At PwC we recognise that our reputation relies, in part, on being transparent about how we work. Our Audit Transparency Report details how we continue to focus on audit quality through a range of measures such as learning and development and ensuring sustainable workloads for our people. We understand that delivering quality goes beyond reporting and compliance – it includes culture, standards, training, governance and the tools we use to deliver our work.

This commitment to transparency is part of our approach to building trust. We know that trust in audits is fundamental to investors and wider society, particularly now as challenging economic conditions and market volatility persist. The goal of this report is to provide investors, regulators, industry bodies, and the wider market with insight into what we do and how we operate.

Audit Transparency Report 2023 - Rich Day

The future of the profession

This report comes at a time when the audit profession continues to face a range of changes and challenges that will impact how it operates both now and in the future. Globally, there is a shortage of auditors and the number of students majoring in accounting has declined. A competitive job market means there are a broad range of alternative career opportunities available to accounting and finance graduates. These trends have the potential to create multiple issues for delivering audits. To help address them, we are focused on promoting the attractiveness of a career in audit and the different pathways available to enter the profession. This includes working with professional bodies and universities to explore new ways to recruit talented people.

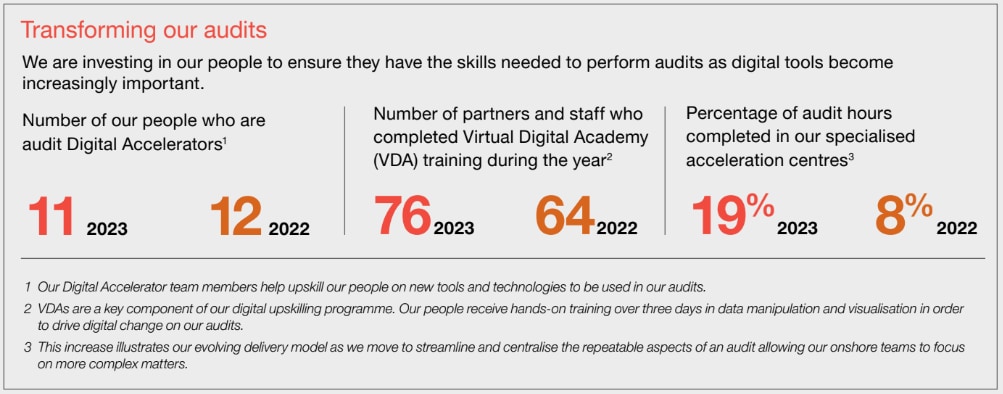

The role of the auditor is evolving with new skills and technology required to meet stakeholder needs and an increasingly complex business environment. These changes mean the expertise required to deliver audits in years to come will likely be different to those today. We are embedding frameworks and support structures into our practice to ensure that those entering the profession are well equipped to meet future demands.

