In today's rapidly evolving business landscape, technology is a critical tool for effective risk management. However, in the New Zealand market, organisations are lagging behind their global counterparts in leveraging technology across the entire risk landscape.

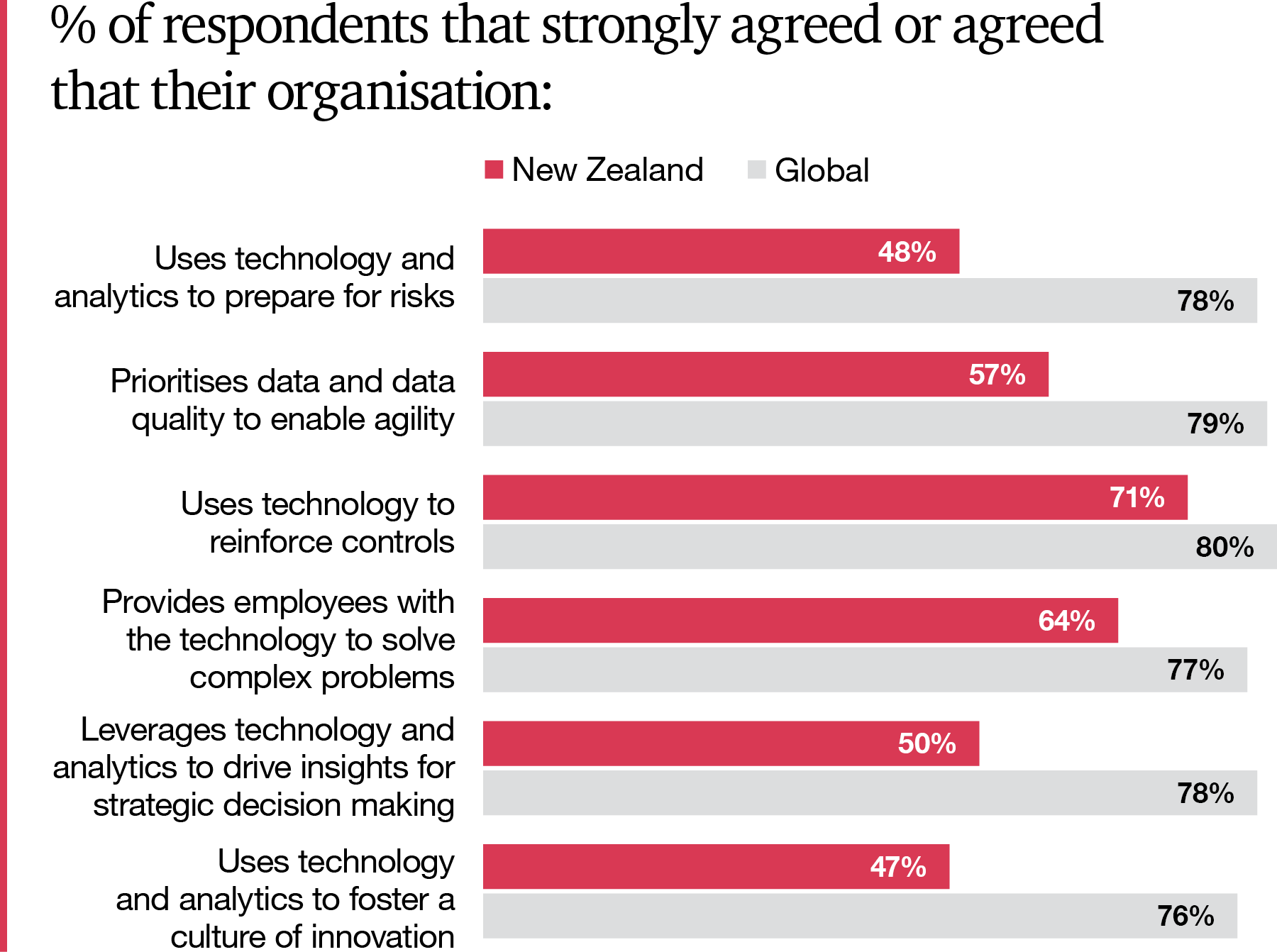

PwC’s Global Risk Survey results show that while over 75% of respondents globally utilise technology to manage risk across all parts of their organisation, in New Zealand the positive response rate ranges from 50-60% across most areas. Interestingly, the only area where New Zealand is aligned with the global results is in using technology to reinforce controls across the organisation, with a positive response rate of 71%.

There are several challenges that may be hindering effective technology for risk management by New Zealand organisations. We take a look at these challenges and provide insights on how leaders can take action to improve the use of technology across their full risk landscape.

