{{item.title}}

{{item.text}}

{{item.text}}

____________________________________________

A PATHWAY TO WELLBEING FOR ALL OF AOTEAROA

The last few years have been some of the more challenging in Aotearoa New Zealand’s history. The COVID-19 pandemic, fractured geopolitics, social tension, supply chain issues and rising inflation have, and are, affecting our communities in ways we previously couldn’t have imagined.

This uncertain environment exacerbates some of the long-term prosperity challenges for Aotearoa New Zealand, such as social inequality, housing affordability, the cost of living and productivity. But, it also provides impetus for change.

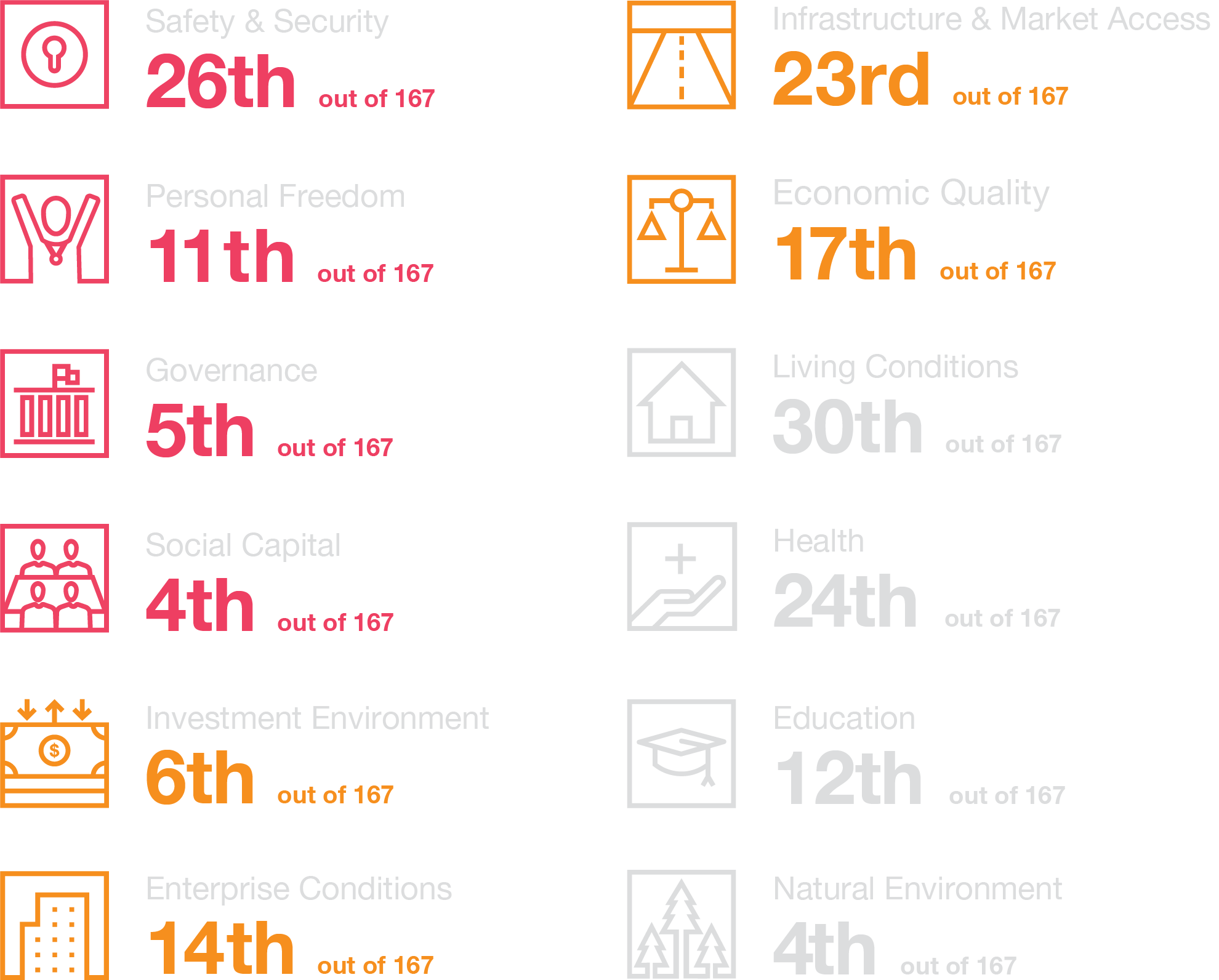

While this is positive, it leaves room for improvement, especially when it comes to living conditions, safety and security, infrastructure and market access, economic quality and health. For many, this is reflected in household incomes not matching the steep increase in the cost of living and the substantial difference in wealth outcomes for those who own their own homes compared to those who don’t2. It also highlights the long-standing inequities in health and access to healthcare, alongside our recognised infrastructure deficit which is in excess of $210b3.

This backdrop raises questions about our country and what we want it to be. How can we create a pathway to greater prosperity for all New Zealanders? Taking prosperity in its broadest sense, a more prosperous Aotearoa New Zealand is a country with improved per capita economic and social outcomes for all.

Put simply, it's an Aotearoa New Zealand where everyone thrives. While economic wellbeing and productivity feed into prosperity, being prosperous goes

beyond those traditional metrics. It means:

- communities that look out for each other

- delivering infrastructure to support the social, community, cultural amenities and services that we need as a nation

- creating a society that attracts the talent and investment required to position Aotearoa New Zealand on the global stage

- caring for our natural resources and building resilience by embracing sustainable practices.

In this report, we explore five opportunities we believe will have an impact in achieving the aspirations outlined above. We highlight the factors that could contribute to a brighter future for our nation and people. Under each, we stress the importance of everyone - government, business, academia, communities - playing their part to ensure success.

In the coming months we will explore these themes in more detail through a series of sector 'deep dives'. Each of the reports will consider how one or two of these themes could be applied to deliver sustained outcomes for the sector and Aotearoa New Zealand.

Aotearoa New Zealand has led the world in social change including women’s voting rights, indigenous parliamentary seats, the Treaty of Waitangi Act 1975 and marriage equality. We believe our forward-thinking nation can show leadership in enhancing social prosperity too. Greater social cohesion is one way in which we can start to improve prosperity for everyone in our society.

A cohesive society is one that:

A sense of belonging and builds trust

Values diversity

Enables full participation in all aspects of society

Protects its members from discrimination4

Provides the conditions for inclusion, equity of opportunities and outcomes

Aotearoa New Zealand’s social cohesion (as defined on the right) has been described as relatively strong6.

But, we cannot be complacent. The pandemic has exacerbated existing inequalities. We know that some New Zealanders are not thriving or being given the opportunity to flourish due to the conditions they are born into and where they live, learn, work, or play. We know that the impacts of climate change could disproportionately affect lower socio-economic groups (for example, in the quest to be ‘greener’ by encouraging electric cars, our most vulnerable members of society who cannot afford to change their transport choices are further marginalised). We also know that access to resources impacts our ability to participate in society and prosper – and the challenge is to ensure there is adequate access to income and resources to lift those that have less opportunity, access and choice7,8. The impact of colonisation has significantly impacted Māori communities, across many areas such as life expectancy, land ownership, education, justice, social and health outcomes - we know there is significant work to be done to close the gap for Māori created by colonisation.

Addressing these complex systemic problems is far from simple, and can appear overwhelming. But, the way we have responded as a nation to various challenges such as the Christchurch mosque attacks and extreme weather events, to name just a couple, shows we can come together to address other societal challenges. We have shown our willingness to trust and cooperate with each other in the interests of all, even if only for a period in time.

During this time of volatility and uncertainty, it is important to build and sustain social cohesion. Not only because social cohesion contributes to economic productivity, but because it’s an essential element for economic resilience. Through greater social cohesion Aotearoa New Zealand can adapt and thrive in the face of significant transformation.

With this in mind, economic recovery in response to the major challenges we are facing (including COVID-19 recovery, the rising cost of living, an ageing population and climate change) must be equitable and not come at the cost of social cohesion.

