Introduction

We are pleased to release our second Treasury Broadsheet publication for 2024.

Over the past year, the global economic landscape has been marked by ongoing challenges, tempered recently by a cautious sense of optimism. As we transition into spring, indicators of economic recovery are beginning to emerge. Borrowers are poised for relief as central banks adjust monetary policies in response to decreasing inflation. In New Zealand, although the overall economic outlook remains muted, there is an anticipated rise in both consumer and business confidence, bolstered by falling interest rates.

The ANZ Business Outlook survey for August 2024 even reported the highest confidence levels returning in a decade. The resilience of an economy is tested during periods of slowed economic activity, with recovery and growth phases highlighting a business's ability to adapt, innovate, and overcome obstacles. Treasury managers play a pivotal role in maintaining this resilience, guiding businesses through cyclical economic downturns, and preparing for inevitable shifts in the economic cycle.

We hope you enjoy this latest edition. Please contact our team using the details below if you have any questions or would like to discuss the articles in this publication further.

Alex Wondergem

Partner

PwC New Zealand

What's in this edition?

Click on the tabs below to learn more.

What are the latest trends in Treasury?

Have the priorities of treasurer’s remained consistent over time, or have they evolved like the economy, and technology? Treasury surveys, such as the PwC Global Treasury Survey and the European Association of Corporate Treasurers (EACT) Treasury Survey, seek to analyse the evolving priorities of treasurers by gathering insights from hundreds of professionals across the globe in the treasury field. A lot has changed over the past few years, since the global pandemic, from quantitative easing through to the rapid rise in inflation leading to widespread central bank interest rate rises around the world.

This year, the results have changed significantly. Fundamental issues are back at the forefront of the treasurers’ priorities.

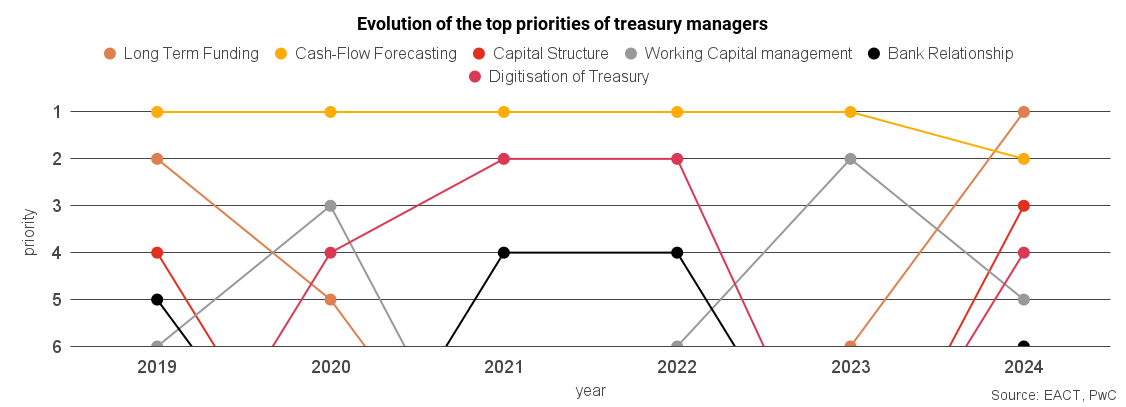

As shown in Chart 1, the 2024 EACT survey shows distinctive changes from the year prior. The need for long-term funding in a world of elevated interest rates (something not fully encapsulated in the 2023 survey) stood out as the top priority in 2024, rising from sixth place. How have the priorities of treasurers evolved with time, and what could these priorities look like in years to come?

Cash is king: the persistent focus on cash-flow forecasting

One of the most enduring priorities for treasurers has been cash-flow forecasting. From 2019 through 2024, this concern has consistently remained at the forefront, driven by the imperative to navigate economic uncertainties and ensure liquidity.

The pandemic, supply chain disruptions, and ongoing market volatility have only amplified the importance of accurate and reliable cash-flow forecasting.

Treasurers have continually faced the challenge of predicting future cash flows amid rapidly changing conditions, underscoring the critical nature of this priority. Key points:

Year after year, cash-flow forecasting remains a core fundamental of treasury.

