Introduction

PwC’s Retail and Consumer Insights provides the latest consumer behaviour news and trends in New Zealand and internationally. We analyse data from the PwC Retail and Consumer Dashboard (focusing on electronic spending by industry in New Zealand) to equip you with insights to inform your business decision making. Our commentary also covers our observations of key changes in the ANZ-Roy Morgan Consumer Confidence Index, Stats NZ, Auckland Heart of the City footfall data and other local and global sources.

Key highlights from our July 2021 edition include:

ANZ-Roy Morgan Consumer Confidence appears to have plateaued with consumer confidence unchanged at 114 in June, still below its historical average of 120.

CPI inflation expectations reached a record high, driven by supply chain constraints, input cost pressures and increasing difficulties in attracting and retaining skilled labour.

Retail sales remain strong with year-to-date performance in all retail categories (with the exception of Fuel) now surpassing pre-COVID-19 levels.

Footfall across the Auckland CBD now appears to be stabilising, although in most cases still below pre-COVID-19 levels.

PwC’s June 2021 Global Consumer Insights Pulse Survey highlights that not only has the shift by consumers to digital accelerated dramatically, more and more of that consumption is happening on mobile / smart phones.

To explore further, select the buttons below.

Consumer confidence

ANZ-Roy Morgan Consumer Confidence Index for the month of June (released on 2 July) continues to suggest that consumer confidence may have plateaued with the Index unchanged at 114 (below its historical average of 120). Consistent with ongoing anecdotal evidence, a net 22% of respondents (up 3% points in June) think it is a good time to buy a major household item. From a retail perspective, this remains the single best indicator of consumer sentiment in the Index.

"We are seeing inflationary pressures grow as a result of capacity constraints within the economy, including labour shortages, supply chain disruptions and higher electricity costs. Inflation figures and labour market data will be key for any potential increase in interest rates."

Alex Wondergem, Treasury Advisory Partner, PwC New Zealand

Perhaps more significantly, CPI inflation expectations jumped 0.7% to 5.1% - a record high in a data series that dates back to 2010. Increasing concerns regarding growing inflationary pressure has led to market speculation that the Reserve Bank might be forced to increase interest rates sooner rather than later. Westpac and ANZ recently joined BNZ and ASB in bringing forward their expectation of a rate rise to November 24, when the Reserve Bank will issue its final monetary policy statement for the year2.

Stats NZ announced on 16 July that annual inflation (as measured by the consumers price index) increased to 3.3 percent in June 2021. This was the biggest increase in nearly 10 years - driven by higher prices for new housing and petrol. Quarterly inflation was 1.3 percent, also the highest in over a decade. ASB, ANZ, BNZ and Westpac all now predict the Official Cash Rate will increase to 0.5 per cent on August 183.

As demonstrated by the Stats NZ March quarterly spend data, household confidence in relation to the purchase of a major household item continues to grow. This is supported by the ongoing limitations on overseas holidays and recent strength in the residential property market.

References

1 With special thanks to PwC’s Matt Gunn and Rebecca Matthews for their assistance in preparing this edition.

2 7 July 2021

3 https://www.stuff.co.nz/business/125759626/fridays-inflation-figure-next-worry-for-rattled-homeowners

Spend trends

Changes in consumer spending habits can be seen in the Stats NZ electronic card transactions series data that includes all debit, credit, and charge card transactions with New Zealand-based merchants. Using the Retail and Consumer Dashboard developed by PwC New Zealand, we are able to compare year-to-date retail related electronic spend data by sector with the comparable periods in 2019 and 2020.

While changes in alert levels continue to influence the data series (all of New Zealand moved from alert level 2 to 1 on 8 June 2020 and Wellington moved between alert levels 1 and 2 during 23 June and 29 June 2021), there is increasing evidence emerging in relation to the ongoing strength in consumer spend in the retail sector, including those categories which continue to benefit from the impact of COVID-19 or have recovered to pre-COVID-19 spending levels.