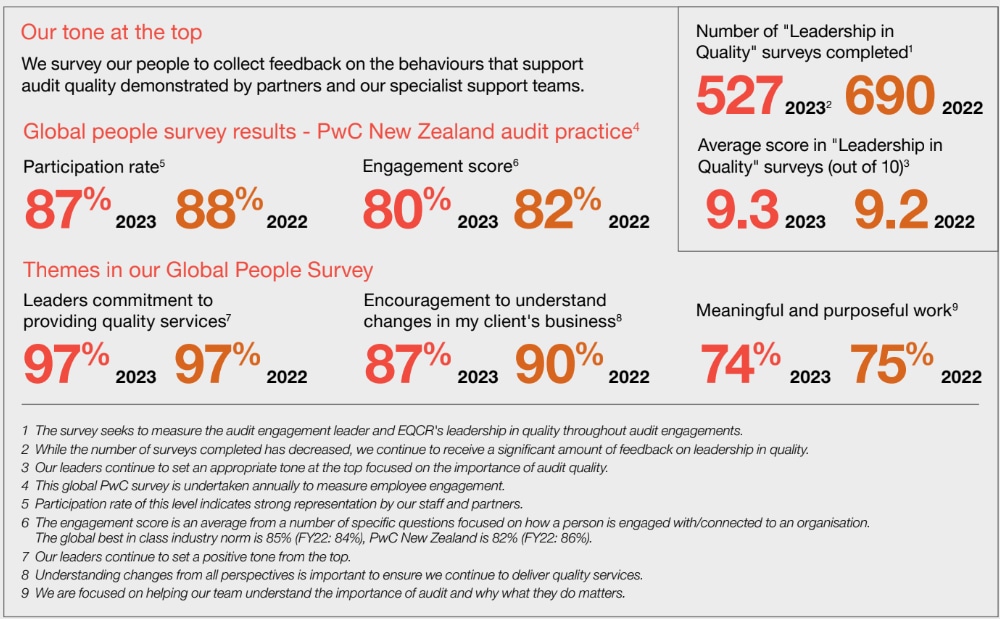

Our people are core to everything we do and we recognise the important role culture plays in audit quality. The wellbeing of our people and the quality of our work goes hand in hand. In FY23 we have continued our work to ensure sustainable and flexible workloads for our people while maintaining high quality standards for our clients and stakeholders.

Our 2023 Audit Transparency Report

PwC is a multidisciplinary firm, however this report is focused on our audit practice and related services in New Zealand. It is split into two parts covering our year in audit quality and how we work to deliver it.

In this, our first section we include:

- our Audit Quality Balanced Scorecard for the year to 30 June 2023;

- the independent Audit Advisory Board’s report for the year to 30 September 2023;

- how we define audit quality and our evaluation of our system of quality management; and

- an overview of recent research we have carried out into how NZX50 companies are reporting the impact of climate change.

In Delivering on our commitment to audit quality we cover a range of information including:

- our policies, systems and processes for quality management;

- how we monitor our work; and

- information on how our firm is governed.

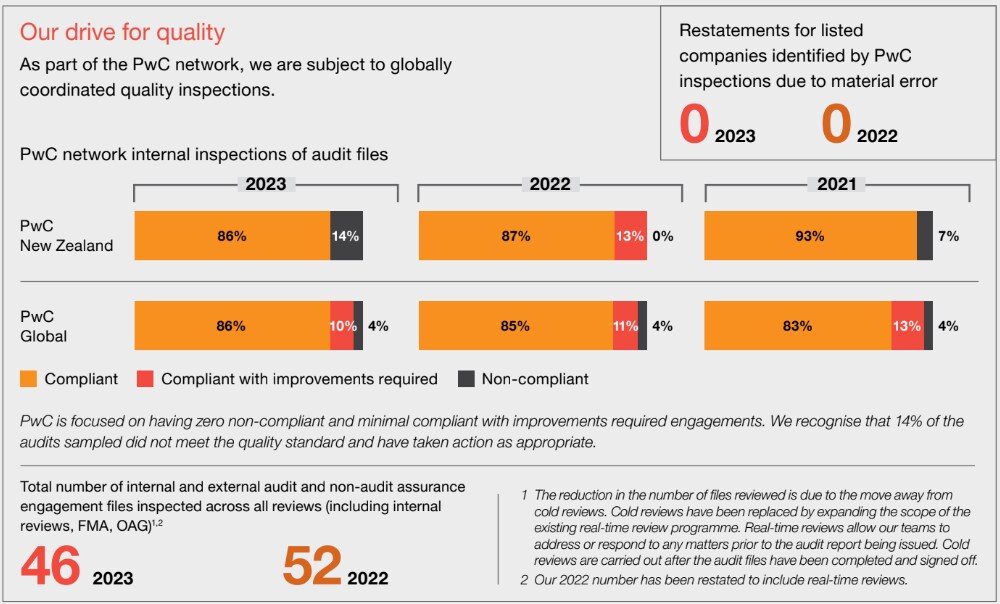

This year, our report and Balanced Scorecard include data points that do not meet the high expectations we have of ourselves. While internal inspections found that 86% of our audit files were compliant, 14% were non- compliant and did not meet our quality expectations. We have responded to the root causes and made changes to our quality system.

In addition, two New Zealand Institute of Chartered Accountants (NZICA) determinations relating to historic audits of former clients Wynyard Group and Fonterra were published in the last 12 months. In the years since those audits were carried out, we have taken a range of actions and continued our investment in our programme to strengthen audit quality including implementing additional training and making changes to policies.

These outcomes were a timely reminder that quality is about continuous improvement and consistency of application.

We are committed to the delivery of consistently high quality audits. Maintaining quality is core to our purpose.