Liquidity is essential for any business, and cash-flow forecasting enables companies to prepare for various economic scenarios. Liquidity risk management can be addressed in the treasury policy to ensure a business can meet its cash obligations as they arise.

The ability to predict cash flows is crucial during periods of market volatility and disruptions, while maintaining a liquidity buffer amount to support the business through these times.

The accelerating pace of digital transformation

In recent years, emphasis has been placed on treasury software and dashboarding solutions, such as our PwC New Zealand, cloud-based FX risk management platform, Treasury Intelligence. The platform highlights the need for ‘real-time treasury’ - the ability to have information readily available and on demand. Naturally, the need for improved enterprise-wide IT systems has also grown with time.

The pandemic further accelerated this trend, as businesses rapidly adapted to remote working environments. The shift from basic digitisation in earlier years to advanced hyper-automation by 2024 and the introduction of artificial intelligence, reflects a continuous effort to leverage technology to address both longstanding and emerging challenges. The adoption of new technologies has not only streamlined processes but also enhanced risk management and improved decision-making capabilities.

The fundamental question for treasurers remains: ‘How do we use new technology to solve old problems and tackle new ones?

Long-term debt financing: strategies for a shifting interest rate environment

Long-term debt financing and capital structure have experienced varying degrees of importance over the years. Although these issues were not a top priority during the early stages of the pandemic, they surged to the forefront by 2024. This shift can be attributed to the rapid rise in interest rates in 2023 and the subsequent cautiousness from banks to extend credit.

The optimal capital structure of a business needs to be considered across the business cycle and fundamentally support the long-term business plans. Mitigating short-term financial market shocks by incorporating long-term debt and diversifying debt maturities will always be a key objective of effective treasury management.

The evolution of treasury priorities from 2019 to 2024 (refer Chart 1) paints a vivid picture of a dynamic and adaptive approach to treasury management. The unwavering focus on cash-flow forecasting, the rapid pace of digital transformation, and the shifting importance of long-term financing and capital structure have profoundly shaped the role of treasurers over these years. As treasurers navigate an ever-changing landscape, their ability to prioritise effectively and harness technology will be pivotal in ensuring their businesses financial stability and growth.

In summary, fundamental treasury issues have once again taken centre stage in treasurers’ priorities. The resilience of cash-flow forecasting, the embrace of digital transformation, and the focus on an optimal capital structure, including the importance of long-term debt funding are clear indicators of the continued strategic importance of the treasury function. As the economic landscape shifts and technology advances, treasurers must remain agile, continually adapting their approach to meet new challenges and seize emerging opportunities.

Authored by Duncan Roff

Back to the tabs

When to use complex treasury risk management strategies

With volatility returning to financial markets in the last few years and an elevated level of interest rates, there have been more opportunities for corporate treasury managers to add value to their organisations. In many ways, the core framework of treasury policy and vanilla hedging instruments have been able to do this. However, more advanced treasury management strategies have become more topical and attractive. This article explores a few cases within the toolkit of most corporate treasury managers.

Earmarking purchased FX options

The first of these is the use of earmarked purchased options. For example, a treasury manager might purchase a six-month NZD call option intending to cover exposures in the next financial year, or out one to two years. By buying a shorter-dated option, a manager has the ability to buy time if the exchange rate continues to move in favour of the exporter saving on the premium cost of a long-dated FX option. At maturity, a manager can decide whether to roll the option contract out into the longer-term time period as initially planned or adjust the hedging strategy accordingly.

Earmarking refers to buying an outright purchased option for a term shorter than the underlying exposure amount.

One recent example has been in the NZD/EUR and NZD/GBP cross rates. Currency pairs had fallen to attractive levels for an exporter, and with many already highly hedged with forward exchange contracts, purchased options have provided the ability to continue to lock in these attractive rates and buy some time if the currencies revert higher. Because volatility has been relatively low (prior to the Bank of Japan), the effective cost of this option strategy has been relatively cheap and is attractive when considering the all-up worst-case rate.