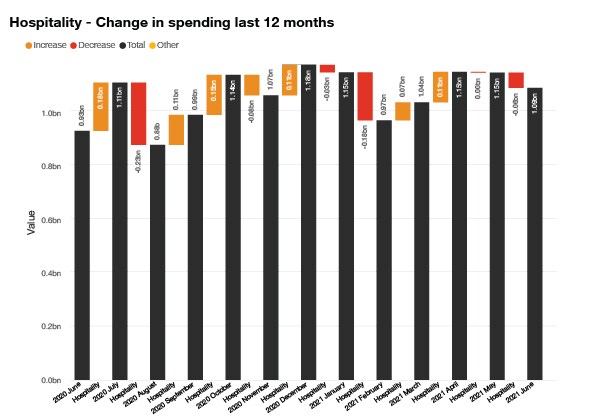

While year-to-date spending in the consumables sector is still down (1.8%) on the comparable period in 2020, spending relative to 2019 continues to perform strongly (+9.6%) compared to the first six months of 2019. Year-to-date spending in the durables sector is up (+21.9%) compared to the first six months of 2020, while spending relative to 2019 has also grown significantly (+17.9%) compared to the same period in 2019. In terms of the sector most directly affected by COVID-19, year-to-date spending in the hospitality sector increased $1.8 billion (+36.8%) from $4.8 billion in the first six months of 2020 to $6.6 billion in the same period of 2021. Perhaps more relevant, year-to-date spending in the hospitality sector is now effectively the same (+0.1%) as that achieved in the first six months of 2019.

Total core retail spending for the first six months of 2021 was up 13.6% and 9.4%, compared to the equivalent six month periods of 2020 and 2019, respectively. The strength of consumer spending in New Zealand is demonstrated by the fact that spending in all retail categories measured by Stats NZ (with the exception of Fuel which is due to commodity price fluctuations) has now surpassed the pre-COVID levels achieved in 2019. This represents a remarkable performance by a sector which continues to be directly affected by:

ongoing changes in domestic alert levels

the fragile nature of the Australasian bubble

supply chain constraints

increasing difficulties in attracting and retaining skilled labour.

Year to date (June) - Electronic spend by sector

Hospitality - Change in spending last 12 months

Auckland footfall insights

Our PwC Retail and Consumer Dashboard also tracks pedestrian footfall data on an hourly basis across the Auckland CBD4. While the post-lockdown recovery is immediately apparent (in most locations), it is also interesting to note that footfall across the CBD now appears to be stabilising, although in most cases below pre-COVID-19 levels (based on June 2019 figures). The most recent data for June demonstrates that footfall at 45 Queen Street has stabilised but is still only ~64% of pre-COVID-19 levels (based on June 2019 figures). However, signs of recovery are emerging, particularly on the eastern side of Queen Street, which has suffered less disruption from construction activity and road closures. June footfall at 2 High Street increased ~63% (compared to June 2020) and is ~80% of pre COVID-19 levels (based on June 2019 figures). Interestingly, footfall on High Street in the evenings (after 6pm) is now back to or above pre-COVID-19 levels.

June Monthly Pedestrian Count

Elsewhere in the country, the recently announced decision by Wellington City Council to ban cars from four key streets in the CBD (Courtenay Place, Lambton Quay, Manners and Willis Streets) has been described as more bad news for retailers. Retail NZ Chief Executive, Greg Harford, commented “the proposal will make it harder for customers to travel into and around the CBD by car, and will likely further damage retail businesses in the CBD. Central Wellington retailers are already struggling as a result of reduced foot traffic as people work from home, and an outflow of customers as a result of car parks that are still out of service following the 2016 earthquakes.”5

References

4 Source: Heart of the City: https://www.hotcity.co.nz/city-centre/results-and-statistics/pedestrian-counts

5 Source: https://retail.kiwi/insights-media/media-releases/bad-news-for-retailers-in-lets-get-wellington-moving-decision/

International insights

PwC’s June 2021 Global Consumer Insights Pulse Survey (The global consumer: Changed for good)6 shows that in just the last six months, consumers have evolved to be even more digital and environmentally aware. Survey participants are also reported as being more price-oriented, health conscious and ‘local.’

In terms of the ongoing impact of COVID-19 on behaviour, the survey found consumers are:

- Dramatically accelerating the shift to digital: Consumers are buying more groceries online, Gen Z consumers have developed apps to find surplus COVID-19 shots, businesses have discovered that remote work really can work - and the list goes on. It is also clear that more and more consumption is happening on mobile phones. Even though there’s been a slight uptick in instore commerce, shopping via smartphone keeps climbing steeply.

More health conscious: Despite many consumers overseas being shut indoors for extended periods, many are reporting that they’ve become healthier since the first Pulse survey. Work-at-home consumers also say they’re spending more in the grocery, health and beauty, and sports and fitness categories.

More eco-friendly: Fully half of all global consumers PwC surveyed say they’ve become more eco-friendly since the first Pulse survey. Continuing the trend from the first Pulse survey, consumers in Southeast Asia and the Middle East are leading the way in terms of environmental awareness. Overall, those working at home appear to shop more sustainably than those still going into a workplace, with work-at-home consumers more likely to check labelling or packaging for assurances about a product’s eco-credentials.

More price sensitive: Even though many people are now receiving vaccinations, and signs of recovery are appearing in some economies, consumers’ money anxieties have not yet eased. More than half of the respondents in the most recent survey say they’ve become more focused on saving than they were when the first survey was conducted. Even more say they’re now more price-oriented.