We welcome the opportunity to continue the conversation about the role and importance of audit quality through releasing this year’s report and we look forward to talking more with you in the coming year.

Rich Day

Audit Leader

PwC New Zealand

Karen Shires

Chief Risk & Reputation Officer

PwC New Zealand

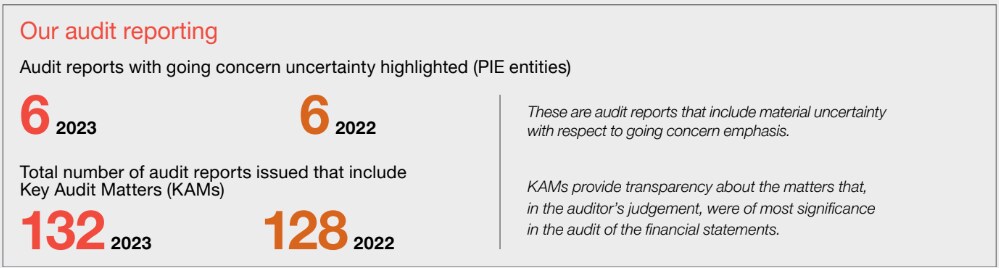

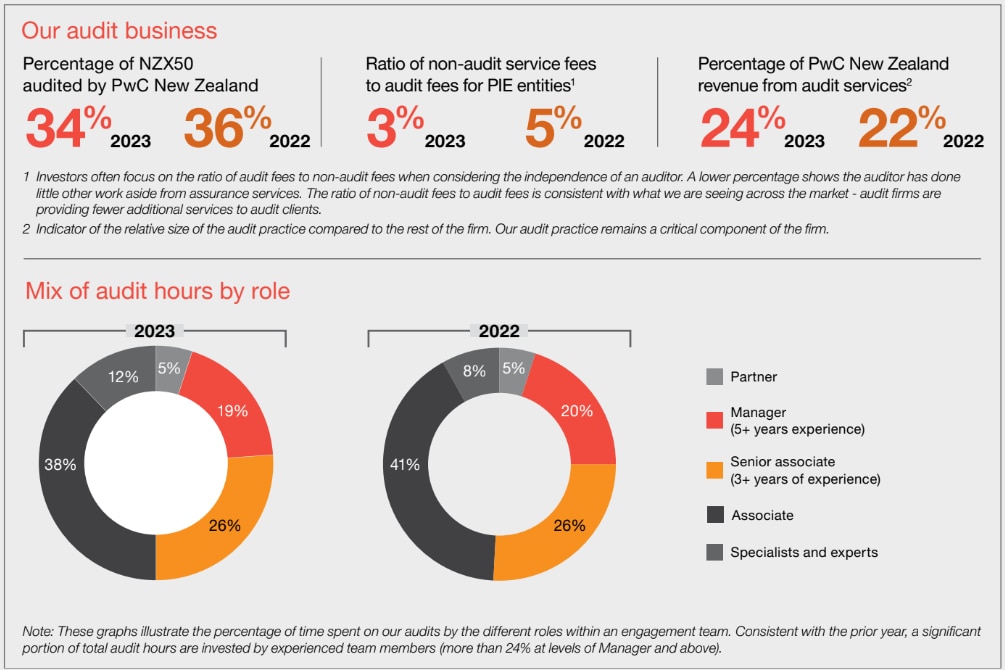

Audit Quality Balanced Scorecard | For the year ended 30 June 2023

External inspections and investigations

PwC New Zealand is subject to regular inspections by regulatory and professional bodies.

There are times these inspection results do not meet our high expectations or those of the community. While these are disappointing, we are committed to being transparent about our audit practice, our mistakes and our commitment to quality and continuous improvement. We acknowledge there will always be more to do as we continue to focus on audit quality.

FMA regulator inspection

The firm is reviewed biannually, and was included in the Financial Markets Authority (FMA) 2023 inspection cycle. The FMA inspected six engagement files and reviewed the quality control systems and processes in place – our system of quality management (SoQM). The findings from the 2023 FMA inspection of PwC and other firms will be included in the FMA’s annual Audit Quality Monitoring Report to be issued in November 2023.