Considering the attractiveness of different interest rate options

With it becoming increasingly clear that the monetary policy cycle has peaked, and aggressive moves in interest rates now widely priced in, there are questions around how best to capitalise on this for long-term risk managers. The outright level of swaps is increasingly attractive, both when considering how many cuts are now priced in as well as against the long-term ‘neutral’ rate considered by the RBNZ. But, with many having layered in a healthy amount of hedging with swaps, the attractiveness of interest rate options is also worth considering. Because of the steep nature of cuts priced in, purchased borrower caps can be hard to price since Bank Bill Reference Rates (BKBM) is well above the swap. For that reason, swaptions (i.e. an option to enter a future swap) are staging a modest comeback, at least for consideration, even if a forward starting swap remains the preferred option.

There have also been some instances where an outright new swap (e.g. for two years) can be combined with selling an interest rate option (e.g. for the three years that follow) to reduce the near-term swap rate while creating a similar profile if rates continue to move lower (e.g. compared to the current two and five year swaps). This is quite an advanced strategy and most treasury policies will restrict the selling of outright options. This type of strategy is only ever applicable as a top-up or an addition to the base level of hedging where the primary objectives of the policy are already being met.

Either way, the return of volatility across both interest rate and foreign exchange markets has been welcomed by many risk managers. Whether the global cutting cycle will lead to a sustained cyclical trend change across different currency pairs remains to be seen, but awareness of the different strategies that can be used will be helpful for those seeking to continue adding value while meeting their treasury objectives.

Authored by Tom Lawson

Treasury themes shaping governance and board decisions

The last few years have been characterised by a series of challenges, stress tests, and abnormal situations that have tested the robustness and completeness of treasury policies. The pandemic, in its early phase, was a true test of businesses' liquidity policies and the strength of their banking and funding relationships. The subsequent boom in economic activity then challenged procurement, foreign exchange risk management, and pricing strategies in ways that were highly unexpected in the early days of the pandemic. The economic response, marked by a historic and aggressive increase in interest rates by central banks, has in the last few years, tested the interest rate hedging frameworks and the capital allocation decisions that come with a higher weighted average cost of capital.

Stepping back, this has clearly created a range of robust and challenging situations that have tested the resolve of the treasury policy. With many companies now conducting annual or tri-annual policy reviews, we have noted our observations and key themes from board meetings and broader governance arrangements below.

Adequacy of management discretion

Despite the challenges, the level of discretion afforded by boards to management has been a necessary ‘shock absorber’ to many of the above risks. In some cases, more robust and timely reporting has been required, but overwhelmingly clients that make use of modern, forward-looking or dashboard reporting and have a reliable risk position have found the level of trust between governance and management to be reasonably robust. It has also allowed for continued proactive risk management with market volatility serving as a ‘friend’ not a ‘foe’ for treasury outcomes.

Rewarding strong and stable banking partners

Corporate borrowers (or organisations using FX or hedging derivatives) need to build trust and work constructively with their bankers, through different operating environments. We continue to support the use of a contestable process to ensure strong funding or banking arrangements; however, price alone should not be the single determining factor when making these strategic decisions. Long standing banking relationships can be a key enabler to support the delivery of long-term business strategies or growth.

Stability and reliability come from collaborating with established banking partners. It's essential that this relationship is a two-way street where communication flows both ways and pricing is consistent and competitive.

Well-constructed risk management frameworks really do work

A well-constructed and well thought out risk management framework and approach, that aligns with the underlying objectives of the business, have held up well. While some boards have challenged the tenor or made some adjustments to minimum and maximum limits percentages, in very few cases has the spreading and smoothing approach, the level of volatility or the achieved result driven boards to fundamentally challenge whether the policy has achieved its stated purpose.

Direct linkage between the capital structure decisions and Treasury Policy

There is a growing awareness of the linkage between an organisation’s Treasury Policy and capital structure and the willingness to document these important components of the treasury function in one place. These linkages manifest in the funding policy or the approach to liquidity management along with the alignment with credit rating methodologies or internal credit or debt capacity guardrails.

The rise of interest rates and the more challenging funding environment that has followed has underscored the connection between capital structure decisions and the mechanics within the treasury function.

Authored by Tom Lawson

How can slow credit growth benefit borrowers?