More local: Small, independent providers and retailers will be pleased to see a further increase in the number of shoppers who say they’ve been doing more to support local, independent businesses. Survey respondents that habitually work from home are also far more likely to shop locally — 65% of respondents who work at home say they actively do more to support local businesses, compared with 45% of respondents who work away from home.

Nobody will ever forget the last year that has been dominated by COVID-19. For many consumers, behaviour changes, both forced and voluntary, will have become a habit. Savvy consumer companies will be alert to these permanent changes and will be making their own adaptations.

References

6 Source: https://www.pwc.com/consumerinsights?j=164348&sfmc_sub=5013464&l=16_HTML&u=2881702&mid=510000034&jb=2

Recent news

Amazon is set to expand its online offering in New Zealand, with plans to open Amazon Australia to New Zealand consumers, allowing Kiwi shoppers cheaper and faster deliveries than was previously possible. The move is expected to increase competition, providing New Zealanders with deliveries within three business days for as little as AU$6.99.

Wesfarmers (API) - Australian retailer and conglomerate Wesfarmers has made a $687m offer to purchase Australian Pharmaceutical Industries (API). This would be Wesfarmers’s first investment in the $25bn pharmaceutical beauty and wellbeing sector. The bid came at a 21 cent premium to API’s post-announcement closing price of $1.36. Several API shareholders have called Wesfarmers proposal opportunistic and believe that it undervalues API.

Scentre Group, the ASX listed company has announced that Louis Vuitton, Saint Laurent, Balenciaga, Alexander McQueen, Moncler, Burberry, Jimmy Choo and Michael Kors will open outlets at Westfield Newmarket. Scentre Group, which owns 51% of Westfield Newmarket, has been trying to fill vacant retail space in the shopping centre since the start of the COVID-19 pandemic.

Kathmandu downgraded FY21 sales guidance by NZD 13m to reflect the foreseeable impact of the recent lockdown enacted by Australian authorities in New South Wales. In addition, Hallenstein Glassons announced the closure of 13 Glassons stores in the Sydney area until the lockdown is lifted. Hallensteins expects online sales to temporarily rise in COVID-19-affected areas until the end of lockdown.

- The Winning Group, one of Australia’s leading technology, retail, distribution and logistics companies is set to open its first distribution centre in New Zealand. The move reflects positive retail market sentiment, as the company brings its world-class distribution and third-party logistic (3PL) services to New Zealand. General manager Mick Bunt says the company already has a 3PL agreement with a leading Kiwi furniture retailer. This customer base is expected to grow as the company benefits from strong demand for major household item purchases which have fundamentally bolstered Kiwi consumer confidence in the post-COVID-19 economy.

Recent deals - recently announced transactions in the retail and consumer sector include:

July:

- The Department of Brands, a New Zealand based vegan and environmentally friendly hair care product maker, will be merged into Pump Group Australia, backed by private equity firm Anacacia Capital.

June:

- Bermele plc, a special purchase acquisition company with specific interests in acquiring late-stage technologies, announced a number of proposals in June, most-importantly the reverse takeover of East Imperial Pte. Ltd, a New Zealand-based branded exporter of premium beverage mixers to Asia-Pacific and US markets. The deal values East Imperial Pte. Ltd at £24.5m and will see Bermele plc become a publicly listed company, trading on the London stock exchange as EISB:LN.

Are Media Pty Limited, an Australian multi-channel publisher owned by Mercury Capital, announced it had agreed to acquire Ovato Retail Distribution Pty Ltd and Ovato Retail Distribution NZ Limited from Ovato Limited.

PwC Retail and Consumer Dashboard:

The PwC Retail and Consumer Dashboard is updated monthly, to include the latest data on electronic spending, consumer sentiment and Auckland pedestrian analysis. Through our dashboard we identify and analyse trends over time, particularly in the aftermath of the COVID-19 lockdowns. If you are interested in online access to our dashboard to help inform your decision making, please contact: Matt Gunn

How we can help:

PwC has advised many of New Zealand’s largest listed and privately owned retailers across a wide variety of projects and roles, including assurance, tax, capital solutions, transactions services, M&A, restructuring, real estate, supply chain and digital consulting services.

We have a comprehensive understanding of the rapidly evolving retail environment (offline and online) and are uniquely placed to combine strategy with technical, industry and execution expertise. We pride ourselves on a focused partnership approach to our work in the sector, based on principles of trust, independence and challenging insight, using specialist teams tailored to specific client needs.

Contact us

Partner, Food & Fibre Leader | Finance & Operations Leader, PwC New Zealand

Tel: +64 21 404 015

Managing Partner, Te Waipounamu and China Business Group Lead, PwC New Zealand

Tel: +64 21 616 232