OAG inspections

The firm is also subject to reviews by the Office of the Auditor-General (OAG) for engagements that are completed on its behalf. During the year ended 30 June 2023, an internal cold file inspection review, which involved the OAG reviewing specific aspects, was completed for one audit partner who is an OAG Appointed Auditor.

NZICA investigations

In the year to 30 June 2023, there was one New Zealand Institute of Chartered Accountants (NZICA) determination relating to PwC New Zealand.

NZICA published Appeals Council, and earlier Disciplinary Tribunal findings, concerning a 31 December 2015 audit of Wynyard Group. These findings related to the application of audit standards, regarding the adequacy of audit evidence and documentation, and independence. The more serious charges of negligence, such that it would bring the profession into disrepute, were dismissed.

In August 2023, the NZICA Disciplinary Tribunal published the determination of its investigation into the 2017-2019 audits of Fonterra. The findings related to the documentation of the application of professional judgement and audit standard requirements. In particular documentation of audit independence in appearance, the form of written representations from the company’s directors, the adequacy of evaluation of the carrying value of an offshore investment and certain financial statement note disclosures. The Disciplinary Tribunal’s decision acknowledged the remedial steps PwC New Zealand has taken to improve audit quality.

The final decisions are available on the CA ANZ website.

Both these matters involved historic audits. Since they were carried out, we have made substantial quality improvements including in the areas of consultation requirements, templates, training and independence.

Audit Advisory Board

Our independent Audit Advisory Board was formed in October 2020. The purpose of the Board is to advise PwC New Zealand on enhancing audit quality and to challenge the firm to continuously improve how it delivers audits.

In this section of the report, we share the Board’s observations and recommendations about audit quality at PwC New Zealand and include an update on recommendations made in the prior year.

The Board is chaired by Warren Allen and includes Stephen Layburn and Alison Posa.

The report was finalised in October 2023 and covers the year ended 30 September 2023.

Warren Allen,

Chair

Stephen Layburn

Alison Posa

Audit Advisory Board observations

The Board’s approach to its work programme to date has been to focus on two key themes:

- Sustainability (of the audit practice); and

- Transformation.

The Audit Advisory Board concludes the enhanced approach adopted by PwC continues to support appropriate emphasis on audit quality:

- In our first two years, we reported significant improvement had been achieved in many audit quality metrics, including the external regulatory and peer reviews of audit assignments, a key element to reporting on audit quality. This pattern has generally been maintained in our third year. However, after two years of fully compliant audit engagement file reviews, this year saw a small number of non-compliant files in external and internal reviews. It is not always possible to identify a common (root) cause, due to the selection criteria for files to be reviewed, and therefore the results cannot be extrapolated as pointing to a major concern across all audits. It is also noted the matters leading to the non- compliant files were considered either isolated or remediated. However, should a similar level of findings occur in the coming years it would be a concerning trend;

- PwC’s firmwide quality management systems are designed to deliver quality audits – these have been subject to recent significant changes to meet the new quality management standards. An initial external review in early 2022 indicated that appropriate systems and processes are in place to enhance future audit quality – and that, in a framework that calls for continuous improvement, these systems and processes are being (and will likely continue to be) subject to evolutionary improvements. Subsequent quality management system reviews performed by both PwC and the FMA indicated no significant matters to report. These systems will be subject to future regulatory review in 2024, now the new quality management standard is fully implemented;

- PwC has continued its focus this year on measuring, reporting and implementing measures that are designed to provide tangible evidence of improvement of firmwide partner personal independence. Recognising that maintenance and enhancement of personal independence is critical for the delivery of quality audits, PwC commenced, in 2022, a similar process across selected senior staff. The ongoing rollout of these measures has instilled across all resource levels a greater discipline of maintaining precise records to support the firm’s demonstrable independence from its audit client base;

- PwC has developed and evolved, over recent years, an extensive audit quality dashboard, which is used by audit practice management and the CRRO to monitor key metrics that drive audit quality. This year has seen the maintenance and enhancement of appropriate levels of audit quality, with the dashboard being used effectively to target action where it has indicated an adverse trend; and

- PwC had, during this reporting period, the final resolution of two key professional disciplinary processes. Each of these matters arose during audits completed several years ago, were both found ‘to be at the lower end of the scale of seriousness’ and were amongst the key motivators for the extensive drive by PwC to enhance their entire system of audit quality.