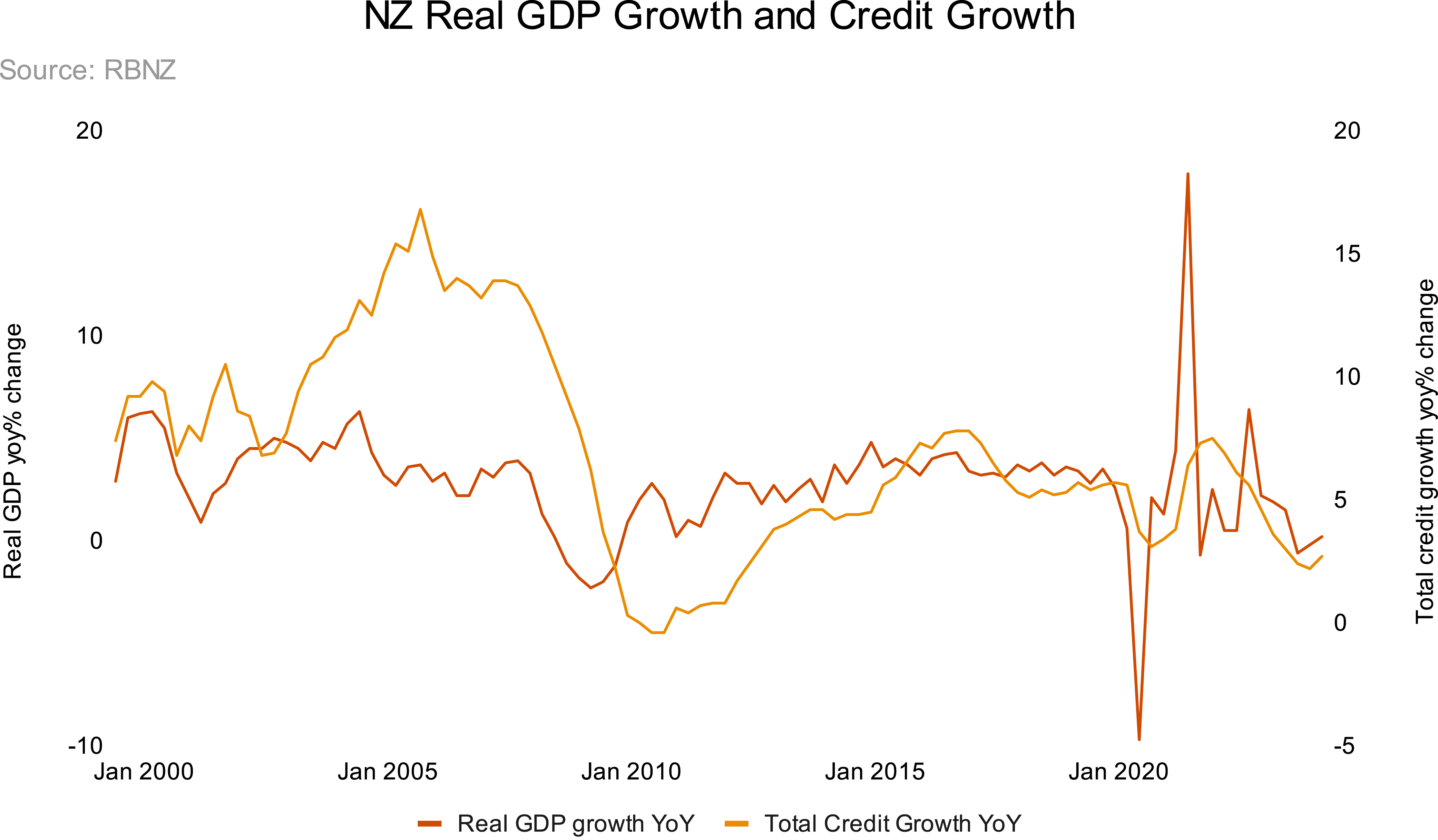

Following multiple periods of flat or negative GDP growth and a widespread economic slowdown across New Zealand, it comes as little surprise that recent credit growth has been subdued. Historically, in New Zealand, credit growth has been closely correlated with GDP growth, and both indicators are currently at lows not seen since the Covid-19 pandemic and the Global Financial Crisis.

Credit growth, which measures the increase in the amount of credit available to borrowers, is a critical indicator of economic activity. It reflects the willingness of financial institutions to lend and the demand for borrowing from businesses and consumers.

