest rates look to remain at current levels for longer.

It’s difficult for businesses to plan for the future or make significant decisions in these uncertain times and this is the same for lenders and investors. The result can be reluctance from lenders and investors which can be frustrating for businesses if they are looking to access additional capital, whether this is debt or equity.

The ongoing ability to access capital is important for businesses as they plan for the future.

As businesses look to raise capital, it is important to take a broad market view to ensure there is sufficient liquidity and diversification to enable a successful debt raise.

Following global trends, we are observing the rise of non-bank lenders in the New Zealand market in the debt space. These non-bank lenders consist of offshore credit funds as well as domestic non-bank lenders and can offer borrowers an attractive alternative to traditional bank finance. The volume and diversity of appetite across the risk spectrum is compelling. Some of our key observations from working with non-bank lenders are:

- One size does not fit all: They often have specific sector, return and volume requirements. - it is important to understand the right parties to approach.

- Flexibility: They are often able to offer more flexibility in terms than traditional bank finance.

- Higher risk appetite: Appetite for risk and leverage varies for each lender. Non-bank lenders typically have a higher level of risk appetite than traditional banks.

- Higher pricing: Flexibility and an appetite for more risk means higher pricing than traditional bank finance.

If businesses are looking to approach lenders for financing (including new to bank and refinancings), look for a broad base of lenders to diversify and mitigate against relying on a single lender or type of lender.

PwC’s Debt and Capital Advisory team can support the preparation of required debt financing materials to help you achieve an optimal outcome through a robust and independent process that goes beyond an initial transaction.

Authored by Janet Chang

A guide to best practice treasury policy fundamentals

Effective treasury management plays a crucial role in ensuring a company’s financial stability and growth. Therefore, it is important that a business has a fit-for-purpose Treasury Policy.

A Treasury Policy is an essential tool for businesses to manage financial risks, maintain liquidity, and make informed decisions that align with their strategic objectives. It also provides a structured and consistent approach to treasury operations, ensuring risks are properly identified, measured, managed and reported.

A ‘good’ Treasury Policy will help ensure financial results are within expected ranges and ensure sufficient cash flow for liquidity purposes. The Treasury Policy document should also have measures in place to prevent unauthorised transactions and protect assets.

A treasury function’s primary purpose is to manage financial risk, maintain sufficient liquidity, and optimise cash flow.

In order to manage risks, they first need to be identified. These risks include market risks such as interest rate and currency fluctuations, credit risks, liquidity risks, and operational risks to name a few. The scope of a Treasury Policy should be tailored to the specific needs and risks identified by the business.

Treasurers then need to quantify the potential financial impacts of the risks identified. A materiality and risk matrix is an easy way to measure this. For example a company, Dynamic Limited, might have $10 million of USD exposure each year and a budget rate of 0.6200. If the currency moved by 1 cent, Dynamic Limited would be impacted by ~$256,000. The company can do this for the various risks identified which will help quantify the potential adverse impact on earnings of not managing the relevant risks.

The company must then agree on its level of risk tolerance before developing policy frameworks.

Establishing risk tolerance levels is a critical step in developing a risk management policy.

Treasurers work closely with senior management to set acceptable levels of risk exposure. Based on this, comprehensive risk management policies that guide decision-making across the organisation are created.

Key components of a comprehensive risk management policy

- Funding and liquidity risk

- Interest rate risk

- Foreign exchange risk

- Counterparty credit risk

- Best practice tips for Treasury Policy implementation

Funding and liquidity risk

Liquidity risk management focuses on ensuring that a business can meet its cash obligations as they arise. Effective management of this risk involves measuring, managing and maintaining a liquidity buffer, in addition to efficient cash management practices.

Approaches to determining liquidity requirements vary, but some of the most common are listed below:

Based on a percentage over peak debt.

Based on a certain amount of months operating expenses.

Based on meeting the next 12 months dividends.

Based on a portion of debt maturing in the next 12 months.

Based on a fixed dollar amount.

Funding risk management is concerned with ensuring that debt funding can be secured or refinanced in the future at acceptable terms regarding both cost and term.

At a single point in time, credit markets may face constraints and offer pricing and conditions that are less favourable than what is currently available. A key control of funding risk management is to spread and smooth debt maturities. This aims to minimise the concentration of risk to ensure that overall borrowing costs are not unnecessarily increased, or the debt maturity profile compromised. A funding maturity framework should be tailored to an organisation's risk profile. An example could be ‘No more than 25% of core debt may mature within any 12-month period’. A more comprehensive funding policy would have minimum and maximum percentages for each time band e.g. 25% min and 85% max maturing in the 0-2 year time band.

Interest rate risk

Interest rate risk refers to the possibility that borrowing costs may significantly exceed business plans due to fluctuations in market wholesale interest rates.

The primary aim of interest rate risk management is to reduce uncertainty associated with changes in wholesale interest rates by fixing interest rates.

This involves proactively managing the underlying interest rate exposures to achieve an acceptable degree of predictability in interest expenses.

In order to manage the interest rate risk a business may choose to borrow on a fixed rate basis, or alternatively, use interest rate hedging instruments to fix or partially fix debt borrowed on a floating rate basis. Reasons for using interest rate hedging instruments include:

Interest rate hedging instruments can be applied to a portfolio or tailored for a specific exposure.

Forward protect interest rate risks before new borrowing or refinancing is undertaken.

Having a greater choice of instruments.

Swaps and options have the ability to be re-profiled as forecasts, and interest rates change, where fixed rate borrowing does not.

Efficient use of bank credit.