The key challenge is aligning the audit practice’s staff and partner resources with the objective of enhancing audit quality. The Advisory Board is of the opinion PwC has continued with substantial efforts in this area and these efforts are yielding worthwhile results:

- Further enhancements have been implemented into the audit delivery process. For example, as business process automation and digitisation is increasingly being used by clients, PwC is seeing greater opportunities for using client data more extensively in their audits. Several key initiatives have been developed including a greater involvement in all audits from the Centre for Innovation and Technology (CIT) (a dedicated team within the audit practice). This enables a skilled assessment of the processes, controls and risks associated with client IT systems relied upon to produce financial statements. The ability this provides for the PwC audit teams to interact with client IT personnel drives better audit quality in an increasingly technologically advanced business environment;

- Learning and Development (L&D) processes have continued to develop. An example is a New Zealand-developed approach to training called Optimise Prime. This was used most effectively with the training this year for the introduction of a ‘fundamentally altering’ new audit standard (ISA (NZ) 315) concerning the auditor’s responsibility to determine and assess risk. Specifically, this has created a shift in what auditors are required to understand about a client’s operation – different questions asked and more people spoken to outside of finance departments. It has delivered a deeper understanding of client’s business processes, risks and the potential impact on financial statements – and improved audit quality;

- Again this year, a commendable achievement, in the most difficult of circumstances, in terms of retaining skilled staff and partner resources, which delivered timely results to all audit assignments. The industry again faced immense challenges during this period, with skilled staff shortages, but the initiatives put in place by PwC ensured the goal of sustainable and flexible workloads was advanced. Audits were delivered on time even though they required increased hours to implement the new ‘client risk’ audit standard, which has a positive impact on audit quality;

- This reporting period saw an ‘imported challenge’ from Australia following a serious breach of PwC Australia’s values and policies. This resulted in an external independent review which was commissioned in May 2023 and reported back on 22 September 2023. The external review generated a significant number of far-reaching recommendations, particularly in relation to the governance structure, risk mitigation and culture of PwC Australia. The firm structure is important to audit quality as it sets the ‘tone-at-the-top’. Culture is also key as it sets the partner and staff commitment to delivering high-quality audits. In this regard, it was pleasing to see the external report referred to the lessons learned from the implementation of the Australian equivalent of the Advisory Board (Audit Quality Advisory Board (AQAB)) as providing an external lens challenging the approach to audit quality. The external report and PwC Australia’s response may give rise to changes to PwC’s New Zealand operation or governance in the future. Consequently, the Advisory Board will include this in our future agendas, to monitor impacts on audit quality; and

- This year the Advisory Board considered the effectiveness of the integration of ‘experts’ into the audit process, in particular accounting and auditing standards, financial modelling, valuation and taxation specialists. PwC has placed much emphasis on these specialist services, they appropriately sit within the Audit practice and they are involved in all relevant audits. The personnel involved receive specialised audit training to enable them to document their work directly in the audit files. In the opinion of the Advisory Board these subject matter teams have highly skilled partners and staff who are motivated by the delivery of high-quality audits. They provide an appropriately integrated specialist component to the audit service and add a valuable component to audit quality.

PwC is well aware of the need to transform the audit practice to respond to the ever-increasing changes it is facing. The Advisory Board observes that several key initiatives have been progressed or planned this year by the audit practice:

- The New Zealand market is developing at pace for the delivery of assurance services on the various ESG reports being produced by clients. This is particularly so around the new requirements for the Aotearoa New Zealand Climate Standards and the related disclosures for climate reporting entities. PwC has mobilised a specialist team to assist clients in preparing for this significant change in their disclosure requirements and also to undertake the necessary assurance services. The Advisory Board has had this new reporting area on its agenda several times during this reporting period. We consider the firm is well-placed to deliver services both to climate reporting entities and, ultimately, a wider audience including (for example) supply chain entities with the necessary skill base, assurance processes and system of audit quality;

- The firm has implemented additional quality controls in the early stages of ESG assurance reporting engagements, for example the mandatory inclusion of a Quality Review Partner (QRP or EQCR) on all assurance engagements and expanded the number of QRPs for ESG. Further detailed Advisory Board observations will be undertaken next year as the implementation of this service expands;