Over the past 12 months, total credit growth in the New Zealand economy has been relatively stagnant at 2.7% year on year (YoY), significantly lower than the 6.9% (YoY) average since records began in June 1999. Similarly, GDP growth has been negative in four of the last six quarters and has contracted on a per capita basis.

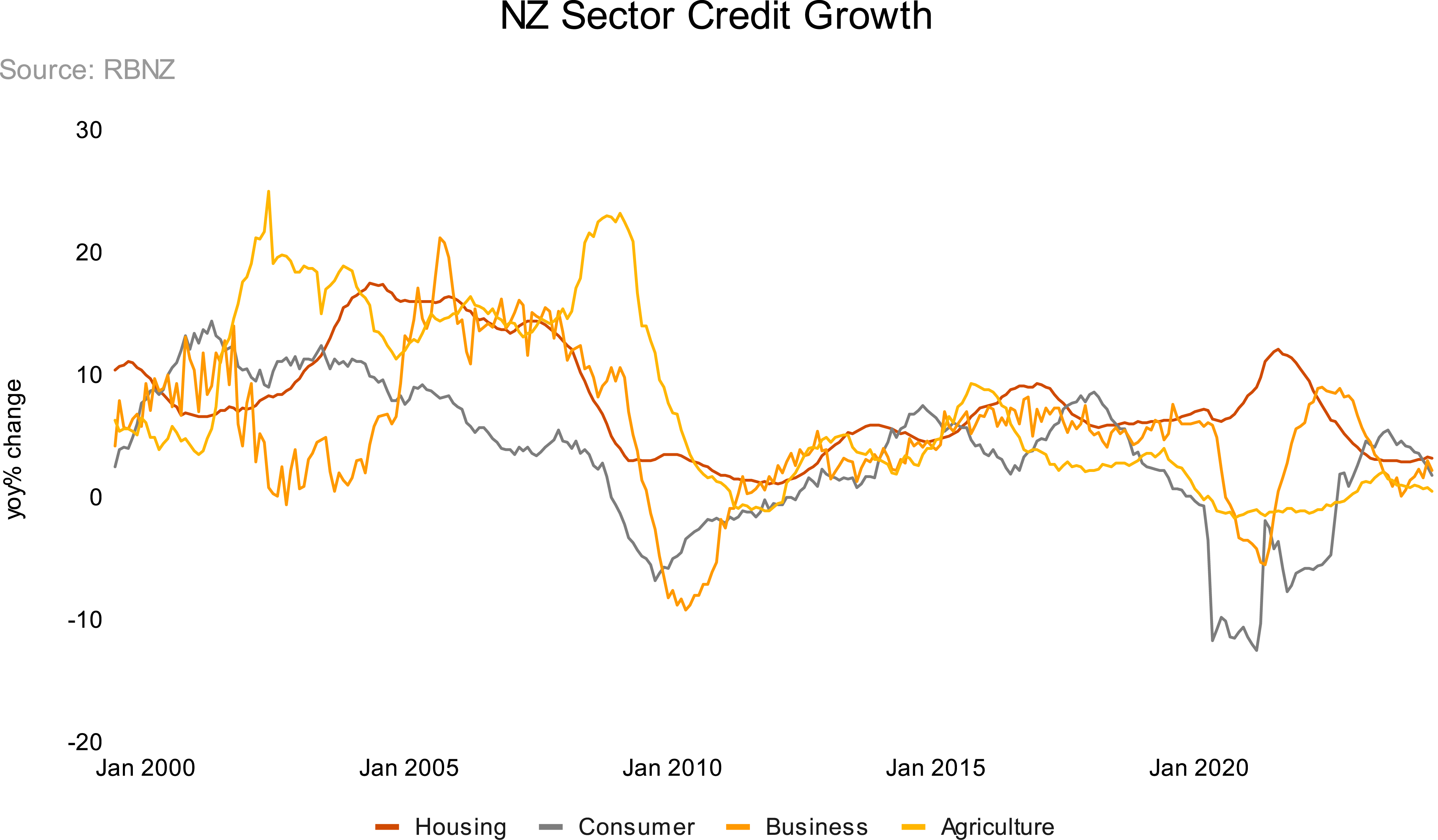

An analysis of credit growth by sector presents a varied picture, with all sectors currently below historical averages but showing different responses to the Reserve Bank of New Zealand’s (RBNZ) tightening cycle between 2021 and 2023.