Our collective actions today can start to reset conditions for a more socially cohesive society in which future generations can thrive.

To help achieve greater social cohesion, policy makers and business leaders must understand what people value most now and into the future. We must coordinate our activities and plans by working collaboratively towards common goals and priorities. We believe we can drive greater social cohesion by:

Box1. Defining social cohesion

Social cohesion can be defined in terms of two groups of criteria - the elements of socially cohesive behaviour and the high-level conditions necessary for a socially cohesive society (Peace & Spoonley, 2019).

Elements of socially cohesive behaviour

A sense of belonging derives from being part of the wider community, trusting in the other people, and having a common respect for the rule of law and for civil and human rights. New Zealand is home to many peoples, and is built on the bicultural ambitions of the Treaty of Waitangi. Ethnically and culturally diverse communities and individuals experience a sense of belonging and their contribution is recognised, celebrated and valued.

Participation includes involvement in economic and social (cultural, religious, leisure) activities; in the workplace, family and community settings; in groups and organisations; and in political and civic life (such as voting or standing for election on a school Board of Trustees). All people in New Zealand are able to participate in all aspects of New Zealand life.

Conditions for a socially cohesive society

Inclusion involves equity of opportunities and of outcomes, with regard to labour market participation, income, access to education and training, social benefits, health services, and housing. All people in New Zealand share access to equitable opportunities and services contribute to good settlement outcomes in ways that are recognised and valued.

Recognition involves all groups, including the host country, valuing diversity and respecting differences; protection from discrimination and harrassment; and a sense of safety. Diversity of opinions and values amongst the many cultures that make up New Zealand today are accepted and respected, and people are protected from the adverse effects of discrimination.

Legitimacy includes confidence in public institutions that act to protect rights and interests; the mediation of conflicts; and institutional responsiveness. Public institutions foster social cohesion, engender trust and are responsive to the needs of all communities.

Social and economic prosperity are linked and depend on each other. Ensuring this concept is at the heart of our decision making is important for achieving sustainable wellbeing, equity and greater self-reliance.

As a country, we have begun to look beyond financial indicators for measuring economic prosperity. Treasury now captures our country’s wealth through physical capital and human capability, including culture, environment and social cohesion as well as financial metrics9.

However, we need to further shift economic and social prosperity policy and measurement beyond the current Living Standards Framework set by Treasury. This means devising and introducing new measurement tools to guide and assess progress on the many dimensions of prosperity including economic, social, and environmental factors. An example of where this is currently being worked through is He Ara Wairoa - Treasury’s framework for including a Māori perspective on wellbeing in its vision for ‘lifting living standards for all New Zealanders’. Treasury is considering tiakitanga for inclusion in the framework.

Collaborating with te ao Māori perspectives and Pacific viewpoints, as well as cultural frameworks, in the measurement of socio-economic prosperity and related concepts is crucial. This includes a more human-centred approach than previous efforts in measuring economic performance and wellbeing, and ensuring the voices of all those whose quality of life is being measured are incorporated.

Part of this involves ‘by people, for people’ kaupapa. For example, in both the Māori health and disability focus areas, there is a strong directive to lead from within communities. In the disability change agenda, the kaupapa is disabled people ‘led’ not ‘informed’ or ‘centric’.

We also see that the newly established Māori Health Authority, Te Aka Whai Ora (Independent Statutory Entity) provides an opportunity to devolve resources and decision-making powers to Iwi Māori to fulfil their tino rangatiratanga (sovereignty) and mana motuhake (self-determination). It is a chance for Māori to determine their own pathway to achieve ‘kia piki te ora’ (good health).

Pacific people have a unique place in Aotearoa New Zealand, with shared Polynesian whakapapa to Māori and strong government-to-government relationships between neighbouring countries, including the Cook Islands, Niue and Tokelau being part of the Realm of New Zealand. Similar to Māori, Pacific communities have shown time and time again, when empowered with the right resources and self-determination is enabled, they employ their own solutions to their own issues. For example, with New Zealand’s first COVID-19 outbreak occurring in South Auckland, where a large proportion of the population are Pacific, government agencies were led by Pacific health, clergy and social sector leaders to stop the spread to the rest of New Zealand. As a result of Pacific-led approaches and agency, building on pre-existing social capital and trusted relationships, Pacific people ended up having the lowest rates of COVID-19 and the highest rates of testing by ethnicity at the time.

Social investment is key to social cohesion - without it we cannot hope for more prosperous collective outcomes. Social investment has traditionally used data and analytics to ensure investment intended to improve social outcomes is directed to those areas which provide the best financial and social returns. Social investment is critical in lifting participation in socially deprived communities which enables more positive outcomes for the disadvantaged and society more broadly.

When wellbeing is overlaid with social investment, it has been proposed10 that new levels of prosperity can become possible - non-fiscal as well as fiscal returns become relevant, long-term generational views are considered, and steps are taken to reduce the liabilities created from advantage11 (as well as seeking to lift the disadvantaged).

The human capital of a country - its workforce - is a key pillar of its current and future prosperity. To deliver value for the country, the economy and New Zealanders, our workforce must continually evolve to meet changing environmental, social and economic needs through upskilling, reskilling and expanding our talent pool.

As the sectors that drive our economy change over time, so too must our workforce. The skills that were required in the past, were different to those we need today12. For example, digital transformation is driving a new set of skills that did not exist in the past. We must build a future-fit workforce to lay the foundations for continued prosperity. Currently there are concerning trends relating to Aotearoa New Zealand's human capital:

A recent study showed that 40% of students who get NCEA level 2 are not functionally literate or numerate13.

While each country faces different challenges and opportunities in creating greater prosperity, the small advanced economies that have consistently outperformed their peers e.g. Israel and Singapore embrace similar themes around their human capital.

They have made it a priority to continually build and refine their in-country workforce, both organically e.g. through lifelong education and training and inorganically e.g. by promoting immigration - with governments and business working closely together.

So that we can focus on our efforts, we should identify two or three of the highest potential growth drivers of the economy.

Applying these learnings and drawing on Singapore as an example, we believe Aotearoa New Zealand must:

For Aotearoa New Zealand to move forward we must understand our workforce needs today, and importantly, what our needs are for the future. This means getting clear on the skills we need our workforce to have. These should be based on our unique differentiators, features and aspirations as a country.

So that we can focus our efforts, we should identify two or three of the highest potential growth drivers of the economy. With a constant focus on keeping its workforce fit for the future, Singapore recently released its 'Skills Demand For The Future Economy Report'17. The report identifies three future growth areas - the digital economy, green economy and care economy - and spotlighted the top 20 skill groups needed to drive growth in those areas in the next one to three years. In Aotearoa New Zealand, examples could be agritech, sustainable technology, medtech/biotech and climate technology. This would form the basis of a future-focused workforce development strategy that includes training and skills development around these areas.

Once the initial groundwork is done, there is a need to relentlessly execute, review and pivot the workforce strategy as necessary. By doing this, we can continue to adapt to the changing environment and navigate any challenges.

Closer sustained and systematic collaboration between government, businesses and educational institutions is required to identify, develop and deliver the targeted training needed to drive workforce development and productivity throughout the worker lifecycle. This will ensure that the right skills are developed at the right time and in the right quantity for effective deployment to meet areas of existing and emerging need.

We believe the Government could take a leading role in creating a national framework for lifelong learning, similar to Singapore’s national initiative, 'Skillsfuture'. Singapore’s programme provides its citizens with opportunities to learn throughout life regardless of their starting point (early education, mid-career or post-retirement) in the drive towards an advanced, inclusive society.

At the same time, employers need to invest further in upskilling their workforce. We know that 77% of New Zealand workers are ready to learn new skills and retrain18. However, currently employers are not sufficiently upskilling and retraining their workforces to meet future needs.

Aotearoa New Zealand can be a destination of choice for talent, known for its quality of life, natural beauty, political stability and socially progressive society. Although recent studies show a decline in appeal19.

We must adjust and continually adapt our immigration policy settings as a matter of urgency, with the objective of attracting and enabling immigrants with desired skills to work and live here, in alignment with a national workforce strategy.