- Again this year, several initiatives were introduced examining how PwC can keep and build the reputation of the audit profession as an attractive career pathway for talented staff – launching a Career Development Pathway which clearly articulates the various stages such staff will follow during their career with PwC, and the skills obtained at each staff level. This is an excellent channel to articulate the value of a career in auditing, and specifically the enhancement it delivers to an individual’s CV. This should assist in the attraction and retention of skilled staff to the audit profession – a key plank to audit quality;

- Work was started this year, together with other key stakeholders such as professional bodies and universities, to explore other pathways to recruit more talented school leavers into the audit profession. This is key to ongoing audit quality. With the approaching ‘perfect storm’ of reduced numbers of commerce students in New Zealand universities, foreign graduates not staying on in New Zealand to obtain their practical experience and fewer overseas qualified staff wishing to take up a secondment to New Zealand, especially from the traditional markets – a new approach to staffing is essential. Good progress this year, but this is a difficult initiative that will take some time to deliver. It also will be the subject of future agenda items for the Advisory Board; and

- Continued response to increasing and changing demands from the regulatory community, ensuring all public interest entities audited by PwC continue to meet the public interest need for quality audits. This is also carried through to all other audits.

Audit Advisory Board recommendations and PwC’s response

The Audit Advisory Board (AAB), based on its work during 2022/2023, wishes to make two recommendations for consideration by PwC. These recommendations are in the form of supportive actions that the Advisory Board sees as being needed in addition to activities already underway within the audit practice. It is our opinion these actions are necessary to ensure PwC continues to have a sustainable audit practice capable of delivering consistent quality audits in the future which is responsive to multiple stakeholders’ needs.

Recommendation 1

We observed, that during this reporting period, the delivery of audits was characterised by the following:

- the challenge of continuing staff shortages together with the need to acclimatise overseas staff to the New Zealand audit practice;

- the first-time implementation of a challenging new risk assessment audit standard across all clients;

- the need to reset the work hours of staff to continue the move towards more flexible and sustainable workloads; and

- in some clients a more demanding business environment leading to a greater complexity of audit issues.

It does appear the above characteristics will continue to apply to audits over the next few years.

PwC New Zealand's response: We agree with the recommendation made by the AAB and have taken certain actions that support several of these initiatives already. We will consider additional plans of action to further address the recommendations within this report.

Recommendation 1.1

Against this background PwC must continue its focus on rebalancing the workload to improve staff engagement, while maintaining the financial sustainability of the audit practice. Continued enhancement of initiatives already underway, such as the integration of service centres and the use of technology to both drive efficiency and improve quality will be critical to unlocking work pressure on team members.

PwC New Zealand's response: A primary focus continues to be ensuring the workloads of our people are sustainable and all of our partners, along with our dedicated resourcing team, have specific accountability and objectives in respect of this. We will continue to invest in our service delivery centres and technology, particularly with respect to automation and standardisation of our methods.

Recommendation 1.2

Also, the occurrence of non-compliant file reviews highlights the importance of continually reinforcing audit quality processes to audit partners and staff. These audit quality processes have been significantly enhanced over the past four years, and are now seen as highly effective. While progress on maintaining independence is encouraging, the approach to file reviews highlights many factors which impact audit quality. For quality processes to translate into consistently high-quality audits they require continued and constant reinforcement, impactful training, communicating expectations on engagements and timely review. Ongoing attention to the relevant causative factors should ensure the file review outcomes for this reporting period will be seen as an aberration rather than the pointer to a worrisome trend.

PwC New Zealand's response: We are disappointed in having any non compliant files. Encouragingly, our root cause analysis did not identify any systemic or pervasive matters. However, we will continue to give ongoing attention to the causal factors underlying both positive and negative review results.

We are committed to improving our existing communication channels to ensure guidance and reminders are readily available, clear, consistent, and reaching all target audiences. We recently published a reference ‘first stop shop’ on several key audit areas for our staff.

Our Learning, Education and Development team will look at ways to enhance training and fill training gaps that may have led to performance or quality concerns. We also plan on enhancing our onboarding process, including training, for lateral hires.