The interest rate risk framework itself should be tailored to the organisation's risk tolerance. Most corporates and council’s use a corridor-styled interest rate Policy approach. This has minimum and maximum fixed percentages for each time period. The time periods and percentages should be determined by the organisation based on its forecastability and risk tolerance.

Foreign exchange risk

Foreign exchange risk refers to the potential impact of fluctuations in exchange rates, leading to New Zealand dollar (NZD) cash flows that deviate from the anticipated forecasts.

Most local importers and exporters will identify their primary foreign exchange risk as transactional, arising from purchases in foreign currency or sales receipts in foreign currency.

In order to manage foreign exchange risks, the business should have a management framework in place to manage future exposures to foreign currency. As near term forecastability is more accurate than longer-term forecasts, generally minimum and maximum enforced hedging percentages are higher in the shorter time bands and move lower as they move into the longer term time bands. The minimum and maximum percentages and time bands should be tailored based on the ability to forecast and risk tolerance levels of the organisation.

A company with low visibility on forecasts beyond 12 months may have lower minimum hedging percentages beyond 12 months. However, a company with seasonal forecasts may have better visibility on longer term forecasts and will therefore have a higher minimum enforced hedging percentage.

Counterparty credit risk

Counterparty credit risk is the risk of losses to the company (realised or unrealised) arising from a counterparty defaulting on a financial instrument where the company is a party.

The credit risk to the company in a default event will be weighted differently depending on the type of instrument entered into. The company is exposed to counterparty credit risk when placing bank deposits, executing interest rate swaps and entering foreign exchange financial instruments with banking counterparties. Counterparties and maximum credit limits within a policy are approved on the basis of minimum long-term and short-term credit ratings.

It is suggested that limits are spread amongst a number of counterparties to avoid concentrations of credit exposure.

Best practice tips for Treasury Policy implementation

In our experience, we observe that having a disciplined and proactive approach to treasury management drives successful outcomes. It is important to remember that as a Treasurer you are a risk manager and not a trader. The task is to protect and manage business cash flows. This means staying within the Board approved Policy limits despite your personal view on the currency or interest rate outlook.

As a considered Treasurer, it is important to look past short term market volatility and have a medium to long-term view when making strategic treasury decisions.

In order to make informed decisions based on accurate treasury data, regularly interacting with internal stakeholders and keeping forecasts updated is important. Hedging strategies may need amending. A robust treasury analytic and reporting tool (such as PwC’s Treasury Intelligence) provides confidence in making strategic treasury decisions and reporting to the Board.

Authored by Rajeev Verma

Uncovering merchant services fees

If you operate a business that accepts card payments, such as retail stores, restaurants, e-commerce websites, and service providers, you are most likely to face Merchant Service Fees. These fees can range from 0.5% to 3.0% of total sales value- not an insignificant cost to any business. It is important to understand what you can and can’t control when negotiating merchant fees with your financial services provider.

Merchant Service Fees, also known as card processing fees, are charges a business pays for accepting credit and debit card payments. These fees are typically paid to payment processors or merchant service providers who facilitate the transaction between the business and the cardholder's bank.

In New Zealand, Merchant Service Fees are typically calculated as a percentage of the transaction amount. The exact fee can vary heavily depending on factors such as the type of card being used, the payment processor, the volume and type of transactions, and the average transaction value. Below, we have broken down what’s included in Merchant Service Fees.

Interchange Fee:

Interchange is the fee that the cardholder's bank (the "Issuer") charges for the provision of card payment services.

It is a variable fee set by the card scheme providers (Visa/Mastercard) and depends on the customer and their purchase. Fee factors include the nature of the transaction, card type, merchant industry and processing environment for the transaction. A higher interchange fee will apply in certain circumstances such as when an international card is used, or if a purchase is made in an online environment. These fees have been regulated and capped in New Zealand since 2022.

A transactional banking provider charges the business for this but does not make any margin on the interchange fee. Instead the Issuer’s bank is the recipient of this fee for the provision of card payment services.

Scheme Fee:

This is the fee charged by the card scheme (Visa/Mastercard) for the provision of the card payment services.

Again, the Issuer’s bank charges the business for this but does not make any margin on the scheme fee.

Switch or Transaction Fee:

The fee charged by the payment network or e-commerce gateway to process a transaction, players in this industry include Windcave, Paymark, and Verifone.

Bank Fee (acquirer margin):

The fee the Issuer’s bank charges for the provision of card payment services. This can include bank margin, merchant support, fraud prevention and authorisations.

Can fees be reduced?

Most of the fees listed are not negotiable unless your business generates significantly high card sales value. There are ways businesses can recoup or reduce Merchant Service Fees. The most common method is for businesses to pass on their fees to their customers, through either a payWave or credit card surcharge. This has become more common and accepted by consumers over the past few years.

Businesses can also promote the use of debit cards in their stores as part of a broader channel management strategy. Debit cards are subject to substantially lower interchange fees than credit cards.

It is also worth noting that online or ‘card not present’ transactions have the highest interchange fees because the chance of fraud and chargebacks is higher without the card present.

Today, Merchant Service Fees appear to be a necessary part of doing business, with the cost mostly outside the control of a business. Gone are the days of cash transactions and bustling retail outlets - today’s customer wants to be able to purchase anything from a takeaway meal to new whiteware from the comfort of their couch.

For businesses it is important to understand and account for these fees when setting prices and managing finances. By doing so, there can be an accurate assessment of the cost of accepting card payments and informed decisions made about payment processing options.

Authored by Ben Keen

Contact us