For example, in an effort to deal with workforce shortages the Australian Government has recently announced the country’s migration cap will be lifted to 195,000 places - an increase of 35,00020. While three new residence categories were announced for New Zealand in July 202221 the effectiveness of these changes and whether the settings are best aligned with lifting our prosperity remains to be seen.

In the context of a tight labour market, there is a significant opportunity for employers to build closer relationships with their employees, going beyond their employer value proposition to create true engagement.

One in five employees report they are ‘extremely’ or ‘very likely’ to change employers within the next 12 months22. This means it is more important than ever that employers are fostering an engaged workforce.

Developing a workforce strategy to understand the future workforce they need will enable employers to appropriately reskill or upskill their people to meet these needs.

Coupled with a focus on ensuring employee experience reflects their values and purpose as an organisation, will mean they will attract and retain valuable employees, enhancing their employer reputation in the market.

Innovation and entrepreneurship are accepted unlockers of prosperity. There is an opportunity for Aotearoa New Zealand to better leverage innovation to increase prosperity both now and into the future. Part of this includes deciding where, and in what unique areas, we can compete on a global scale. Where does Aotearoa New Zealand have a natural right to win? How can we best use the unique assets we have?

Innovation and entrepreneurship have long been a part of our story, however we face a range of challenges. These include a fragmented education sector with considerable competition for talent, rivalry for funding and commercialisation opportunities between institutions, operating on a small scale compared to global markets, and coordination challenges. What can we do to overcome these difficulties and prosper?

To build a thriving culture of innovation and entrepreneurship we need to bring focus, coordination and collaboration to the sector, and make participation inclusive. To do this, we suggest:

Diversity shortfall throughout the talent pipeline, 2019

Studies indicate that, consistent with global trends, our academic performance in STEM subjects is declining23,24. A focus on STEM education and developing innovative skill sets (agility, resilience, teamwork, curiosity and creativity) remains critically important especially at secondary school. The work of local innovators such as Frances Valintine (MindLab), Alexia Hilbertidou (Girl Boss), Michelle Dickinson (Nanogirl) and others are positive foundations that can be built upon.

When it comes to the tech workforce, Māori make up just 4%25. The lack of participation is a missed opportunity to bring diverse thinking to drive creativity and innovation. Increasing Māori participation requires a growth strategy focused on addressing the accessibility and participation barriers that exist for Māori to learn, explore and engage with STEM.

Effective solutions to closing the digital divide that exists for Māori are far more likely to be those that are Māori-led. A consideration for accelerating this is better enabling and resourcing the Māori education medium: Kōhanga, Kura and Wānanga. These education providers are more connected to the localised aspirations, needs and barriers to creating meaningful education solutions that will shift the needle for Māori participation in our future-focused industries.

Removing barriers for Māori participation in the fast-growing, high-paying tech sector represents a significant opportunity to help improve economic outcomes. Māori participation means money and opportunities flowing into households, communities and building intergenerational prosperity.

This includes unleashing the untapped potential of Māori mentioned previously, but also female entrepreneurs.

The University of Auckland GUESS survey data reveals a significant gender gap:

There are well understood challenges when it comes to female participation in entrepreneurship. Global Women Chair, Theresa Gattung notes that female entrepreneurs are most likely to have received less informal encouragement, received formal support, don’t have access to the same business networks and are likely to be treated differently when they pitch for funding.

We can help address the entrepreneurial gender gap through greater measurement and management. Government business support programmes should be required to track and report support provided on the basis of gender representation.

Improved access to government programme support through transparency will assist female-led startups.

This particular dynamic is well understood internationally with institutes like the NASDAQ Entrepreneurship Centre26 focused on supporting and encouraging equitable entrepreneurship across the next generation of entrepreneurs via mentorship, education and a connected community.

Within Aotearoa New Zealand, there is an emerging set of private individuals and venture capital funds focused on funding, connecting and supporting female entrepreneurs. The ArcAngels Fund II, SheEO and Entrepreneurial Women with Purpose are just some examples. Connecting these ideas and organisations, and securing allyship in the broader economy, will be critical to changing the dial on our innovation story.

Globally we have seen innovation thrive where there is a vibrant and well-connected ecosystem of people, academics, business and investors. There is an opportunity to enhance this ecosystem in Aotearoa New Zealand.

For this to happen institutions and organisations must work together effectively to achieve the common goal of a prosperous innovation culture, where businesses are getting the resources they need to thrive.

For example, the innovative partnerships programme27 run by the Ministry of Business, Innovation and Employment (MBIE) is designed to help research and development intensive businesses connect, collaborate and invest in Aotearoa New Zealand. It has already seen a number of successes like Xero, Fisher and Paykel Healthcare and Seequent to name a few.

Government support for research and development (R&D) intensive companies is also a key factor for lifting innovation. These businesses are incentivised through the Research and Development Tax Incentive (RDTI) introduced by the Government in 2018. The Government has allocated $1,020m over four years for the RDTI. However, only $150m has been paid out in the first two years. To achieve better outcomes the Government must work more collaboratively with R&D businesses, to ensure access to this funding is more readily available.

A focus on STEM at secondary school level to build innovation skill sets will help provide a stream of talent into tertiary courses. Degrees, such as Auckland University’s Bachelor of Commerce ‘Innovent’ major, where students study alongside successful innovators and entrepreneurs will set the ecosystem up with the resources and talent it needs to drive innovation and entrepreneurship.

This alignment and coordination between academic institutions, innovative businesses and investor networks should be a focus for the Government.

Mapping global problems to areas that Aotearoa New Zealand is uniquely placed to solve will help us identify where we can win, and compete on a global stage. This approach to problem solving means our innovative businesses are immediately competing on a global stage and can realise the benefits of scale quickly.

There are some areas of innovation where Aotearoa New Zealand has a track record of producing world class innovation such as deep tech28, SME SaaS, medtech/biotech and climate tech. Also gaming and Web 3.0/blockchain are all areas that investors say they’re either actively investing in or watching for signs of scale.

These areas already attract foreign investment and could be developed at scale into broader innovation industries. Beyond the obvious economic upsides, innovating in these areas (or similar) is likely to create more prosperous environmental and wellbeing outcomes - building long-term resilience and an international brand for Aotearoa New Zealand.

Improved capital allocation or, putting capital to work in the most productive assets, is central to greater prosperity. This lowers the cost of capital with a more productive economy, allowing for higher wages. Allocating capital to low or non-productive assets (like residential property) reduces the potential of the economy and, as a consequence, wage potential. Generally improvements in productivity require capital e.g. investment in infrastructure or technology. With a weakened Aotearoa New Zealand balance sheet in the wake of COVID-19, overseas investment will be required to fund meaningful productivity improvements.

Capital allocation is a multidimensional subject area. We accept that there are many sources of capital beyond banks - ACC, pension funds, superannuation, listings, private equity - and how these can be best accessed to fund Aotearoa New Zealand businesses, entrepreneurship and productivity needs to be thought through.

There are a number of possible ideas in this area that may help to reduce the cost of, and improve the availability of, capital for local businesses e.g. small and medium sized business (SMB) equity investment vehicles, SMB banks, SMB government loan guarantees. But, within our prosperity theme, we are focusing on Aotearoa New Zealand’s bank capital framework and overseas investment rules given how central they are to the topic.

Regulation plays an important role in providing stability and protecting the underlying financial system. Put simply, regulation is needed to preserve prosperity. In particular, bank capital settings are intended to ensure appropriate capital is held against lending risks after taking into consideration recovery mechanisms. When it comes to investing in productive assets, it’s largely the case around the world that more capital is required to be held given the higher risk29.

The Reserve Bank of New Zealand (RBNZ) capital allocation rules include two aspects in the current settings that cause this country to be an outlier globally. These are:

The amount of capital banks must hold relative to their loans.

The risk weightings allocated to the loans made.