How is this playing out in different sectors?

Housing

Housing credit growth most recently peaked in July 2021 at 12.1% YoY, driven by historically low mortgage rates and readily available credit. Since then, various measures including the removal of interest deductibility, the extension of the bright-line test, reinstatement of LVRs, and the CCCFA, combined with interest rate hikes between 2021 and 2023, have moderated mortgage growth back to near historic lows. More recently, the trend has reversed with RBNZ’s August 2024 0.25% OCR reduction already having an impact on mortgage rates.

Business

Business credit growth peaked in September 2022 at 8.9% YoY, the highest level since the pre-global financial crisis era, but has since retracted as higher interest rates have permeated the economy, affecting businesses.

Consumer

Consumer credit growth was severely impacted by the Covid-19 nationwide lockdown in 2020, dropping to -10.8% YoY, the lowest level on record, and experienced another hit during the Auckland lockdown in 2021. Since then, consumer credit growth has recovered to 1.8% YoY in June 2024, aligning more closely with the long-term average of 3.5% YoY.

Agriculture

Agricultural credit growth has remained relatively stable but at historical lows in recent years. This stability is largely due to weak commodity prices since 2022 across meat and dairy, with horticulture being an exception due to flooding. Additionally, high agricultural cost inputs and interest rates have compressed margins.

Amidst low credit growth, New Zealand banks are forced to compete for market share to grow their lending books.

A closer examination of business lending data by major banks reveals no clear winners or losers in the current market share dynamics. In an environment of low credit growth, banks are compelled to gain market share from one another to achieve growth. This competition has led to creditworthy borrowers successfully running RFP processes to secure competitive pricing and flexible terms and conditions.

This observation is consistent with current trends in the bank lending markets. Creditworthy borrowers have successfully run RFP processes to secure competitive pricing and flexible terms and conditions. As always, demonstrating credit strengths and risk mitigations while speaking with the right lenders are key to securing the best outcome.

If you would like to explore your borrowing options further, please get in touch with our debt and capital advisory team to see if we can assist.

Authored by Rob Ford

How will Artificial Intelligence impact treasury?

Driven by advancements in technology and changes in consumer expectations, finance technology ("fintech") continues to evolve in our increasingly digital world. It offers constant improvements and enhancements all the while providing greater visibility to support businesses in strategic decision-making and operational efficiency. One emerging technology is the increasing use of artificial intelligence (AI), and machine learning, to add tools to the toolkit and better support corporate treasury functions.

The role of a Treasury Management System

The most commonly used treasury tech is in a core Treasury Management System (“TMS”). The role a TMS plays is to primarily centralise and automate various treasury activities, providing useful tools, automating tasks and visibility through reporting (see Table 1). Over the next decade, and with rapid advancements in AI, from improving data-driven decision-making to automating routine tasks and ensuring compliance, treasury teams globally are positioned to undergo transformative operational changes through this ‘intelligent tech’.

While the use of a treasury management system continues to currently serve as the foundation for treasury technology, AI is expected to increase the efficiency and productivity of treasury teams and move the role of finance from reporting on the past to a focus on the future.

Artificial Intelligence

Artificial intelligence (AI) focuses on performing specific tasks intelligently by learning from data and making decisions or predictions based on that data. AI impacts daily life through voice assistants (Siri), recommendation systems (Netflix, Spotify), search engines (Google), social media (Facebook), email filtering (Gmail), virtual customer support (chatbots), navigation (Google Maps), and online shopping (Amazon). These systems tailor responses based on programming and data. One advanced development in AI is Generative AI (GenAI), which uses large language models (LLMs) to create coherent and contextually relevant content in text, images, and audio. GenAI generates new data that closely resembles its training data, enabling the creation of novel content.

GenAI is anticipated to impact how companies grow revenue, manage their finances including treasury functions, conduct everyday operations, engage customers and employees, build new business models, and more.