Legacy systems and tech debt

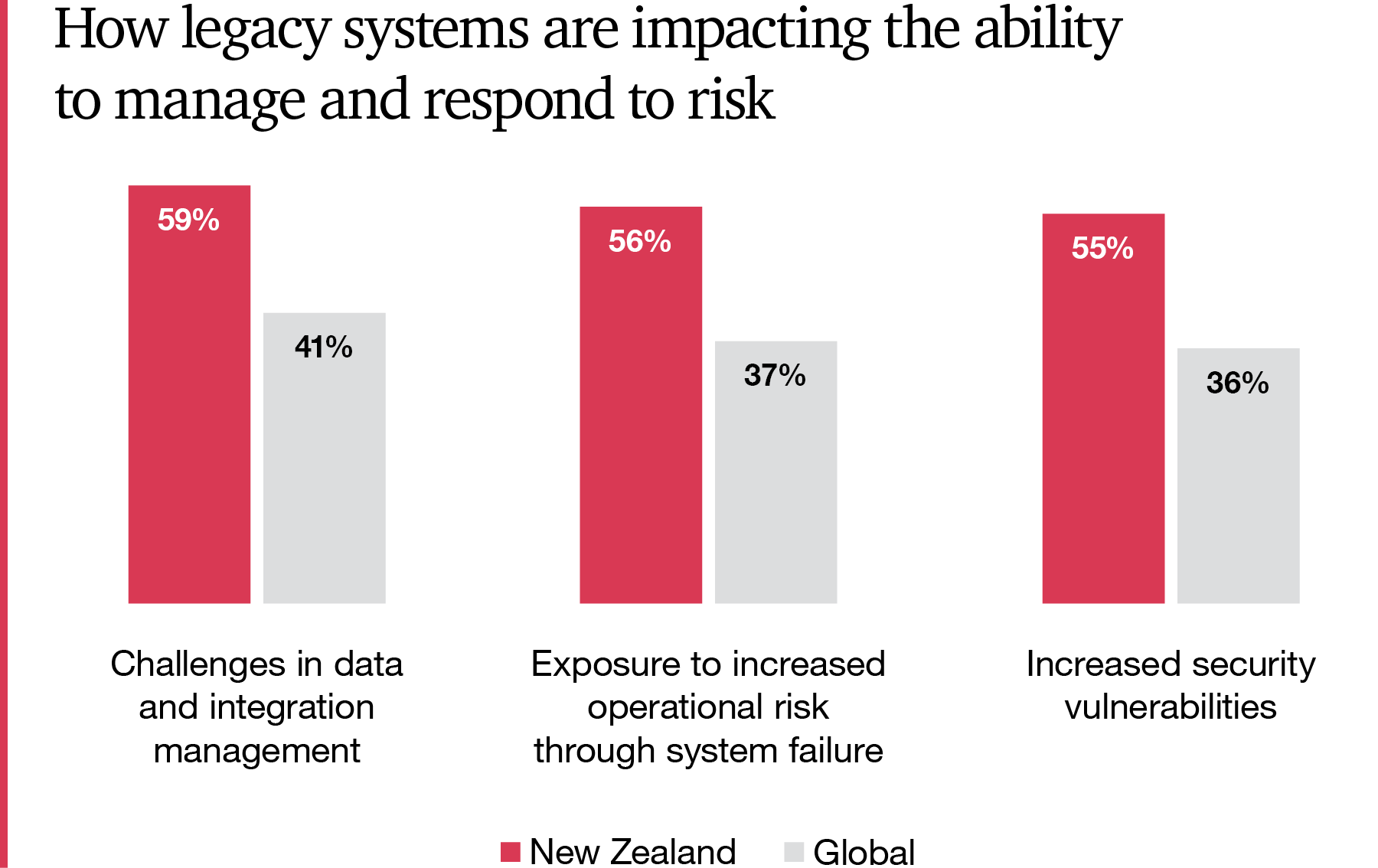

One of the primary challenges faced by businesses in New Zealand is the presence of legacy systems and other areas of tech debt. Many organisations have outdated systems that are challenging to leverage effectively in support of business initiatives, let alone maintain and update. The Global Risk Survey revealed that legacy systems are impacting the ability to manage and respond to risk more heavily for New Zealand organisations than their global counterparts. Fifty-nine percent said they created challenges in data and integration management (versus 41% globally), 56% feel they are exposed to increased operational risk through a system failure or lack of vendor support (versus 37% globally), and 55% believe they face increased security vulnerabilities (versus 36% globally).