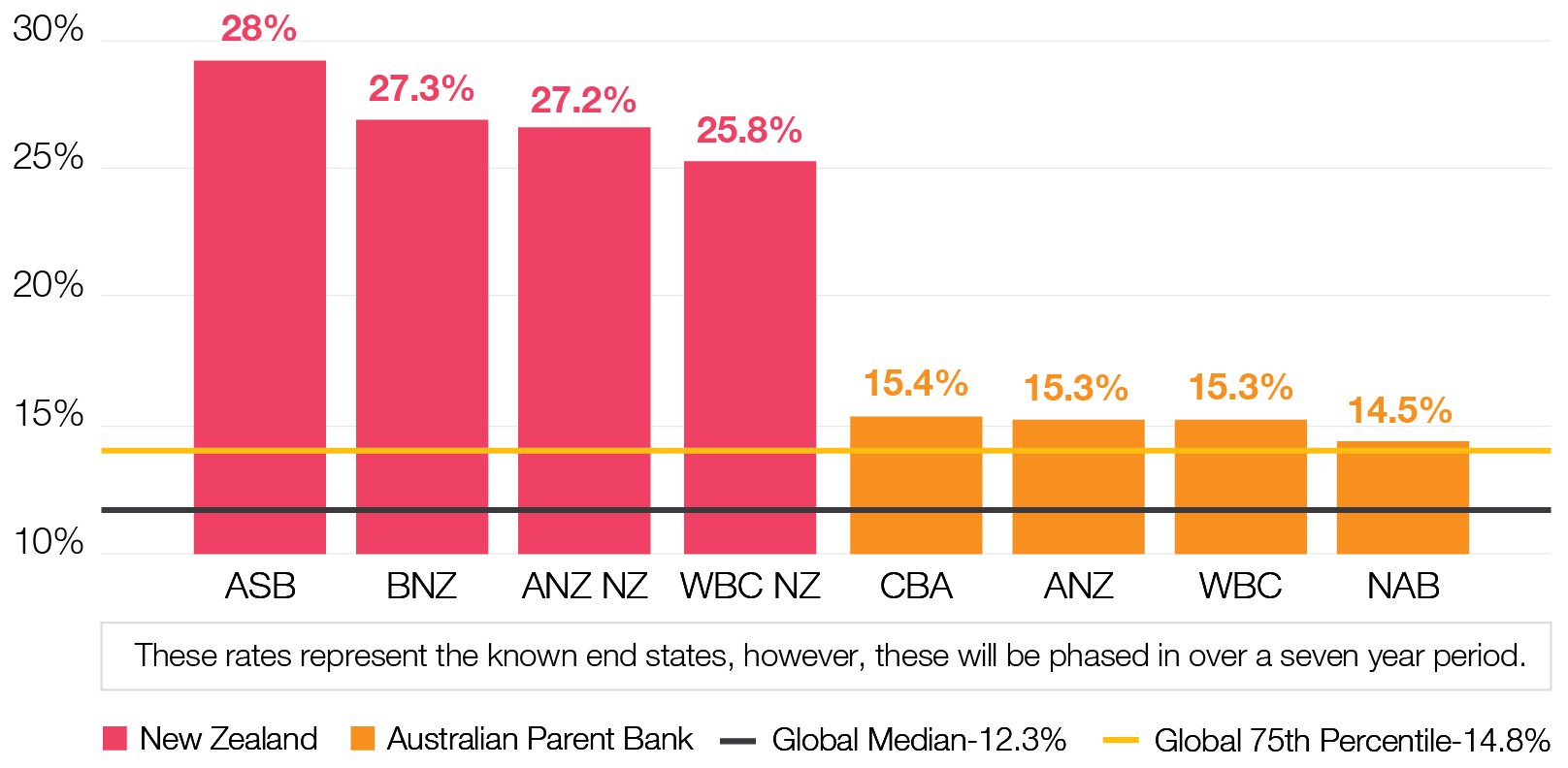

In relation to the first, the RBNZ revised the minimum capital requirements for banks with effect from 1 July 2022. Higher capital requirements will be phased in over a seven year transition period (by 2028).

These settings are higher than global peers and those of the parent banks with operations in Aotearoa New Zealand. While global settings tend to be set with reference to insuring against a 1 in 100 year event, New Zealand’s settings have been set to ensure the bank’s balance sheets can withstand a 1 in 200 year shock. This is due to (among other things) the increased volatility across the globe, the higher potential for more extreme global events, climate change and a swing away from globalisation towards localisation.

Major Australian and New Zealand banks - Common Equity Tier 1 (CET1) ratio

Major international banks - Common Equity Tier 1 (CET1) ratio by Nation

But, this additional level of protection comes with a cost. The consequences of Aotearoa New Zealand's capital requirements are that borrowers are likely to pay more for their financing. The higher capital requirements will likely see a moderation as to how offshore banks invest in the New Zealand markets causing them to:

invest their marginal dollars of bank capital in jurisdictions other than Aotearoa New Zealand (as getting the same return on an equivalent loan in New Zealand requires a greater allocation of capital)

invest in loans that require lower amounts of capital e.g. non-productive mortgage lending.

As a result, we could see the continued emergence of non-bank lenders who may not be regulated by the RBNZ, who as a general rule require higher returns than bank lenders.

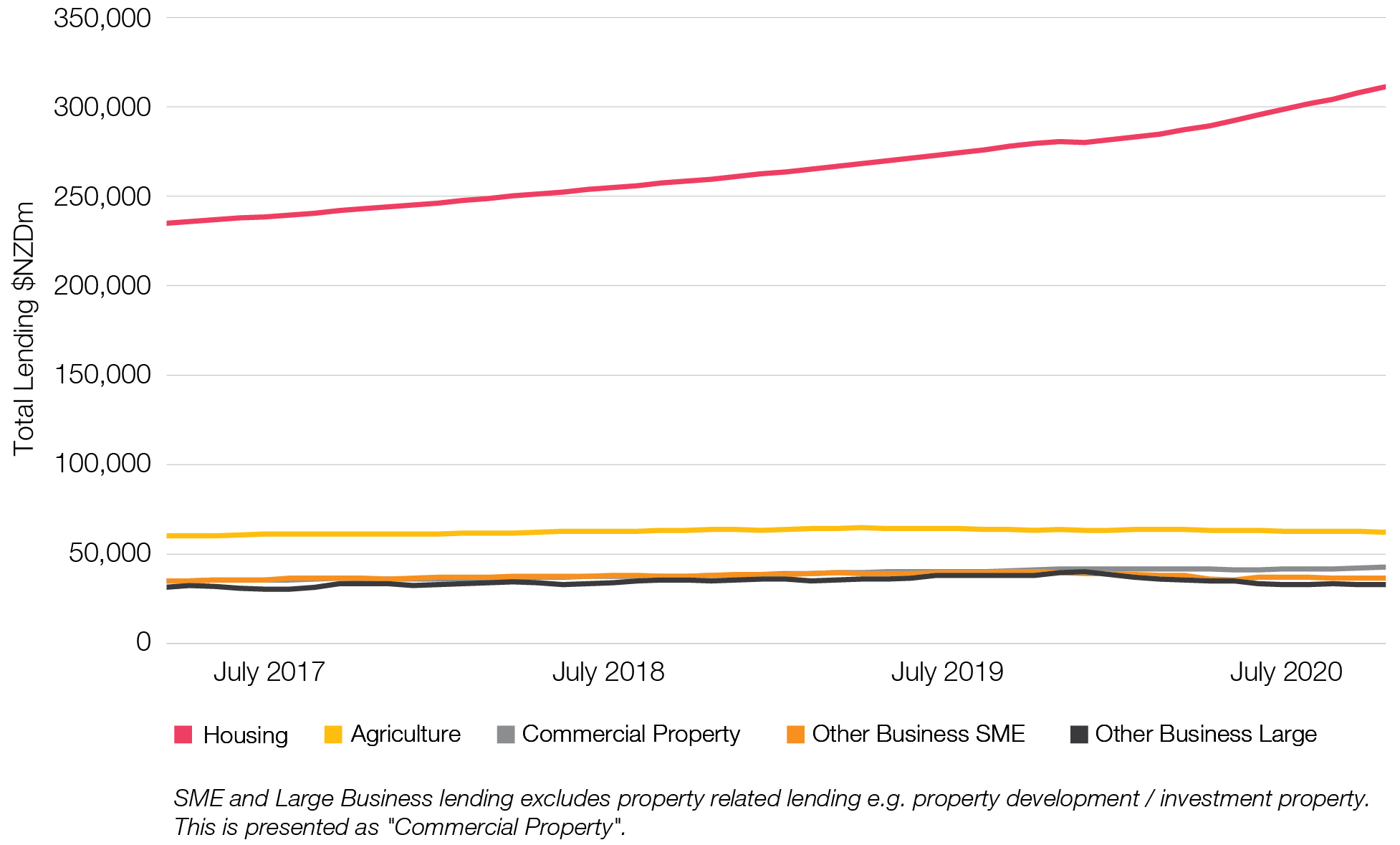

In addition to bank capital, the risk weightings allocated to loans tend to favour investment in property assets (many being non-productive such as housing) over productive ones. This means that banks have a capital incentive to lend in the mortgage market and arguably less motivation to lend to business.