Treasury innovation enhanced by artificial intelligence

Although a treasury management system still remains the cornerstone of today’s treasury tech, the opportunity is for the use of automation, data analytics, artificial intelligence and machine learning to enhance the experience, and in particular through the use of GenAI, to provide valuable intelligent and human replicated insights.

AI can turn vast amounts of financial data into actionable insights, empowering the treasury team to make smarter, faster decisions and boost treasury performance allowing for a more strategic focus.

Treasury functions across businesses are typically diverse, and involve various processes and considerations with a unique set of needs and processes, so what works for one may not necessarily work for another. Due to this, customisation for specific needs is often required, which can be challenging due to TMS limitations or budget constraints. Therefore, combining layers of support through different tools and contexts, such as Robotic Process Automation (RPA) and Artificial Intelligence (AI), can provide greater value by offering a wider set of capabilities. Table 1 highlights the various capabilities across the below tech approaches:

Treasury Management System (TMS) |

Robotic Process Automation (RPA) and Data Analytics |

Artificial Intelligence (AI) and Machine Learning (ML) |

Software features and functionalities to support treasury management |

Automation and data insights |

Infusing AI and ML to replicate human intelligence to support decision making |

Features and functionalities that a robust treasury management system (TMS) should offer include:

|

Data wrangling/ ETL - Data wrangling involves cleaning and organising raw data for analysis. ETL (Extract, Transform, Load) is a process that extracts data from sources, transforms it, and loads it into storage. Data visualisation - uses visual elements like charts, graphs, and maps to help people understand trends, patterns, and insights within the data. Robotic Process Automation (RPA) - tech that uses software robots or "bots" to automate repetitive tasks, as example data entry, to increase efficiency and reduce errors. Advanced analytics - A method used in predictive modelling, machine learning, data mining, and statistical analysis to uncover patterns and enable data-driven decisions. |

AI is the broad concept of developing advanced machines that replicate human intelligence and numerous subsets fall within the realm of AI such as Machine Learning (MI) and Deep Learning (DL) with the most recent evolution called Generative AI (GenAI). |

The evolution of AI builds on past advancements, enhancing capabilities to offer more options and better outcomes. Older technologies often integrate into advanced versions like GenAI, rather than being completely replaced.

In which areas of treasury management will AI have the greatest impact?

Globally, AI use in treasury has already begun to have an impact and will continue to transform and shape various aspects of the function. As the technology evolves the primary impact of AI will be to enhance the skills of treasury teams, allowing them to concentrate on more strategic initiatives. Key areas of impact include:

Decision making:

GenAI will enhance decision-making for treasury teams by analysing extensive, up-to-date data to provide comprehensive insights and accurate predictions. This enables faster, data-driven decisions, reduces risk, and improves efficiency. AI-generated information allows treasurers to strategise, model, compare outcomes, and select the best options.

Risk Management:

AI helps identify and mitigate treasury risks by analysing large datasets to detect anomalies and predict issues like credit, market, and operational risks. It offers data-driven recommendations to proactively address and minimise these risks.

Forecasting:

AI uses historical and external data to provide accurate financial forecasts. Machine learning enables AI to generate new data, such as cash flow forecasts and predictive models, aiding in better liquidity management and planning.

Data Management:

GenAI simplifies vast amounts of data by efficiently collating, organising, and utilising information from various systems. Machine learning cleans and standardises data, uncovering trends and forecasting future scenarios. AI also automates routine tasks and assists in generating detailed reports, increasing efficiency and allowing team members to focus on higher value activities.

Compliance:

AI continuously monitors transactions in real time for regulatory compliance, automates reports to reduce manual effort and errors, and uses machine learning to detect and flag suspicious activities for fraud prevention.

AI and machine learning joins the traditional treasury management systems (TMS), Robotic Process Automation (RPA), and data analytics as tools in the toolkit for treasury managers to use. As AI continues to evolve and more data becomes accessible, it will provide opportunities for treasury teams and fintech providers aiming to make greater progress within treasury operations in New Zealand. This shift will be further accelerated by the recent introduction of GenAI and its improvements, harnessing AI for better strategic insight and efficiency and set to challenge the traditional treasury management system, price point and capabilities.

Authored by Natasha Reddington

Contact us