These legacy systems pose security risks and hinder an organisation's ability to respond to emerging threats effectively. Moreover, these systems often lack the flexibility and scalability required to adapt to changing business needs. From a risk management perspective, relying on legacy systems can be detrimental. They may not have the necessary capabilities to collect and analyse data effectively, making it difficult to identify and mitigate potential risks. Additionally, the lack of integration between different systems and data sources can lead to inconsistencies and inaccuracies, making it challenging to implement high-quality data governance solutions.

Businesses in New Zealand need to consider how they prioritise technology replacement and transformation programs. By modernising their systems and infrastructure, organisations can enhance their risk management capabilities, improve data quality, and enable more agile decision-making.

Regulatory environment vs. innovation

Another significant challenge in New Zealand is the tension between the regulatory environment and the need for innovation. Regulatory bodies, such as financial regulators, prioritise highly resilient systems and compliance. While regulations are essential for protecting consumers and maintaining stability in the industry, they can sometimes slow innovation and the adoption of new technologies, especially for organisations that struggle to change efficiently and effectively.

Businesses, especially those in regulated industries, may be hesitant to embrace new technologies due to concerns about compliance challenges. 26% of New Zealand respondents cited difficulty in complying with newer regulatory standards as a challenge for their organisation. The fear of non-compliance and the associated penalties, can create tension between new technology providers that are less mature in their approach to governance, risk and compliance, and regulated entities that have significant obligations, creating a barrier to early adoption.

New Zealand organisations need to build trust and mature the technology risk conversation. This includes understanding the technology risk practices of the organisations they collaborate with (such as suppliers, or customers), and considering regulator expectations so that trust can be built quickly and change can occur with pace.

Curating insights and aligning teams

Many organisations in New Zealand have access to vast amounts of data but struggle to derive meaningful insights from it. This information gap can hinder effective risk management and decision-making processes.

Businesses need to prioritise data-driven decision-making and foster a culture of innovation. Leaders should invest in building data analytics capabilities and provide training to employees to enhance their data literacy skills. By aligning technology initiatives with business strategy and clearly defining the rationale and benefits, organisations can create a shared understanding of the value of data and technology investment.

Furthermore, there can be a misalignment between business functions and technology teams, leading to siloed operations and missed opportunities for collaboration.

Organisations should encourage cross-functional collaboration and ensure that technology teams are integrated into the broader business strategy. By breaking down silos and fostering collaboration, businesses can leverage technology to drive innovation and improve risk management practices.

Implementation challenges and risk controls

Implementing new technology solutions can be complex and challenging, particularly when integrating them into existing legacy environments. Fifty-nine percent of New Zealand respondents noted this as a current pain point for their organisation. This integration difficulty often makes it harder to make a business case for technology adoption, leading to a reluctance to invest in new solutions.

Additionally, organisations can overlook the importance of risk controls during the implementation process. They may focus more on delivering systems with the right functionality rather than considering security, data quality, and process robustness. This can result in poorly controlled systems that fail to meet risk management requirements.

To mitigate these risks, organisations should involve risk and control professionals in the implementation process from the outset. By integrating risk controls into the design and development phases, businesses can ensure that technology solutions are secure, compliant, and aligned with risk management objectives. This approach helps organisations avoid costly rework and ensures that risk controls are embedded in the technology infrastructure.

Leveraging AI safely and securely

Artificial Intelligence (AI) presents significant opportunities for businesses to enhance risk management practices. However, organisations may struggle to enable their workforce to leverage AI effectively due to concerns around data privacy, security, and intellectual property protection.

Business leaders should ensure they deliver generative AI tools responsibly, putting governance at the heart of the process. This involves implementing robust privacy settings, ensuring data security, and establishing clear guidelines for AI usage. By providing employees with the necessary tools and training, organisations can empower them to explore AI solutions while managing associated risks and ensuring compliance.

Adopting technology to achieve better business outcomes

Overcoming the challenges in technology adoption for effective risk management requires a strategic and proactive approach. By addressing legacy systems, striking a balance between regulatory compliance and innovation, fostering data-driven decision-making, and involving risk professionals in the implementation process, businesses in New Zealand can enhance their risk management capabilities.

Organisations should prioritise cross-functional collaboration, align technology initiatives with business strategy, and ensure that risk controls are embedded in technology solutions from the outset. By doing so, businesses can leverage technology to drive innovation, improve data quality, and enhance risk management practices, ultimately leading to better business outcomes.

Author: Anthony Steele

Are you a Risk Pioneer? Take our real-time benchmarking survey.

This ten-minute survey will compare your responses with our global study data to help you explore your approach to risk and reveal your risk archetype.

Contact us

If you’d like to learn more about the survey, or talk about any of the topics covered, please reach out to one of our team or click here