Registered Banks' lending by type (NZD$m)

We have seen some adjustments to settings where there have been unintended consequences which may contribute to enhancing prosperity e.g. July 2022 revisions30 to the Credit Contracts and Consumer Finance Act and the RBNZ August 2022 announcement clarifying which bank branches can participate in wholesale lending to institutions and corporates31. These are positive steps, but it’s our view that a review of bank capital requirements and risk weightings is critically important to enhancing our prosperity, while ensuring protection and prosperity are appropriately balanced. Connecting RBNZ’s KPIs more closely to enhancing prosperity would support this, noting that the RBNZ is currently measured on inflation and stability32.

Access to offshore capital and foreign expertise has always been essential to the development of our country. While levels of foreign investment are driven by a broad range of factors (e.g. political stability, tax policy settings33), we focus in this report on the Overseas Investment Act (OIA) which regulates investment by ‘overseas persons34’ in ‘sensitive land’ or ‘significant business assets’. The overseas investment regime is managed by the Overseas Investment Office (OIO), part of Land Information New Zealand (LINZ).

There is significant debate on both the scope of our overseas investment restrictions and the underlying philosophy. Modifications over the years have had a mixed effect - in some respects making rules more cumbersome, while reducing regulatory complexity in other areas. The OIA is based on the principle that investment in Aotearoa New Zealand is a privilege but fails to hold in similar regard the options available to global investors.

While we support further simplification of the rules (as currently there are examples where vendors accept a lower sale price for a transaction with a New Zealander), the focus of this section is on the regime structure and timeframes for approval.

Deals occur subject to conditions, including OIO approval. Many of the conditions are able to be settled relatively quickly but OIO approvals have been taking a considerable amount of time - up to three months for acquisitions of significant business assets, up to nine months where the acquisition involved sensitive land, and some investments being subject to a further ‘national interest’ assessment with additional assessment timeframes.

While the introduction of statutory timeframes for processing (in November 2021) were widely welcomed as a way to create more certainty and accountability, the jury’s out on whether this will eventuate given the OIO’s ability to pause or extend these timeframes (in certain circumstances) and the lack of a penalty for the OIO in not meeting these timeframes.

There are commercial challenges with lengthy approval timeframes. Incoming investors carry the business risk during that time, with no ability to control the business. While material adverse change clauses within sale and purchase agreements can provide some protection, they are less than perfect.

The implication of lengthy timeframes and OIA rules is a higher cost of capital for business, delaying and potentially reducing the proceeds vendors have to reinvest in local businesses.

The Government could achieve significant and meaningful wins by identifying the various types of investment that supports government strategy, and streamlining the OIO approval process around these. Currently the onus is on investors to identify (as part of demonstrating benefits of the investment to New Zealand required for consent) significant government policy and then make a compelling case to the OIO for investment, at considerable cost and risk to the investor.

There is an opportunity to build on the proactive role that the OIO has started to play in limited contexts (such as certain types of forestry investment and build-to-rent developments). Providing clear support, guidance and streamlined processes around all critical and urgent areas of investment will help to shift the dial.

The overseas investment regime has evolved so that it covers more than land. This means it isn’t as strongly linked to LINZ as it once was. A way forward could be to extract the OIO from LINZ, and create an independent Crown Entity in much the same format as the Commerce Commission, Financial Markets Authority and Takeovers Panel.

The food and fibre sector is at the heart of Aotearoa New Zealand and it's now at an exciting stage, poised for further innovation and greater change.

So far in this report, we have covered four themes we believe will significantly shift Aotearoa New Zealand towards increased prosperity. These are all applicable to the food and fibre sector. As part of our broader research, in the coming months we will dive into these themes and how they can be applied to other sectors and provide a more detailed look at the food and fibre sector itself.

For our final area of focus in this report, we look to understand what can we learn from a sector that has been a large part of our economy for the last 200 years. What's next and how can it further contribute to Aotearoa New Zealand’s wider prosperity?

In mid 2022 the food and fibre sector is facing a number of challenges. Recent headlines have focussed on:

The acute shortage of labour, due to COVID-19 impacts, on the availability of Recognised Seasonal Employer (RSE) workers utilised in the horticulture and viticulture sectors.

Supply chain issues/shortages and cost inflation across all key inputs - labour, plant and equipment, fertiliser, fuel, pesticides, stockfeed etc.

The potential for synthetic or plant-based substitutes to replace animal produce - the meatless burger or milkless milk.

Regulatory impacts on freshwater, catchment specific watertake and total water usage, and changing land use.

The impacts of climate change, including severe weather events such as droughts and flooding, a change in land use as a result of climate change and regulations35 and the impacts this will have on the productivity of the land.

Financially, the sector has enjoyed a record year, and is forecast to generate $52.2b in export revenues. According to MFAT, this represents approximately 79% of our annual merchandisable exports36. The combination of generally strong prices, strong produce/product demand and a weaker New Zealand dollar have all contributed record returns across a largely commodity centric export37 basket.