Recommendation 1.3

Against the background stated above, including the outcome of the file reviews, it was observed by the Advisory Board that a common theme for audit quality issues was shortcomings in review and supervision. It is acknowledged this becomes challenging during busy audit periods and more so in a climate such as that experienced over the past two or three years. However, this is one of the most significant audit quality procedures and it must be given timely due attention during all phases of the audit. Reinforcement, allocating sufficient time to the task, achieving a balance between client-specific knowledge and objectivity and a strengthening of the cultural commitment to this specific quality procedure should see the achievement of the expected level of consistency.

PwC New Zealand's response: We agree that effective review and supervision is paramount to audit quality. Our response to the recommendations in 1.1 above will help achieve the objective of creating more time and space for our experienced staff to ensure the right individuals have the time needed to perform a detailed and focused review, and to be more available for coaching and upskilling of other staff. We will continue to refine our training and coaching to help our more senior team members understand what our expectations of them are regarding review and supervision. This includes training and coaching for newer managers and being clearer around the roles and responsibilities of our partners and managers. In particular, the review of work performed by our internal experts by senior engagement team members will be a key focus area.

Responsibility: Jonathan Freeman, Audit Quality Leader

30 June 2024

Recommendation 2

The wider New Zealand firm, to date, has avoided any significant issues such as the breaches of values and weaknesses in governance processes reported in relation to the advisory practices of PwC Australia during this year. PwC Australia has, as a result of those breaches, recently received a detailed independent report following a review predominantly of the firmwide governance structure, culture and risk management. That report makes extensive recommendations for change. Whilst acknowledging this report and its recommendations are tailored for PwC Australia, it is noted the review referred to the lessons learned from the implementation of the Australian AQAB.

The report may provide the wider New Zealand firm with an opportunity to consider some of the recommendations. Such a consideration, focused on continuous improvement of the audit practice, may highlight some implementable changes to enhance audit quality.

PwC New Zealands response: PwC New Zealand has a commitment to continuous improvement and is dedicated to maintaining a culture of quality and integrity. Our Board and Executive Leadership Team are reflecting on the Independent Review and PwC Australia’s response to consider any learnings that may be relevant for our operations (given our size and the market here).

Responsibility: Mark Averill, CEO

31 March 2024

2022 recommendations and progress to date

The Advisory Board, based on its work during 2021/2022, made three recommendations for consideration by PwC. The following indicates the Advisory Board’s current view as to progress achieved during this current year on these recommendations:

Progress work on climate reporting so PwC is, in an audit-quality sense, ready to meet market expectations.

Status update: Progressing. The firm has created a dedicated team and identified experts to provide specialist support.

PwC should consider an exercise reviewing and determining what the future of the audit profession may be. The Advisory Board encouraged consideration, possibly for a practical joint approach, with PwC Australia.

Status update: Started and on-going. The firm has implemented initiatives to help broaden the potential talent pool such as engaging with professional bodies on alternative pathways into the audit profession.

PwC’s future L&D programme will be required to have more emphasis on the ‘non-technical’ skills required of a PwC auditor of the future.

Status update: Progressing. The firm has evolved the Career Development Pathway (CDP) with a view to using it as part of its recruitment strategy.

What is audit quality? At PwC, ‘audit quality’ means that we consistently:

Comply with ethical and auditing standards.

Apply a deep and broad understanding of our clients’ businesses and the financial environment in which they operate.