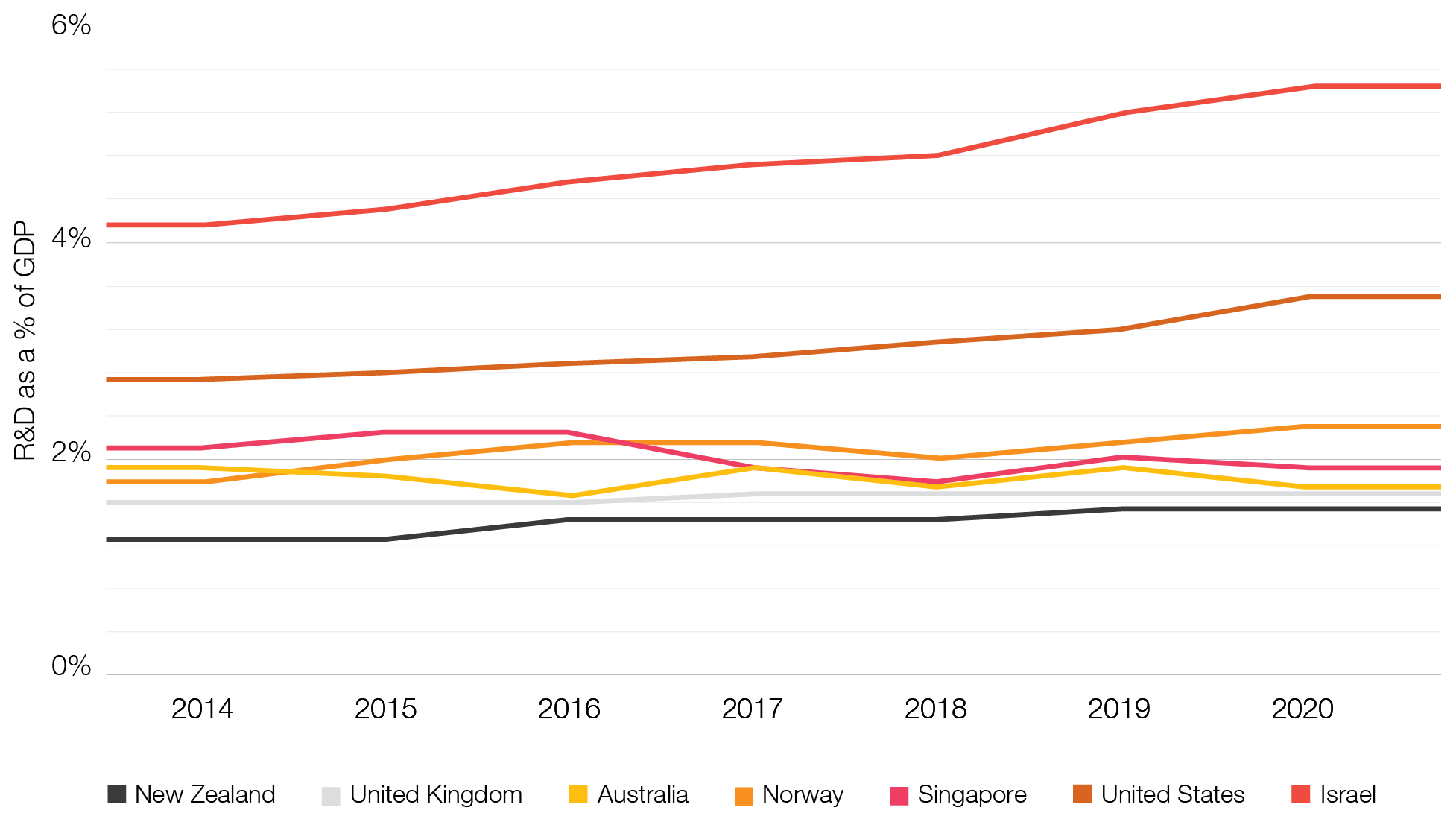

However, some of the long-term challenges remain. For example, our aggregate level of R&D spend is low. Using overall levels of country expenditure on R&D as a percentage of GDP as an overall proxy, we fall at the bottom of a range of our peers.

In line with low R&D spend, again at an aggregate country level (noting the large influence of the primary sector) the number of patents we file annually is low compared with other small advanced economies.

R&D spend as a percentage of GDP (Source OECD stats)

Patent filing comparisons

Note: Latest data available is reflective of pandemic effects, hence the pan country decline in patent applications.

Our prosperity in the sector largely hinges on a set of comparative advantages enjoyed in growing/manufacturing volume produce/products, our pastoral system, good regulation that has built trust in New Zealand products, and southern hemisphere seasonality. We now face a new set of systemic challenges - climate change and water in particular - that must be addressed.

Foreign competition for products and produce is high and there is a need to drive greater innovation to create value and enable greater productivity.

For both commodity and unique products, history shows that capability, innovation and collaboration are essential ingredients to unlocking prosperity. If we apply these concepts across the sector, there is an opportunity to create change by:

Recent research undertaken by the New Zealand Productivity Commission on frontier firms at the forefront of productivity included the dairy and horticulture sectors. This research highlighted the importance of innovation ecosystems and strong industry organisations.

We can see examples of how this works in other countries and sub-sectors. For example:

The agricultural innovation ecosystem in the Netherlands has driven productivity performance with a focus on high complexity/differentiated export products. Constant investment in this ecosystem ensures ongoing innovation in products and marketing. The innovation ecosystem itself has become the source of competitive advantage. From 2010-2016, Dutch multifactor productivity growth averaged 2.5% a year compared to 1.3% for Aotearoa New Zealand.

The Australian Cooperative Research Centres (CRC) federal programme, established in 1990, explicitly recognises that innovation is most likely to occur when the research stretches across functional boundaries and pulls in diverse skill-sets. The CRC programme emphasises time bound cooperative public-private partnerships to deliver science based outcomes for users. A structural feature of CRCs is the creation of scholarships for postgraduate students.

Closer to home, Zespri demonstrates the value of industries that are inherently fragmented, with many growers/farmers having an anchoring entity that can bring direction, scale and cohesion. Zespri helps with the development of new kiwifruit varieties, intellectual property (IP) protection, cohesive international branding, marketing and distribution and diffusion of these factors to a network of industry growers. Miro, a berry grower, has illustrated how Māori values and agronomy can play a key role in marketing differentiated produce.

There is an opportunity to create a more cohesive national strategy, for the sector, centred on the science/markets-based research and innovation system. ‘Fit for a Better World38’, developed in 2020, is a ten-year programme of work towards a more productive, sustainable and inclusive agri sector. It’s a start, however if we look to Ireland’s Origin Green strategy39 it provides a useful example of a similar-sized economy being focused on delivering added value through a more comprehensive, integrated and funded programme to drive sustainable prosperity.

To ensure innovation can thrive, the food and fibre sector needs a coordinated approach. For example, currently climate change and water-related sustainability policy/R&D initiatives are pursued independently from one another, prior to farmer/grower implementation.

And, recent work by the Productivity Commission40 has indicated that government investment in infrastructure, research and people will need to be focused in areas to complement the efforts and investments of the private sector. A more coordinated approach could lead to greater success.

When it comes to R&D there is an opportunity to partner with more global innovation partners and for a government-led step-change increase in co-funding, with a clear focus on the creation of IP that must invest in locally-owned entities. Qualifying businesses should demonstrate how individual scientists/researchers will materially share in the upside. Funding and incentives are intended to turbo-charge sector R&D and leverage existing scale advantages to make Aotearoa New Zealand a global talent magnet.

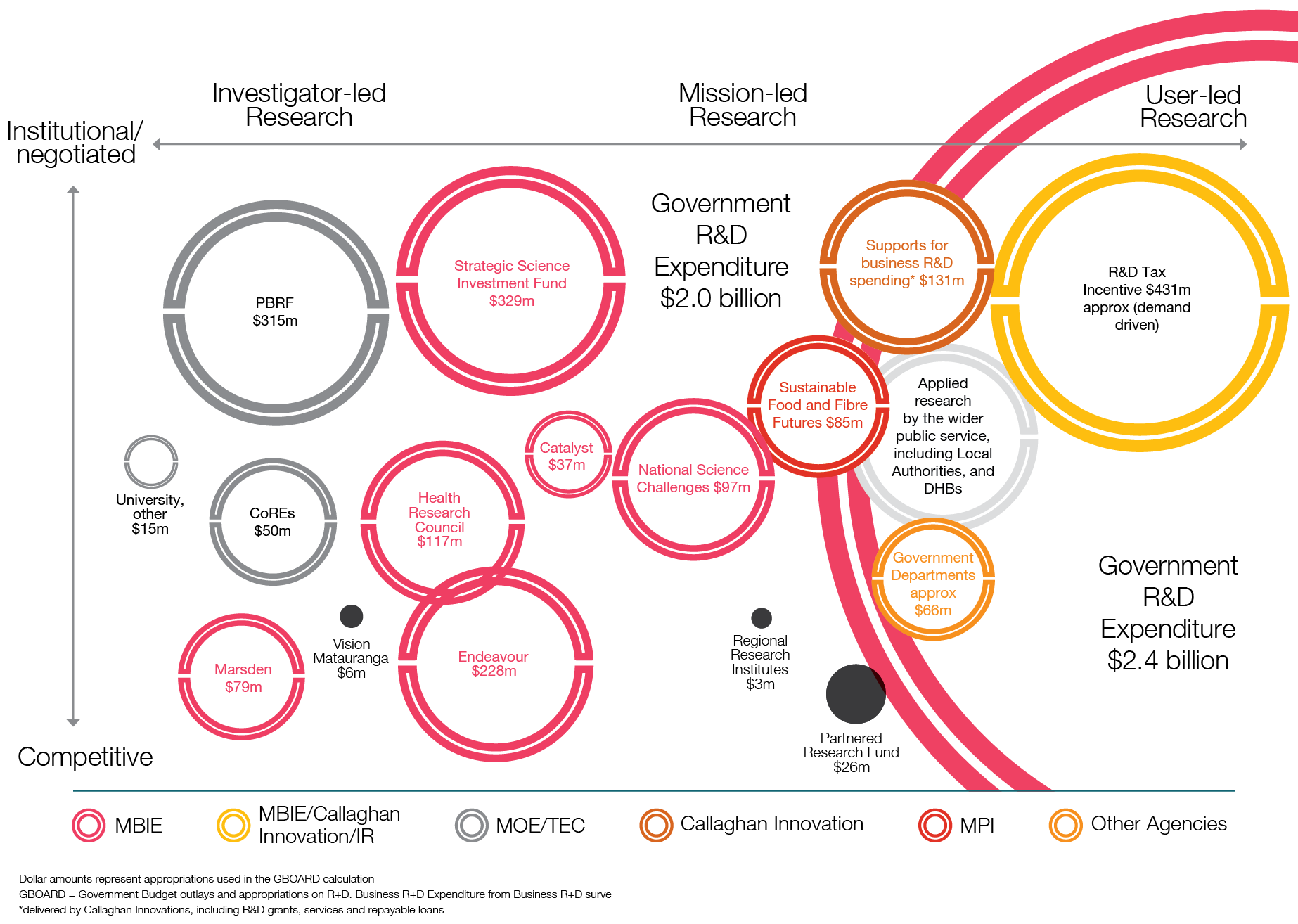

There’s also an opportunity to defragment the government science sector. The graphic below, provides an indicative picture of the overall government science funding landscape. The seven Crown Research Institutes (CRIs41) spearhead the Government's main investment in scientific research, with all but one touching the food and fibre sector.

Established in 1992, the CRI model has made a profound contribution. Plant and Food Research’s contribution to Kiwifruit Gold is one example of many. However the CRIs themselves have highlighted that unproductive funding competition, fragmentation, overlaps and missed opportunities to share resources are hindrances. The 2019 Te Pae Kahurangi review of CRIs made this point. A single government science entity at the core, with partnering vehicles around the outside (as per the Australian co-operative research centres working with industry) would make more sense.

New Zealand science funding system

In this report, we have explored five areas we believe will have an impact in helping to build prosperity in Aotearoa New Zealand:

- achieving greater social cohesion

- creating a future-fit workforce

- unlocking innovation and entrepreneurship

- rethinking capital allocation and overseas investment

- evolving our food and fibre sector.

Common threads emerge that are critical to enabling success. These include a need for focus and a shared vision, creating value from what’s unique to Aotearoa New Zealand, investment in innovation and improved inclusion to unlock untapped potential.

None of these sit solely with one part of society, and we stress the importance of us all - government, business, academia, communities - playing our part through enhanced collaboration, cooperation and cohesion to build a pathway to wellbeing for all of Aotearoa New Zealand.

Over the coming months, we will be taking a deeper look into how the five areas of focus and the common threads which run through them could be applied across a number of Aotearoa New Zealand’s most significant sectors to drive improved prosperity outcomes for the country. Look out for our reports focused on Food & Fibre, Financial Services, Technology, Hauora, Energy, Infrastructure, Private Equity, Manukura Māori Business and Retail and Consumer.

Our global strategy, responds to fundamental changes happening in the world, which are having a huge impact. ‘Building prosperity - A pathway to wellbeing for all of Aotearoa’ looks for the opportunities in the challenges we face, brings focus to areas that matter, and contributes to an important conversation to help unlock Aotearoa New Zealand’s prosperity now and in the future.

We understand we have a role to play alongside government, academia, communities and other industries to help build a pathway to greater prosperity for all New Zealanders. Here, we outline some of the ways we are helping build trust and deliver sustained outcomes, for a more prosperous Aotearoa New Zealand.

We’ve committed $8m over three years to digitally upskill our Aotearoa New Zealand team of 1,700 people as part of our ‘Reimagine digital’ programme. The programme is designed to give our people the knowledge, skills and tools they need to adapt to the digital future both at PwC, and in future roles. So far more than 550 of our staff have completed our Digital Academies programmes.

We are proud to have partnered with GirlBoss New Zealand to support young women to pursue careers in digital technology, transformation and innovation. This collaboration reflects the firm’s focus on attracting and encouraging people with unique experiences, to challenge the status quo and solve problems through innovative thinking.

Our Manukura Māori team is deeply woven through PwC New Zealand and helps bridge the gap between te ao Māori (the Māori world), and the conventional corporate world and government institutions. Underpinned by te reo Māori me ōna tikanga through a kaupapa Māori approach, our 80+ strong team works with clients and communities, and within PwC New Zealand leads Te Māramatanga and Te Ohonga, programmes which help our people build a Māori worldview knowledge base. More than 1,000 of our people and partners have completed at least one of these programmes.

PwC’s Equity practice focuses on supporting clients to identify barriers and provide solutions to eliminate inequities. Our community of problem solvers work alongside government agencies and crown entities, NGOs, Iwi and a range of hauora providers to realign systems to eliminate inequities and improve holistic wellbeing outcomes for tāmariki, whānau, Māori, Pacific and other priority groups.

We’ve been working with a client to successfully remove a tax barrier to building much needed build-to-rent projects. As a result the Government has made a commitment to retrospectively amend the tax law to remove the tax issue, paving the way for current and future joint venture housing projects that will increase New Zealand's housing stock by several thousand modern healthy new homes.

We are working with a government agency to transform the way they deliver services for whānau and families to ensure their needs are at the centre of how it delivers to help families and whānau build on their strengths and achieve their aspirations.

Our infrastructure practice is integrated with our real estate and analytics teams to provide our clients advice on the community aspects of infrastructure development. The provision of timely and cost effective infrastructure is important to economic and social prosperity. As an example, our advice on Auckland Light Rail has provided deeper insight into infrastructure and community aspects of that project.

Through the PwC Foundation we make a significant and lasting contribution to the communities we work in by leveraging the talent, enthusiasm and generosity of our people. Our core cause is child welfare primarily through education. Our secondary focus is growing our OnBoard programme. Our third focus is supporting our regions by engaging with local charities and celebrating our people making a difference within their communities.

Through our FLiP (Financial Literacy Program) we use a play-based approach to equip children aged 8-10 years with valuable financial concepts of loans, creditors and debtors, as well as practical ways to manage income. The programme provides us with the opportunity to connect with our communities and work towards the common goal of improving child welfare.

Toitoi publish a quarterly journal of writing and art by New Zealand children. Our partnership with Toitoi allows our volunteers to visit low decile schools around Aotearoa and read these journals with a small group of children aged 8-10 years. During each session, we donate journals to the school, one for each child to take home, and a box to keep in the school library.

PwC On Board provides support to our people across the firm who would like to secure a board or advisory role with a not-for-profit. Our people are able to use their professional skills to give back to the community, broaden their governance knowledge and networks, and contribute towards building more sustainable organisations in society.

As CEO and Senior Partner, Mark leads our Aotearoa New Zealand team of 148 partners and over 1,700 staff. With over 34 years’ experience, including over 20 years as a Partner of PwC, he is responsible for executive leadership and strategy, and all aspects of our relationship with other PwC member firms and PwC Global. Mark also sits on the New Zealand China Council Board and is a member of the New Zealand Champions for Change. In 2019 he was made a fellow of the Chartered Accountants Australia and New Zealand (CAANZ).

As Chair, Keren leads our Board and is responsible for overseeing the governance and corporate responsibility of the firm. The Board plays a critical role in setting the firm’s strategy in a rapidly changing environment, with a strong focus on Environmental, Social and Governance (ESG), and diversity and inclusion. Keren is also lead partner of the PwC Non-Executive Director Programme. As an experienced Assurance Partner, Keren has a deep understanding of the strategic opportunities and challenges facing businesses. She is a member of New Zealand Global Women and Chartered Accountants Australia and New Zealand (CAANZ).