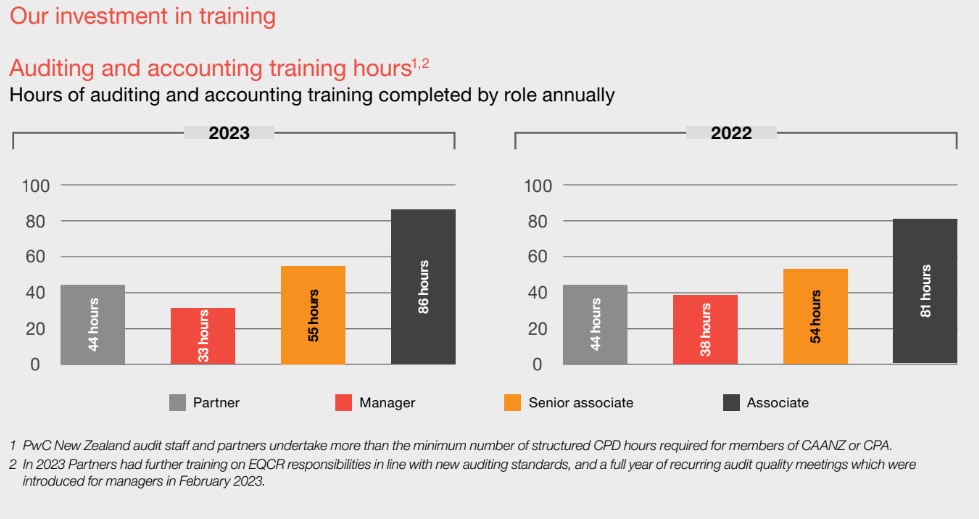

Focus on the wellbeing of our people and invest in their development.

Exercise professional scepticism.

Respond to changes in the audit profession.

Use our experience and expertise to identify and resolve issues in a timely manner.

Upskill our people on how to use new technology and tools.

This means that we:

- Ask tough questions and have conversations throughout our clients’ businesses.

- Apply an objective and sceptical mindset.

- Embrace the supervision and review process as a way to continuously improve.

- Have timely, meaningful exchanges with audit committees and management including identifying where an entity needs to improve financial reporting processes, resourcing and the quality of supporting workpapers.

- Plan our work and resolve issues in a timely and thorough fashion.

- Remain alert for issues that need deeper analysis.

- Act with professionalism

- Provide reliable and informative audit reports.

- Help our people grow and develop in their careers so they can perform at their best.

- Welcome new challenges.

- Keep our people up to date on professional standards including:

- adopting technology and applying our skills to new areas where they are needed; and

- collaborating as a team to find the best outcomes.

- Continuously improve and update our system of quality management to ensure we are prepared for changes to standards.

Responding to changes in professional standards

During the year ended 30 June 2023 there have been significant changes made to standards:

- Professional and Ethical standards, particularly those relating to independence, quality management and engagement quality reviews (see page 3 of Section 2).

- ISA (NZ) 315 which sets out the requirements of the auditor’s assessment of the risks of material misstatement.

We have worked with our teams to upskill them on these changes, keep them up to date and ensure compliance with the new standards.

Our evaluation of our System of Quality Management (SoQM)

Although our SoQM operates continually and is updated to respond to new or changing risks as they arise, our SoQM year ends on 31 March each year. This includes a formal assessment of reasonable assurance after the completion of our periodic monitoring procedures which took place on 31 May 2023. We reassessed reasonable assurance as at 29 September 2023 (following the completion of the PwC Global inspections programme) and at 31 October 2023 (for the purposes of this report) after taking into consideration all events, including quality findings, at each date. We have concluded, at each of these dates, that our SoQM provides us with reasonable assurance that the objectives of the SoQM are being achieved.

Section 2 of our 2023 Audit Transparency Report sets out how we operate and assess our SoQM which is underpinned by the PwC Network’s Assurance Quality Management for Service Excellence (QMSE).

Investigating climate reporting

Part of our work relating to audit quality involves helping build awareness about financial reporting and the role of audit. Our recent work in this area has involved investigating how climate change has been reflected in the financial statements of the NZX50. Last year we released reports examining March, June and December 2022 reporters.

This year we revisited March reporters to see how, and what, they are reporting in 2023. Have climate change disclosures in financial statements increased? Have the effects of the recent extreme weather-related events in Aotearoa New Zealand led to any changes in reporting?

The key findings from our analysis of NZX50 March 2023 reporters reveals:

- more entities are beginning to discuss the impact of climate-risks in their financial statements;

- the inclusion of climate-related information is still not widespread; and

- an increasing number of entities are including some non-financial climate-related information outside of the financial statements.

In the coming year we expect these trends to increase as Climate Reporting Entities will be required to fully comply with the Aotearoa New Zealand Climate Standards.

Partner, Sustainability Reporting & Assurance Leader, Auckland, PwC New Zealand

+64 21 355 879

Mariann Trieber

PwC is #AuditorProud

#Auditor Proud is a global day recognising auditors and their role. At PwC New Zealand we recognise the important work our audit teams do over a week long period (28 September – 1 October 2023). Read below to find out why some of our team are #AuditorProud and on our website here.