As Infrastructure sector leader, Carl applies his extensive transactional and fund management expertise across the property, infrastructure, government and utilities sectors. As a Partner in our Deals team he maintains a broader merger and acquisition interest. Carl has significant expertise in direct property and infrastructure, private equity and public-private partnerships. Carl is Chair of the New Zealand Takeovers Panel which has a regulatory focus and is responsible for strengthening investor confidence in our capital markets.

Pete is the lead Partner for our food and fibre sector team and Operations, Supply chain and Procurement practice. Building the resilience, agility and reputation of businesses is important to Pete. He is driven by working with clients to solve their most important challenges around changing consumer preferences, supply chain continuity, food security, traceability, sustainability and crisis management. Pete also supports these businesses to seize unique opportunities to grow and succeed on the global stage.

As a Partner in our Consulting practice, Griere supports clients across the public and private sectors to understand current workforce challenges, and plan for future workforce opportunities. Griere has extensive experience working with clients to understand the capabilities they need today, and how these will change in the future. She also advises clients on how to attract, retain and engage their people, and on developing workforce strategies to support the achievement of organisational priorities. Griere has an extensive background working in human resources and strategy roles in the public and private sectors, both internationally and in New Zealand.

Rob is our Technology Consulting Lead Partner and has worked with government and enterprise clients for over 15 years to transform the experience they provide customers, employees and partners. His team specialise in the design and delivery of digital solutions based on human-centred design. As part of our Manukura Māori team, Rob is passionate about increasing Māori participation in technology and consulting, and removing barriers. This has seen him appointed as Advisory Group Chair for the Whitihiko ki te Ao initiative, which works with Te Wānanga o Raukawa to support industry to become employers of choice for Māori. He takes every opportunity to work with Iwi and Māori business to support their aspirations.

Anand is a Partner, Private Business Leader and Co-Leader of the firm’s Technology sector. He enjoys working with clients with the entrepreneurial spirit looking to expand into or on the global stage. Anand is the Partner sponsor of the biannual Startup Investment Magazine, in collaboration with the Angel Association and New Zealand Growth Capital Partners. This provides insights and commentary on the startup sector in New Zealand. Anand has a sector focus on high growth innovative technology businesses, and believes success in the tech sector will be a key driver for the long term and sustainable success of Aotearoa New Zealand. He leads PwC’s partnership with the NZ Hi-Tech Awards which celebrate New Zealand’s most innovative and successful high-tech companies and individuals.

As a Partner in our Corporate Tax team, Leigh’s tax experience spans over 20 years across New Zealand and the UK. She specialises in tax compliance, tax advisory and tax governance matters - supporting businesses to future proof their tax compliance function, build resilience and trust, and deliver value. Leigh is a PwC New Zealand Board Member, is the Growth & Markets leader for PwC New Zealand’s Financial Advisory Services business and co-founded PwC New Zealand's Women in Leadership employee network group which focuses on empowerment and enablement.

Our global strategy, reflects fundamental changes in the operating environment faced by our clients and stakeholders, including technological disruption, climate change and fractured geopolitics.

Our community of solvers is dedicated to solving the complex problems businesses are facing in today’s changing marketplace, helping organisations and individuals create the value they’re looking for. As part of a global network of firms in 155 countries with more than 327,000 people, we are committed to delivering quality in assurance, tax and advisory services.

1 https://www.prosperity.com/globe/new-zealand

2 https://www.treasury.govt.nz/publications/an/an-21-01-html

3 https://infrastructure.org.nz/budget-2022-and-addressing-the-national-infrastructure-deficit/

4 https://informedfutures.org/wp-content/uploads/Sustaining-Aotearoa-New-Zealand-as-a-cohesive-society.pdf

5 Peace, R., & Spoonley, P. (2019). Social Cohesion and Cohesive Ties: Responses to Diversity New Zealand Population Review

6 https://informedfutures.org/wp-content/uploads/Social-Cohesion-in-a-Post-Covid-World.pdf

7 https://www.mindthegap.nz/

8 https://www.otago.ac.nz/wellington/departments/publichealth/research/erupomare/research/otago019494.html

9 2021 living standards framework The Treasury

10 Tim Hughes, Social Investment (in Wellbeing)

11 For example, without conscious thought and/or intervention, larger houses may lead to greater energy consumption and so the potential for a greater carbon footprint exists

12 https://www.stats.govt.nz/tools/which-industries-contributed-to-new-zealands-gdp

13 “Aotearoa New Zealand teens could fail compulsory NCEA literacy and numeracy standard”, RNZ, 26/4/2022

14 “Assessing the risk of Aotearoa New Zealanders emigrating as border restrictions ease”, MBIE briefing, 25/2/2022

15 “Tight labour market leaves businesses preparing for a tough few years”, Stuff, 26 June 2022

16 Future of Jobs Report2020, World Economic Forum

17 https://www.skillsfuture.gov.sg/skillsreport

18 PwC Upskilling Global Hopes and Fears Survey 2021

19 https://www.internations.org/expat-insider/

20 https://www.theguardian.com/australia-news/2022/sep/02/australia-raises-permanent-migration-cap-to-195000-to-ease-workforce-shortages

21 https://www.immigration.govt.nz/about-us/media-centre/news-notifications/new-residence-categories-announced

22 PwC Upskilling Global Hopes and Fears Survey 2021

23 Trends in International Mathematics and Science Study (TIMSS), Dec 2020

24 Productivity Commission Report "Technological change and the future of work" March 2020

25 Digital Skills Aotearoa Report 2021

26 https://thecenter.nasdaq.org/

27 https://www.mbie.govt.nz/science-and-technology/science-and-innovation/international-opportunities/new-zealand-r-d/innovative-partnerships/

28 Those start-up organisations whose business model is based on high tech innovation in engineering, or significant scientific advances

29 Because of the larger amounts involved and productive assets being generally not as well secured

30 https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjs4cLz_OL5AhXk7jgGHRdcANUQFnoECBAQAQ&url=https%3A%2F%2Fwww.mbie.govt.nz%2Fdmsdocument%2F21456-responsible-lending-code-june-2022&usg=AOvVaw18n86BRoMZnIcOvBYPfPkk

31 https://www.rbnz.govt.nz/hub/news/2022/08/feedback-sought-on-policy-for-branches-of-overseas-banks

32 https://www.rbnz.govt.nz/about-us/responsibility-and-accountability

33 Inland Revenue’s February 2022 work on Tax, Foreign Investment and Productivity posits that “compared to other OECD countries, New Zealand appears to have relatively high taxes on inbound investment. These taxes are likely to mean higher costs of capital … for investment in New Zealand …”, https://taxpolicy.ird.govt.nz/publications/2022/2022-other-draft-ltib; and Inland Revenue’s August 2022 Tax, Foreign Investment and Productivity - Long-term insights briefing document https://taxpolicy.ird.govt.nz/publications/2022/2022-other-final-ltib which focusses on building an understanding of how taxes on inbound investment can combine to affect incentives to invest in New Zealand and prompt a conversation on whether reform is worthwhile

34 This captures a range of individuals and entities. Certain exemptions apply for Australian and Singapore investors investing in residential land, and non-government investors from signatory countries to trade agreements with New Zealand (including CPTPP) benefit from increased permitted thresholds to invest.

35 For example, rezoning for housing, https://www.aucklandcouncil.govt.nz/plans-projects-policies-reports-bylaws/our-plans-strategies/unitary-plan/Pages/default.aspx

36 https://www.mfat.govt.nz/en/trade/mfat-market-reports/market-reports-global/an-overview-of-new-zealands-trade-in-2021/

37 PwC estimates that commodities, as distinct from high complexity or differentiated goods/services made up over 80% of New Zealand exports in the year to March 2022.

38 https://fitforabetterworld.org.nz/

39 https://www.origingreen.ie/what-is-origin-green/

40 Lewis et al, 2021

41 AgResearch, Inst. of Env. Science Research, Inst. of Geological and Nuclear Science, Landcare, NIWA, Plant and Food Research and Scion (Forestry)

{{item.text}}

{{item.text}}

A definition of Social Cohesion

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.